- Flash HICP in August 5.3% (5.1% anticipated, 5.3% in July)

- Flash core HICP in August 5.3% (5.3% anticipated, 5.5% in July)

- The important thing shifting common supplies resistance as soon as once more

Eurozone financial indicators this morning have been one thing of a combined bag, though merchants appear enthused on the again of them somewhat than disillusioned.

We’ve seen regional information over the past couple of days which gave us some indication of how right this moment’s HICP report would look and a drop within the core studying according to expectations mixed with no lower within the headline appeared to make sense. Unemployment, in the meantime, remained at a report low regardless of a rise within the variety of these unemployed.

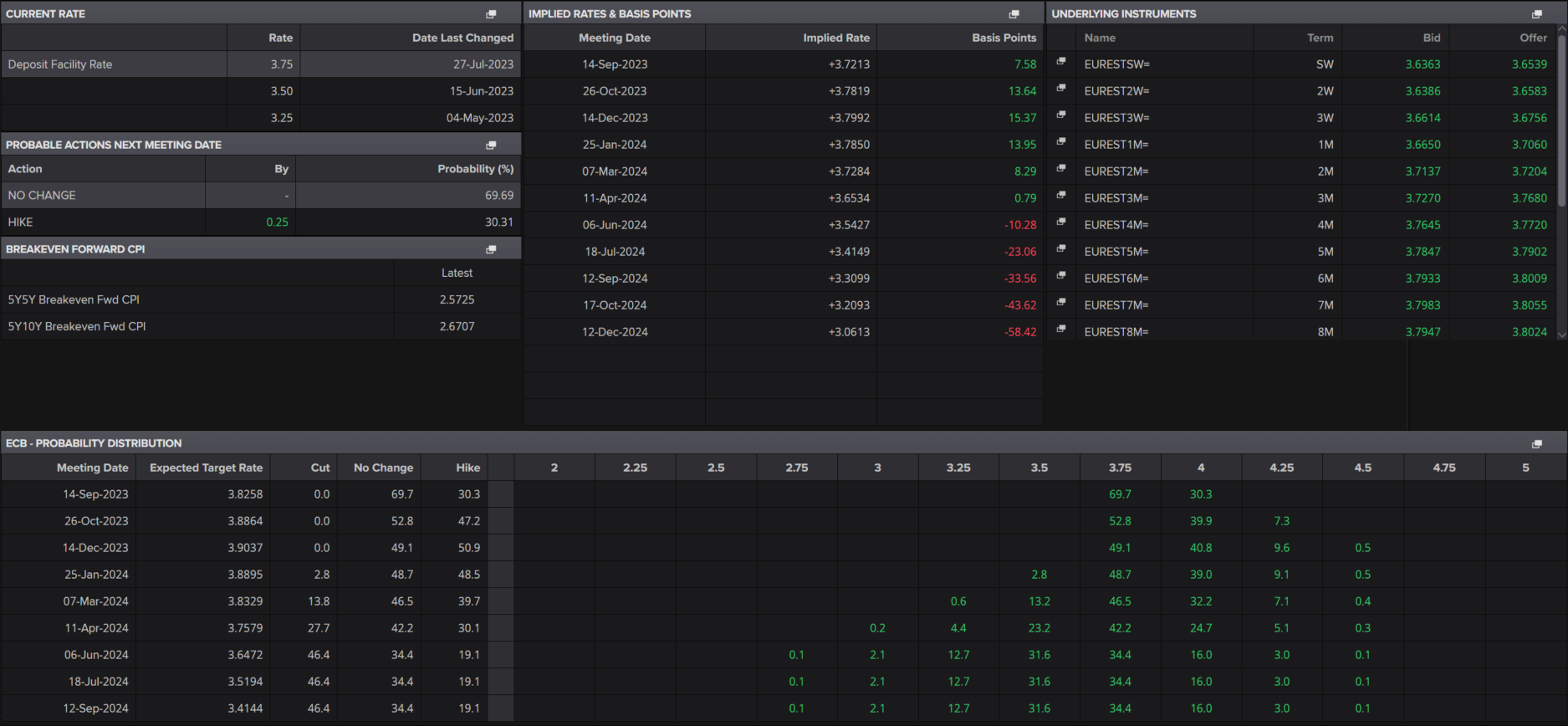

Maybe there’s some aid that the headline HICP charge didn’t tick just a little larger whereas the core did decline which mixed with expectations for the approaching months provides the ECB loads to debate. One other hike in September nonetheless strikes me as extra probably than not however on the again of this launch, markets are swinging the opposite method, pricing in a close to 70% likelihood of no enhance.

ECB Chance

Supply – Refinitiv Eikon

That’s helped the euro to slip greater than 0.5% towards the this morning – related towards the and rather less towards the pound whereas regional markets are seemingly unmoved and proceed to commerce comparatively flat.

Additional bearish technical indicators following the eurozone information

Whereas the autumn towards the pound was rather less important, it has enabled it to as soon as once more rotate decrease off the 55/89-day easy shifting common band, reinforcing the bearish narrative within the pair.

EURGBP Each day

Supply – OANDA on Buying and selling View

has run into resistance on various events across the higher finish of this band, with the 100 DMA (blue) arguably being a extra correct resistance zone over the summer time.

Regardless, that also leaves an image of decrease peaks and comparatively regular assist round 0.85. Whereas that will merely be consolidation, the decrease peaks arguably give it a slight bearish bias, a big break of 0.85 clearly being wanted to verify that.

Unique Submit