EUR/USD AND S&P 500 FORECAST:

- EUR/USD slides on risk-off sentiment, testing a key technical assist close to the psychological 1.0900 stage

- The S&P 500 additionally loses floor, however Alphabet’s strong rally cushions market weak point

- This text appears at key technical ranges to observe on EUR/USD and the S&P 500 over the approaching days

Really useful by Diego Colman

Get Your Free EUR Forecast

Most Learn: USD Breaking Information – Favorable PPI Print Accompanied by Softening Jobs Information

The U.S. greenback strengthened throughout the board on Thursday, regardless of falling U.S. bond yields, indicating that the transfer was pushed by elevated demand for defensive property in response to danger aversion. On this context, EUR/USD sustained heavy losses within the session, down 0.6% to 1.0910 on the time of writing.

Within the fairness house, the S&P 500 was additionally underwater, with the index falling 0.35% to 4,135 in early afternoon buying and selling, hit by weak point in most cyclical sectors. The sell-off would have been bigger had it not been for Alphabet shares’ robust rally, which gained about 5% on “AI hype” following the discharge of latest merchandise (Alphabet is Google’s mum or dad firm).

In any case, unfavourable sentiment was triggered by renewed issues about regional banks after PacWest Bancorp (PACW) revealed that it misplaced 9.5% of its deposits final week, an indication that outflows could also be reaccelerating amid rising pessimism surrounding the trade.

JPMorgan Chase CEO’s feedback warning that the current banking sector turmoil just isn’t over and that industrial actual property losses could take just a few monetary corporations down appeared to have bolstered the bearish tone on Wall Avenue.

The big bounce in unemployment claims made issues worse for riskier property. In line with the U.S. Division of Labor, the variety of Individuals submitting for jobless advantages climbed to its highest stage in 18 months for the week ending Could 6, suggesting the roles market could also be beginning to crack.

Though rising unemployment could lead the Fed to undertake a dovish stance before forecast, the consequences of a coverage pivot could not transmit linearly to most property. For instance, earlier than weakening steadily, the USD may rise on flight-to-safety flows if markets start to convulse due to an imminent downturn.

| Change in | Longs | Shorts | OI |

| Day by day | 6% | -7% | 0% |

| Weekly | 50% | -17% | 8% |

EUR/USD TECHNICAL ANALYSIS

After the current pullback, EUR/USD appears to be sitting above technical assist positioned close to the psychological 1.0900 stage. If bulls fail to fend off the present bearish assault and the ground is breached, promoting momentum may speed up, setting the stage for a transfer towards trendline assist at 1.0850.

Then again, if patrons regain the higher hand and trigger costs to reverse increased from current ranges, preliminary resistance seems at 1.1035. On additional power, the main focus shifts increased to the 2023 swing highs only a contact under the 1.1100 deal with.

EUR/USD TECHNICAL CHART

EUR/USD Chart Ready Utilizing TradingView

Really useful by Diego Colman

Get Your Free Equities Forecast

S&P 500 TECHNICAL ANALYSIS

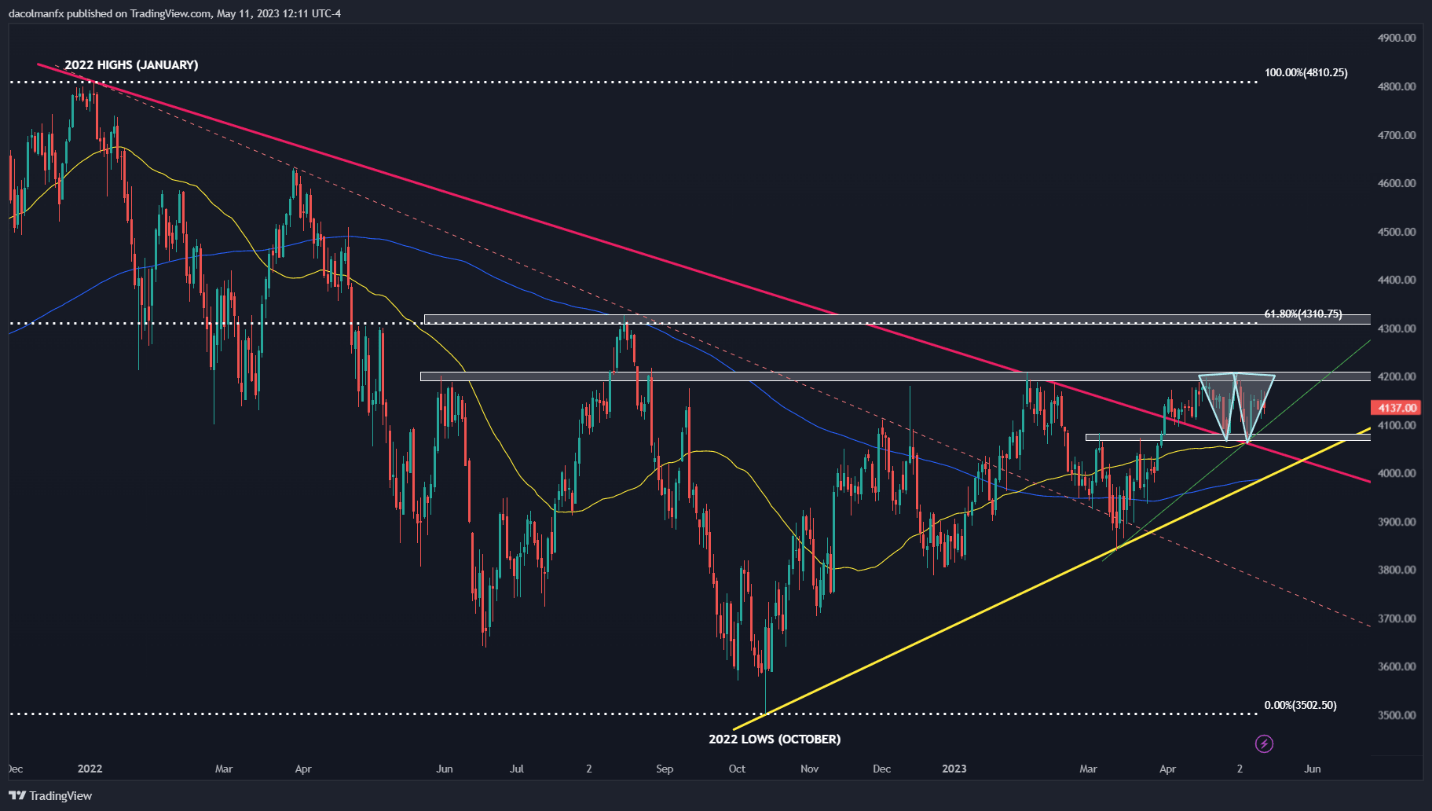

A cautious examination of the S&P 500’s each day chart suggests costs are creating a double-bottom sample, a bullish setup based on technical evaluation. The configuration, which has not but been accomplished, could be confirmed by a breach of resistance at 4,200. This bullish breakout may open up the potential for a transfer towards 4,310, the 61.8% retracement of the 2022 decline.

Conversely, if sellers retake management of the market and push the index decrease, the primary assist to think about rests at 4,100, adopted by 4,075. If each flooring are taken out decisively, the double-bottom formation could be invalidated, paving the best way for a drop towards 4,150. On additional weak point, bears may change into emboldened to launch an assault on trendline assist at 4,000.

| Change in | Longs | Shorts | OI |

| Day by day | 4% | -1% | 1% |

| Weekly | -12% | 10% | 0% |

S&P 500 TECHNICAL CHART

S&P 500 Futures Chart Ready Utilizing TradingView