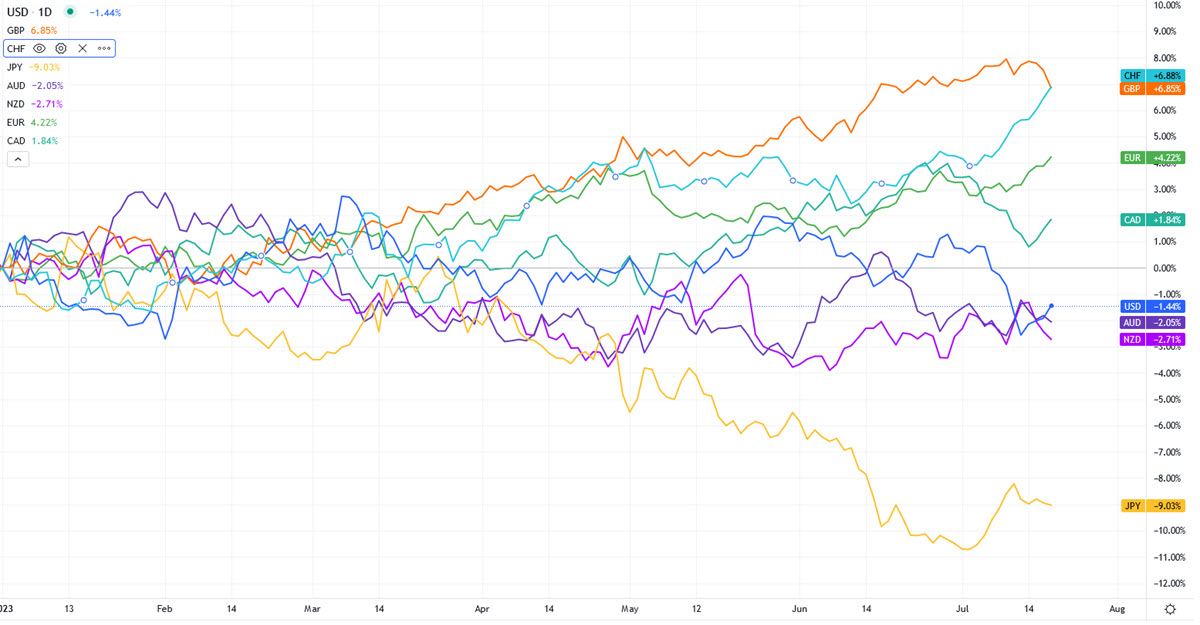

Are you aware which has been the strongest main in 2023? Properly sure, the Pound Sterling, +6.98% is the YTD results of its weighted index (okay, the CHF didn’t accomplish that dangerous neither). Properly, UK inflation has been the very best among the many DMs and the ‘Previous Woman’ – the BOE – has been repeatedly accused – particularly internally – of getting been too gradual to react, to take motion, of being clearly ‘behind the curve’. So, at a sure level the conviction unfold that the prospects for his or her strongly restrictive motion, way more than some other central financial institution, would have been the almost certainly possibility. A number of weeks in the past, the terminal charge was anticipated by the markets to be 6.5% by MAR 2024 (with some chance of 6.75%); the present charge is 5%, simply in your information.

Foreign money Indices, 2023

This morning the headline CPI lastly dropped beneath 7% Y/Y (6.9%) – and bear in mind it was at 10.1% in March. Producer value inputs slumped into deep deflationary territory at -2.7% y/y. And so did expectations on the terminal charge on swap markets: beneath 6% at the moment. Sterling is sinking: -0.95% in opposition to the USD, -0.81% in opposition to the EUR. However since we regularly speak in regards to the Cable and furthermore the USD has been significantly weak these days (-13% since September 2022) at the moment we’ll have a look at the EURGBP chart.

TECHNICAL ANALYSIS

Though it isn’t so clearly seen on this chart, EURGBP has been buying and selling between 0.83 and 0.93 since 2016, slowly shifting from one aspect of the wide selection to the opposite: the 0.93 space was nearly touched in September 2022 whereas the following bearish section did not go all the way down to 0.83, stopping its fall first within the 0.8575 space and some weeks in the past within the 0.85 space. Within the final 4 classes the EUR has been regaining energy (nicely the Pound is weakening, as is the case at the moment) and the pair has come to commerce at 0.8690. Properly, there’s a bearish trendline passing simply right here and furthermore 0.8715 is a somewhat essential intermediate resistance/assist space. The RSI is clearly constructive and the MACD can also be tilted upwards. The value broke above the 50 days MM simply at the moment however is beneath the 200 days MM.

EURGBP, Each day, 2019 – At present

So, between 0.8690 and 0.8715 we’re actually at a pivotal level, and we acquired there due to at the moment’s ”stunning” (ahem) information. We’ll monitor this space rigorously, a break upwards might extend the rally, additionally as a result of the MM200 additionally passes very near 0.8725.

However we’ll be trustworthy: for now, regardless of the symptoms, we choose the speculation that the one of many previous couple of days is solely a short lived rebound and that financial coverage and value tendencies nonetheless favour the Pound within the medium time period. Regardless of this, allow us to not neglect that no less than as soon as, in Might 2019, the rally to 0.93 began from 0.85 and – though it isn’t so prone to occur now in our opinion – allow us to hold this in thoughts.

EURGBP, 4 Hours

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.