Euro Greenback (EUR/USD) Speaking factors

- Euro Greenback stagnates because the US celebrates President’s Day

- EUR/USD breaches trendline resistance round 1.069. Can bulls retest 1.070 psychological degree?

- Danger occasions for the week embody sentiment and inflation information for Europe and FOMC minutes

Really helpful by Tammy Da Costa

The best way to Commerce EUR/USD

EUR/USD has managed to seek out non permanent assist above 1.066, pushing costs into one other tight vary round 1.069. With the most important forex pair at the moment susceptible to political and elementary headwinds, a public vacation within the US (Presidents Day) has contributed to immediately’s lackluster momentum.

As market members proceed to give attention to central financial institution coverage and recession dangers, the financial docket may contribute to driving volatility for the rest of the week.

DailyFX Financial Calendar

Though expectations of upper charges have already been priced in, diminishing progress prospects have raised query on when central banks could pivot.

Preserve observe of curiosity price selections by visiting our Central Financial institution Calendar

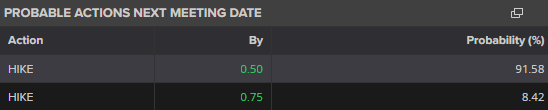

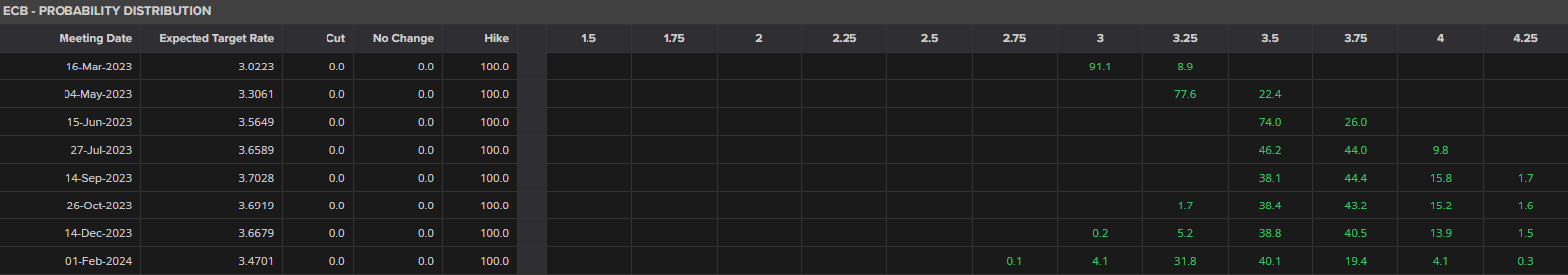

In anticipation of Wednesday’s FOMC minutes, price expectations will doubtless stay on the forefront of threat sentiment. Whereas the Federal Reserve and the ECB (European Central Financial institution) have reconfirmed their dedication to taming inflation by way of extra price hikes, larger charges and chronic value pressures proceed to weigh on shoppers.

In the meantime, for Europe, ZEW sentiment information for the Euro and Germany will assist present perception into how analysts count on the economic system to carry out over the following six months. Whereas inflation information may assist set the stage for the ECB who’re anticipated to boost charges by a further 50-basis factors (0.5%) in March.

Supply: Refinitiv

EUR/USD Technical Evaluation

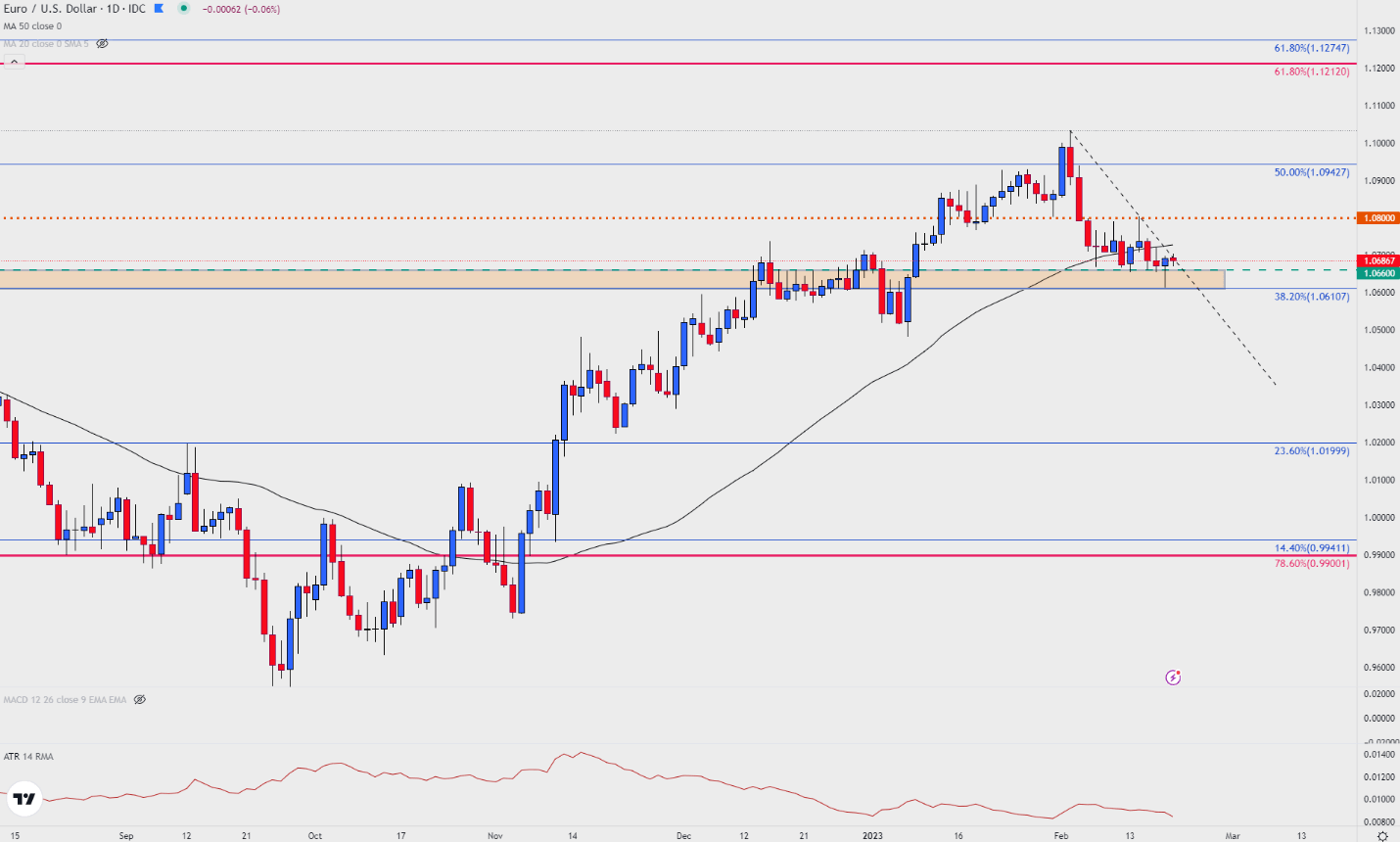

After the formation of a hammer candle on Friday, a bounce off Fibonacci assist at 1.061 (the 38.2% Fibonacci of the 2021 transfer), drove costs to the trendline resistance (from the Feb excessive) round 1.069.

Because the ATR (common true vary) on the each day chart continues to say no (indicating low volatility), the mixture of financial sentiment, inflation and price expectations could help in serving to EUR/USD break the present vary if the information delivers any surprises that might drive buyers to reprice modifications within the elementary backdrop.

Go to DailyFX Training to find use ATR (common true vary) to measure volatility in monetary markets

With the 1.070 psychological degree simply above, the 50-day MA (transferring common) has shaped a further barrier of resistance round 1.073.

EUR/USD Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

| Change in | Longs | Shorts | OI |

| Each day | 18% | 10% | 14% |

| Weekly | -1% | 5% | 2% |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707