holds above 1.14, and the US–China commerce talks are in focus. appears to US-China commerce talks after Chinese language knowledge

EUR/USD Holds Above 1.14, US–China Commerce Talks in Focus

- USD rose after the US NFP on Friday

- EUR supported as ECB nears the top of its slicing cycle

- EUR/USD holds above 1.14

- EUR/USD is rising, recovering from Friday’s selloff, buying and selling above the 1.14 stage.

The is underneath renewed strain in cautious commerce as US-China commerce talks happen. The USD is falling, giving again good points from Friday following the , which confirmed that the US jobs market slowed however by lower than anticipated. Payrolls rose by 139k, vs. 130k anticipated, in comparison with 147k within the earlier month.

Immediately, consideration is being paid to the US-China commerce talks scheduled in London. US Treasury Secretary Bessent and two different Trump administration officers are set to debate with Chinese language counterparts after talks that had been stated to have been scheduled a few weeks earlier. Any indicators of progress may give the US greenback a lift.

The EUR is rising amid expectations that the ECB is nearing the top of its rate-cutting cycle. The ECB reduce charges by 25 foundation factors final week, and ECB President Christine Lagarde famous the central financial institution was nearing the top of the cycle.

Trying forward, the eurozone financial calendar is comparatively quiet this week. Immediately, the Eurozone Sentix investor confidence may affect buyers.

EUR/USD Forecast – Technical Evaluation

EUR/USD recovered from the 1.1065 low, rising to a peak of 1.15 final week, earlier than easing decrease to present ranges at 1.1425. The uptrend stays intact, though momentum has slowed.

Consumers might want to rise above 1.15 to increase the bullish run in the direction of 1.1475.

Sellers might want to take our minor assist at 1.14. Under, 1.1280 assist comes into play.

Oil Appears to US-China Commerce Talks After Weaker Chinese language Knowledge

Oil costs had been decrease initially of Monday however held onto most of final week’s good points because the market watched US-China commerce talks in London. A deal may present some peak in the direction of an bettering world financial outlook and be fueled and armed.

The prospect of a US-China commerce deal helped elevate oil costs final week. Three of Donald Trump’s high aides are set to satisfy with Chinese language counterparts to restart commerce talks after they stalled a couple of weeks earlier. A further name between Trump and President Xi Jinping on the finish of final week helped WTI acquire 6% throughout the week, its first weekly acquire in three weeks.

Oil costs are additionally helped by the US jobs report, which confirmed the unemployment charge held regular at 4.2% in Could and payrolls fell by greater than anticipated.

In the meantime, Chinese language export progress slowed within the three months to Could as U.S. commerce tariffs slowed shipments. Manufacturing unit gate deflation worsened to a stage not seen in two years. The info exhibits that China’s crude oil imports declined in Could to the bottom every day charge in 4 months, as a result of widespread upkeep plans in each state-owned and impartial refiners.

Expectations are rising that OPEC+ may additionally speed up provide hikes in August and September, which may elevate the draw back danger for oil costs. The brand new sooner tempo of APEC plus manufacturing will increase seems to be right here to remain.

In the meantime, ongoing wildfires have disrupted manufacturing in Canada, supporting the worth together with sturdy US gas demand within the driving season.

Oil Forecast – Technical Evaluation

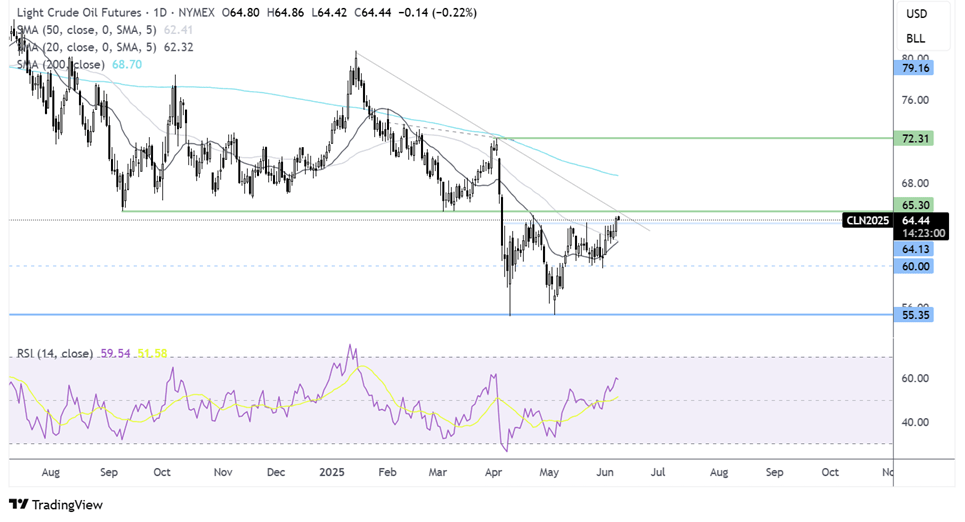

Oil has prolonged its restoration from the 55.30 low, rising above the 50 SMA in the direction of the 65.00 and the multi-month falling trendline resistance.

Consumers supported by momentum will look to increase the restoration above 65 to show the 200 SMA at 68.75.

Failure to rise above the 65 resistance zone may see the worth retest resistance at 64, and beneath right here, 60.00 comes into play. A break beneath 60 creates a decrease low, altering the chart’s construction.

Unique Submit