World shares rose for the fourth day in a row, marking their finest streak in over two months. This got here as commerce tensions eased and Federal Reserve officers signaled they may decrease earlier than anticipated.

Markets had been extra optimistic that the US and China had been ready to barter a deal. This got here after Bloomberg Information reported that Chinese language Authorities had been ready to droop its 125% tariff on some US imports.

U.S. futures additionally benefited after Google’s dad or mum firm Alphabet (NASDAQ:) exceeded revenue expectations and confirmed its AI funding plans; its shares jumped practically 5% in after-hours buying and selling, boosting different tech shares as effectively.

European futures rose, with STXEc1 up 0.6% and rising by 0.2%. In the meantime, on Wall Road, the gained 2% regardless of blended company earnings.

On the FX entrance, the , which had struggled in current weeks because of tariff updates and shifts in investor confidence, stabilized at 1.1330 to the and 143.6 in opposition to the .

Forex Power Chart, Strongest – Weakest: USD, AUD, CAD, GBP, NZD, EUR, CHF, JPY

Supply: FinancialJuice

The commodities facet noticed safe-haven falter once more on the improved sentiment. The valuable metallic fell from an early Asian session excessive round $3371/oz to commerce round $3300/oz mark on the time of writing.

rose for a second day on Friday, supported by hopes of easing the U.S.-China commerce tensions. Nevertheless, the market was nonetheless on monitor for a 2% weekly drop because of worries about oversupply.

Is the worst behind us? In relation to tariffs that is the query that market contributors will grapple with transferring ahead.

Given the feedback by each US and China officers over the previous 72 hours, one might moderately assume that the worst could also be behind us. Each events now appear to grasp that no one wins in terms of tariffs and this could possibly be the increase that market contributors have been searching for.

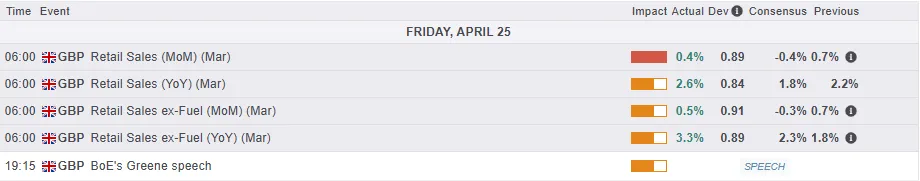

Financial Knowledge Releases

From a knowledge standpoint, it’s a little bit of a quiet day when it comes to information for the EU and UK. The best affect information launch for the morning, which was wage information from the UK, has been launched with markets more likely to give attention to general sentiment as EU earnings releases are additionally comparatively sluggish as we speak.

Chart of the day – DAX

From a technical standpoint, the has continued its advance consistent with different threat property.

This has introduced the index to an important confluence degree across the 22300-22400 deal with the place the 50-day MA rests.

The index has additionally damaged above the 50 degree on the period-14 RSI, an indication of the bullish momentum in play.

A break above the 22400 deal with might result in additional features with resistance at 22800 and 23200, respectively.

A rejection right here might convey the help degree across the 21800 deal with into focus earlier than the 20 and 100-day MAs round 21500 turn out to be an space of curiosity.

Supply: TradingView.com

Authentic Publish