This week ex-Goldman Sachs CEO Lloyd Blankfein requested, “wouldn’t you suppose crypto could be having a second now? Not seeing it within the worth, to date.” Blankfein seems to have taken a step again from his January U-turn on crypto, the place he claimed his views have been evolving.

Stating that he’s protecting an open thoughts about crypto, he questions why crypto isn’t surging because the world reminds us how centralized our finance system is. CryptoSlate lately wrote about how the conflict in Ukraine highlights the facility a handful of companies and governments have over the world. Additional, CryptoSlate additionally reported how gold had outperformed Bitcoin as a risk-off asset throughout these unsure occasions.

A Bitcoin second

It virtually looks like a meme, however the reply can usually be discovered by listening to the age-old recommendation to ‘zoom out’.Bitcoin is up virtually 500% since January 2020. The reply to the query is having a second is that sure, and it’s been having one for years. Normally, solely critics or day merchants concentrate on day-to-day fluctuations in crypto costs.

The state of affairs in Ukraine highlighted a number of the main failings of centralized banking. Nevertheless, as a result of Bitcoin has not rocketed up one other 500% since Russia invaded, it doesn’t imply that it’s not ‘having a moment.’

Michael Saylor replied to Blankfein inside hours, stating the strain between merchants and buyers lies. Merchants deal with Bitcoin as a risk-on asset while buyers see it as the last word risk-off asset. Ex-Coinbase President Assiff Hirji additionally joined the debate to agree that crypto “correlates with the overall risk-on/off mentality. That may and is altering as utilization will increase”.

There’s a stress between standard merchants that see #bitcoin as one thing to purchase or promote relying upon their present danger evaluation & rate of interest expectations, and basic buyers that merely wish to purchase all of it and maintain perpetually. Over time, the #HODLers will win.

— Michael Saylor⚡️ (@saylor) March 7, 2022

A wolf on the door

Co-Founding father of crypto funding large Paradigm, Matt Huang, defined Saylor’s level quite poetically final week as he acknowledged that there are two wolves inside Bitcoin:

The excessive development tech asset (with excessive equities correlation)

And the non-sovereign retailer of worth (as a hedge in opposition to inflation, instability, autocracy, and so forth)

One wolf is getting stronger by the day…

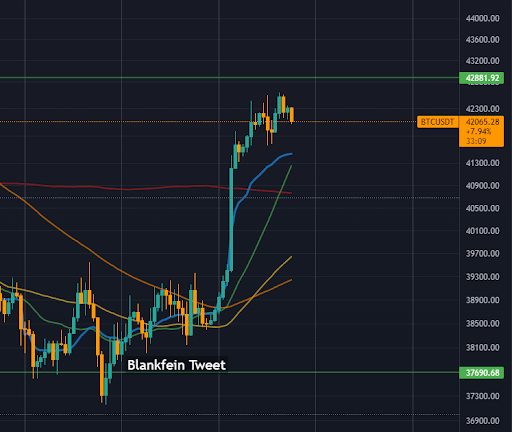

Blankfein believes the wolf needs to be even stronger proper now. I’m questioning if that is solely the start. Since Blankfein despatched that tweet, the worth of Bitcoin has gone up 10%. It virtually seems the crypto market purchased the dip to spite him. Maybe we are having a second. Blankfein appears somewhat too impatient now that he’s warming to decentralization.

Get your each day recap of Bitcoin, DeFi, NFT and Web3 information from CryptoSlate

It is free and you may unsubscribe anytime.

Get an Edge on the Crypto Market 👇

Develop into a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Worth snapshots

Extra context

Be a part of now for $19/month Discover all advantages