EUR/USD KEY POINTS:

- Eurozone final inflation came in slightly below market expectations

- Risk aversion nudges US Treasury yields higher bolstering the USD amidst growing recession fears

- EUR/USD outlook remains gloomy

Recommended by Cecilia Sanchez Corona

Get Your Free EUR Forecast

Most Read:US Dollar Price Action Setups: EUR/USD, GBP/USD, USD/CAD, USD/JPY

The final Eurozone CPI headline data for September indicates rising price pressures in the Euro-area which puts the ECB on edge for the upcoming policy meeting. This new norm of high prices and tighter financial conditions around the world are fueling concerns about a global recession, driving volatility, risk aversion and demand for safe-haven assets, underpinning USD strength.

The September annual headline inflation figure for the euro area was revised slightly downward. The preliminary figure was 10.0% but was reduced to 9.9% year-over-year. Despite the adjustment and avoiding the double-digit mark, inflation pressures remain too high and put the ECB in a difficult position as the economy in the euro-area is nowhere near strong, while also navigating the energy crisis.

At the ECB’s next meeting on October 27, markets expect a second consecutive interest rate hike of 75 bp, following the 50 bp increase in July. While this would be positive for the euro, concerns about a global recession are mounting as central banks around the world continue to raise interest rates.

In the United States, interest rates have reached levels not seen since 2008. The 10-year yield now stands above 4.10% and the Federal Reserve has reinforced its commitment to curb inflation by pushing rates into a more restrictive territory. This rise in yields is underpinning dollar strength which also translates into further euro weakness, but also because, in fundamental terms, the U.S. economy is in better shape than the Eurozone.

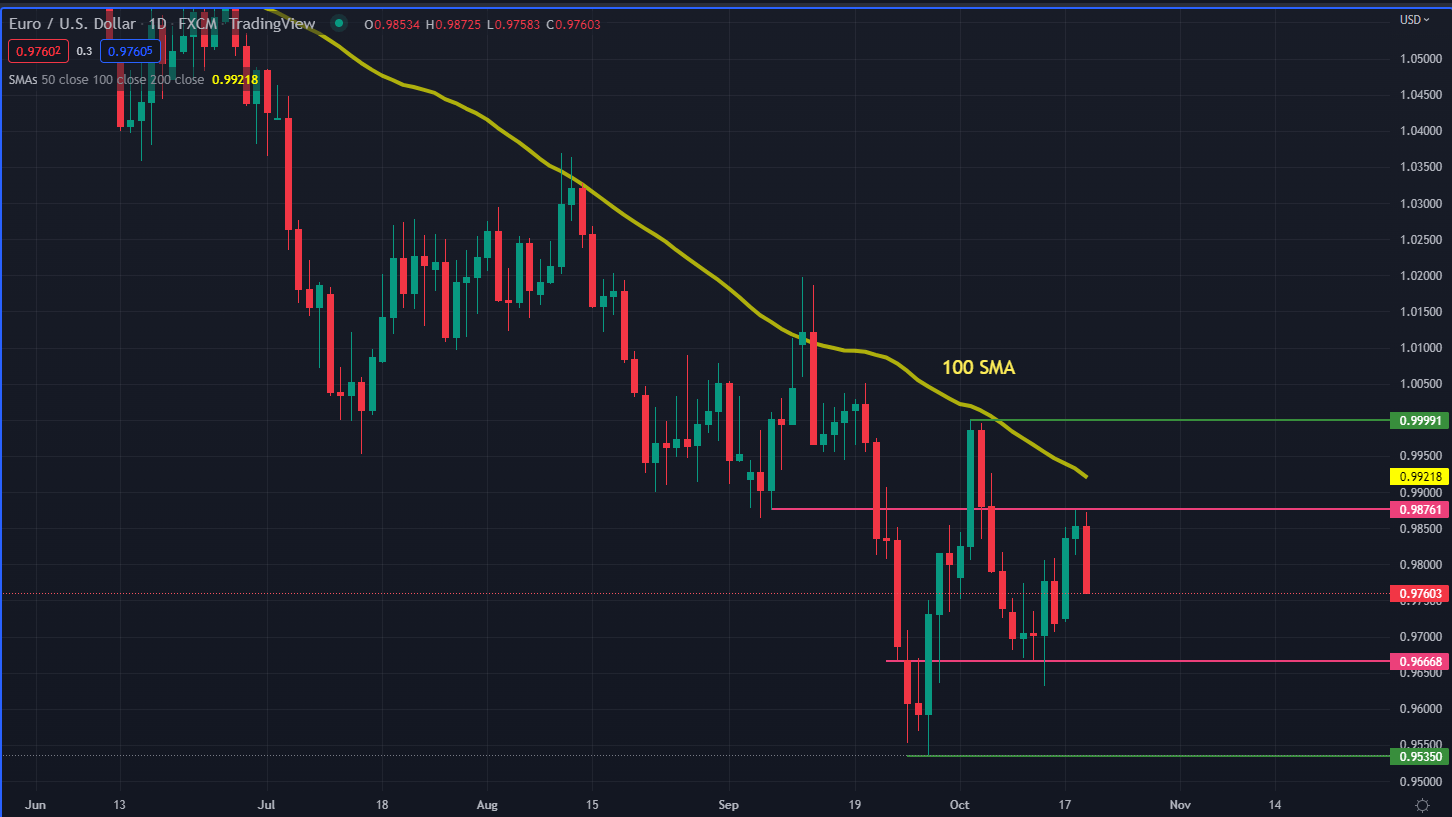

From a technical standpoint, during the past two days EUR/USD advanced as investors weighed some positive news items, but the medium-term outlook remains bearish for the currency pair. Looking at the Daily Chart, there is a short-term range between 0.9540 and 0.9999. Within that area, there is resistance around 0.9875 which is close the 100 SMA, while support is seen around 0.9665

Looking ahead, Eurozone consumer confidence is expected to be released this Friday, ahead of a round of PMI figures on Monday, Germany’s Ifo Business on Tuesday, and the ECB’s monetary policy decision next Thursday.

EUR/USD Daily Chart

Source:TradingView

Recommended by Cecilia Sanchez Corona

Improve your trading with IG Client Sentiment Data

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download thebeginners’ guide for FX traders

- Would you like to know more about your trading personality? Take theDailyFX quizand find out

- IG’s client positioning data provides valuable information on market sentiment.Get your free guideon how to use this powerful trading indicator here.

—Written by Cecilia Sanchez-Corona, Research Team, DailyFX

DailyFXprovides forex news and technical analysis on the trends that influence the global currency markets.