Ethereum is buying and selling under the $3,000 mark because it makes an attempt to push greater and reclaim key structural ranges wanted to sign the beginning of a restoration. To date, these efforts have failed. Value stays capped by persistent resistance, and market confidence continues to deteriorate.

Whereas short-term bounces have emerged, most analysts and traders count on the broader downtrend to proceed, arguing that Ethereum lacks the demand and momentum required to maintain a significant reversal. Sentiment has turned deeply pessimistic, with merchants more and more positioned for additional draw back slightly than restoration.

On-chain and technical knowledge reinforce this cautious outlook. A current CryptoQuant report reveals that after Ethereum’s steep decline from its $4,800 peak, the value has grow to be trapped in a slim vary centered across the $2,800 stage for practically a month. This zone has successfully become a state of market purgatory. Bulls have been unable to generate the conviction wanted to reclaim greater highs, whereas bears have repeatedly didn’t power a decisive breakdown under assist.

The result’s a chronic part of volatility compression. Value motion has tightened, signaling widespread indecision amongst market contributors and a scarcity of directional dedication. Traditionally, such compression usually precedes a pointy transfer, however the route stays unsure.

Muted Layer-2 Flows Mirror Ethereum’s Stalemate

A current report from CryptoOnchain highlights that Ethereum’s value stagnation is being carefully mirrored by on-chain habits. Weekly ETH netflows on Arbitrum, one in every of Ethereum’s most essential Layer-2 networks and a standard proxy for smart-money positioning and DeFi exercise, stay subdued and extremely uneven.

Slightly than exhibiting a transparent influx or outflow pattern, the information displays a market working with out robust conviction, reinforcing the concept bigger contributors are selecting to stay on the sidelines.

This lack of directional move means that capital will not be aggressively getting into or exiting the ecosystem. As a substitute, traders seem like ready for clearer macroeconomic indicators or a definitive shift in market construction earlier than committing.

In earlier cycles, sustained expansions in Arbitrum netflows have usually coincided with durations of renewed threat urge for food or decisive pattern modifications. The present inactivity stands in sharp distinction to these environments.

The alignment between compressed value motion round key assist ranges and dormant on-chain exercise factors to a buildup of latent vitality throughout the market. Ethereum is successfully coiling. Whereas this equilibrium can persist for prolonged durations, it hardly ever resolves quietly. When the steadiness breaks, strikes are typically swift and forceful.

Arbitrum netflow is now a vital metric to observe. A sudden and sustained growth in flows may act as an early sign that this extended part of indecision is nearing its decision, probably setting the route for Ethereum’s subsequent main transfer.

Ethereum Stabilizes Close to $3,000 as Downtrend Strain Persists

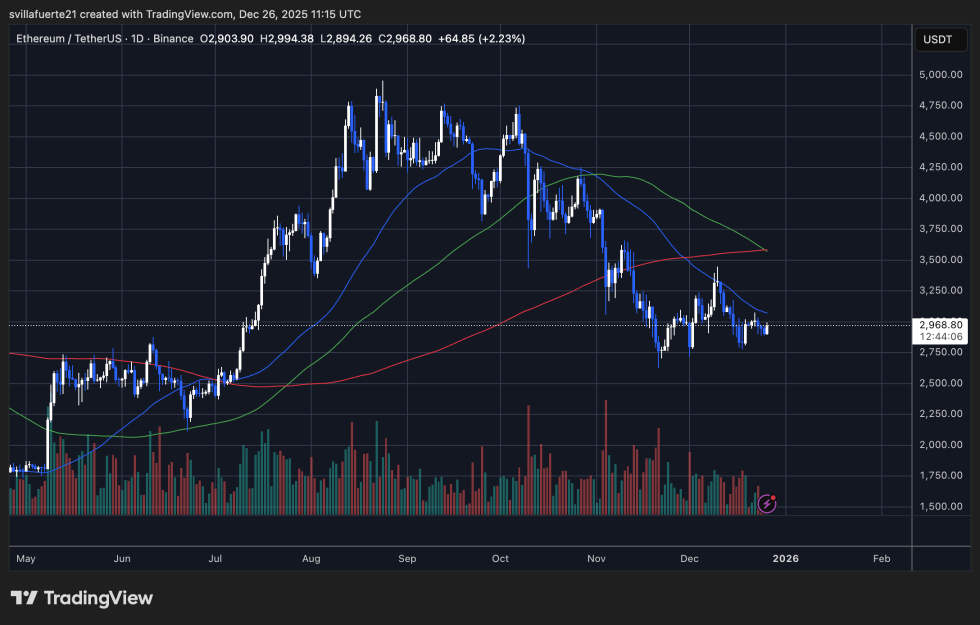

Ethereum is buying and selling close to the $2,970 stage on the day by day chart, trying to stabilize after an prolonged decline from the $4,800 highs recorded earlier this cycle. Whereas current candles present modest restoration makes an attempt, the broader construction stays fragile. ETH continues to print decrease highs and decrease lows, signaling that bearish momentum has not but been invalidated regardless of short-term reduction bounces.

Technically, value stays under its key day by day shifting averages. The sooner shifting common has rolled over sharply and is appearing as speedy resistance, whereas the 111-day and 200-day easy shifting averages converge within the $3,300–$3,600 vary. This cluster varieties a heavy overhead provide zone, limiting the chance of a sustained upside transfer except quantity and momentum increase meaningfully.

The current bounce from the $2,800–$2,900 space has helped Ethereum keep away from a deeper breakdown for now. Nonetheless, this transfer has occurred on comparatively muted quantity, suggesting a scarcity of conviction from patrons. In distinction, the preliminary leg decrease was accompanied by robust promoting stress, reinforcing the concept the dominant pattern stays to the draw back.

From a structural standpoint, the $2,800 stage stays vital assist. A decisive break under this zone would possible speed up losses and ensure bearish continuation. Conversely, for Ethereum to shift momentum, value should reclaim $3,200–$3,300 and maintain above its declining day by day averages.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.