EUR/USD News and Analysis

- Euro benefits from softer dollar, improved risk sentiment and GBP recovery

- EUR/USD technical hurdles that need to be overcome for bullish narrative to take hold. Longer-term outlook remains bearish

- Risk Events: US Jolts, ISM PMI data, ADP and NFP to round up the week

Recommended by Richard Snow

Get Your Free EUR Forecast

Euro Benefits from Softer Dollar, Improved Risk Sentiment and GBP Recovery

The Euro has benefitted from the recent improvement in risk sentiment and a softer dollar, as US treasury yields ease off and markets trim back expectations of the Fed’s terminal rate. The Euro’s association with ‘risk assets’ is due to its proximity to the ongoing conflict in Ukraine and via the conflict-linked energy crisis ahead of the winter months.

However, looking at the EUR/USD chart, the bullish move is still contained within the longer-term bearish trend – shown by the descending channel. Prices have climbed higher but there is no indication yet that this is a long-term move. Euro fundamentals are still weak (GDP growth concerns, potential gas shortages, inflation hitting 10% for September, aggressive rate hikes and the lingering possibility of rising periphery bond spreads).

Key EUR/USD Technical Levels

The daily chart provides a clear path of challenges to the recent EUR/USD relief rally. Currently, the pair tests the 78.6% Fib retracement of the large 2000-2008 move at 0.9900. Further upside resistance appears via the 0.9954 level of prior support followed by parity which coincides with the upper bound of the descending channel. Any signs of slowing down around those key levels could be accompanied by positive US data towards the end of the week, which typically favors a return to USD strength.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

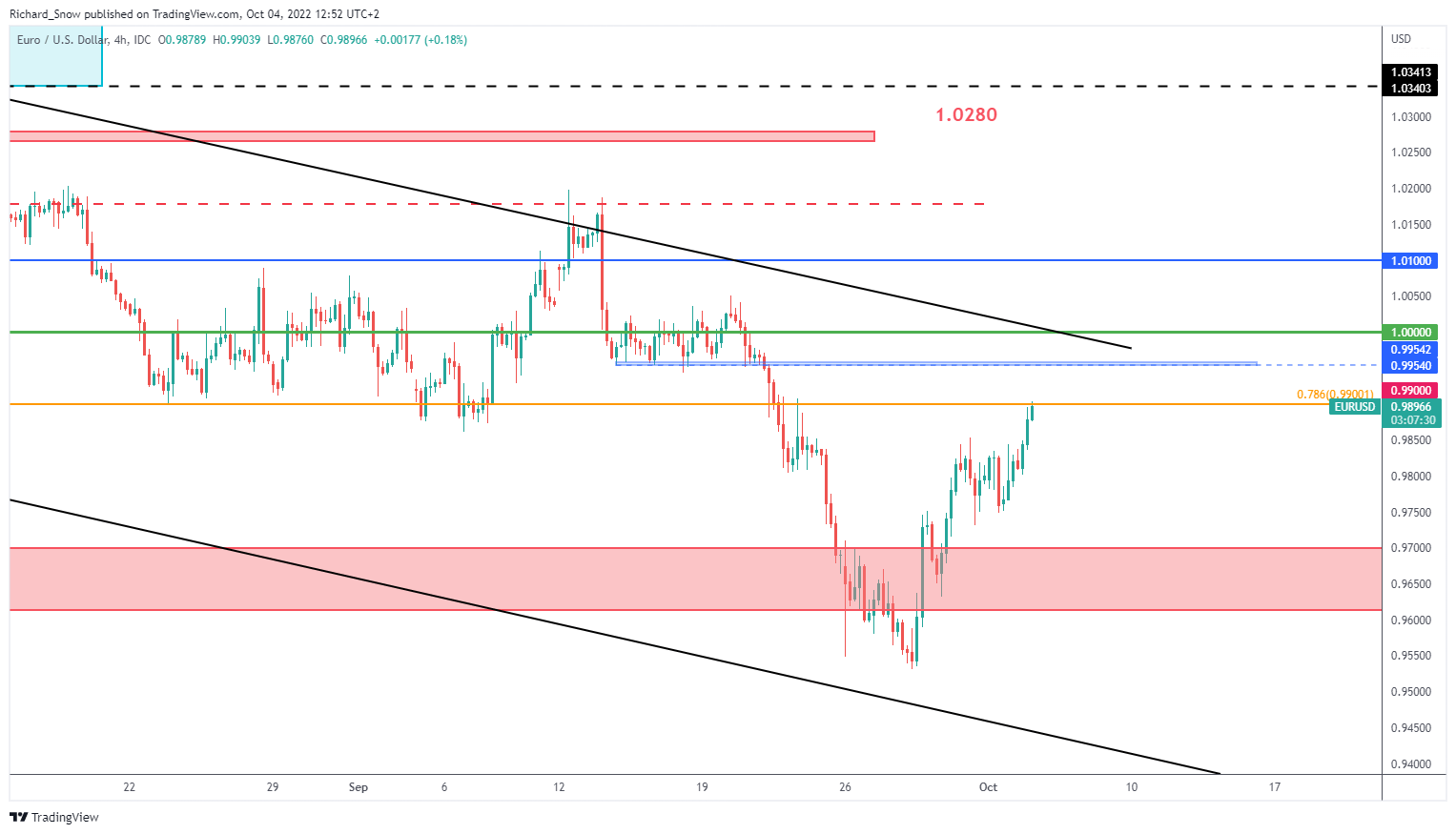

The 4-hour chart reveals a test of the 78.6% Fibonacci retracement at the psychologically important 0.9900 level. Further upside would need to test the level of support that held up price action at 0.9954. Finally, parity remains as a very significant challenge for the pair. Euro bears looking for a return to USD strength will keep a close eye on a number of rather significant US data prints this week.

EUR/USD 4-Hour Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

Major Event Risk

After a disappointing ISM manufacturing PMI report, market participants will naturally look ahead to the services side of PMI data tomorrow. The services sector is the largest in the US economy and therefore the data carries a fair amount of significance. A strong beat could cut the EUR/USD run short, as the focus would likely return to Fed hikes, while a miss compounds the disappointing manufacturing figures, potentially sending yields and the dollar even lower. The ECB policy meeting accounts are likely to create some volatility especially around mentions of quantitative tightening.

Lastly, US non-farm payroll data (NFP) is expected to show a continuation of job gains with an additional 250k jobs added. The resilient jobs market has helped the Fed continue to hike rates and a sizeable beat in the expected figure could result in a hawkish repricing of the terminal rate, which has eased recently from 4.5% to under 4.4%. A hawkish repricing ought to see the dollar move higher, by extension, a move lower in EUR/USD.

Customize and filter live economic data via our DaliyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX