Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In an interview hosted by Kyle Chassé, Bitwise Chief Funding Officer Matt Hougan and Bloomberg ETF analyst James Seyffart weighed through which spot ETF may appeal to extra inflows– XRP or Solana–if permitted on the identical day. Each concluded that the preliminary wave of capital would possible favor XRP, whilst longer‑time period asset accumulation may tilt towards Solana.

XRP or Solana: Which Spot ETF Will Dominate?

Seyffart grounded his view within the efficiency of current spinoff‑based mostly merchandise. “We did have, we had a type of a state of affairs like this the place we had futures Solana ETFs and leverage futures or derivatives based mostly ETFs which have publicity to Solana launched earlier than the XRP variations. And the XRP variations have gotten extra property and flows than the Solana model,” he stated.

Whereas cautioning that “derivatives based mostly merchandise are nowhere close to as excessive within the checklist of demand for traders because the spot merchandise could be,” he cited that precedent alongside the power of XRP’s retail neighborhood. In line with Seyffart, a “pseudo spot product from Rex Osprey that went by way of a complete bunch of loopholes and finish arounds to try to get publicity to identify Solana with staking” has additionally “carried out very nicely,” however not sufficient to change his close to‑time period rating.

Associated Studying

“I feel within the close to time period, I might wager on XRP, however over the long run, I’d most likely wager on Sol getting extra property,” Seyffart continued, pointing to mass‑market familiarity with XRP narratives—“anybody I do know who doesn’t actually know this area in any respect…they like XRP. They suppose it’s gonna be the backend settlement system for all banks”—and the persistent quantity of XRP‑associated dialogue throughout TikTok, Reddit and different social platforms.

“The bottom recreation is unreal,” he stated, earlier than including that institutional conversations skew in another way: “From an institutional perspective…there appears to be much more critical individuals taking a look at Solana…positively I lean Solana or Ethereum from my perspective.”

Hougan concurred with the sequencing. “I really agree. I feel XRP would do higher out of the gate,” he stated, emphasizing that the depth of a dedicated minority, somewhat than broad sentiment, drives day‑one ETF flows. “I feel the typical opinion of Solana is best than it’s for XRP throughout crypto traders, however that’s not who buys the ETF on day one. It’s the eagerness, proper?”

Associated Studying

Recounting his expertise at an XRP‑centered occasion, he underscored the depth of that base: “I went to an XRP convention in Vegas on a Saturday. There have been 1,200 individuals within the room. Each seat was taken. That’s loopy…There’s a military of people who find themselves actually enthusiastic about XRP, and I feel it will do exceptionally nicely out of the gate. It doesn’t matter, once more, that 90% of individuals hate it. What issues is 10% of individuals like it.”

Hougan added that Solana’s eventual trajectory would rely upon its “narrative transition,” suggesting a shifting storyline across the community may affect timing-sensitive allocations. “If Solana is ripping…it will do nicely,” he stated. “However my base case out of the gate could be XRP, no less than for the primary few months.”

Taken collectively, the analysts’ assessments define a bifurcated path: an early surge in XRP spot ETF inflows propelled by a extremely mobilized retail constituency, adopted by a possible reversion through which Solana, benefiting from deeper institutional engagement and evolving narratives, may surpass XRP in complete property over time.

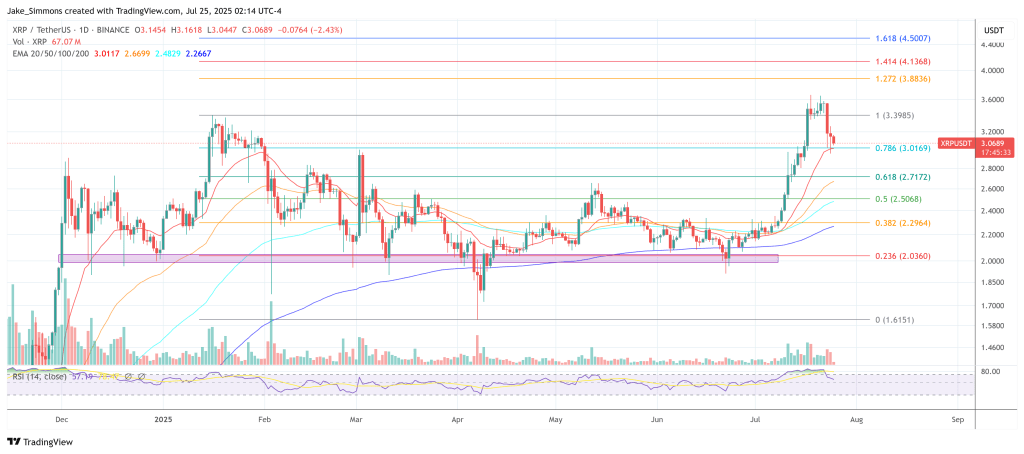

At press time, XRP traded at $3.06.

Featured picture created with DALL.E, chart from TradingView.com