EURUSD – Speaking Factors

- EURUSD fails to carry above 200-day shifting common

- Submit-PPI spike falls in need of testing key 1.05 stage

- Every day candle offers some hope to bears after brutal few weeks

Advisable by Brendan Fagan

Get Your Free EUR Forecast

EURUSD has cooled from session highs after getting a shot within the arm through the New York session following delicate PPI information. The US Greenback took one other sharp leg decrease within the minutes following 8:30 EST as market individuals rejoiced over one more delicate inflation print. Consecutive delicate prints in CPI and PPI have bolstered current Fed commentary that has set the desk for a slowing of the tempo of charge hikes. After printing a session excessive of 1.0481, a retracement again beneath the 200-day shifting common materialized because the US Greenback rebounded barely.

After we have a look at the each day timeframe on EURUSD, we are able to see the clear break of descending trendline resistance has was a large breakout. That trendline resistance had penned in value for everything of this transfer decrease all year long, with every advance getting rejected. However this resistance broke because the market caught a scent of a possible slowdown from the Federal Reserve. Lower than two weeks in the past, EURUSD was buying and selling beneath 0.9750. As we now sit simply shy of the 1.05 deal with, merchants can start to understand the magnitude of the transfer in current periods.

EURUSD Every day Chart

Chart created with TradingView

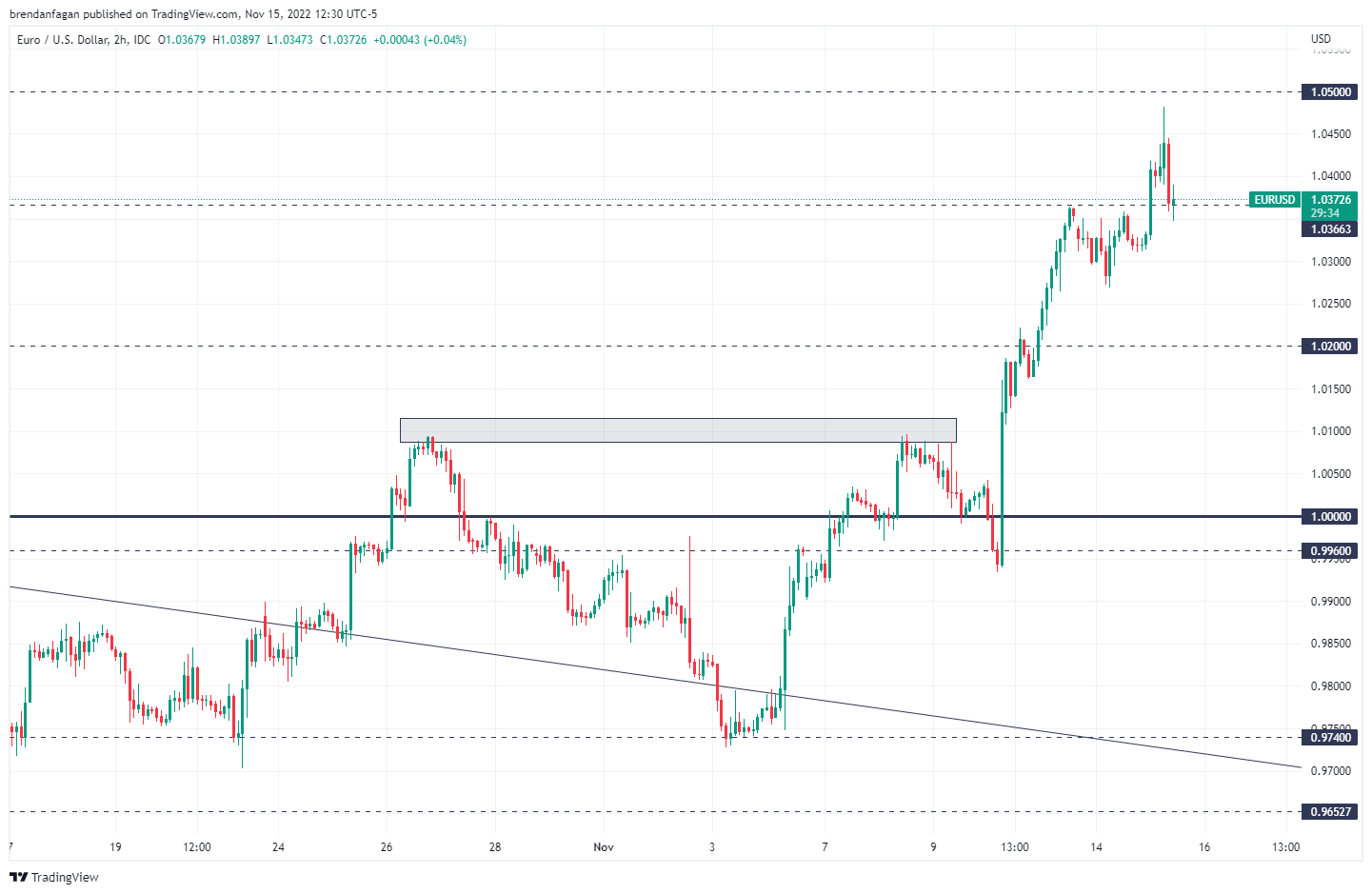

After we get into the smaller timeframes, we are able to see that EURUSD has had a uneven experience to increased costs. An advance in late-October that stretched briefly above parity was offered again right down to assist at 0.9740 earlier than this rollercoaster of a rally started. On two events, EURUSD upside stalled out at resistance just under 1.01, however this zone was obliterated within the post-CPI squeeze final week. Since then, a mixture of recent longs and shorts masking has propelled EURUSD to costs that haven’t traded since August.

EURUSD 2 Hour Chart

Chart created with TradingView

It must be famous that bulls have taken EURUSD a good distance in a brief period of time as merchants reassess the longer term path of Fed coverage. Whereas the US inflation prints are excellent news, the struggle stays removed from over. This has been echoed in Fedspeak this week by Christopher Waller and Vice Chair Lael Brainard. With that in thoughts, it could be too early to take a victory lap and name for an finish to Fed tightening. As now we have discovered in current months, all it takes is one scorching inflation print to unwind this optimism that has constructed up.

Taking a look at Tuesday’s motion, it’s notable that bulls had been unable to even check the 1.05 space. Their advance was instantly offered right down to the important thing 1.0365 stage, a spot that EURUSD has failed to shut above for the final two periods. I can be preserving this stage in thoughts into the top of the session, as an in depth above signifies bulls are usually not but able to rollover. That being stated, the lengthy wick on the each day candle does fear me, because it reveals bears are beginning to dig their heels in.

With all this in thoughts, EURUSD could look to revisit that 200-day shifting common as soon as once more and even the 1.05 psychological stage ought to there be some overshoot. Ought to a broad USD rebound materialize, I might search for EURUSD to commerce again to 1.02.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

RESOURCES FOR FOREX TRADERS

Whether or not you’re a new or skilled dealer, now we have a number of assets out there that will help you; indicator for monitoring dealer sentiment, quarterly buying and selling forecasts, analytical and academic webinars held each day, buying and selling guides that will help you enhance buying and selling efficiency, and one particularly for many who are new to foreign exchange.

— Written by Brendan Fagan

To contact Brendan, use the feedback part beneath or @BrendanFaganFX on Twitter