Falcor

We’re almost midway via the Q1 Earnings Season for the Gold Miners Index (GDX) and probably the most latest firms to report its outcomes was Equinox Gold (NYSE:EQX). Whereas the headline outcomes weren’t fairly with a average improve in output and gross sales volumes offset by a 5% improve in all-in sustaining prices [AISC], the corporate made significant progress on making certain it may well fund Greenstone with out additional share dilution, securing $140 million from a gold ahead sale and prepay settlement, and extra proceeds from lowering its fairness investments in i-80 Gold (IAUX) and Solaris Assets (OTCQB:SLSSF).

And though Equinox completed the quarter with one of many weakest steadiness sheets sector-wide and traders can proceed to anticipate vital money outflows till 2025 when Greenstone ramps as much as business manufacturing, they’ll breathe a sigh of reduction with ~$410 million in liquidity (excluding fairness investments). Plus, Greenstone is monitoring on finances and schedule, and its potential to ship near finances is aided by an all-star building workforce in G Mining, a dip in gasoline costs, and continued softness within the Canadian Greenback. That stated, with the inventory hugging resistance and not attractively, I see this rally to US$5.80 as a chance to ebook some earnings.

Los Filos Operations (Firm Web site)

Q1 Manufacturing & Gross sales

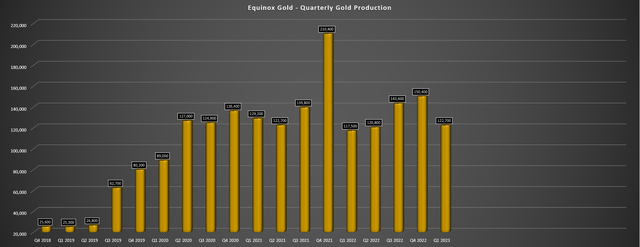

Equinox Gold launched its Q1 outcomes this week, reporting quarterly manufacturing of ~122,500 ounces of gold and gross sales of ~123,300 ounces. This translated to a 4% improve in output and gross sales vs. the year-ago interval, and the corporate benefited from the next common realized gold value of $1,895/oz, leading to a 5% improve in income to $234.1 million. A greater quarter from Los Filos, Aurizona, and Fazenda helped to drive the rise in manufacturing, with an extra profit from Santa Luz, a brand new mine in Brazil that didn’t contribute within the year-ago interval. And with progressively larger manufacturing because the 12 months progresses plus the next gold value, we should always see an extra enchancment in monetary outcomes sequentially.

Equinox – Quarterly Gold Manufacturing (Firm Filings, Writer’s Chart)

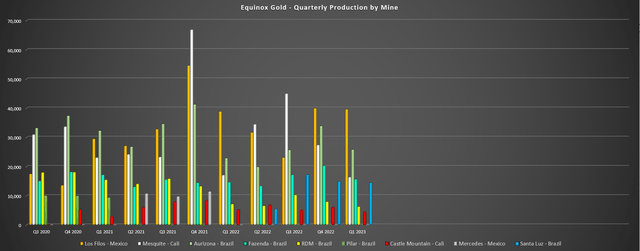

Wanting on the chart of mine by mine manufacturing beneath, the most effective performers had been Los Filos (~39,600 ounces), Aurizona (~25,800 ounces), and Fazenda (~15,700 ounces), although Aurizona’s improved year-over-year efficiency was largely associated to straightforward year-over-year comps with simply ~22,900 ounces produced within the year-ago interval. Sadly, the upper manufacturing from these three mines mixed with ~14,500 ounces from Santa Luz was offset by its lower-grade mines, Mesquite and Fort Mountain, which mixed for simply ~20,900 ounces within the interval. This was down from ~22,300 ounces mixed in Q1 2022, and RDM additionally had a tough quarter, with restricted entry to low-grade stockpiles attributable to allow delays, leading to manufacturing of simply ~6,400 ounces at all-in sustaining prices of $2,348/oz.

Equinox Gold – Quarterly Manufacturing by Mine (Firm Filings, Writer’s Chart)

Though the general manufacturing determine wasn’t something to jot down house about for an organization with seven mines and Equinox continues to be unfold fairly skinny, the corporate’s 60% owned Greenstone Venture will dramatically change its manufacturing profile, and output ought to enhance at present belongings because the 12 months progresses. It will embrace extra normalized manufacturing at RDM following a manufacturing stoppage in January, barely larger manufacturing at Fort Mountain which appears to be like extra prone to ship into the low finish of steering (25,000 ounces vs. 30,000 ounces), and barely larger manufacturing from Los Filos with a extra delayed leach cycle due to larger copper content material within the ore which impacted recoveries.

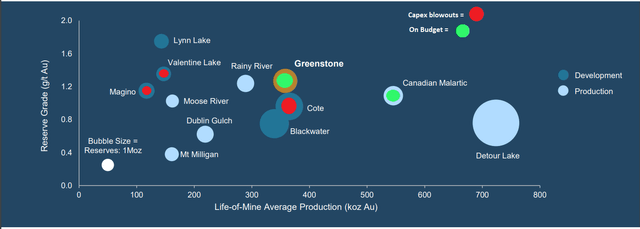

And as for Greenstone, Equinox reaffirmed the very optimistic information that the undertaking stays on finances and schedule, a large deviation from what we have seen at different Ontario greenfields initiatives which noticed appreciable capex blowouts, like Cote Gold and Magino. The mixture of building prices monitoring in the direction of finances with bolstered liquidity (gold prepay/ahead gross sales and sale of fairness investments) has considerably improved Equinox’s monetary place, as has the upper gold value, which is enhancing its money movement era regardless of its ~$1,600/ozcost profile in 2023/2024, partially offsetting the numerous development capital heading out the door that is being spent at Greenstone.

Open Pit Mines in Canada (Manufacturing/Development/Growth) (Firm Presentation, Writer’s Notes)

As of quarter-end, Equinox had ~$410 million in liquidity between money and remaining capital on its revolving credit score facility with $400 million in monetary, working and capital commitments within the subsequent twelve months. Nonetheless, this does not embrace ~$130 million of marketable securities and the corporate has extra on its At-The-Market Fairness Program. The excellent news is that whereas Equinox was pressured to make use of its ATM to enhance its monetary place and this led to ~1.2% share dilution (absolutely diluted foundation) with ~4.4 million shares offered at US$3.88, the upper gold value ought to put it aside from having to make any extra share gross sales, and it is also in a position to hold its portfolio intact vs. IAMGOLD (IAG) that dumped a number of belongings to make sure it might full its share of Cote Gold building.

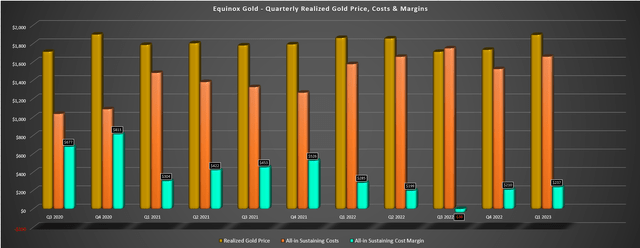

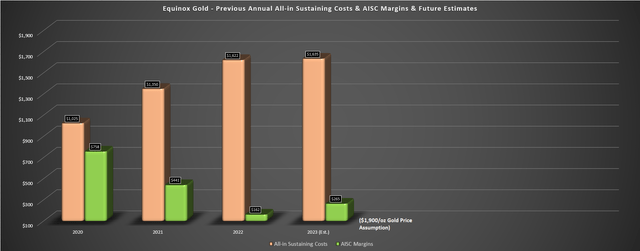

Prices & Margins

Shifting over to prices and margins, we noticed one other quarter of significant value will increase, with money prices up over 10% to $1,376/oz (Q1 2022: $1,237/oz), and AISC hovering to $1,658/oz, up over 5% year-over-year. And this was regardless of a slight tailwind from 12% decrease sustaining capital within the interval vs. Q1 2022 ranges. That stated, the corporate ought to profit from barely decrease unit prices because the 12 months progresses with a slight improve in sustaining capital spend being offset by larger manufacturing and gross sales volumes. So, whereas AISC have continued to climb and it could shock me to see Equinox’s AISC are available beneath the steering midpoint of $1,635/oz, the worst appears to be like to be over from a margin compression standpoint.

Equinox Gold – Quarterly Realized Worth, Prices & AISC Margins (Firm Filings, Writer’s Chart)

The excellent news is that whereas prices have risen and stay at among the worst ranges sector-wide, Equinox noticed restricted assist from the gold value in Q1 2023 ($1,895/oz), leading to AISC margins declining to $237/ozvs. $285/ozin Q1 2022. Nonetheless, Equinox ought to profit from a median realized gold value above $1,925/ozfor the remainder of the 12 months when together with the affect of hedges. And if we assume a median realized gold value of $1,900/ozfor FY2023 to be conservative and provides Equinox the advantage of the doubt and assume AISC of $1,635/oz, we’d see an enchancment in AISC margins year-over-year regardless of larger prices, with Equinox getting bailed out by the upper gold value.

Equinox Gold – Annual AISC, AISC Margins & Ahead Estimates (Firm Filings, Writer’s Chart & Steerage Midpoint)

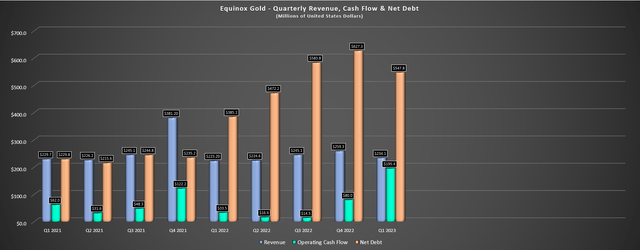

Lastly, if we take a look at the corporate’s monetary outcomes, money movement improved to $195.4 million within the interval, although this was due to the one-time good thing about a $139.5 million money cost from its Gold Prepay association. And whereas web debt was decrease than I anticipated helped by higher margins associated to the upper gold value, it nonetheless stands at ~$548 million, up from ~$385 million in Q1 2022. That stated, and as mentioned above, whereas Equinox stays extra leveraged than its peer group, the potential funding hole seems to be solved with latest actions taken to enhance its liquidity place and strong efficiency by the development workforce at Greenstone.

Equinox Gold – Quarterly Income, Money Circulate & Internet Debt (Firm Filings, Writer’s Chart)

Whereas that is optimistic information and the latest transfer above $2,000/ozfor the gold value ought to assist Equinox to have a a lot better the rest of the 12 months, the corporate will nonetheless see vital money outflows over the subsequent two years because it builds Greenstone. So, whereas this will likely be a money cow for the corporate beginning in 2025, it is attainable that Equinox continues to underperform because it bleeds money throughout Greenstone building, even with the advantage of a $1,900/ozgold value. So, with a number of different producers returning capital to shareholders which boosts their whole returns and producing vital free money movement, I proceed to see extra enticing alternatives elsewhere within the sector. Let’s take a look at Equinox’s up to date valuation:

Valuation & Technical Image

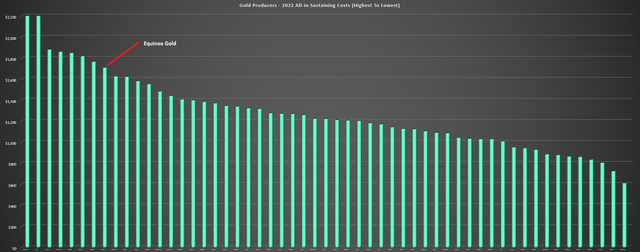

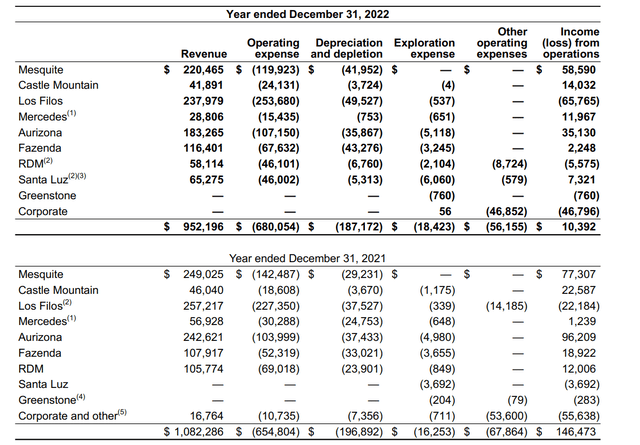

Based mostly on ~366 million absolutely diluted shares and a share value of US$5.65, Equinox is buying and selling at a market cap of ~$2.07 billion, and an enterprise worth of ~$2.62 billion. And whereas this may look like an inexpensive valuation in comparison with different mid-tier and intermediate producers within the sector like Lundin Gold (OTCQX:LUGDF) and Alamos Gold (AGI) given the corporate’s larger manufacturing profile (post-Greenstone), Equinox differs as a result of it has a a lot larger working value profile, a a lot weaker steadiness sheet, and its solely world-class asset is Greenstone, of which it owns 60%, whereas the opposite two firms have full possession of world-class belongings (Island Gold, Fruta Del Norte).

Gold Producers – 2022 AISC Ranked (Firm Filings, Writer’s Chart)

Lastly, though Equinox trades at a decrease enterprise worth relative to those two firms, each Alamos Gold and Lundin Gold are buying and selling at what I’d argue to be lofty valuations after doubling off their lows. So, from a relative worth standpoint, it is troublesome to match Equinox to most different producers and I imagine a reduction is justified given its industry-lagging margins (even publish Greenstone – $1,350/ozor larger). As for its valuation relative to web asset worth, I proceed to see Greenstone as absolutely valued from a P/NAV standpoint, with an estimated web asset worth of ~$1.86 billion after subtracting out web debt and estimated future company G&A. This leaves the inventory buying and selling at a slight premium to web asset worth at the moment, and I’ve discovered no worth in paying a premium to web asset worth for sector laggards and or high-cost producers.

Equinox Gold – Annual Income, Working Bills, Company G&A (Firm Filings)

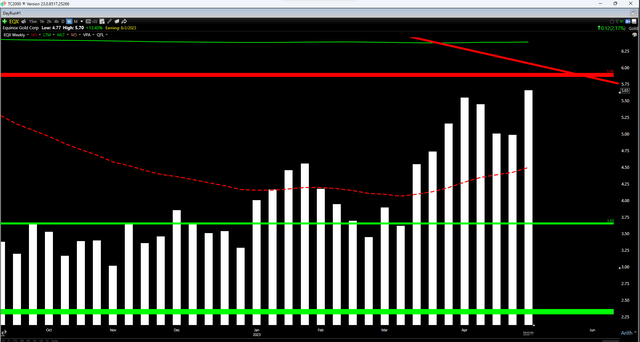

Lastly, if we take a look at the technical image, Equinox has rallied right into a probably robust resistance space and has no robust help till US$3.65. If we measure from a present share value of US$5.70, this interprets to a reward/threat ratio of lower than 0.10 to 1.0, a really unfavorable reward/threat ratio short-term. Clearly, a rising tide (gold value) might proceed to raise all boats, and this will surely profit a lower-margin producer like Equinox. Nonetheless, the time to purchase to guess on a turnaround was beneath US$3.25, not after the inventory has soared 130% off its lows.

EQX Weekly Chart (TC2000.com)

Abstract

Equinox Gold has seen an enchancment in its monetary place because of latest gross sales of fairness investments and a stronger gold value, and it is positioned to generate significant free money movement in FY2025 as soon as Greenstone is in business manufacturing if gold costs stay above $2,050/oz. That stated, the inventory appears to be like to be absolutely valued right here short-term, we’re nonetheless over two years away from significant free money movement era as Greenstone could have a ramp-up interval and the inventory is now heading right into a resistance space the place it might turn into extra weak to a pointy correction. Therefore, I’d view any additional energy within the inventory above US$5.80 as a chance to ebook some earnings.