cagkansayin

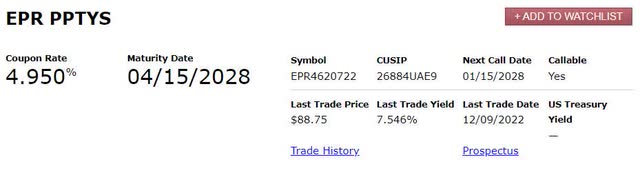

EPR Properties (NYSE:EPR) is a REIT that’s nonetheless recovering from the COVID-19 pandemic. The corporate noticed its largest tenant kind, theatres, shut down by the general public well being restrictions. This 12 months, with restrictions lifted, the corporate noticed its tenants get again to enterprise. Earnings buyers have three distinctive choices when taking a look at EPR. Two of these choices are the 7.9% yielding frequent share dividend and a 7.9% yielding most popular share dividend. For these threat hostile to the hazards of the business, the 2028 maturing bond, which at present yields over 7.5%, are the higher funding choice.

FINRA

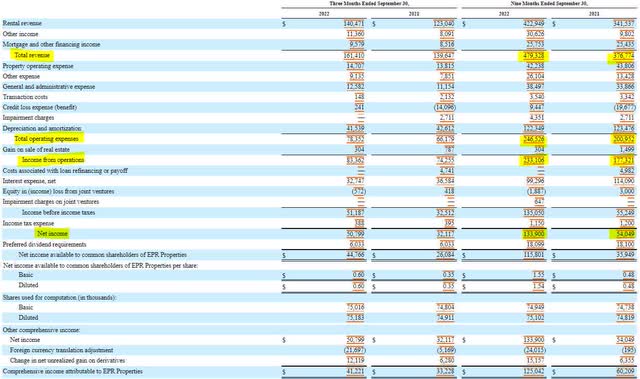

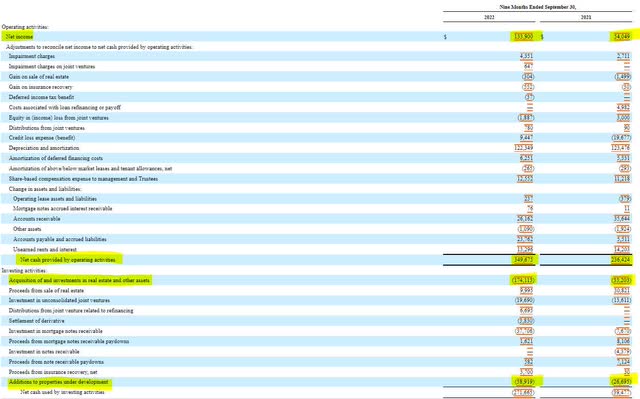

EPR’s revenue assertion reveals that the corporate has made marked enhancements because the pandemic. Revenues have grown by greater than $100 million within the 9 months of this 12 months in comparison with final 12 months. Moreover, with bills solely rising $46 million in the identical interval, working revenue has grown by $60 million. The REIT’s lower in curiosity expense, additionally pushed web revenue larger, up $80 million from the 12 months prior.

SEC 10-Q

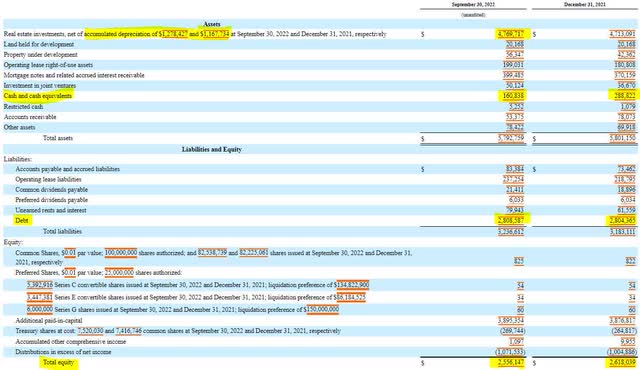

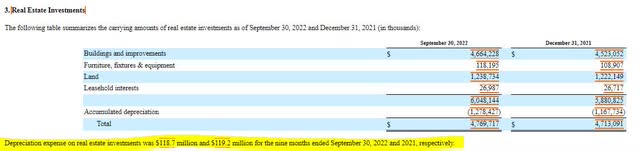

EPR’s steadiness sheet is kind of uneventful. As anticipated, the corporate has most of its property tied up in actual property. Most of its liabilities are in long-term debt. Each balances remained comparatively unchanged from the tip of final 12 months. The corporate did see a notable decline in its money steadiness. One merchandise of observe is the $110 million enhance in depreciation. Many REITs lump upkeep capex with improvement capex when reporting money flows, so I take advantage of depreciation as an indicator as to what acceptable capex needs to be in analyzing a company’s money stream assertion. The precise depreciation expense was disclosed in observe 3 of the final 10-Q submitting.

SEC 10-Q SEC 10-Q

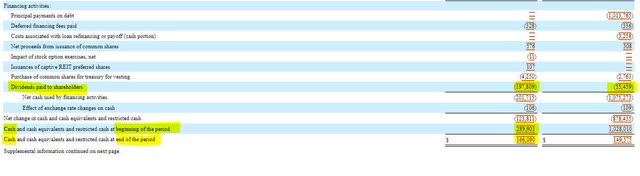

Earnings and adjustments in working capital account for practically all EPR’s enhance in working money stream in comparison with 12 months so far 2021. The corporate spent in whole capex to the tune of $232 million, though a few of this included redevelopment of properties and asset acquisition. After capex, EPR had roughly $117 million to use in the direction of its dividend funds of $197 million. EPR didn’t have satisfactory money stream to cowl its dividend commitments in 2022, however ought to the corporate function in the direction of upkeep capex, the money stream needs to be near satisfactory to cowl the dividends.

SEC 10-Q SEC 10-Q

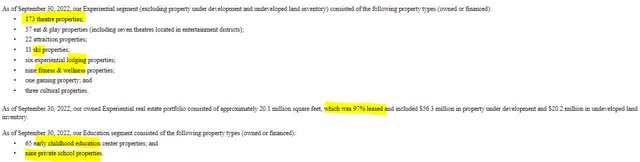

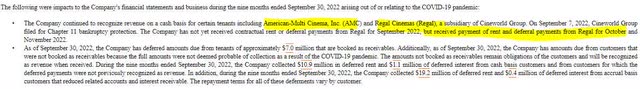

One main threat to EPR’s enterprise is the monetary well being of its tenants. EPR’s foremost tenant is film theatres, which had been struggling earlier than the pandemic, not to mention throughout a interval of extended shutdown. Happily, there may be some diversification in EPR’s portfolio, together with ski and lodging properties, gaming, and training facilities.

SEC 10-Q

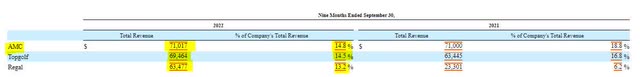

The corporate has been very clear in acknowledging some film theatre tenants have already filed for chapter and the results of these bankruptcies haven’t been blistering but as many of the lease continues to be paid by means of restructuring. Two of the highest three tenants are theatres accounting for 27% of whole income. EPR ought to generate roughly $220 million in free money stream (working money stream much less depreciation), due to this fact a lack of $134 million in income ought to hold the corporate free money stream optimistic, however it could current a cloth weak spot to the dividend.

SEC 10-Q SEC 10-Q

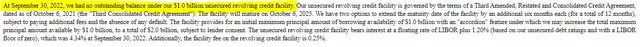

Whereas the corporate doesn’t present a maturity schedule, it did disclose that its subsequent debt maturity could be in 2024. Within the notes, the corporate had a $148 million personal placement observe due in 2024. In line with FINRA, the corporate has$300 million in notes due in 2025, and$400 million in notes due in 2026. Happily, EPR has an untapped $1 billion unsecured line of credit score to assist assist any debt maturities that come due throughout this time ought to the corporate discover itself locked out of the debt issuance markets.

SEC 10-Q

Whereas the notes are buying and selling at 50 foundation factors beneath the frequent and most popular dividends, I consider that low cost is a small alternative value for the security of the funding. If a cloud continues to hold over the film theatre business, a cloud will hold over EPR’s skill to pay its present dividend. The corporate’s conservative method to its steadiness sheet and additional diversification in actual property property will make solvency extra possible for debt buyers.

CUSIP: 26884UAE9

Worth: $88.75

Coupon: 4.95%

Yield to Maturity: 7.546%

Maturity Date: 4/15/2028

Credit score Score (Moody’s/S&P): Baa3/BBB-