That the Eurozone isn’t in fine condition economically we all know and now we have mentioned it many occasions: manufacturing, orders, PMIs, hours labored (in Germany they reached the bottom for the reason that information began being collected in 1971, 34.3 hours per week on common). Yesterday, two different items of information got here out, essential though typically not so carefully watched by retail merchants, regarding financial progress. The M1 mixture (forex, checking accounts, demand deposits and different liquid deposits) has been contracting since late 2022 however lastly the July information confirmed that the broader M3 mixture (which incorporates all types of saving deposits, time deposits and cash market funds) additionally contracted for the primary time in 13 years (the final time was in 2010, after the GFC). The shift from in a single day deposits to longer-term deposits was a significant factor, however there it’s. Why does this matter? As a result of cash provide is the oil that drives the financial engine.

And one other dangerous signal got here from the progress of credit score via personal loans: +1.3% y/y to the lowest stage since 2016. Banks in some unspecified time in the future final spring halted lending as simply as earlier than, each to people and to corporations, halting the enlargement of their steadiness sheet.

How are European inventory indices doing in all this? Not too dangerous, buying and selling round 2% to 4% off their latest highs, which in some circumstances are additionally all-time highs (as within the case of the GER40 and FRA40). In truth, evaluating 1-year efficiency towards their US friends, the continental indices are doing a lot better (GER40 +21.75% vs US30 +7.05%) and even lowering the timeframe to the month of August solely, the Spanish IBEX can be on the run (-1.57% towards -4.46% of US100 and -3.40% of the US500).

Comparability of the efficiency of US and EU indices

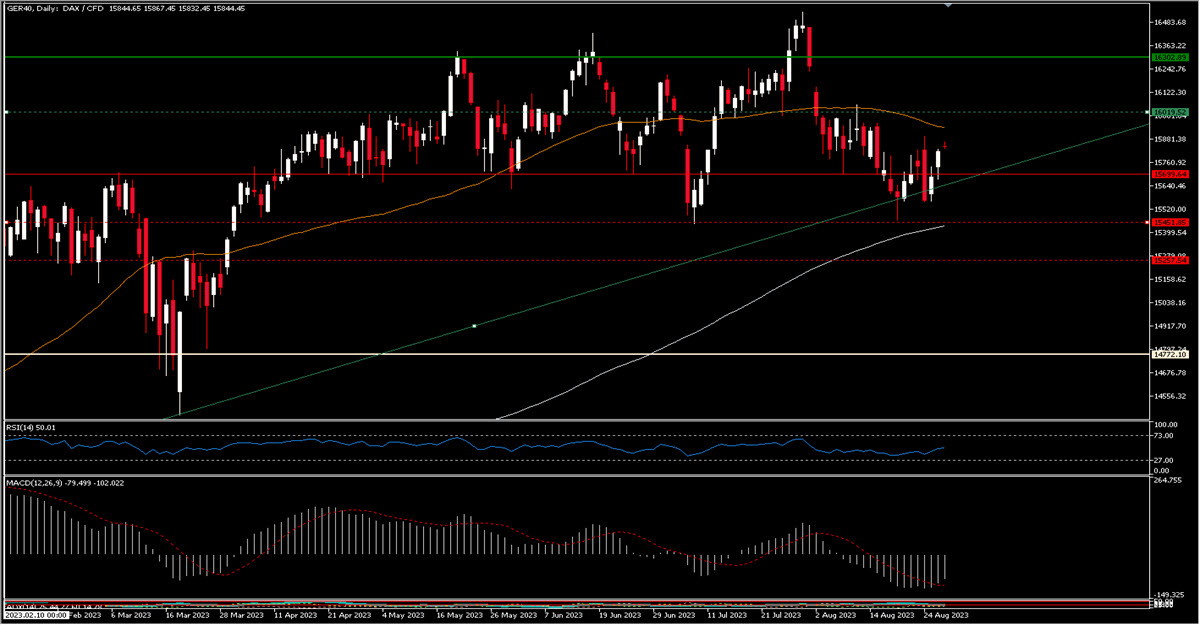

Trying on the charts, we discover vaguely related behaviour among the many 3 primary European indices we provide: all have misplaced the sturdy bullish momentum that began in October 2022 and have slowed down transferring virtually sideways since April this 12 months. Within the case of GER40 there’s a actual vary with 15450, 15700 as essential ranges downwards and 16000, 16300 upwards.

GER40, Day by day

SPA35 appears to be the strongest of the three benchmarks as it’s transferring in a barely bullish channel which these days would have its decrease sure at 9230 and higher one at 9730 (which can also be the latest excessive and a key stage earlier than the Covid crisis-related collapse).

SPA35, Day by day

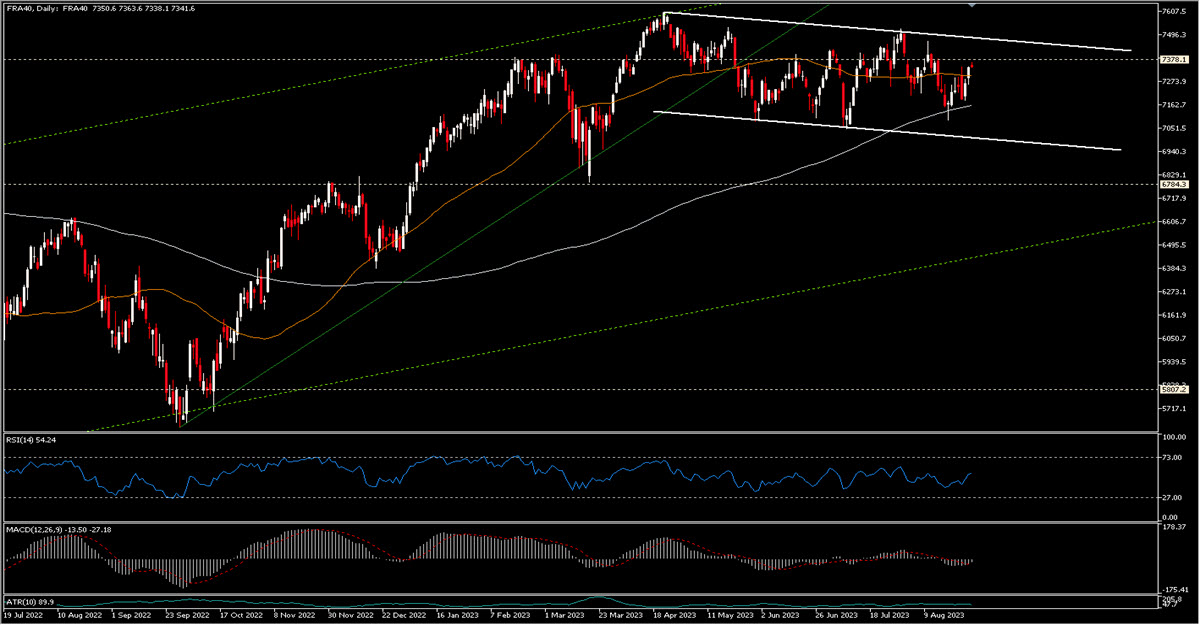

However, the French FRA40 exhibits descending highs and lows however nonetheless inside a channel (higher restrict at 7475, decrease within the 7000 space thus far).

FRA40, Day by day

And that is truly what makes the European indices fascinating, a fairly steady and outlined behaviour over the past 4 months or so, with clear reference factors to comply with. Till they’re damaged, in fact.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.