Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth plunged 2% within the final 24 hours to commerce at $4,013 as of three:33 a.m. EST on buying and selling quantity that dropped 28% to $41.6 billion.

Tom Lee’s BitMine Immersion Applied sciences took the chance purchase the dip, snapping up 104,336 ETH value about $417 million from Kraken and BitGo, in accordance with on-chain knowledge from Lookonchain.

The contemporary acquisition follows the corporate’s $828 million buy final week.

It seems like Bitmine(@BitMNR) simply purchased one other 104,336 $ETH($417M).

Over the previous 7 hours, 3 new wallets acquired 104,336 $ETH($417M) from #Kraken and #BitGo.

Regardless of the crypto market crash, Tom Lee nonetheless predicts $ETH will hit $10K by year-end.https://t.co/KewyZ4cAeP… pic.twitter.com/Vn5b9ijP2Z

— Lookonchain (@lookonchain) October 16, 2025

“The crypto liquidation over the previous few days created a worth decline in ETH, which BitMine took benefit of,” stated BitMine chairman Lee. “Volatility creates deleveraging, and this may trigger belongings to commerce at substantial reductions to fundamentals.”

In the meantime, in accordance with current knowledge from Bitwise, almost all the Ethereum gathered by public firms up to now occurred inside a three-month window between July and September.

95% of all ETH held by public firms was bought up to now quarter alone.

Watch this area.

Company ETH Adoption, Q3 2025 Version pic.twitter.com/9hDARuo9vQ

— Bitwise (@BitwiseInvest) October 15, 2025

Of the 4.63 million ETH held on public firm steadiness sheets as of September 30, roughly 4 million have been added in the course of the third quarter, it stated.

Sharplink Gaming co-CEO Joseph Chalom stated on Wednesday that he’s “bullish” about Ethereum as it’s “the only option for establishments.”

“It’s decentralized, safe and constantly rising its community,” Chalom stated.

Ethereum Worth Regains Its Footing After Sharp Correction

The ETH worth has lately discovered stability after a risky interval that examined the $3,600 help zone.

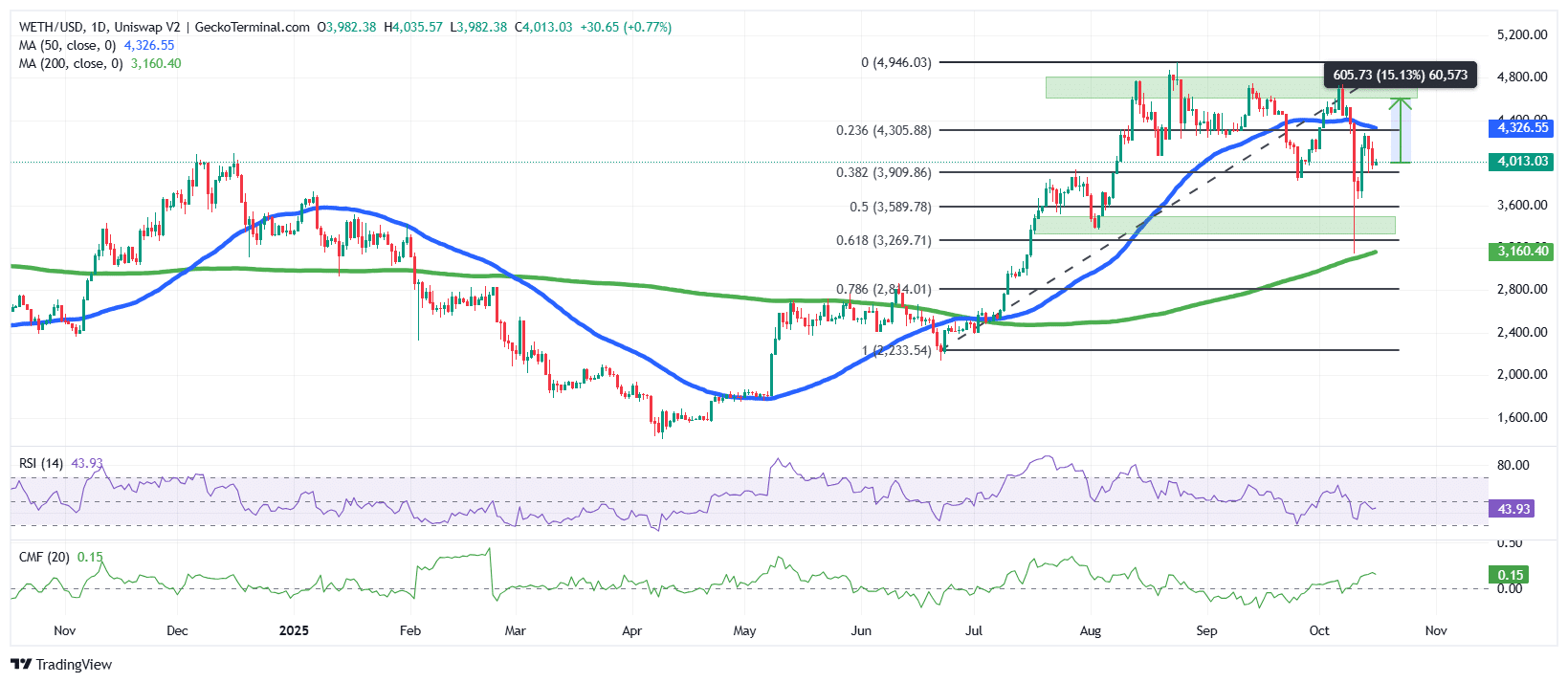

The Ethereum worth day by day chart reveals that ETH is now buying and selling round $4,013, recovering steadily after dipping beneath its short-term help on the 0.382 Fibonacci retracement degree ($3,909). This sharp rebound from this area signifies robust shopping for curiosity, significantly across the mid-Fibonacci zone between 0.382 and 0.5.

In the meantime, the broader construction displays a bullish restoration inside a medium-term uptrend, although current ETH worth swings have launched short-term uncertainty.

The 50-day Easy Transferring Common (SMA) at $4,326 at the moment acts as dynamic resistance, whereas the 200-day SMA close to $3,160 gives a strong base of long-term help. The 50-day SMA remaining above the 200-day SMA means that the development stays constructive, at the same time as the worth of Ethereum exams essential resistance ranges.

The Relative Energy Index (RSI) at the moment sits at 43.93, suggesting that the market is rising from mildly oversold circumstances. This degree usually precedes restoration phases when accompanied by supportive worth motion.

Furthermore, the Chaikin Cash Move (CMF) indicator reads +0.15, reflecting renewed capital inflows after a short interval of outflows. A constructive CMF sometimes signifies that purchasing strain is constructing, which aligns with the current worth stabilization above $4,000.

ETH Targets $4,600 as Bulls Regain Confidence

ETH seems poised for a possible retest of the $4,600–$4,900 zone, representing a 15% upside from present costs. Sustained momentum above the 50-day MA would affirm the continuation of the broader bullish construction.

Nevertheless, if the worth of Ethereum fails to take care of help above $3,900, a retest of $3,600 and even the 0.618 Fibonacci degree close to $3,270 stays doable.

This bearish sentiment is supported by crypto analyst Ali Martinez, who says that the Ethereum worth is on the verge of a MACD crossover.

Ethereum $ETH is on the verge of a bearish MACD crossover on the weekly chart. The final two instances it occurred, the worth dropped 43% and 61%. pic.twitter.com/RRIjFeR63k

— Ali (@ali_charts) October 16, 2025

General, the development stays cautiously bullish. A breakout above $4,326 would mark a renewed uptrend, doubtlessly paving the best way for a retest of yearly highs close to $4,946.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection