EUR/USD Worth, Chart, and Evaluation

- ECB ramps up the hawkish rhetoric.

- EUR/USD advantages from ongoing US greenback weak spot.

Beneficial by Nick Cawley

Get Your Free EUR Forecast

The European Central Financial institution is just not for turning and can proceed to lift rates of interest, and hold them there for lengthy sufficient, ‘in order that we are able to return inflation to 2%’, in accordance with ECB President Lagarde, talking on the World Financial Discussion board in Davos. Ms. Lagarde additionally warned those that questioned the ECB’s intent to additional tighten financial coverage into restrictive territory saying, ‘I might invite them to revise their place, they’d be well-advised to take action’. Additionally talking at DAVOS, Dutch central financial institution chief Klass Knot instructed that fee hikes is not going to cease with only one 50bp hike. Knot added ‘a lot of the floor that we now have to cowl, we are going to cowl at a fixed tempo of a number of 50 foundation level hikes’. Whether or not the markets selected to take heed to the ECB is one other matter, and except the central financial institution follows via on its speak, its authority will come underneath growing stress. Monetary markets are a really unforgiving place.

Subsequent week’s financial calendar has a raft of high-importance releases that can have an effect on either side of EUR/USD. The latter half of the week seems the almost definitely to drive value motion with the primary have a look at US This fall GDP, adopted the following day by the Fed’s most well-liked measure of inflation, core PCE. If both of those releases misses or beats expectations then EUR/USD volatility will surge. Along with these releases, the newest spherical of PMI knowledge will probably be revealed on Tuesday (twenty fourth) subsequent week and they need to be intently adopted.

For all market-moving financial releases and occasions, see the DailyFX Calendar

Beneficial by Nick Cawley

The way to Commerce EUR/USD

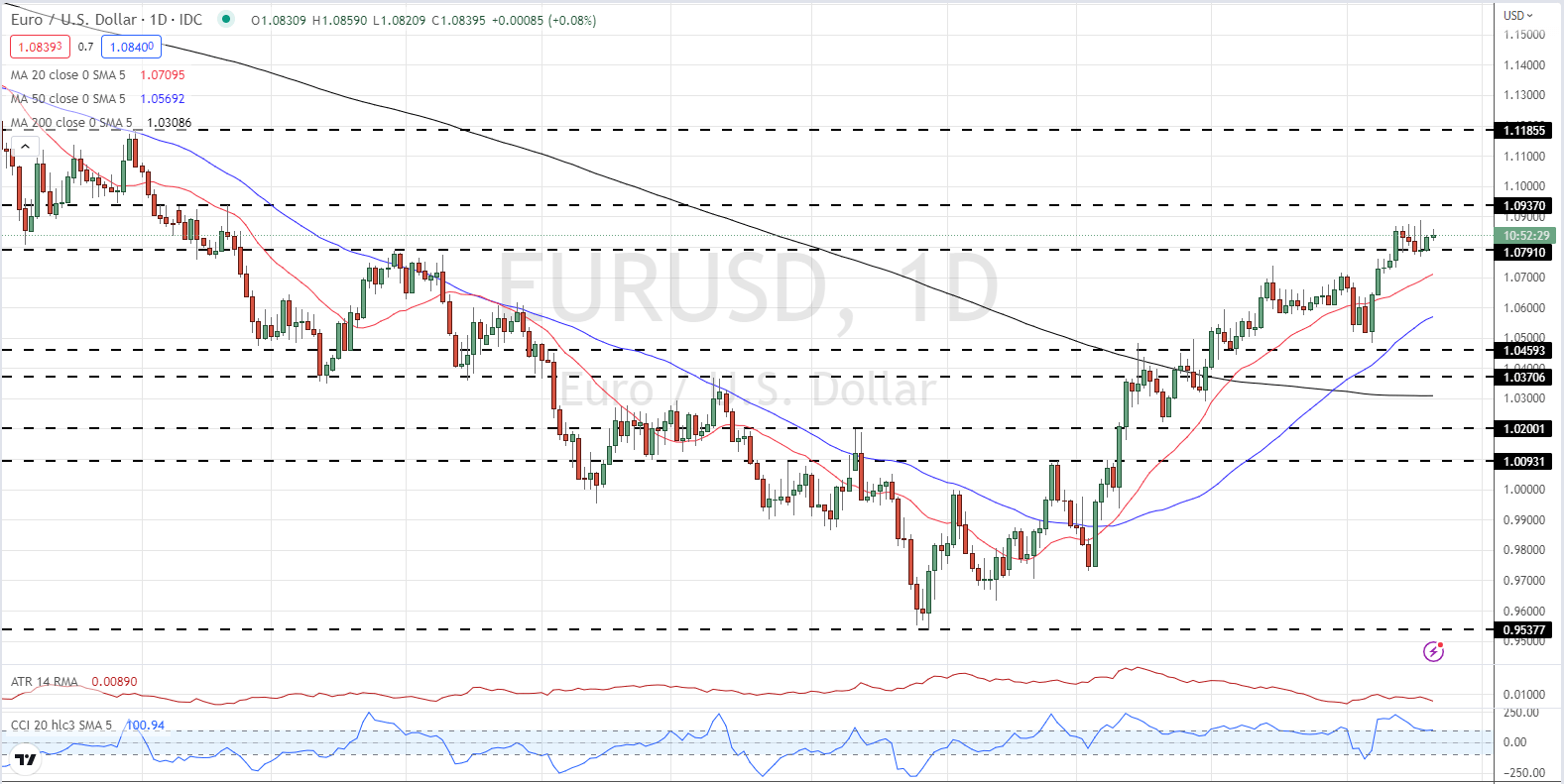

The Euro is presently in a decent, consolidation sample towards the US greenback with short-term help round 1.0770 to 1.0780 trying stronger as every session passes. Above there, an previous degree of horizontal help round 1.07910 can be seen with the following degree of resistance seen at 1.09370. If the pair make a confirmed above this degree then there may be little in the best way of technical resistance forward of 1.11855. The latest overbought CCI studying is presently being reset decrease and this may assist underpin the pair within the brief time period.

EUR/USD Day by day Worth Chart – January 20, 2023

Charts by way of TradingView

Retail Merchants Trim Lengthy Positions

Retail dealer knowledge present 37.65% of merchants are net-long with the ratio of merchants brief to lengthy at 1.66 to 1.The variety of merchants net-long is 9.03% decrease than yesterday and 26.51% larger from final week, whereas the variety of merchants net-short is 10.46% larger than yesterday and seven.12% decrease from final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests EUR/USD costs could proceed to rise. Positioning is extra net-short than yesterday however much less net-short from final week. The mix of present sentiment and up to date modifications offers us an extra combined EUR/USD buying and selling bias.

What’s your view on the EURO – bullish or bearish?? You possibly can tell us by way of the shape on the finish of this piece or you may contact the creator by way of Twitter @nickcawley1.