EUR/USD ANALYSIS & TALKING POINTS

- ECB price hike seems to inflation information for steerage as cash markets require extra conviction between a 0.25% and 0.50% increment.

- USD receives further assist from souring danger sentiment.

- Technical evaluation favors euro draw back on each weekly and each day timeframes.

Really useful by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL FORECAST: BEARISH

The euro head into the central financial institution centered week on the backfoot however might change within the buildup to the European Central Financial institution (ECB) price choice (see financial calendar beneath). Key metrics together with eurozone core inflation and credit score information will give markets worthwhile enter to investigate the state of the area. So far core inflation has remained elevated as a consequence of wage progress offsetting increased costs and is ready to stay excessive. The difficulty the ECB now faces is the truth that inflationary pressures have migrated from the supply-side (abating vitality costs) to demand elements.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

EUR/USD ECONOMIC CALENDAR

Supply: DailyFX financial calendar

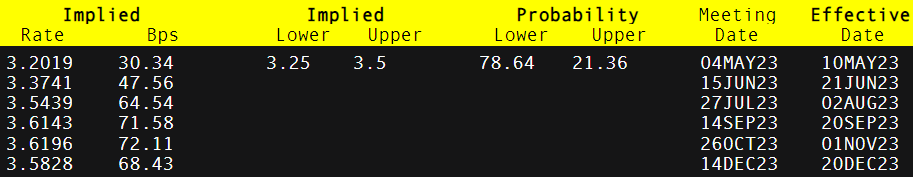

The query for subsequent week is probably going ‘’by how a lot will the ECB hike charges?’’. In keeping with present cash market pricing (check with desk beneath), there’s a 78% likelihood that the ECB will hike by 25bps. That is most likely a large choice in that the ECB can re-assess financial variables forward of the June assembly as the present setting is riddled with uncertainty – primarily via elevated battle exercise in Ukraine in addition to warning across the latest banking disaster.

ECB INTEREST RATE PROBABILITIES

Supply: Refinitiv

From a US perspective, world danger aversion if sustained because of the elements outlined above could play into the safe-haven attribute of the dollar. As well as, US financial information displays a sturdy economic system in relation to inflation and labor. As has been the case for a while, the implied Fed funds futures suggests this can be the final hike from the Fed for 2023. Sustained robust inflation and jobs information might add strain on the Fed to proceed mountain climbing leaving the euro uncovered to additional draw back.

TECHNICAL ANALYSIS

Introduction to Technical Evaluation

Candlestick Patterns

Really useful by Warren Venketas

EUR/USD WEEKLY CHART

Chart ready by Warren Venketas, IG

The weekly EUR/USD chart above seems to be printing a protracted higher wick. If the weekly candle closes on this vogue, just like a headstone doji or capturing star, might level to subsequent draw back for the pair. Coupled with a Relative Energy Index (RSI) approaching overbought territory, the technical options favor euro bears.

EUR/USD DAILY CHART

Chart ready by Warren Venketas, IG

Day by day EUR/USD value motion exhibits the continuation of the ascending channel (black) from mid-March 2023. A break and affirmation shut beneath channel assist might assist the weekly indicators and convey into focus the 1.0900 psychological deal with

Resistance ranges:

Help ranges:

IG CLIENT SENTIMENT DATA: MIXED

IGCS exhibits retail merchants are presently SHORT on EUR/USD, with 58% of merchants presently holding quick positions (as of this writing). At DailyFX we sometimes take a contrarian view to crowd sentiment however as a consequence of latest adjustments in lengthy and quick positioning, we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas