ExxonMobil Corp. is scheduled to report its earnings on Friday [27/10], earlier than market open. The report shall be for the fiscal quarter ending September 2023. The $433.74 billion market cap firm is presently one of many largest publicly traded multinational oil and gasoline corporations, with the most important petroleum and chemical merchandise advertising and refining operations on the earth. The corporate has lengthy been thought of a blue-chip inventory as it’s a longtime and financially sound firm.

Exxon earlier this month confirmed the acquisition of Pioneer Pure Assets (PXD) in a $59.5bn deal that’s mentioned will remodel its upstream enterprise. The entire implied enterprise worth of the transaction, together with web debt, is about $64.5 billion. That is the corporate’s largest acquisition since Exxon acquired Mobil in 1999. Based on ExxonMobil, the merger combines Pioneer’s greater than 850,000 web acres within the Midland Basin with ExxonMobil’s 570,000 web acres within the Delaware and Midland Basins, creating an industry-leading, high-quality undeveloped US stock place.

The Zacks Consensus Estimate for ExxonMobil’s third-quarter earnings per share of $2.39 has proven eight upward strikes and no downward revisions over the previous 30 days. The EPS reported for a similar quarter final 12 months was $4.45. The estimated determine exhibits a decline of 46.3% from the quantity reported a 12 months earlier. The Zacks Consensus Estimate for third-quarter income of $88 billion signifies a 21.5% decline from the determine reported final 12 months. The Zacks Consensus Estimate for ExxonMobil’s day by day manufacturing quantity is 3,722 thousand barrels of oil equal per day, in comparison with 3,716 MBoe/day within the year-ago quarter.

Nonetheless, the Zacks Consensus Estimate for ExxonMobil’s earnings after earnings tax from the upstream phase is pegged at $5,505 million, displaying a big decline from $12,419 million reported within the year-ago quarter. It will most certainly have an effect on ExxonMobil’s efficiency within the third quarter. ExxonMobil presently carries a Zacks ranking of #2 (purchase).

Oil costs are additionally in focus because of the impression of the Israel-Hamas struggle, though this may largely be realised within the firm’s fourth quarter. Crude oil costs rose practically 4.5% in noon commerce after the weekend the struggle broke out between Hamas and Israel. At the moment, most analysts imagine the impression on oil costs could also be restricted to an preliminary spike.

And now, USOil crude oil fell in direction of $86 per barrel in Monday buying and selling, dropping for the second consecutive session as diplomatic efforts to maintain the Israel-Hamas struggle from spreading right into a wider battle within the Center East eased some considerations about provide disruptions within the oil-rich area. Help convoys additionally started arriving within the Gaza Strip from Egypt on the weekend, whereas Israel agreed to droop its offensive towards Hamas amid stress from the US.

On a aspect word: Oil costs don’t want one other catalyst to proceed transferring increased. Oil shares are already rising because of the supply-demand imbalance. Nonetheless, geopolitical occasions, significantly regarding the Center East, may have a big impression on the upcoming trades.

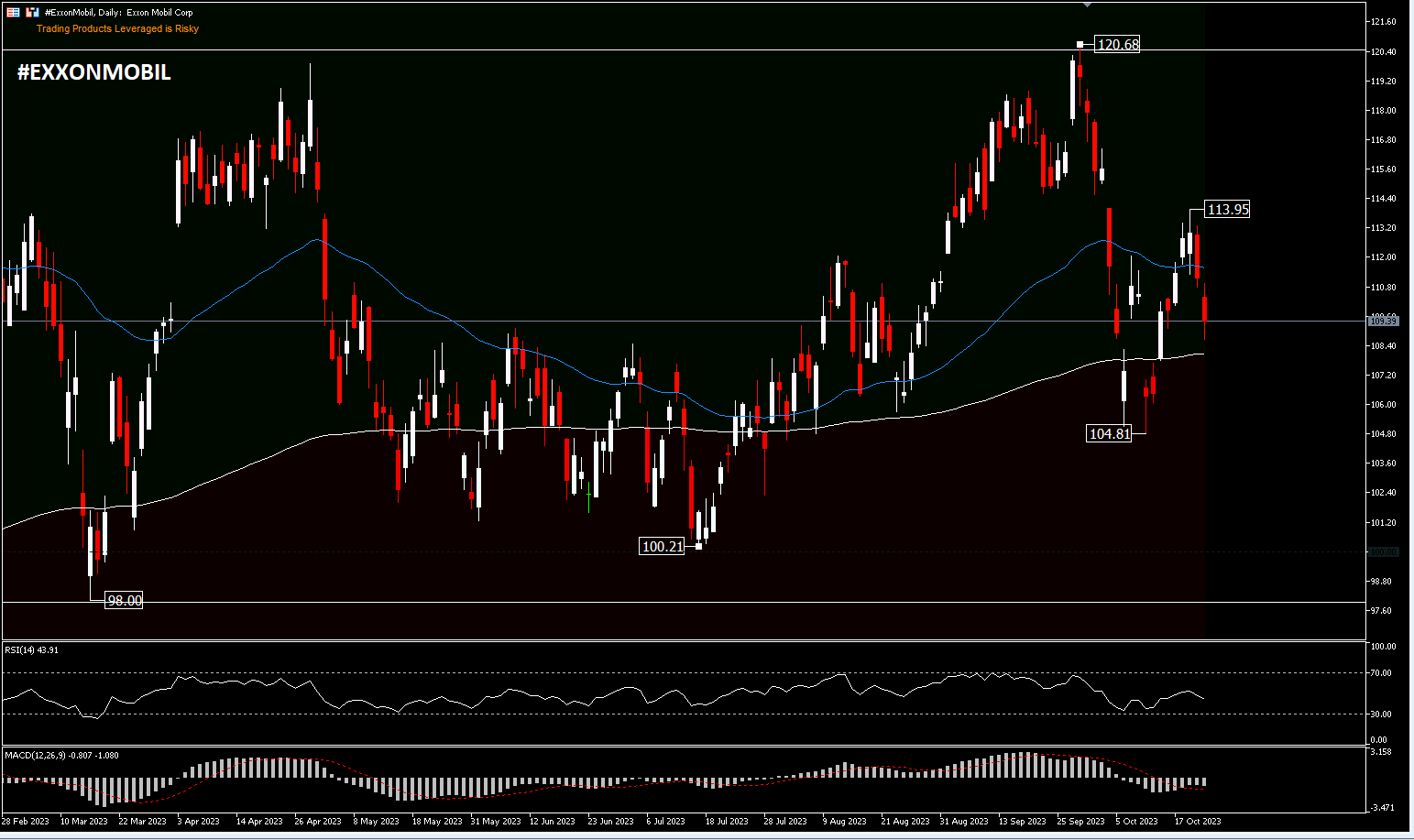

Technical Assessment

Shares of #ExxonMobil fell -1.47% in Monday’s buying and selling [23/10], proving to be a dismal buying and selling session for the inventory market, with the USA500 Index -0.17% and USA30 -0.58%. Exxon Mobil Corp. closed at $109.39, under the 50-day EMA stage and above the 200-day EMA. Consolidation has been ongoing for the previous 12 months in a $100-$120 value vary. The fast assist is seen at $104.81, subsequent $100.21 after which the essential assist of $98.00. Nonetheless, the psychological benchmark value of $100.00 appears to have develop into the barometer up to now 12 months. On the upside, the closest assist is $113.95 and the triple high at $120.68. The RSI technical indicator has dived under the mid-level and the MACD is within the promote zone.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.