EUR/USD TALKING POINTS

- Inflation in focus next week.

- Uncertain exhibited by daily EUR/USD.

EURO FUNDAMENTAL BACKDROP

The euro has displayed much resilience against the U.S. dollar this week particularly after weak eurozone PMI figures. The dollar remained elevated throughout as we saw Fed Chair Jerome Powell tone down recession fears while other Fed officials heightened the hawkish narrative. The declining outlook for the EU was reiterated by Friday’s German Ifo business climate read for June which missed expectations showing a drop in entrepreneur sentiment around the EU business environment.

EUR/USD ECONOMIC CALENDAR

The economic calendar holds much in the way of high impact events in the coming week (see calendar below) with focus on inflation from both the U.S. and EU. The EU is expected to remain at 3.8% but anything higher could trigger hawkish ECB bets and potentially push the euro higher. The aggressive outlook from the Fed is likely to negate any significant euro gains in the coming weeks so I forecast more of a rangebound consolidation type move from the EUR/USD currency pair.

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

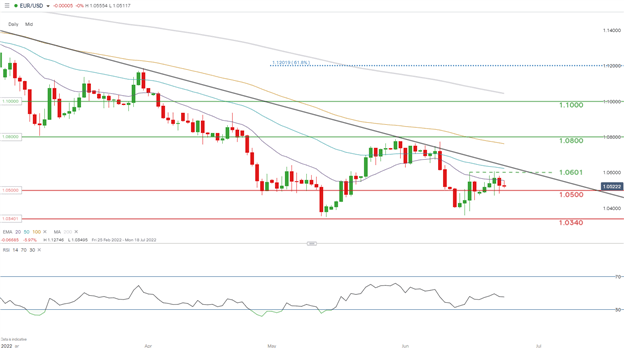

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart above is evidence of this relatively muted price action which is likely to extend into next week. Bulls are looking at the medium-term trendline resistance (black) while bears aim to pierce below the 1.0500 psychological support zone. Until then, there is little in the way of a distinctive directional bias.

Resistance levels:

- Trendline resistance (black)

- 50-day EMA (blue)

- 1.0601

- 20-day EMA (purple)

Support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 67% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and follow Warren on Twitter: @WVenketas