EUR/USD ANALYSIS

- Euro space financial scenario stays weak however EUR bulls capitalize on US information.

- NFP and US ISM providers PMI in focus tomorrow.

- EUR/USD stays inside creating rising wedge.

Elevate your buying and selling expertise and acquire a aggressive edge. Get your arms on the Euro This fall outlook right this moment for unique insights into key market catalysts that needs to be on each dealer’s radar.

Beneficial by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro pushed increased after disappointing Euro space information confirmed weak manufacturing PMI’s (see financial calendar under) proceed to plague the area. The HCOB manufacturing PMI launch slumped to 3-month lows and the sixteenth consecutive print under the 50 degree that marks the change from contraction to growth. German and French PMI’s that have been launched prior additionally urged vital weak spot in demand by way of new order statistics that declined at a fast fee. That being mentioned, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Business Financial institution said that the Eurozone could also be at its lows and will see an ascension within the months to come back. This might be troublesome with the present tight financial coverage surroundings and geopolitical uncertainty holding enterprise and traders on edge.

US labor information by way of the jobless claims print confirmed a rise relative to forecasts that might sign the start of an unwinding jobs market. Though there’s minimal correlation between this report and the Non-Farm Payroll (NFP) determine tomorrow, coupled with the miss on ADP employment change yesterday, markets could also be expectant of a weaker total NFP launch tomorrow.

Wish to keep up to date with probably the most related buying and selling info? Join our bi-weekly publication and hold abreast of the most recent market shifting occasions!

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

ECONOMIC CALENDAR (GMT+02:00)

Supply: Refinitiv

TECHNICAL ANALYSIS

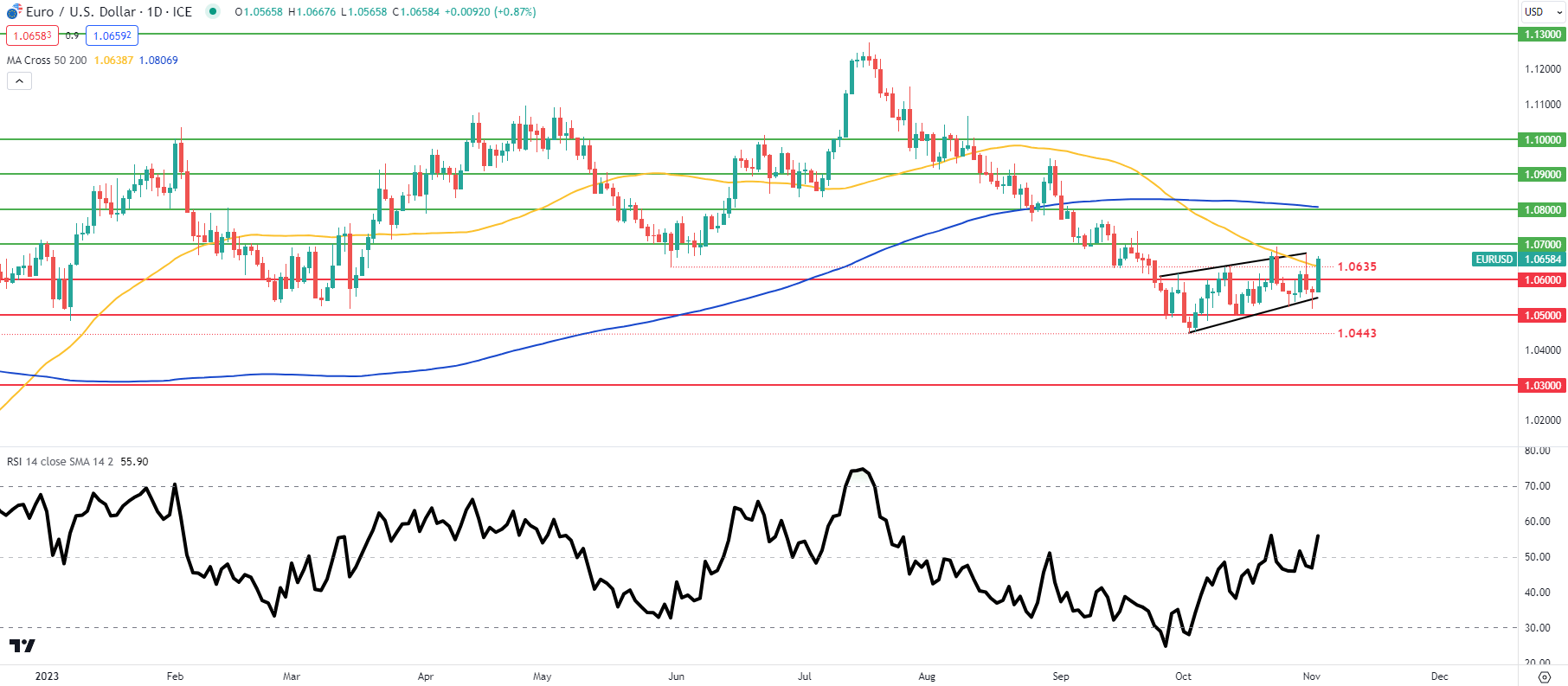

EUR/USD DAILY CHART

Chart ready by Warren Venketas, IG

The day by day EUR/USD day by day chart stays inside the sample rising wedge (black) after testing wedge assist yesterday. The decrease lengthy wick shut yesterday naturally noticed costs push increased right this moment however this can be temporary contemplating the weak financial information within the Euro space. Brief-term directional bias hinges on tomorrow’s US NFP and ISM providers PMI.

Resistance ranges:

- 1.0800

- 1.0700

- Wedge resistance

Assist ranges:

- 1.0635/50-day MA

- 1.0600

- Wedge assist

- 1.0500

- 1.0443

- 1.0300

IG CLIENT SENTIMENT DATA: BULLISH

IGCS reveals retail merchants are at the moment neither NET LONG on EUR/USD, with 55% of merchants at the moment holding lengthy positions (as of this writing).

Obtain the most recent sentiment information (under) to see how day by day and weekly positional modifications have an effect on EUR/USD sentiment and outlook.

Introduction to Technical Evaluation

Market Sentiment

Beneficial by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas