Euro (EUR/USD, EUR/GBP) Evaluation

Markets Await the Fed’s Abstract of Financial Projections for Clues

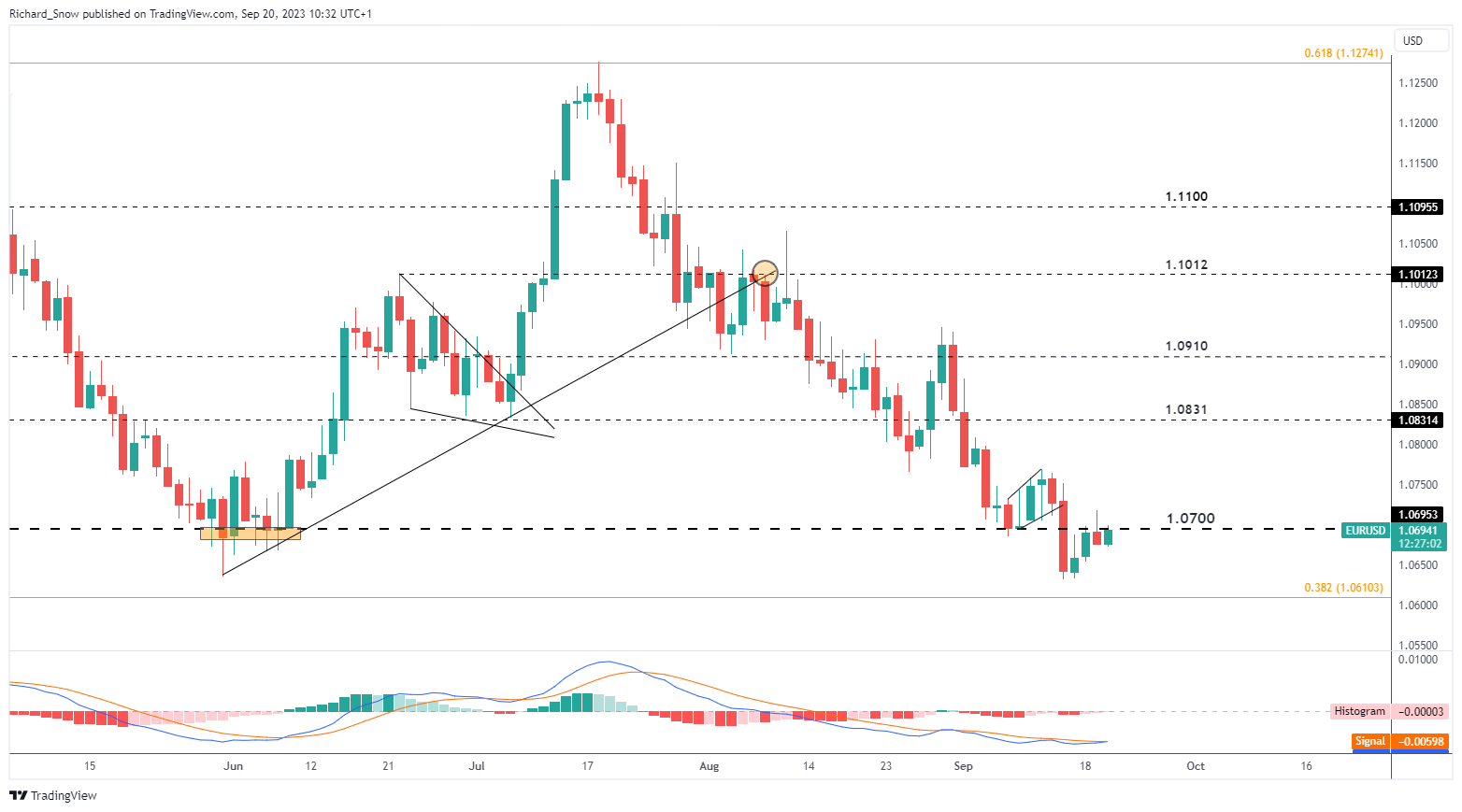

The euro has recovered a big portion of losses in opposition to the greenback, as markets look to the up to date quarterly forecasts often called the abstract of financial projections for clues. EUR/USD dropped instantly after the ECB determined to hike rates of interest, for probably the final time, to 4%.

The bearish transfer was a continuation of a previous channel break (seen on the weekly chart beneath) that now highlights the 1.0640 mark as assist.

EUR/USD Weekly Chart

Supply: TradingView, ready by Richard Snow

Really helpful by Richard Snow

Tips on how to Commerce EUR/USD

Development, Peak Charges and Inflation Forecasts to Set the Tone for This autumn

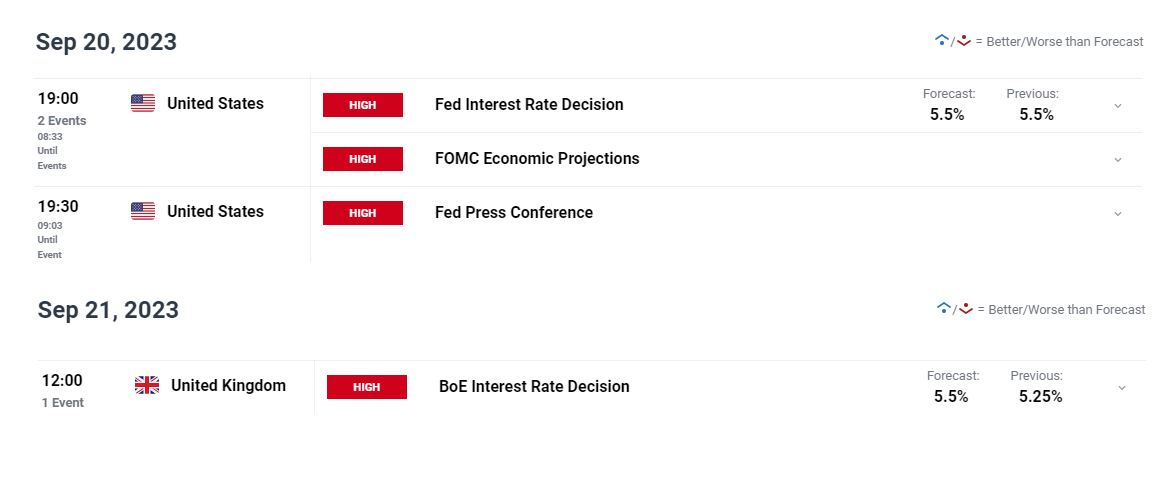

Development, the height rate of interest, and inflation forecasts shall be scrutinized by market individuals this night. The US financial system has been in cruise management, requiring an upward revision in anticipated GDP progress within the June launch and there might very nicely be one other on the way in which.

Any materials change within the dot plot should be felt throughout FX markets because the Fed will ponder whether or not the choice of another quarter level hike shall be sufficient contemplating the most recent risk to inflation – the surging oil market.

Markets will even look to inflation forecasts in 2025 and the ‘long-run’ time-frame for proof of entrenched inflationary pressures which will develop into the norm shifting ahead. Ought to this materialize it suggests rates of interest might want to stay larger for longer within the US – weighing on EUR/USD.

EUR/USD Day by day Chart

Supply: TradingView, ready by Richard Snow

Inflation Progress Throws BoE Resolution Large Open, EUR/GBP Checks Vary

The Financial institution of England (BoE) had been shaping as much as be an easy one earlier than at present’s inflation knowledge instructed that prior tightening is lastly beginning to yield constructive outcomes. Each core and headline inflation got here in decrease than anticipated, offering the BoE’s financial coverage committee with a possible cause to carry charges regular. Learn the UK CPI report for extra particulars.

Customise and filter dwell financial knowledge by way of our DailyFX financial calendar

Learn to put together and commerce round excessive impression information by studying the information beneath:

Really helpful by Richard Snow

Buying and selling Foreign exchange Information: The Technique

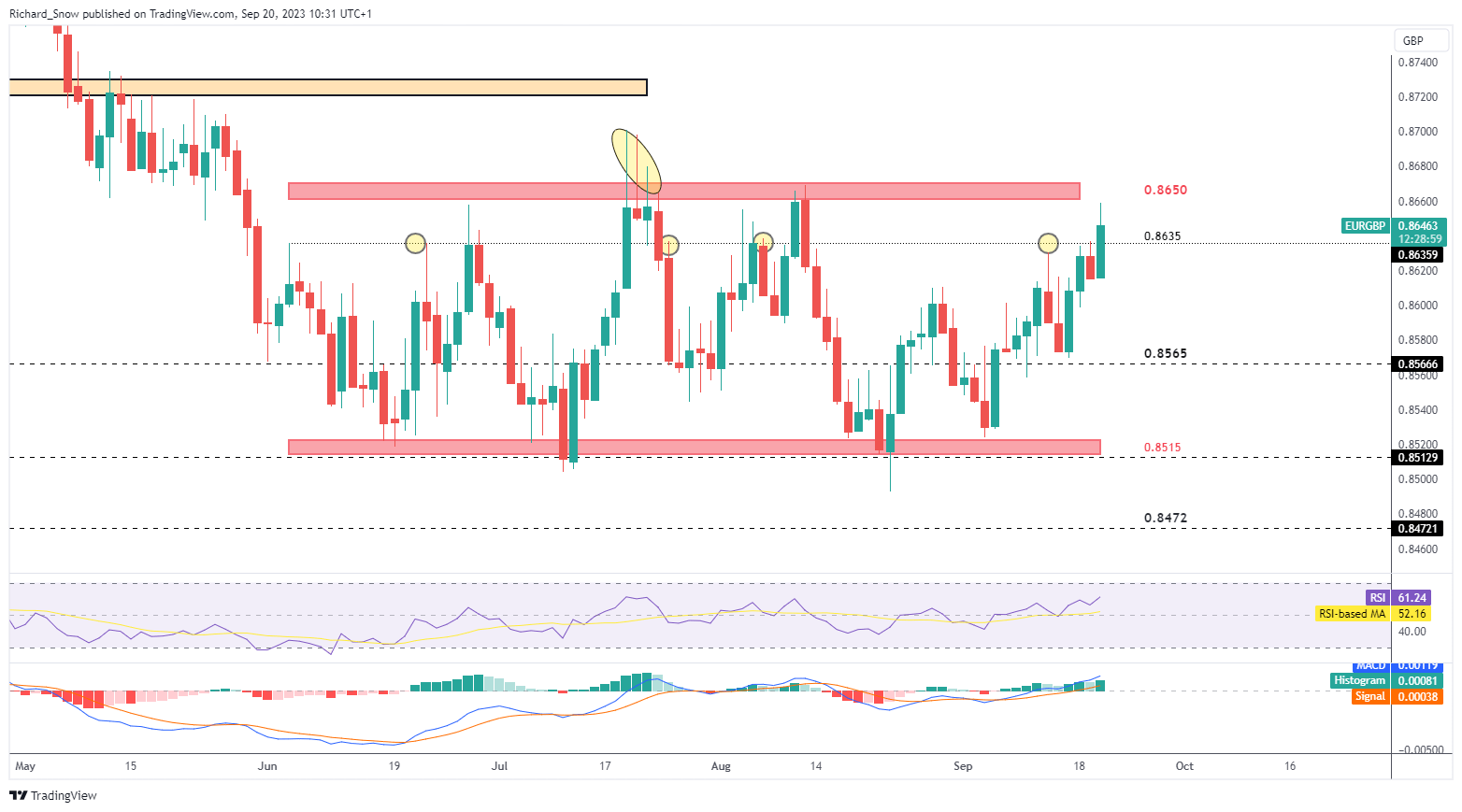

EUR/GBP presently assessments the higher sure of the broad vary (0.8650) as sterling comes beneath stress. Each the euro and pound sterling have struggled to see durations of extended power in opposition to G7 currencies, making them supreme candidates for ranging situations when seen as a pair.

Ought to the BoE maintain charges tomorrow, the vary might come beneath stress with EUR/GBP probably breaching channel resistance. Presently, in keeping with charges markets, there may be nice potential for repricing as half the market nonetheless expects one other hike.

Within the occasion the financial institution does hike, sterling could claw again latest losses – extending the buying and selling vary. The arguments for and in opposition to a hike seem extra finely balanced. Elevated wage pressures and surging oil costs level to upside dangers to inflation, whereas an easing jobs market and decrease inflation recommend the committee can afford to pause.

EUR/GBP Day by day Chart

Supply: TradingView, ready by Richard Snow

Be taught the #1 mistake merchants make and keep away from it! The beneath knowledge was gathered by hundreds of IG dwell accounts:

Really helpful by Richard Snow

Traits of Profitable Merchants

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX