EURUSD – Talking Points

- EURUSD lacks direction below 0.9700 psychological level

- Aggressive Fed keeps pushing USD higher as inflation remains hot

- ECB’s Knot hints at more “supersized” rate hikes in months ahead

Recommended by Brendan Fagan

Get Your Free EUR Forecast

After a rough start to the month for EURUSD, the cross appears to have found some footing around the 0.9700 psychological level ahead of tomorrow’s major US CPI report. This morning saw the release of US PPI data, which came in hotter than expected. Numerous headwinds continue to weigh on EURUSD, as soaring energy costs and growth concerns cloud the outlook for the continent.

Despite the concerns over economic growth, the European Central Bank (ECB) appears committed to its current tightening regime. In comments made earlier in the session, ECB policymaker Klaas Knot indicated that the ECB remains “way below neutral” when it comes to interest rates. Knot also stated that he believes the eurozone needs “at least two more significant rate hikes.”

Upcoming Economic Calendar

Courtesy of the DailyFX Economic Calendar

On the other side of the pond, aggressive remarks from Federal Reserve speakers continues to limit EURUSD upside. Recently, Fedspeak has forced home the idea that the Fed has no intention of pivoting policy anytime soon, as inflation remains well above target. Neel Kashkari of the Minneapolis Fed stated this morning that he expects the fed funds rate to reach 4.5% in 2023, with the benchmark rate remaining elevated for some time. Given the strong standing of the US economy, the Federal Reserve can afford to remain hawkish for longer than the rest of G7. With this in mind, the US Dollar may continue to rise as it not only benefits from widening rate differentials, but eventually a potential “flight to safety” should a severe global recession materialize.

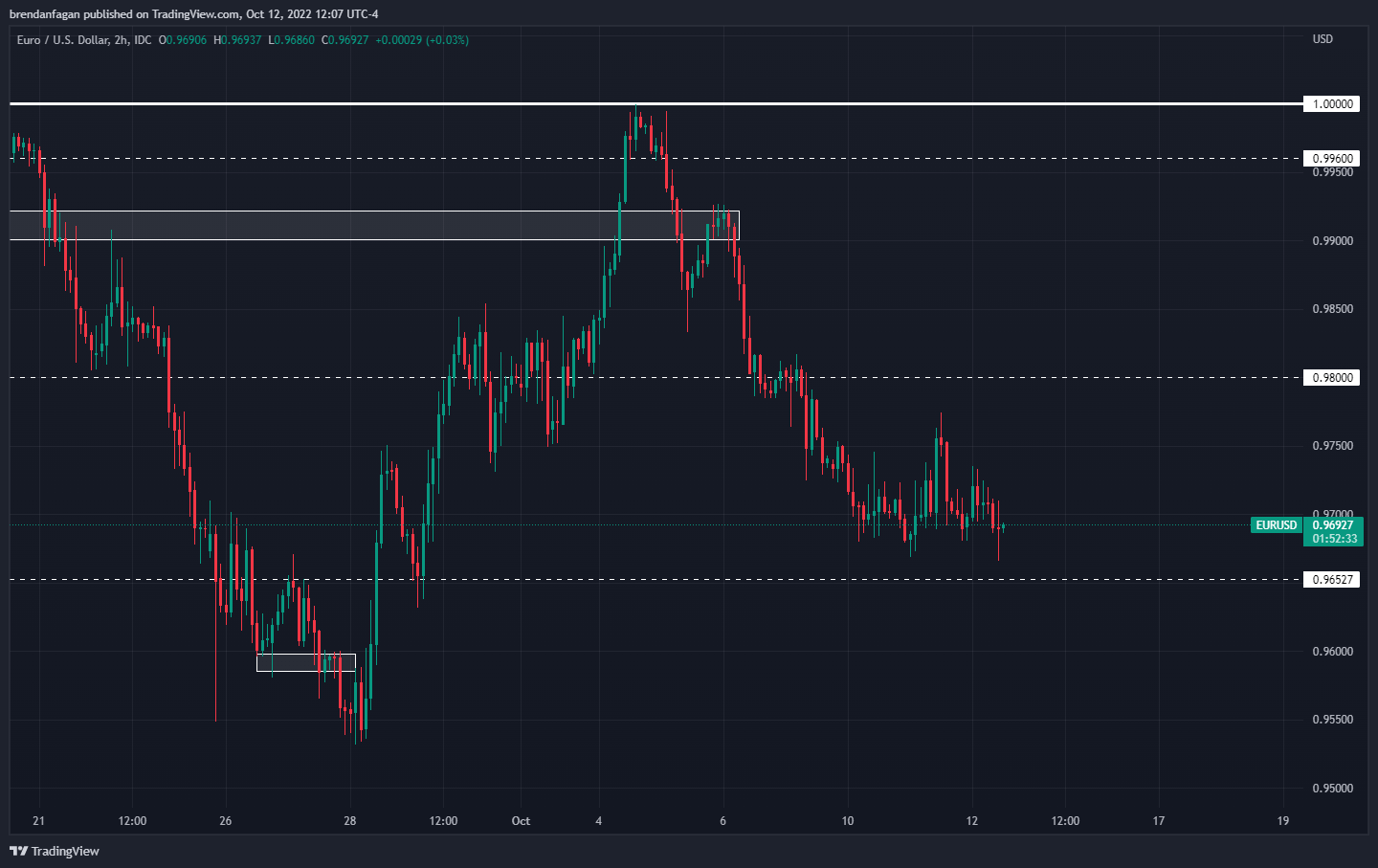

EURUSD 2 Hour Chart

Chart created with TradingView

EURUSD has chopped around the 0.9700 psychological level for the past few sessions, as it appears traders are simply jostling for position ahead of Thursday’s CPI report. After re-testing parity on Oct. 4, recent USD strength has seen EURUSD fall over 300 pips.

The risk heading into tomorrow is clearly two-sided, as the market will likely jolt in either direction upon the release of the September CPI figure. While there may be volatility across asset classes, the bar remains extremely high to shift the narrative surrounding a 75 basis point rate hike from the FOMC in November.

The firm rejection at parity represented a failure at both trendline and psychological resistance, and also notched a “lower-high” in the longer run below the early Sept. swing-high around 1.02. This hints at a potential breach of current YTD lows below 0.9550, but all may depend on upcoming data and news flow. Should the two be supportive of the current trend, it may only be a matter of time before we pierce the current low at 0.9532.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter