Trygve Finkelsen

Overview

My suggestion for ESAB Company (NYSE:ESAB) is a purchase score, as I imagine it is ready to develop EPS at a mid-teens CAGR by FY28, in step with administration steering. This perception is supported by the continuing tailwinds at ESAB finish markets and the on-track inner initiatives that ought to begin to present their affect within the financials quickly. Notice that I beforehand gave a purchase score for ESAB as a result of I believed the enterprise had publicity to a number of end-markets that had been experiencing optimistic tendencies. As ESAB reveals steady natural progress and margin enhancements, its valuation ought to enhance.

Current outcomes & updates

The inventory has carried out rather well since my protection in March this 12 months, returning nearly 30% on the present share value of (~$86). ESAB’s latest 3Q23 quarter stays very robust, with internet gross sales rising 12% to $644 million (ex-Russian affect). By section, Americas income was up 9%, whereas EMEA and APAC had been up 14%. Profitability was within the highlight as EBITDA reached a file excessive within the quarter. EBITDA margin elevated by 170bps on an annual foundation to 18.3%, with absolutely the EBITDA coming in at $118 million. In consequence, adj. EPS got here in at $1.08, beating the consensus estimate of $0.96.

With the robust efficiency, administration refreshed their long-term outlook throughout Investor Day, which I discovered to be very optimistic. For individuals who missed the presentation, administration is now guiding high-teen EPS CAGR potential by FY28. Particularly, administration’s 2028 targets level to low-double-digit share natural EPS progress with the potential to succeed in high-teen share progress with the help of acquisitions. Breaking down the expansion contribution between income and earnings, income is predicted to develop at 9% CAGR, and EBITDA margin is predicted to hit >22%. Mixture of each would result in 10% EPS progress; topping that with acquisitions results in high-teen EPS progress potential. As such, there are two key debates right here: whether or not ESAB can develop organically and if they’ve the capability to amass.

Beginning with the primary debate. I imagine ESAB can proceed to develop because the near-term tendencies stay robust. By way of quantity, whereas quantity was down within the Americas by 3%, if we regulate for the PLS affect, quantity was truly up throughout all areas (Americas could be up by low single-digits). Quantity was notably resilient in Europe, the Center East, and India, as administration famous. Particularly, quantity progress stays robust as a result of reshoring tendencies in the USA, Canada, and Mexico and powerful ranges of infrastructure funding in India and the Center East. Progress tailwinds in ESAB’s finish markets stay robust, and there seem like no indicators of a slowdown. As an example, renewable power investments in Europe, the Center East, the US, and South America proceed to be a long-term tailwind, and the identical dynamic could be seen within the agriculture and downstream O&G funding end-markets.

As for the automation and tools enterprise, gross sales additionally stay robust. Administration has additionally known as out their market share positive aspects with their new merchandise like Volt, Warrior Edge, and Cobot, that are bought to each current and new prospects. From a share efficiency foundation, latest efficiency additionally means that administration long-term steering of 9% CAGR could be simply achieved. The enterprise noticed low-double-digit share quantity progress, which outpaced consumable progress, whereas Cobot gross sales even grew triple-digits vs. final 12 months. The proportion of income attributable to tools combine elevated from 26% in 2016—the 12 months earlier than ESAB’s determination to reinvigorate its tools portfolio—to 31% in 3Q23. As such, steady robust progress right here has a excessive contribution to ESAB on a consolidated foundation. Notably, tools gross margins are increased than consumables; as such, the upper tools progress has a optimistic combine shift affect on margins (in step with administration steering). Trying forward, ESAB seems to be on observe to succeed in its goal mixture of 35% tools, which ought to proceed to contribute to margin growth.

Touching extra on margin growth, it isn’t solely supported by top-line progress. ESAB inner initiatives must also yield optimistic outcomes. The Denton, TX, facility was one in all a number of that accomplished Kaizens within the third quarter as EBX (ESAB Enterprise Excellence) ramped up its efforts. There’s a present push to consolidate manufacturing, primarily in Europe, and I count on that it will start to repay within the subsequent few quarters. On the whole, ESAB’s plan to scale back its footprint continues to be on observe, and I anticipate additional encouraging information within the close to future. Elsewhere, the PLS initiative needs to be just about accomplished by 4Q in America. The vast majority of the work on rightsizing SKUs within the Americas and addressing the related quantity drag might be accomplished by 4Q23. Because of this the near-term headwinds might be over, and we must always see a optimistic affect on financials beginning in 1Q24

Lastly, by way of acquisitions, administration plans is to make use of 85% of extra capital for M&A and 15% for dividends. The leverage goal is to maintain the web leverage ratio at 2x over the long run, and any capital that does not go towards acquisitions will go towards paying down the debt. I imagine these are truthful objectives, and given ESAB’s current internet debt to EBTIDA ratio of round 2x, there may be ample alternative to extend leverage within the occasion of favorable offers. The truth that ESAB is ready to pay down debt is important as a result of the corporate is EBITDA and FCF optimistic. Importantly, M&A offers should meet administration’s requirements, which embrace a gross margin of 40% or increased and a ROI of 10% or increased over three to 5 years. What this implies is that every one M&A are going to be margin accretive to the enterprise as ESAB present gross margin is just 36%.

Valuation and danger

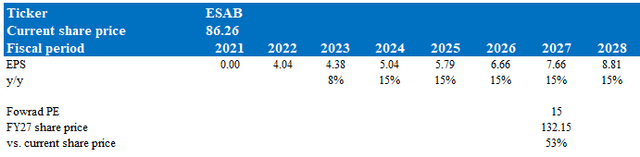

Creator’s valuation mannequin

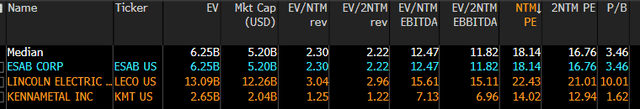

Based on my mannequin, ESAB is valued at $132 in FY27, representing a 53% enhance over 4 years (or 10+% a 12 months). This goal value relies on the administration’s long-term EPS CAGR outlook. Administration has guided for a potential high-teens EPS CAGR, however I’m utilizing a decrease assumption as 9% of the high-teens outlook is from M&As that may not happen. One factor to notice for my FY23 estimate is that I used consensus estimates. At a 15% CAGR, ESAB ought to generate round $8.80 of EPS by 2028. I used a 15x ahead PE a number of for ESAB as an alternative of the present 18x, because the relative a number of in opposition to friends appears too excessive. I imagine ESAB ought to commerce nearer to Kennametal Inc. (KMT), because it has increased anticipated progress and margins than KMT. ESAB ought to commerce at a reduction to Lincoln Electrical due to its decrease margins and better debt profile (LECO has 1x internet debt to EBITDA and a 19% EBIT margin vs. ESAB, which has ~2x internet debt to EBTIDA and a 15% EBIT margin).

Bloomberg

Threat

The European market, which accounts for round 30% of ESAB˟s gross sales might expertise a significant recession within the subsequent few quarters, which might have a heavier affect on ESAB than I had anticipated. Though I’m nonetheless bullish on various ESAB’s finish markets, this does depart the corporate weak to a wider vary of challenges, a few of which can be tough for public buyers to evaluate.

Abstract

I reiterate my purchase score for ESAB. Administration’s revised outlook throughout Investor Day, aiming for a high-teen EPS CAGR by FY28, signifies robust progress potential primarily pushed by natural progress and potential acquisitions. The tailwinds at ESAB’s end-market should not exhibiting any indicators of slowing down, which may be very optimistic and supportive of administration’s progress outlook. Furthermore, strategic initiatives like facility consolidations and the nearing completion of PLS ought to assist drive margin growth, supporting EPS progress.