Printed on August twenty sixth, 2025 by Bob Ciura

Essentialism means specializing in the important and letting go of the not-so-important. Essentialism is about distilling issues right down to their essence; eradicating the superfluous to get to what actually issues.

Making use of essentialism to investing will get to the core of why we make investments.

The rationale almost all of us make investments is to interchange our earnings once we are not working. And to hopefully substitute it by a large margin.

Earnings, both by way of harvesting capital positive aspects, or ideally by getting paid dividends, is important to investing for monetary freedom.

Specializing in earnings in investing cuts by way of lots of unneeded market noise. When your dividend earnings exceeds your bills, your portfolio covers your life-style.

Dividend investing traces up with the rationale we make investments: earnings. So long as these dividends maintain rolling in, no promoting is required.

Because of this, we advocate earnings buyers buy excessive dividend shares.

You’ll be able to obtain your free full listing of all excessive dividend shares (together with necessary monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Nevertheless, not all high-yield shares make equally good investments.

This text will focus on 10 excessive dividend shares with yields above 5%, that even have sustainable dividend payouts.

To measure this, we are going to deal with shares with Dividend Threat Scores of ‘C’ or higher within the Positive Evaluation Analysis Database, with

Desk Of Contents

The ten excessive dividend shares are listed by payout ratio, in ascending order.

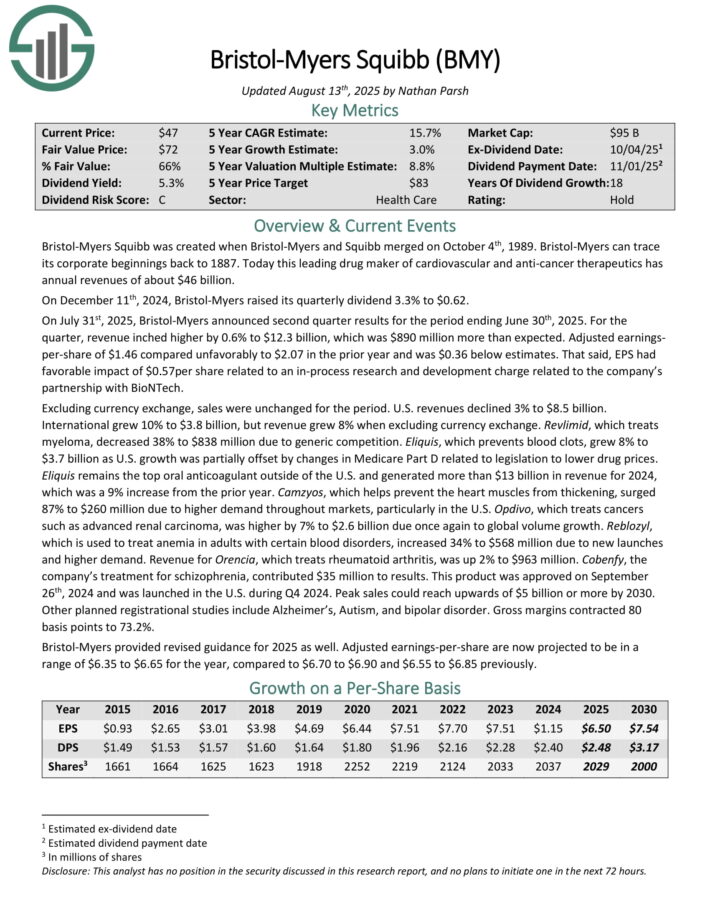

High quality Excessive Dividend Inventory: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is a number one drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On July thirty first, 2025, Bristol-Myers introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income inched increased by 0.6% to $12.3 billion, which was $890 million greater than anticipated. Adjusted earnings-per-share of $1.46 in contrast unfavorably to $2.07 within the prior yr and was $0.36 beneath estimates.

That mentioned, EPS had favorable affect of $0.57per share associated to an in-process analysis and improvement cost associated to the corporate’s partnership with BioNTech.

U.S. revenues declined 3% to $8.5 billion. Worldwide grew 10% to $3.8 billion, however income grew 8% when excluding foreign money alternate. Eliquis, which prevents blood clots, grew 8% to $3.7 billion as U.S. development was partially offset by adjustments in Medicare Half D associated to laws to decrease drug costs.

Eliquis stays the highest oral anticoagulant outdoors of the U.S. and generated greater than $13 billion in income for 2024, which was a 9% improve from the prior yr. Opdivo, which treats cancers equivalent to superior renal carcinoma, was increased by 7% to $2.6 billion due as soon as once more to international quantity development.

Bristol-Myers offered revised steering for 2025 as properly. Adjusted earnings-per-share are actually projected to be in a variety of $6.35 to $6.65 for the yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on BMY (preview of web page 1 of three proven beneath):

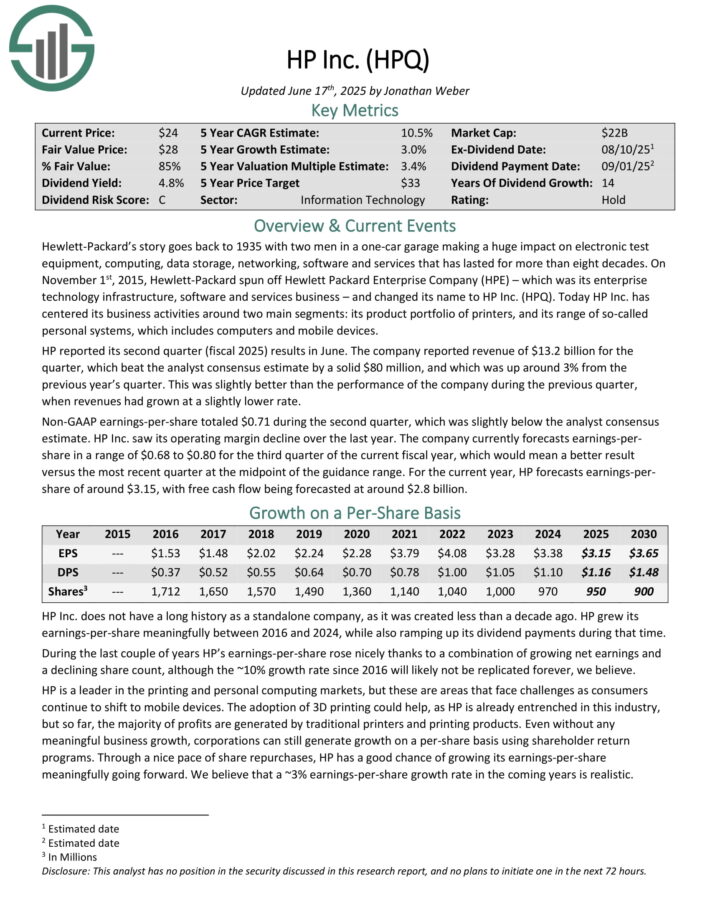

High quality Excessive Dividend Inventory: HP Inc. (HPQ)

Hewlett-Packard’s story goes again to 1935 with two males in a one-car storage making a big impact on digital check tools, computing, knowledge storage, networking, software program and companies that has lasted for greater than eight many years.

HP Inc. has centered its enterprise actions round two foremost segments: its product portfolio of printers, and its vary of so-called private methods, which incorporates computer systems and cell gadgets.

HP reported its second quarter (fiscal 2025) leads to June. The corporate reported income of $13.2 billion for the quarter, which beat the analyst consensus estimate by a stable $80 million, and which was up round 3% from the earlier yr’s quarter.

This was barely higher than the efficiency of the corporate throughout the earlier quarter, when revenues had grown at a barely decrease fee.

Non-GAAP earnings-per-share totaled $0.71 throughout the second quarter, which was barely beneath the analyst consensus estimate. HP Inc. noticed its working margin decline during the last yr.

The corporate presently forecasts earnings-per-share in a variety of $0.68 to $0.80 for the third quarter of the present fiscal yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on HPQ (preview of web page 1 of three proven beneath):

High quality Excessive Dividend Inventory: Sonoco Merchandise (SON)

Sonoco Merchandise offers packaging, industrial merchandise and provide chain companies to its clients. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend development streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior yr, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Client Packaging revenues surged 110% to $1.23 billion, largely attributable to contributions from Eviosys.

Quantity development was sturdy and favorable foreign money alternate charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million because of the affect of overseas foreign money alternate charges and decrease quantity following two plant divestitures in China final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

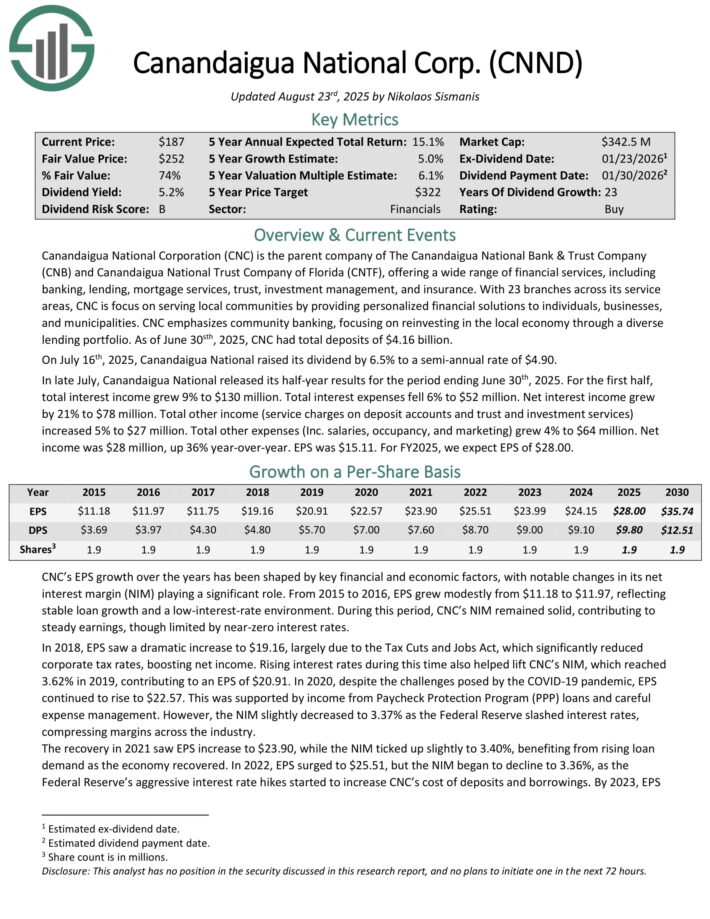

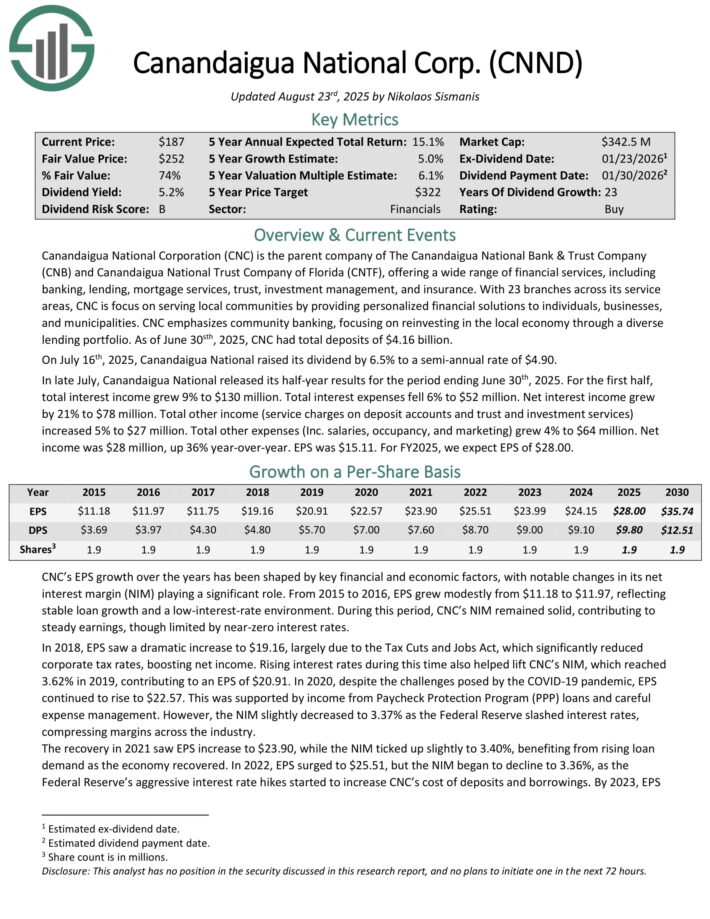

High quality Excessive Dividend Inventory: Canandaigua Nationwide Company (CNND)

Canandaigua Nationwide Company (CNC) is the father or mother firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF), providing a variety of economic companies, together with banking, lending, mortgage companies, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is deal with serving native communities by offering customized monetary options to people, companies, and municipalities. CNC emphasizes neighborhood banking, specializing in reinvesting within the native financial system by way of a various lending portfolio.

As of June 30sth, 2025, CNC had complete deposits of $4.16 billion. On July sixteenth, 2025, Canandaigua Nationwide raised its dividend by 6.5% to a semi-annual fee of $4.90.

In late July, Canandaigua Nationwide launched its half-year outcomes for the interval ending June thirtieth, 2025. For the primary half, complete curiosity earnings grew 9% to $130 million. Whole curiosity bills fell 6% to $52 million. Web curiosity earnings grew by 21% to $78 million.

Whole different earnings (service expenses on deposit accounts and belief and funding companies) elevated 5% to $27 million. Whole different bills (Inc. salaries, occupancy, and advertising and marketing) grew 4% to $64 million. Web earnings was $28 million, up 36% year-over-year. EPS was $15.11.

Click on right here to obtain our most up-to-date Positive Evaluation report on CNND (preview of web page 1 of three proven beneath):

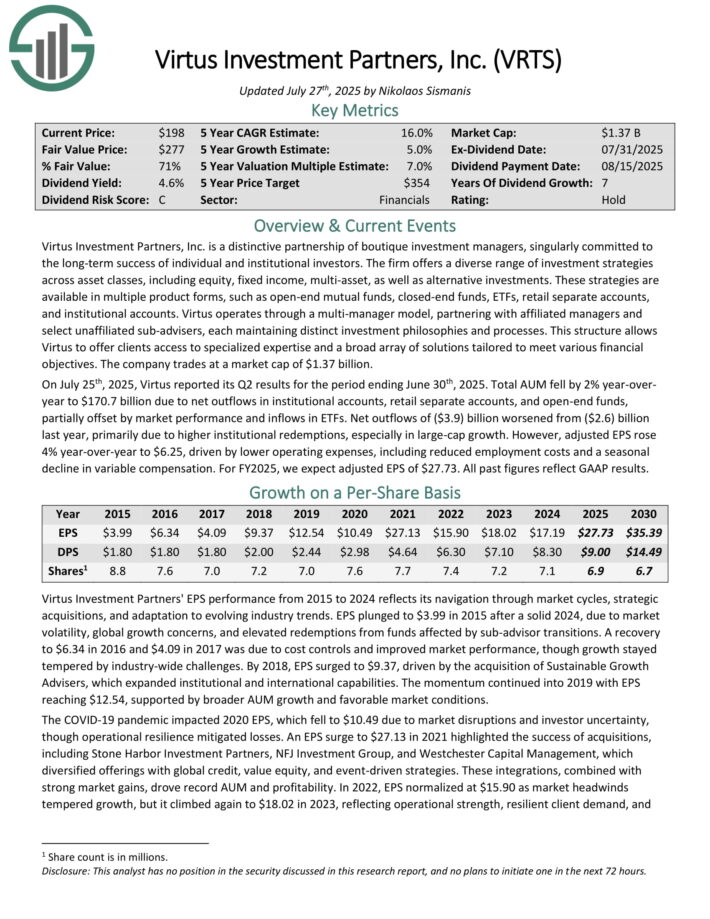

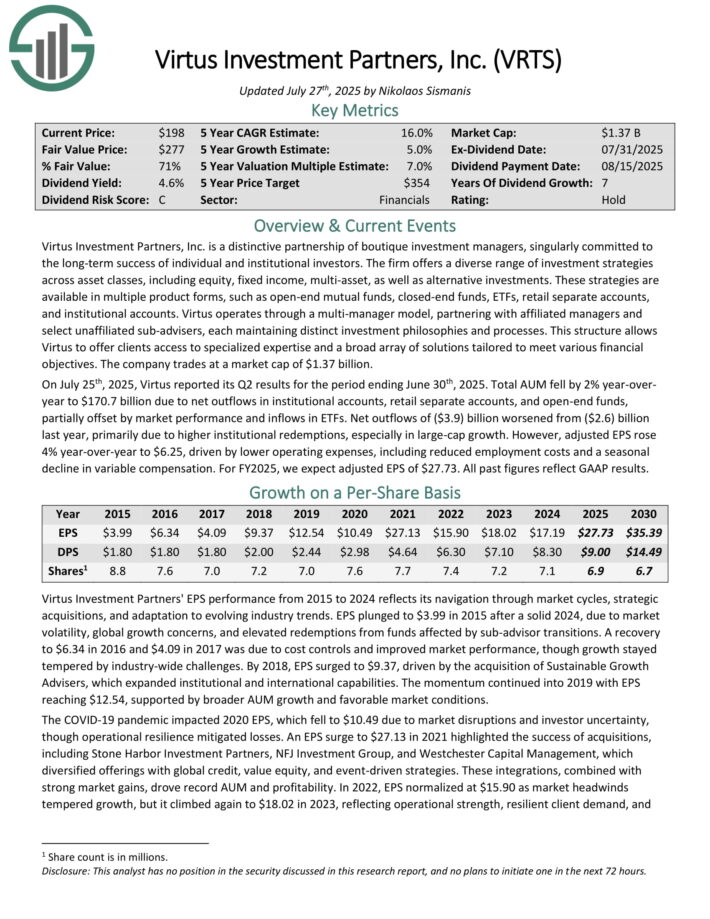

High quality Excessive Dividend Inventory: Virtus Funding Companions (VRTS)

Virtus Funding Companions is a partnership of boutique funding managers. The agency affords a various vary of funding methods throughout asset courses, together with fairness, mounted earnings, multi-asset, in addition to different investments.

Virtus operates by way of a multi-manager mannequin, partnering with affiliated managers and choose unaffiliated sub advisers, every sustaining distinct funding philosophies and processes. This construction permits Virtus to supply purchasers entry to specialised experience and a broad array of options tailor-made to satisfy varied monetary goals.

On July twenty fifth, 2025, Virtus reported its Q2 outcomes for the interval ending June thirtieth, 2025. Whole AUM fell by 2% year-over-year to $170.7 billion attributable to internet outflows in institutional accounts, retail separate accounts, and open-end funds, partially offset by market efficiency and inflows in ETFs.

Web outflows of ($3.9) billion worsened from ($2.6) billion final yr, primarily attributable to increased institutional redemptions, particularly in large-cap development. Nevertheless, adjusted EPS rose 4% year-over-year to $6.25, pushed by decrease working bills, together with lowered employment prices and a seasonal decline in variable compensation.

Click on right here to obtain our most up-to-date Positive Evaluation report on VRTS (preview of web page 1 of three proven beneath):

High quality Excessive Dividend Inventory: JBT Bancorp (JBTC)

JBT Bancorp is a long-standing, unbiased neighborhood financial institution holding firm primarily based in Jonestown, Pennsylvania, with a historical past spanning over 150 years.

By means of its wholly owned subsidiary, Jonestown Financial institution & Belief Co., JBT operates 11 full-service workplaces and a couple of limited-service workplaces throughout Lebanon, northern Lancaster, and japanese Berks counties.

The financial institution affords a full suite of economic services, together with private and enterprise checking and financial savings accounts, time period certificates, residential mortgages, business loans, client loans, and specialised companies equivalent to treasury administration and hashish banking. The corporate generated $32.3 million in internet curiosity earnings final yr.

On July fifteenth, 2025, JBT Bancorp reported its Q2 outcomes for the interval ending June thirtieth, 2025. The corporate generated quarterly earnings of $2.17 million, or $0.89 per share, in comparison with $1.97 million, or $0.81 per share, in Q2 2024. Six-month reported earnings rose 11% year-over-year to $3.86 million, or $1.58 per share.

Outcomes benefited from continued deal with sensible development and sustaining margin, in response to administration. The corporate declared a second quarter dividend of $0.27 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on JBTC (preview of web page 1 of three proven beneath):

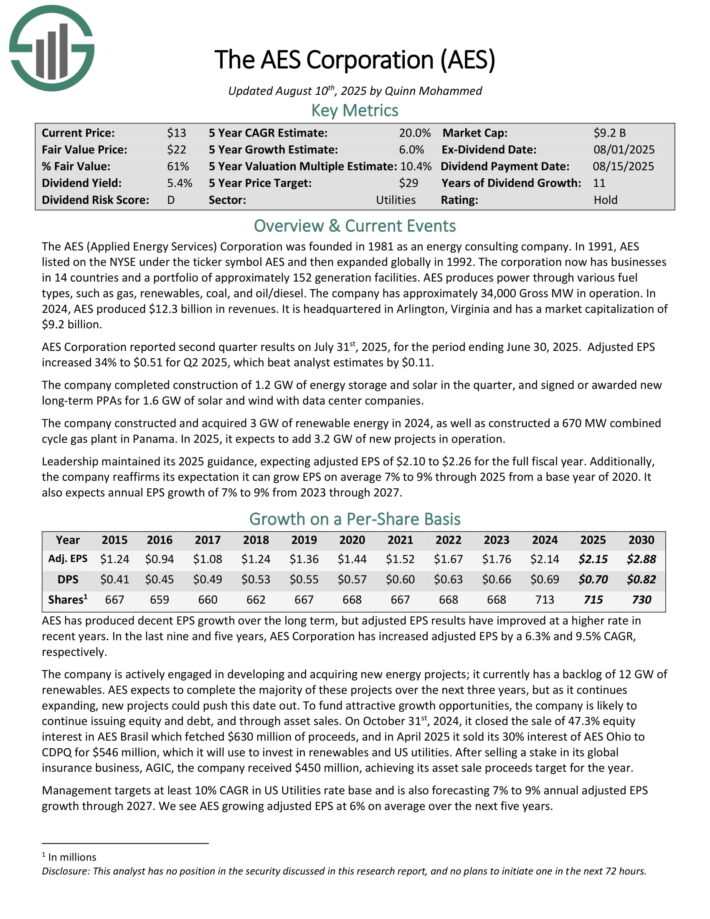

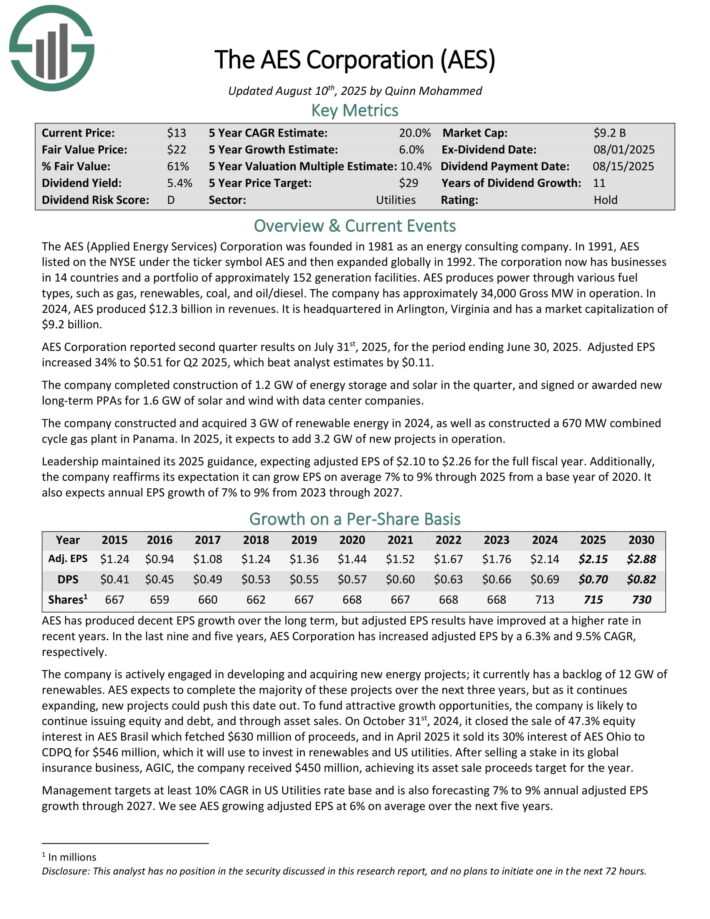

High quality Excessive Dividend Inventory: AES Corp. (AES)

The AES (Utilized Power Companies) Company was based in 1981 as an vitality consulting firm. The company now has companies in 14 international locations and a portfolio of roughly 152 technology amenities.

AES produces energy by way of varied gasoline varieties, equivalent to gasoline, renewables, coal, and oil/diesel. The corporate has roughly 34,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported second quarter outcomes on July thirty first, 2025, for the interval ending June 30, 2025. Adjusted EPS elevated 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The corporate accomplished building of 1.2 GW of vitality storage and photo voltaic within the quarter, and signed or awarded new long-term PPAs for 1.6 GW of photo voltaic and wind with knowledge middle firms.

The corporate constructed and purchased 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. In 2025, it expects so as to add 3.2 GW of recent tasks in operation. Management maintained its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal yr.

Moreover, the corporate reaffirms its expectation it will probably develop EPS on common 7% to 9% by way of 2025 from a base yr of 2020. It additionally expects annual EPS development of seven% to 9% from 2023 by way of 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven beneath):

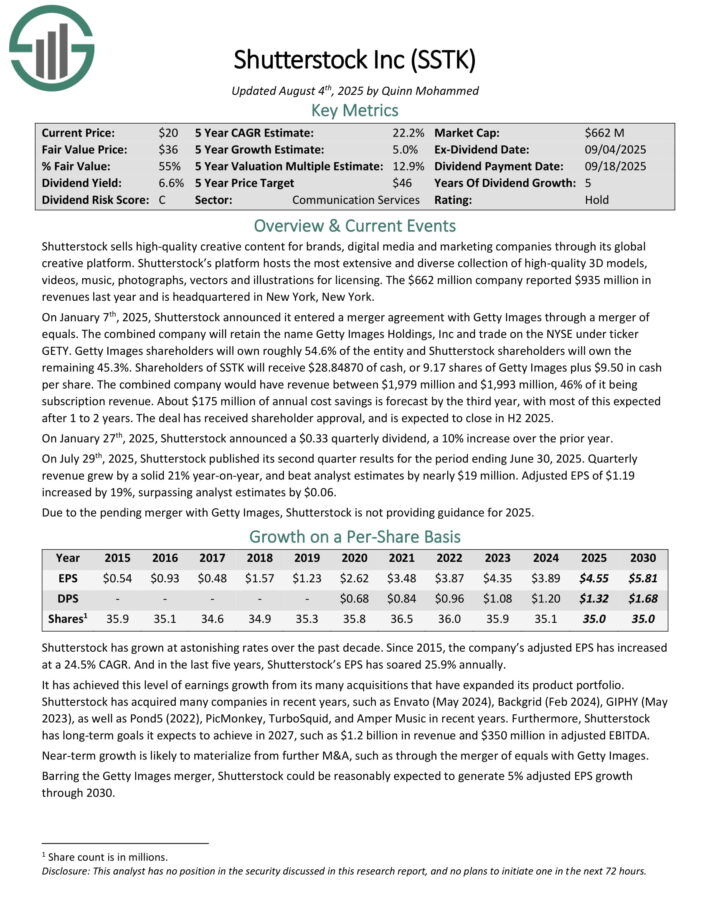

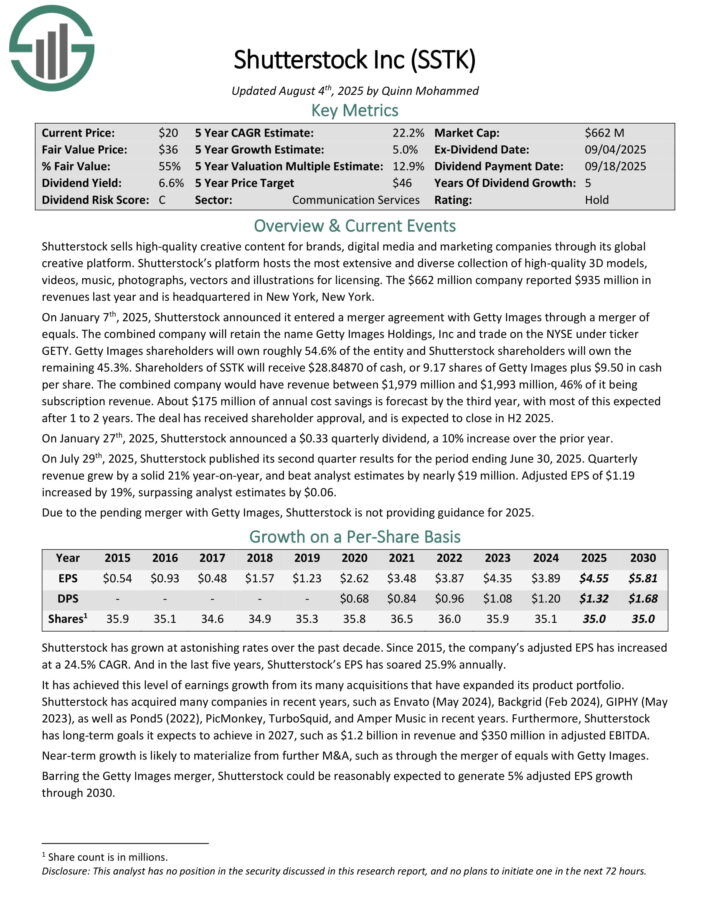

High quality Excessive Dividend Inventory: Shutterstock, Inc. (SSTK)

Shutterstock sells high-quality inventive content material for manufacturers, digital media and advertising and marketing firms by way of its international inventive platform.

Its platform hosts essentially the most in depth and numerous assortment of high-quality 3D fashions, movies, music, images, vectors and illustrations for licensing. The corporate reported $935 million in revenues final yr.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Pictures by way of a merger of equals. The mixed firm will retain the title Getty Pictures Holdings, Inc and commerce on the NYSE below ticker GETY.

Getty Pictures shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Pictures plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual price financial savings is forecast by the third yr, with most of this anticipated after 1 to 2 years.

On July twenty ninth, 2025, Shutterstock printed its second quarter outcomes for the interval ending June 30, 2025. Quarterly income grew by a stable 21% year-on-year, and beat analyst estimates by almost $19 million. Adjusted EPS of $1.19 elevated by 19%, surpassing analyst estimates by $0.06.

Click on right here to obtain our most up-to-date Positive Evaluation report on SSTK (preview of web page 1 of three proven beneath):

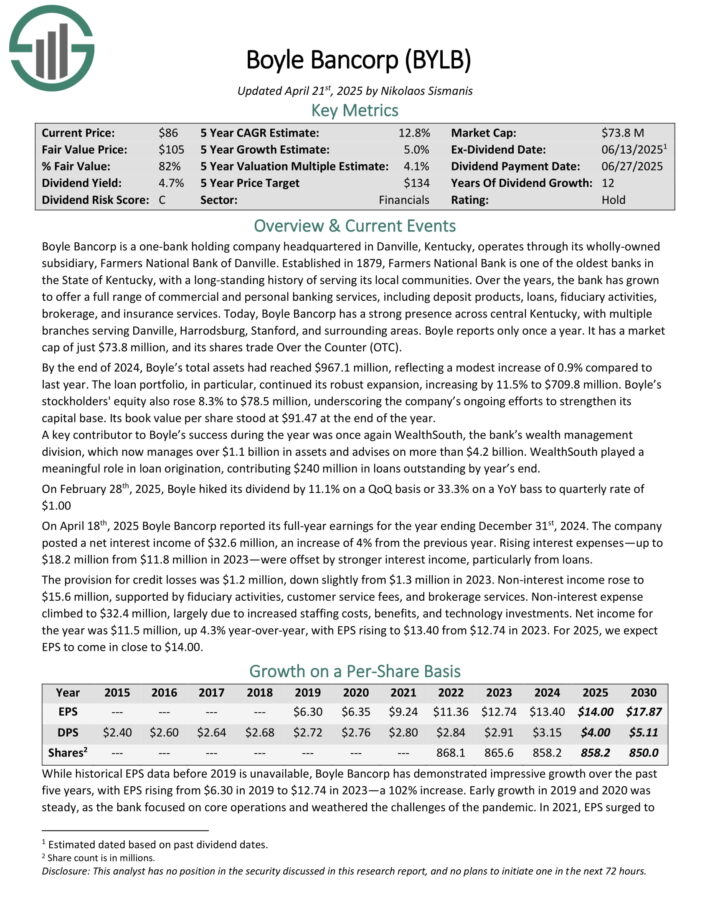

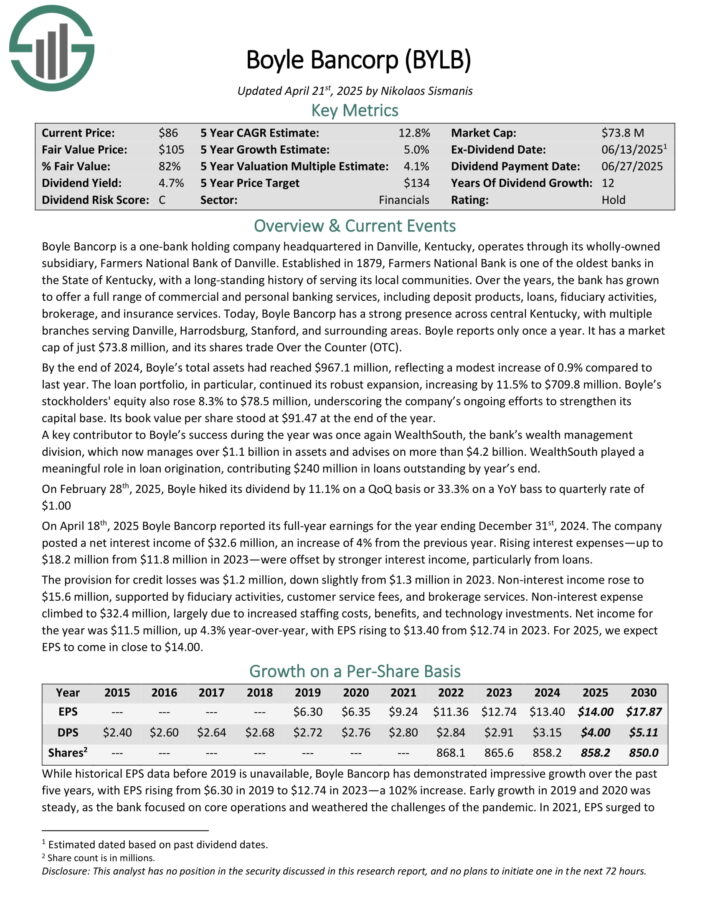

High quality Excessive Dividend Inventory: Boyle Bancorp (BYLB)

Boyle Bancorp is a one-bank holding firm headquartered in Danville, Kentucky, operates by way of its wholly-owned subsidiary, Farmers Nationwide Financial institution of Danville. Established in 1879, Farmers Nationwide Financial institution is without doubt one of the oldest banks within the State of Kentucky, with a long-standing historical past of serving its native communities.

Immediately, Boyle Bancorp has a robust presence throughout central Kentucky, with a number of branches serving Danville, Harrodsburg, Stanford, and surrounding areas. Boyle studies solely yearly.

By the tip of 2024, Boyle’s complete belongings had reached $967.1 million, reflecting a modest improve of 0.9% in comparison with final yr. The mortgage portfolio, specifically, continued its strong growth, rising by 11.5% to $709.8 million. Boyle’s stockholders’ fairness additionally rose 8.3% to $78.5 million, underscoring the corporate’s ongoing efforts to strengthen its capital base. Its guide worth per share stood at $91.47 on the finish of the yr.

On April 18th, 2025 Boyle Bancorp reported its full-year earnings. The corporate posted a internet curiosity earnings of $32.6 million, a rise of 4% from the earlier yr. Rising curiosity bills—as much as $18.2 million from $11.8 million in 2023—had been offset by stronger curiosity earnings, significantly from loans.

Click on right here to obtain our most up-to-date Positive Evaluation report on BYLB (preview of web page 1 of three proven beneath):

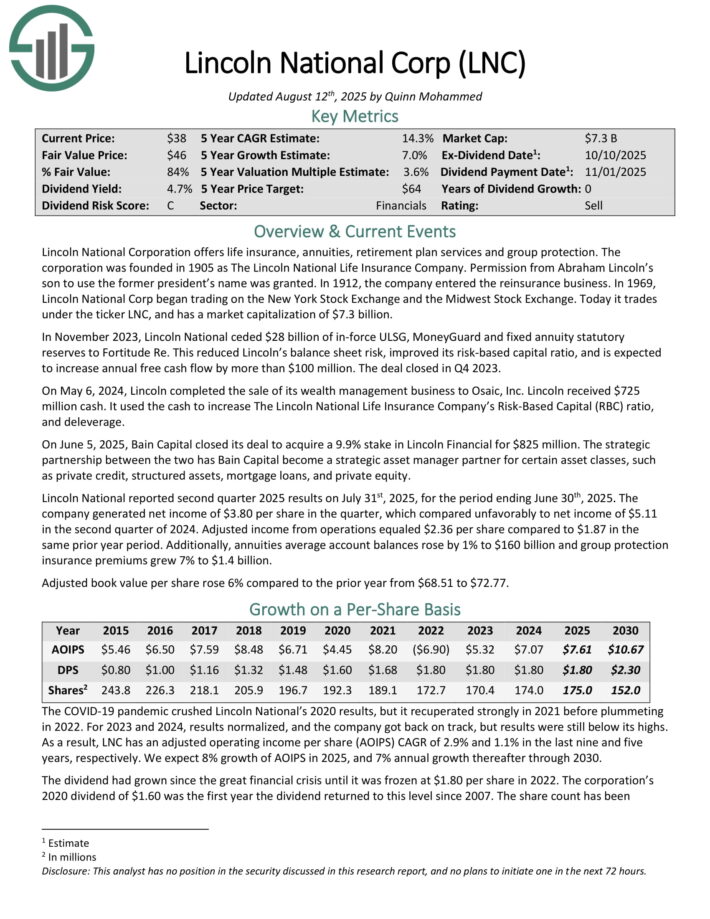

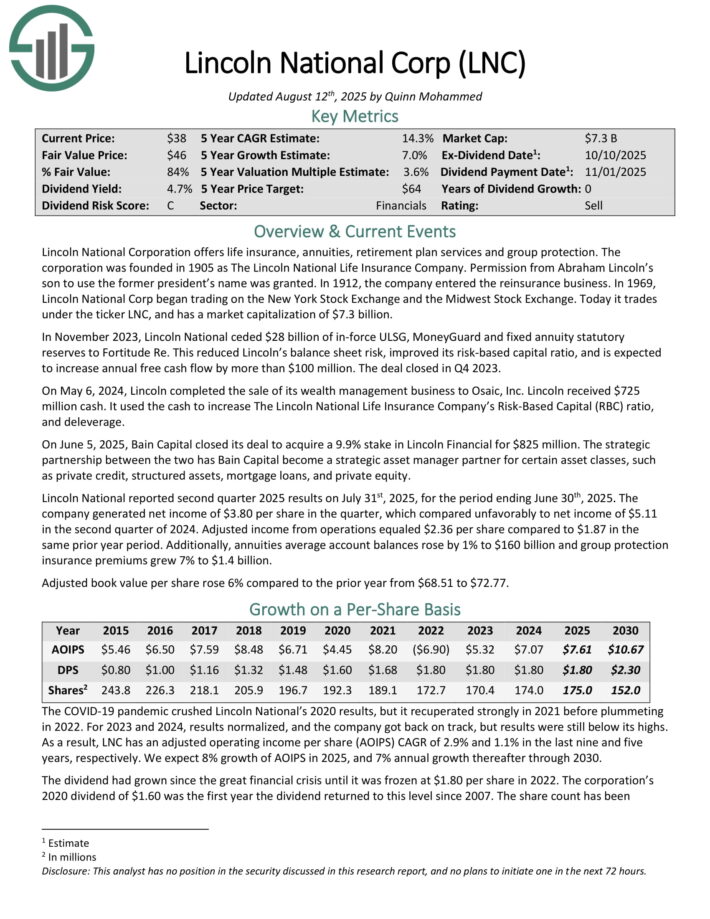

High quality Excessive Dividend Inventory: Lincoln Nationwide Corp. (LNC)

Lincoln Nationwide Company affords life insurance coverage, annuities, retirement plan companies and group safety.

On June 5, 2025, Bain Capital closed its deal to amass a 9.9% stake in Lincoln Monetary for $825 million. The strategic partnership between the 2 has Bain Capital turn into a strategic asset supervisor companion for sure asset courses, equivalent to non-public credit score, structured belongings, mortgage loans, and personal fairness.

Lincoln Nationwide reported second quarter 2025 outcomes on July thirty first, 2025. The corporate generated internet earnings of $3.80 per share within the quarter, which in contrast unfavorably to internet earnings of $5.11 within the second quarter of 2024. Adjusted earnings from operations equaled $2.36 per share in comparison with $1.87 in the identical prior yr interval.

Moreover, annuities common account balances rose by 1% to $160 billion and group safety insurance coverage premiums grew 7% to $1.4 billion. Adjusted guide worth per share rose 6% in comparison with the prior yr from $68.51 to $72.77.

Click on right here to obtain our most up-to-date Positive Evaluation report on LNC (preview of web page 1 of three proven beneath):

Extra Studying

In case you are taken with discovering different high-yield securities and earnings securities, the next Positive Dividend sources can be helpful:

Excessive-Yield Particular person Safety Analysis

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].