Editor’s Notice: As of February 2023, Private Capital is called Empower. This evaluate can be up to date to mirror this variation.

Empower is a nationally acknowledged platform that gives free instruments for private finance, budgeting, and portfolio evaluation, in addition to a money administration program and wealth administration providers.

In our Empower evaluate, we’re going to be discussing:

- The banking evaluation and budgeting instruments provided on the platform

- The Empower Private Money program that permits you to earn curiosity in your uninvested money

- The funding evaluation options and allocation graphics that present you the way your portfolio is performing

- The monetary planning instruments that show you how to save for retirement safely and construct an emergency fund

- How one can get entry to Empower’s free monetary administration instruments

- The wealth administration providers that join you to a devoted advisor for funding administration and recommendation

Overview

Let’s begin this Empower evaluate with a common overview of the professionals and cons of Empower. We’ll dive into these factors later within the evaluate.

Execs

- Simply hyperlink your whole financial institution, funding, money, and mortgage accounts in addition to your private home worth for an all-in-one view.

- The Web Value device is a straightforward snapshot of your belongings and liabilities that does the give you the results you want.

- Customise your Budgeting device to see how a lot you’re spending and on what.

- See a easy graph of your portfolio versus a benchmark to know whether or not or not you’re beating the market.

- Know precisely how a lot you want to save for retirement yearly with the monetary Planning instruments.

- Know in the event you’re dangerously undiversified with the Funding Checkup.

- Entry your personal, devoted advisor and a custom-made ETF portfolio with the Empower Advisor program.

Cons

- No solution to hyperlink your subscriptions within the Payments part.

- Solely digital transfers to and from the Empower Private Money account – no money transactions or debit card.

- Minimal of $100,000 invested for the Advisor program.

- Increased-than-average administration charges for Advisor, Empower’s wealth administration program.

Okay, now let’s dive into the small print!

Dashboard

The Dashboard view from Empower is your snapshot of your monetary life.

On this web page, you may see your web price, funds, money circulation, portfolio steadiness, retirement financial savings, and emergency fund.

You possibly can see your linked monetary accounts on the left-hand facet together with their particular person balances so you understand how a lot you might have saved, how a lot you might have invested, and the way a lot you owe.

There are additionally particular, custom-made playing cards that pop up in your dashboard to present you monetary recommendation and direct you to different components of the platform that may analyze completely different features of your funds.

From the Dashboard, you may hyperlink to just about each device and report that Empower has to supply.

Let’s speak in regards to the completely different sections you may entry from the dashboard.

Web Value

The Web Value part provides you a timeline view of your web price over time.

When you recall from our article on the High 1% at Each Age, web price is calculated by subtracting your liabilities out of your belongings.

Empower does this give you the results you want by including up what you might have in your checking accounts, financial savings accounts, brokerage accounts, and fairness in different belongings, and subtracting out your bank card debt, mortgage, and different loans.

You possibly can customise your Web Value view by specifying a date vary and selecting which accounts, belongings, and loans you need to see.

Transactions

The Transactions part acts as your personal, private common ledger.

You should utilize this view to see an inventory of transactions you’ve produced from your bank cards, debit playing cards, direct deposits, and nearly all the pieces else. You too can filter this view by date vary and account kind.

Banking

Empower gives evaluation in your money flows, funds, and payments, in addition to a devoted money administration program.

Money Move

The Money Move web page provides you a month-over-month view of your money flows.

This web page is just like the Transactions part, besides non-cash transactions are filtered out.

For instance, in the event you transferred an funding account from one brokerage to a different or rolled an IRA over, Empower will exclude these transfers because you didn’t truly make or spend any cash.

You possibly can break down the Money Move view by “Revenue” and “Expense”, which lets you see your optimistic and damaging money flows individually.

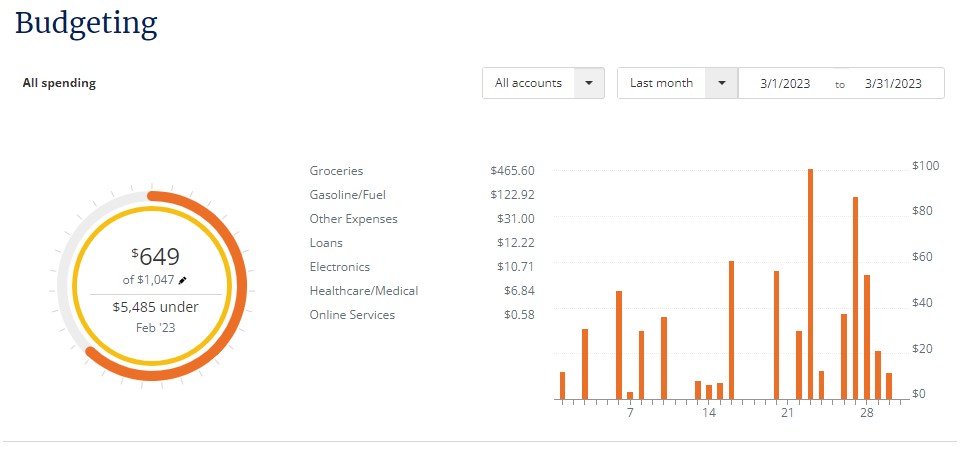

Budgeting

Empower’s budgeting device is slept on.

Whereas the platform is thought for its stellar money administration and wealth administration providers (which we’ll get to later), the free budgeting device can also be top-notch.

The device analyzes each transaction you make out of your linked accounts and provides you a bar chart of your bills damaged down by day.

You possibly can break the view down by spending class so you may pinpoint which varieties of bills you want to give attention to.

You too can manually edit any transaction to vary its title or class, in addition to add tags and photos of receipts.

If you wish to do your personal funds evaluation, Empower allows you to export an inventory of your transactions as a .csv file (which you’ll then learn into Excel)!

When you’re on the lookout for methods to avoid wasting tax cash and develop your funds, try our Energetic HSA Overview.

Payments

The Payments part provides you a fast overview of the payments you might have arising.

When you have unpaid payments, Empower will conveniently hyperlink you to your monetary establishment’s web site the place you may maintain the cost.

Notice: Empower will solely present you payments from linked monetary accounts which might be particularly acknowledged as money owed, resembling bank cards and mortgages.

When you have payments to pay for subscriptions like music providers and procuring platforms, you gained’t discover them within the Payments part.

EMPOWER SUMMARY

What You Get:

- Free Web Value, Budgeting, and Portfolio Evaluation Instruments

- Money Administration Program

- Monetary Advising Program

Set Your Portfolio Up for Success:

- Portfolio Checkup with Prompt Asset Allocations

- Retirement Planning Instruments for Lengthy-Time period Buyers

Empower Pricing:

- Private Finance Instruments Are Utterly FREE

- Wealth Administration Program Is 0.49% – 0.89% of AUM

Empower Private Money

Empower Private Money is Empower’s personal banking program.

Like different money administration accounts from different brokerages, Empower’s money administration program takes your money and deposits it in accomplice banks, that are FDIC insured.

This system doesn’t require a minimal steadiness and doesn’t cost any charges. You can also make limitless transactions to and from the account and even open joint accounts. Empower gives a 4.25% APY for the Money program.

The draw back to the Money program is you could solely carry out digital transfers. You can not deposit or withdraw money, nor do you obtain a debit card to make use of for on a regular basis transactions.

Investing

Empower gives some easy however very efficient instruments that will help you consider the standard of your portfolio within the Investing part.

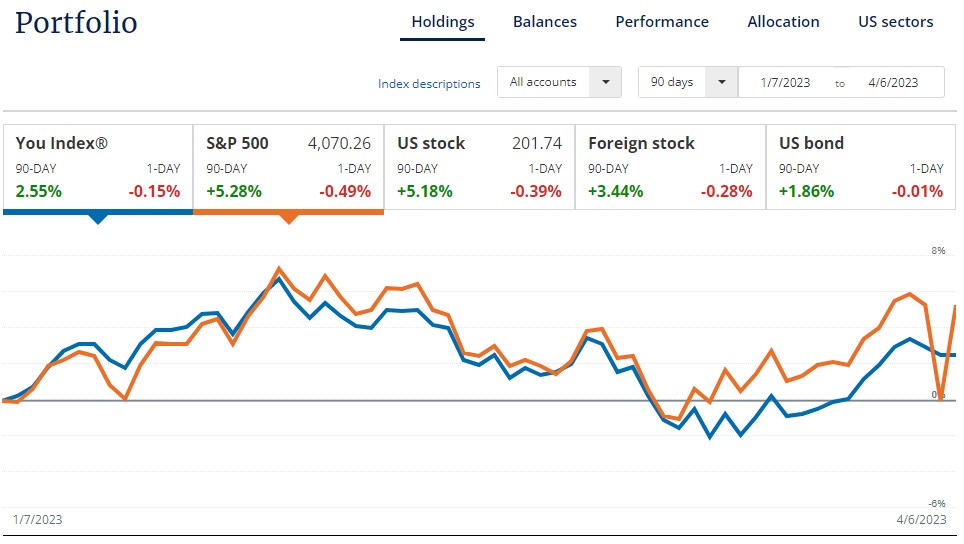

Holdings

The Holdings tab of the Investing part exhibits you a line graph of the You Index versus certainly one of a number of attainable benchmarks (the default is the S&P 500).

The You Index is a particular index from Empower that exhibits the portfolio of all of your present holdings (shares, bonds, ETFs, mutual funds, and so on.) extrapolated backwards in time.

Under the road graph, you see an inventory of your whole particular person holdings.

You possibly can choose a holding and add it to the graph, permitting you to check it to the You Index and your chosen benchmark.

It is a nice solution to see in case your portfolio or certainly one of your particular investments is thrashing the market!

Balances

The Balances tab is a fast solution to see the complete worth of your whole completely different funding accounts over time.

You possibly can filter out particular accounts, view solely taxable or tax-advantaged accounts, and specify a date vary.

Efficiency

In contrast to the Holdings tab, the Efficiency tab tracks your precise portfolio’s efficiency towards a benchmark as an alternative of the retroactive efficiency of your present holdings.

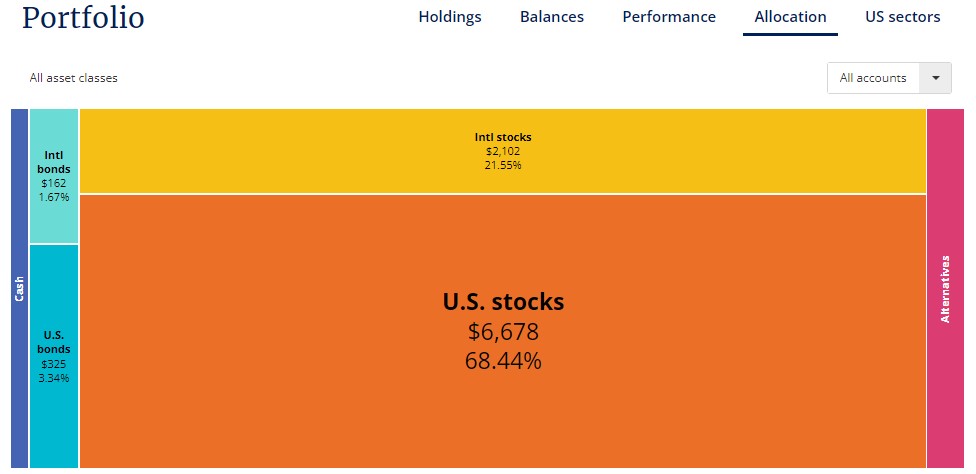

Allocation

The Allocation tab exhibits you a cool view of your present asset allocation.

You possibly can click on on any asset class to see a breakdown of its subclasses, after which click on on a subclass to see your particular holdings in that subclass.

For instance, you may click on on “U.S. Shares”, then “Giant Cap Progress” to see what investments you might have in home large-cap progress shares.

US Sectors

The US Sectors tab is one more manner that Empower breaks down your portfolio so you may view it a sure manner.

This tab provides you a bar graph of every sector you’re invested in.

If you click on on a sector, you’ll see a graphic just like the one from the Allocation tab that exhibits you which of them particular investments you might have in every sector.

Planning

When you’re seeking to plan for retirement, construct an emergency fund, or be sure that your portfolio has the suitable stage of danger in your state of affairs, Empower has some nice instruments for you.

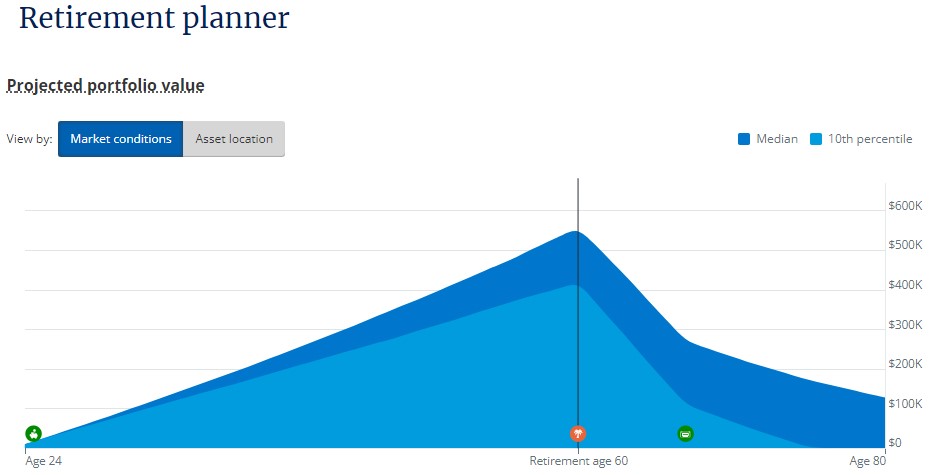

Retirement Planner

The Retirement Planner device provides you a personalised projection of your retirement portfolio and estimates its diploma of success in supporting you thru retirement.

You present Empower with inputs resembling your revenue, how a lot you’re placing apart for retirement, and the way a lot you need to spend in retirement.

The Retirement Planner device makes use of estimated components resembling administration charges and inflation to present you an approximate view of how a lot your portfolio can be price on the time of retirement and for the way lengthy it’s going to assist you.

You should utilize the Retirement Planner device to create completely different situations and examine them with a view to plan in your good retirement.

Financial savings Planner

The Financial savings Planner device tells you precisely how a lot cash you ought to be saving yearly to realize your targets.

You possibly can see how a lot you ought to be saving with a view to have a very good likelihood at attaining your required retirement, how a lot you ought to be placing into your emergency fund, and the way a lot you ought to be placing in direction of your mortgage funds.

Retirement Price Analyzer

Empower gives an amazing device for getting a practical concept of how a lot your 401(ok) can be price on the time of your retirement, often called the Retirement Price Analyzer.

You possibly can enter your annual contributions, how a lot your employer matches, and the way a lot you anticipate to earn in your investments.

The Retirement Price Analyzer device then estimates how a lot of your retirement fund you’ll lose time beyond regulation to administration charges.

Funding Checkup

The Funding Checkup is a particularly great tool that exhibits you the way your portfolio seems to be versus the way it ought to look.

Empower makes use of the data you’ve offered to make a “profile” for you and advocate a particular asset allocation.

For instance, if you’re 22 years outdated with no debt and an estimated retirement age of 65, Empower will advocate an aggressive asset allocation for you.

When you’re nearer to retirement and are supporting your loved ones members, Empower will advocate a extra conservative asset allocation.

The Funding Checkup compares your present allocation to your goal allocation and suggests how a lot cash you must take out of sure asset courses and put into others with a view to attain your goal asset allocation.

Empower may even provide you with a warning if you’re dangerously chubby in a sure sector or inventory.

Wealth Administration

When you’re seeking to take your investing sport to the following stage, Empower has a particular wealth administration program in addition to analysis and a weblog.

Advisor

Advisor is Empower’s paid wealth administration program.

If you join an Advisor account, you get entry to an Advisory workforce of economic advisors that can create and handle a portfolio of ETFs for you and provide you with investing recommendation in your different funding accounts.

Your devoted monetary advisors may even assist with retirement planning and show you how to reign in your spending.

Sadly, you may solely be part of the Empower Advisor program in case you have a minimum of $100,000 to take a position.

When you make investments between $100,000 and $1 million, the administration price is 0.89%.

The administration price for the upper tiers for Empower Advisory purchasers ranges from 0.79% to 0.49%.

Many U.S. traders gained’t have the ability to entry the Empower Advisor program because of the excessive minimal funding requirement.

When you do qualify for this system, you ought to be conscious that the Empower charges are larger than these of different funding platforms.

Many robo-advisors with no minimal funding requirement cost charges of lower than 0.40%.

Empower’s excessive administration price, although, might be justified by the truth that it’s a extra holistic wealth administration platform geared up with monetary advisors that may deal with nearly any facet of your monetary life.

Analysis

The Wealth Administration part of the platform provides you entry to a few of Empower‘s market analysis and insights in addition to a weblog known as The Foreign money.

So, Is Empower Proper for Me?

Now that you just’ve learn our Empower evaluate and find out about all of the options and free monetary instruments provided by Empower, let’s check out whether or not or not it’s the suitable platform for you.

Empower is for:

Individuals who need to see all of their monetary knowledge in a single place. This is among the greatest components of a platform like Empower. As a substitute of getting to open separate apps for every of your financial institution accounts, funding accounts, and budgeting instruments, you are able to do all of it from one dashboard.

Buyers who need free portfolio evaluation. Whilst you gained’t get the identical stage of personalised recommendation you’d get from the paid wealth administration program that gives a devoted monetary advisor, it’s fairly cool to get a fast evaluation that can let you know if you want to diversify extra.

Buyers who need to begin planning for retirement. It’s nice to have a retirement planning device that may let you know what portion of your revenue you ought to be placing away each month to remain on observe for retirement. You too can get entry to wealth administration service and a workforce of economic advisors for a price.

Empower is just not for:

Individuals who need a true checking account. Because the Empower Private Money account doesn’t supply bodily checks or a debit card, you shouldn’t anticipate to make use of it like an actual checking account. It’s an effective way to maintain your cash multi function place for simple transfers into and out of your funding accounts, however you may’t use it in your on a regular basis purchases.

Buyers who need funding recommendation for smaller portfolios. Sadly, you do should have a minimum of $100,000 invested with Empower with a view to be eligible for the Advisor program. If you would like skilled monetary recommendation however your portfolio is on the smaller facet, you might need to take a look at a unique platform with out a devoted monetary advisor.

Buyers on the lookout for low-cost wealth administration. Empower’s charges for the Advisor program are larger than many different platforms. If you would like one thing that prices much less and also you don’t want the holistic monetary recommendation in each facet of your monetary life, you must look into signing up for a robo-advisor as an alternative of a platform that connects you to a workforce of economic advisors.

Closing Ideas

Whereas Empower‘s wealth administration service won’t be a practical selection for each investor, the platform’s free budgeting, investing, and monetary planning instruments are merely a few of the greatest within the enterprise.

Who doesn’t need a simple solution to observe their spending and consider the standard of their portfolio, particularly when it’s free?

This Empower Overview 2023 has been up to date to incorporate the platform’s present options, rates of interest, and charges in 2023. Did we miss something on this evaluate? Tell us within the feedback beneath!

When you’re tightening up your private funds and also you need a easy solution to pay your mates, make investments your cash, and financial institution all in the identical place, Money App could be a very good app for you. Learn our Money App evaluate for extra data.

When you’d prefer to proceed your journey and take a look at extra private finance and budgeting instruments, learn our Quicken evaluate or Simplifi evaluate.

Rating of High Inventory Newsletters Based mostly on Final 3 Years of Inventory Picks as of December 27, 2025

We’re paid subscribers to dozens of inventory and choice newsletters. We actively observe each suggestion from all of those providers, calculate efficiency, and share our outcomes of the highest performing inventory newsletters whose subscriptions charges are beneath $500. The primary metric to search for is “Return vs S&P500” which is their return above that of the S&P500. So, based mostly on December 27, 2025 costs:

Finest Inventory Newsletters Final 3 Years’ Efficiency

| Rank | Inventory E-newsletter | Picks Return |

Return vs S&P500 |

Picks w Revenue |

Max % Return |

Present Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks |

82% | 56% | 76% | 1,583% | January Promotion: Save $50 |

| Abstract: 2 picks per thirty days based mostly on Looking for Alpha’s Quant Ranking; constantly beating the market yearly since launch; tells you when to promote they usually have offered nearly half. See full particulars in our Alpha Picks Overview. Or get their Premium service to get their QUANT RATINGS in your shares to higher handle your present portfolio–read our Is Looking for Alpha Value It? article to study extra about their Quant Scores. |

||||||

| 2. |  Zacks Worth Investor |

60% | 40% | 54% | 692% | January Promotion: $1, then $495/yr |

| Abstract: 10 inventory picks per 12 months on January 1st based mostly on Zacks’ Quant Ranking; Retail Value is $495/yr and contains 6 completely different providers together with these beneath. Learn our Zacks Overview. | ||||||

| 3. |  Moby.co |

50% | 16% | 74% | 2,569% | January Promotion: Subsequent decide free! |

| Abstract: 60-150 inventory picks per 12 months, segmented by trade; constantly beating the market yearly; retail worth is $199/yr. Learn our Moby Overview. | ||||||

| 4. |  Zacks High 10 |

36% | 15% | 71% | 170% | January Promotion: $1, then $495/yr |

| Abstract: 10 inventory picks per 12 months on January 1st based mostly on Zacks’ Quant Ranking; Retail Value is $495/yr and contains 6 completely different providers. Learn our Zacks Overview. | ||||||

| 5. |  TipRanks SmartInvestor |

20% | 9% | 62% | 464% | Present Promotion: Save $180 |

| Abstract: About 1 decide/week specializing in brief time period trades; Lifetime common return of 355% vs S&P500’s 149% since 2015. Retail Value is $379/yr. Learn our TipRanks Overview. | ||||||

| 6. |  Motion Alerts Plus |

27% | 5% | 66% | 208% | Present Promotion: None |

| Abstract: 100-150 trades per 12 months, a lot of shopping for and promoting and short-term trades. Learn our Jim Cramer Overview. | ||||||

| 7. |  Zacks Residence Run Investor |

5% | -0.4% | 45% | 241% | January Promotion: $1, then $495/yr |

| Abstract: 40-50 inventory picks per 12 months based mostly on Zacks’ Quant Ranking; Retail Value is $495/yr. Learn our Zacks Overview. | ||||||

| 8. | Canines of the Dow Technique | 16% | -1.8% | 43% | 44% | Present Promotion: None |

| Abstract: Purchase the ten highest yielding dividends shares within the Dow Jones Industrial Common on January 1st and promote on Dec thirty first every year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | January Promotion: NONE |

| Abstract: Maintains prime 50 shares to spend money on based mostly on IBD algorithm; Retail Value is $495/yr. Learn our Buyers Enterprise Every day Overview. | ||||||

| 10. |  Inventory Advisor |

34% | -3.9% | 75% | 289% | January Promotion: Get $100 Off |

| Abstract: 2 picks/month and a couple of Finest Purchase Shares lists specializing in excessive progress potential shares over 5 years; Retail Value is $199/yr. Learn our Motley Idiot Overview. | ||||||

| 11. |  Zacks Beneath $10 |

-0.2% | -4% | -4.3 | 263% | January Promotion: $1, then $495/yr |

| Abstract: 40-50 inventory picks per 12 months based mostly on Zacks’ Quant Ranking; Retail Value is $495/yr. Learn our Zacks Overview. | ||||||

| 12. |  Rule Breakers |

34% | -5.1% | 69% | 320% | Present Promotion: Save $200 |

| Abstract: Rule Breakers is included with the Idiot’s Epic Service. Get 5 picks/month specializing in disruptive expertise and enterprise fashions; Lifetime common return of 355% vs S&P500’s 149% since 2005; Now a part of Motley Idiot Epic. Learn our Motley Idiot Epic Overview. | ||||||

| High Rating Inventory Newsletters based mostly on their final 3 years of inventory picks overlaying 2025, 2024, and 2023 efficiency as in comparison with S&P500. S&P500’s return is predicated on common return of S&P500 from date every inventory decide is launched. NOTE: To get these outcomes it’s essential to purchase equal greenback quantities of every decide on the date the inventory decide is launched. Investor Enterprise Every day High 50 based mostly on efficiency of FFTY ETF. Efficiency as of December 27, 2025. | ||||||