tampatra/iStock through Getty Photos

Virtually one 12 months in the past, Kazuo Ueda assumed his present place because the Governor of the Financial institution of Japan (BOJ).

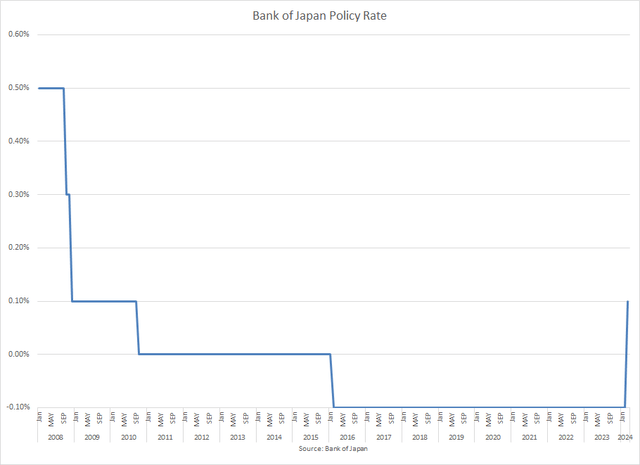

He was changing Haruhiko Kuroda, who served for ten years because the BOJ Governor, and was instrumental in pushing Japan’s extremely free financial coverage by aggressively executing Quantitative Easing via growing Japanese Authorities Bond (JGB) purchases, reducing the BOJ coverage charge to adverse territory at -0.1%, and implementing the Yield Curve Management Coverage (YCC) which set a goal yield for the 10-year JGB at 0.0%.

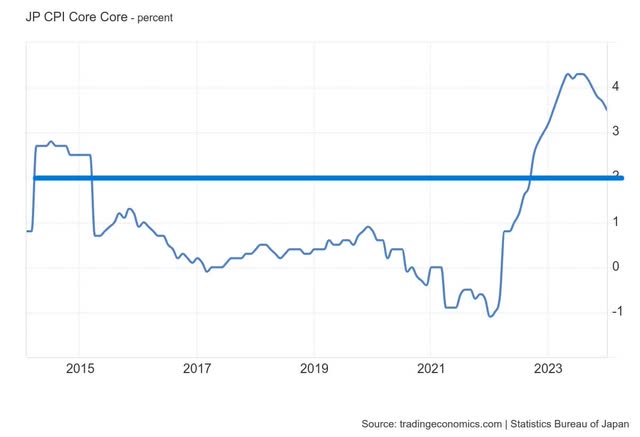

These measures have been affordable when initiated, as a result of Japan was experiencing a interval of low inflation, with Core Core CPI in a spread between 1.0% to -1.0%. Nevertheless, by the tip of Kuroda’s time period, these free insurance policies have been not acceptable.

Buying and selling Economics

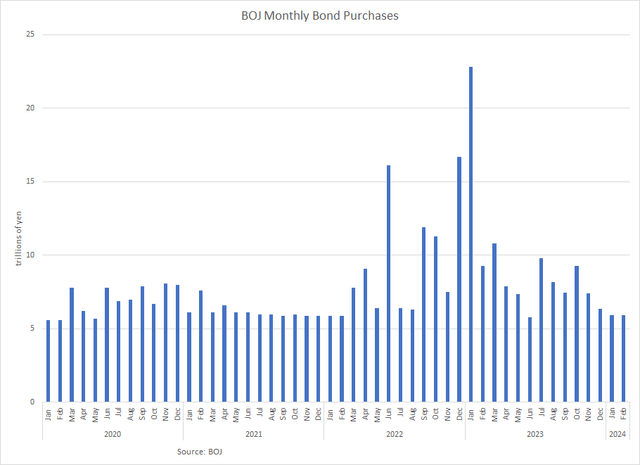

Core Core CPI had spiked above the two.0 % goal by September 2022, then as strain from speculators constructed that BOJ would elevate charges, BOJ was pushed to increase their JGB purchases above their month-to-month purpose to maintain yields inside their YCC framework.

BOJ

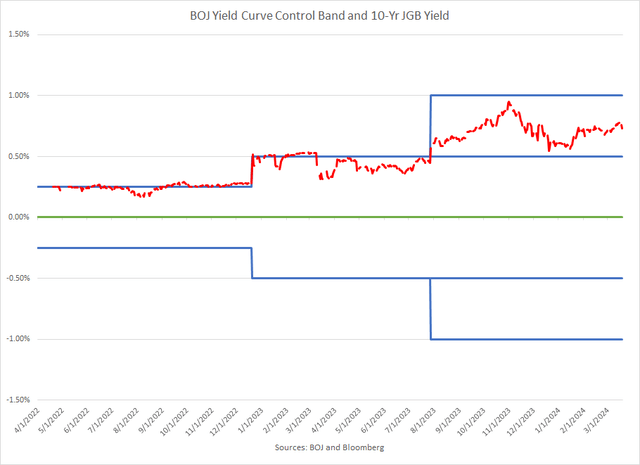

When that wasn’t sufficient, in December 2022, in a shock transfer, Kuroda was pressured to widen the YCC band by doubling it from +/- 25 foundation factors to +/- 50 foundation factors.

By the point Ueda assumed his present position in April 2023, there have been many causes for the BOJ to desert their free cash insurance policies. However Ueda, in his first Coverage Assembly as BOJ Governor, determined to do nothing.

Ueda’s first motion as BOJ Governor got here in July 2023, when BOJ “tweaked” coverage by doubling once more the YCC band, growing it to +/- 100 foundation factors across the goal charge of 0.0%.

BOJ and Bloomberg

Ten-year JGB yields rapidly climbed to the highest finish of the brand new band, once more exerting strain for coverage motion.

Though Core Core CPI confirmed modest enchancment after peaking at 4.3% in August 2023, it remained stubbornly excessive, above the two.0% goal for 18 consecutive months.

Finish of An Period

On the March 19, 2024 Financial Coverage Assembly, the Coverage Board of the BOJ, in a 7-2 vote, succumbed to the present pressures and raised quick charges from -0.1% to 0.1%

Financial institution of Japan

With this transfer the BOJ turned the final central financial institution to exit a Unfavorable Curiosity Price Coverage. Brief charges had been adverse for eight years.

The BOJ transfer was additionally their first charge hike in seventeen years.

It additionally signaled the tip to probably the most aggressive financial stimulus program in trendy historical past.

Wage Hikes Exceed Expectations

The first catalyst for the BOJ coverage transfer was a pointy enhance in wages.

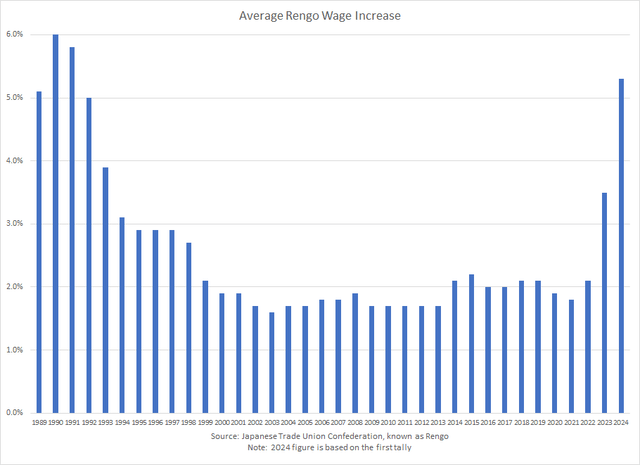

Rengo, the nation’s largest union group, which represents 771 unions, introduced first spherical outcomes to annual wage negotiations, which elevated by 5.3%, wildly exceeding expectations. This was the most important achieve in thirty-three years.

Japanese Commerce Union Confederation, Rengo

Whereas inflation, as measured by Core Core CPI has been stubbornly sturdy for fairly a while, Ueda was reluctant to make a change till he was satisfied inflation on the labor facet was equally sustained above 2.0%. The preliminary Rengo wage hikes at 5.3% satisfied him.

Different Components of Coverage Change

Along with mountain climbing the bottom charge to the vary of 0.0% to 0.1%, the BOJ introduced a number of different modifications to coverage.

-BOJ will abolish YCC.

-BOJ will cease shopping for Trade Traded Funds and Japan Actual Property Funding Trusts.

-BOJ will regularly scale back purchases of Business Paper and Company Bonds, and can finish purchases in a single 12 months.

-BOJ will present loans underneath Fund-Provisioning Measure to Stimulate Financial institution Lending at 0.1% for one 12 months.

-BOJ can pay curiosity of 0.1% to Present Account Balances of monetary establishments excluding Required Reserves.

Ueda was cautious to sign that coverage would stay accommodative. BOJ will proceed with its JGB purchases in broadly the identical quantity as earlier than. They reserve the appropriate “in case of a fast rise in long-term rates of interest, it’s going to make nimble responses ..(by) growing the quantity of JGB purchases … whatever the month-to-month schedule.”

There have been no indications of future charge hikes.

Yen Reacts

The Japanese Yen was not impressed with the coverage change, because it slumped to 151.8, its weakest degree since 1990.

Bloomberg

This step is considered as a dovish hike, with merchants now specializing in the hole between US Treasury and JGB bond yields.

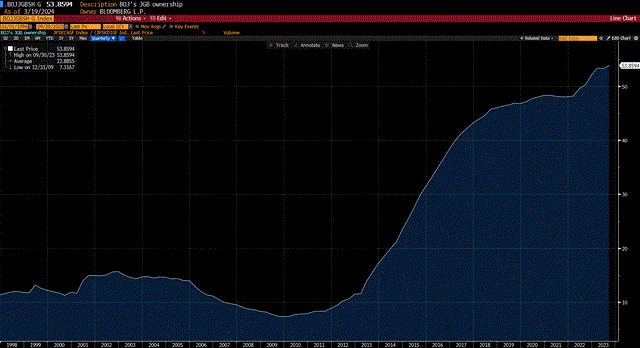

As well as, the continued JGB purchases will solely enhance the BOJs dominant share of JGB possession. At the moment, the BOJ owns 54% of all excellent JGBs. When Kuroda got here to workplace and aggressively began loosening financial coverage, BOJ solely owned 11% of the JGB market.

Bloomberg

Implications of Financial institution of Japan’s Transfer

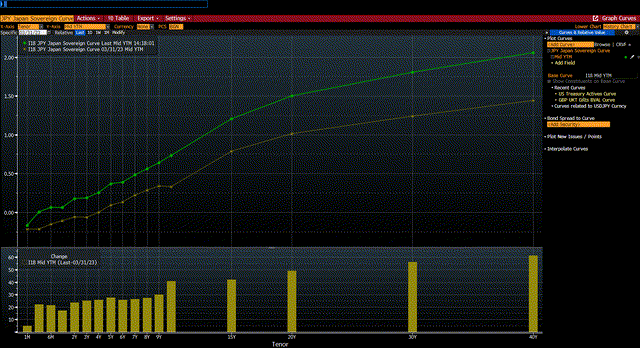

Since Ueda turned BOJ Governor, rates of interest in Japan have risen considerably. Alongside the JGB yield curve, quick charges have risen by 20 foundation factors, going from adverse yields to 0.06%. The ten-year JGB yield, not underneath the oppressive YCC, has risen by 43 foundation factors, greater than doubling to 0.73%. And 30 12 months JGB yields have elevated by 55 foundation factors to 1.81%

Bloomberg

With inflation remaining above goal, and yield gaps with U.S. Treasury bonds nonetheless broad, there’s danger to JGB yields rising additional.

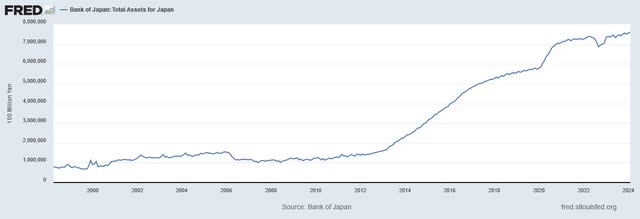

BOJ has proven no indication of steadiness sheet discount, which is the step different central banks have taken to Coverage Normalization.

This can be a concern for BOJ, as they have already got the most important relative steadiness sheet among the many main central banks.

BOJ’s complete property are 756 trillion yen, which equate to 127% of GDP. In contrast, the Fed’s large steadiness sheet of $7.5 trillion is simply 29% of GDP. Proportionally, the BOJ is 4.5 occasions bigger than the Fed, and rising whereas the Fed is shrinking.

Fred

Because the BOJ stays accommodative, regardless of their elevating charges, the Yen might proceed to weaken.

Ueda has indicated that BOJ will transfer slowly, though extra must be completed.

Deeply adverse actual charges and the weak spot within the yen assist additional charge hikes.