yoh4nn/E+ by way of Getty Pictures

Emerson Electrical (NYSE:EMR) reported earnings on November 7 for his or her fiscal 12 months ending September 30, saying adjusted EPS of $4.44, a 22% enhance over fiscal 2022. Web gross sales have been $15.2B for the 12 months, producing $2.36B in free money movement. The fiscal 12 months noticed many milestones as the corporate continues to transition to a pure-play industrial automation firm. Shares are down 7.9% for the reason that starting of the 12 months due partly to considerations that the corporate overpaid for his or her acquisition of Nationwide Devices and a stake in Aspen Expertise. Shares commerce at a ~19x a number of of 2024 free money movement steering just lately offered by the corporate, which can present buyers with an affordable entry level if the corporate can execute on their transformational plans.

Transitions – Shopping for

Emerson accomplished their contentious acquisition of Nationwide Devices for $60 per share on October 11, a 25% premium on the $48 that was provided in Might of 2022. The deal got here after Nationwide Devices carried out a poison capsule technique in January. Whereas Nationwide Devices shareholders benefited from the negotiations, the elevated value might have negated a lot of the worth Emerson stood to realize from the transaction.

Emerson paid $8.2B in fairness worth for Nationwide Devices, equaling 4.9x Nationwide Instrument’s 2022 gross sales of $1.66B. The valuation appeared even worse on a free money movement foundation, as Nationwide Devices’ money movement era had been falling lately. Excluding 2022 as an anomaly, the 5-year common free money movement era between 2017 and 2021 was nonetheless solely $166MM, which might be a value to free money movement of over 49x. Emerson believes they’ll notice $165MM in synergies from the transaction by the tip of 12 months 5, however it is going to come at the price of an extra $155MM in bills. R&D effectivity has been referred to as out as one space of alternative, as Nationwide Devices spent ~20% of income on R&D. For comparability, Fortive (FTV) spends 6.9% of income on R&D.

| 12 months | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

| CFO (hundreds of thousands) | $42.96 | $143.5 | $180.8 | $224.4 | $274.6 | $224.4 |

| FCF (hundreds of thousands) | -$5.2 | $102.5 | $131.1 | $163.5 | $239.9 | 194.2 |

Though the worth of the acquisition could also be questionable, the strategic match is smart. The heritage Nationwide Devices enterprise had 68% gross revenue margins versus 46% for Emerson and annual gross sales are anticipated to develop at a fee of 2-3% sooner than Emerson. Additional, the know-how is very complementary to Emerson’s measurement and management know-how portfolio.

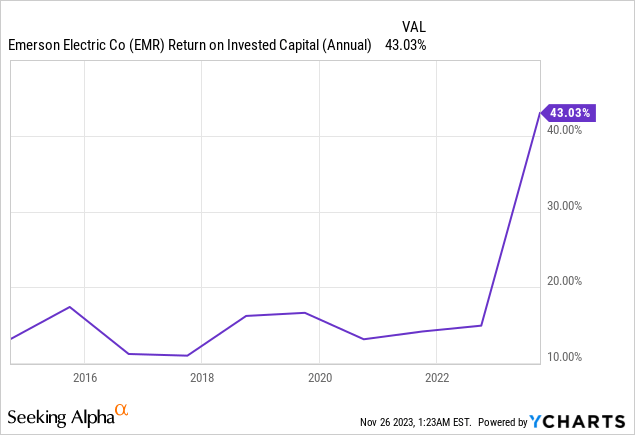

Equally, Emerson seems to have overpaid to amass a 55% stake in Aspen Expertise (AZPN) in 2022. Aspen Expertise has a market cap of $11.8B, however Emerson paid $6B and contributed their Open Techniques Worldwide enterprise, which they paid $1.6B for in 2020, and Geological Simulation Software program enterprise in 2022. Aspen Expertise generated $292MM in free money movement for his or her newest fiscal 12 months ending on June 30, 2023, of which $160.6MM is attributable to Emerson. Aspen Expertise is concentrating on free money movement in extra of $360MM for fiscal 12 months 2024, which might put Emerson’s reduce at ~$200MM and would equate to an acquisition value of effectively over 30x free money movement. Aspen Expertise had 64.2% gross revenue margins in fiscal 2023 and the method optimization software program is able to see development within the coming years, however it’s arduous to justify the valuation. Emerson’s return on invested capital has hovered within the teenagers lately, however will probably be nearer to 10% in 2024 given the massive quantity of goodwill from these two transactions – the latest worth is artificially excessive because of the Local weather Applied sciences transaction.

Transactions – Promoting

Emerson paid for his or her latest acquisitions partly with earnings from the sale of two of their companies. InSinkErator was bought to Whirlpool (WHR) for $3B in October of final 12 months. The enterprise is predicted to ship $100MM in free money movement to Whirlpool, so Emerson seems to have obtained a superb value for the enterprise.

Emerson additionally did effectively in receiving $9.7B pretax and a $2.25B face worth vendor be aware from Blackstone for 60% of their Local weather Applied sciences enterprise in a transaction that closed in Might of this 12 months. Local weather Applied sciences generated ~$675MM in free money movement in 2022, which means Emerson was paid over 24x trailing FCF for the enterprise. Promoting two companies that don’t align with the present enterprise technique for greater than 20x free money movement must be thought-about a optimistic transfer for shareholders.

Shareholder Returns

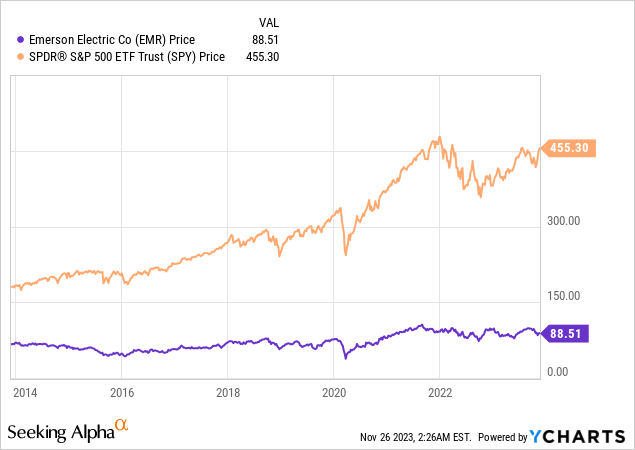

Emerson’s complete shareholder returns have considerably lagged the S&P 500 during the last decade, probably one motive the D. E. Shaw group took up an activist investor marketing campaign towards the corporate in 2019.

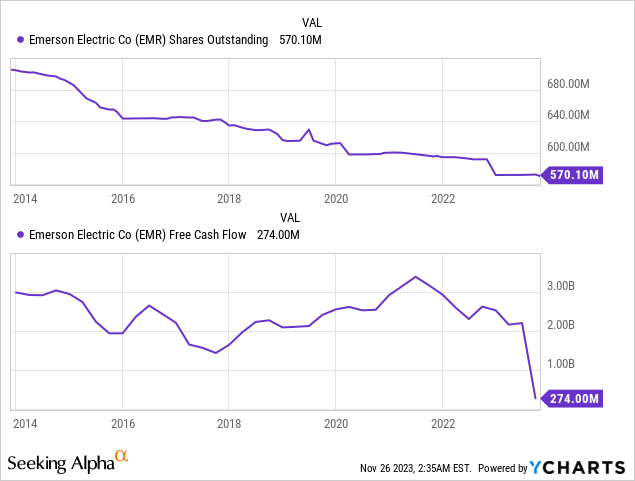

Share repurchases have performed a serious function in Emerson’s shareholder complete returns technique. The corporate has retired 19% of shares excellent within the final decade, going from 703,964,498 shares in October of 2013 to 570.1 million shares at October 31, 2023. The corporate indicated that they intend to spend one other $500MM on share repurchases in fiscal 12 months 2024. The discount in share depend has helped to offset declining free money movement era over the identical interval.

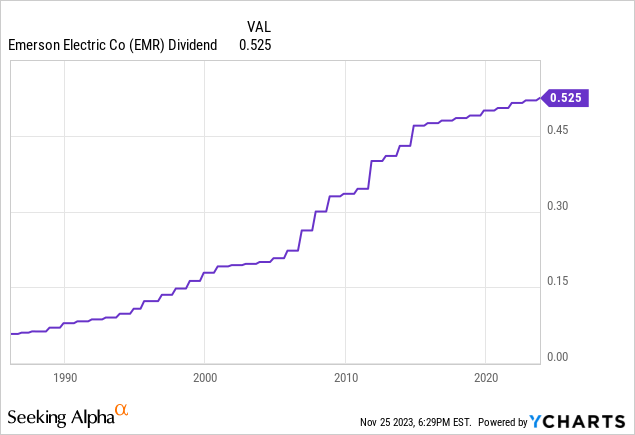

The corporate’s ahead dividend yield of two.37% and anemic dividend development of two.5% per 12 months during the last decade haven’t helped shareholders. Emerson elevated their quarterly dividend by half a cent to $0.525 per share, marking 67 consecutive years the corporate has elevated their payout. The dividend will eat ~$1.2B in money subsequent 12 months and the corporate is projecting fiscal 2024 free money movement of $2.6-$2.7B, placing Emerson in good place to extend dividend payouts at a sooner fee sooner or later in my opinion.

To Purchase or Not?

I applaud Emerson’s choice to divest non-core companies at enticing valuations and I agree in precept to reinvesting the proceeds into increased margin, complementary companies. Nevertheless, the corporate seems to have been overly aggressive of their valuation of Nationwide Devices and the stake in Aspen Expertise. The shortage of value self-discipline in M&A is regarding, notably when the corporate has revamped 20 acquisitions within the final seven years.

That being mentioned, Emerson is placing collectively a steady of manufacturers that generate good margins and will profit from secular development in industrial automation. The corporate offered 2024 free money movement steering of $2.6 to $2.7B, which might equate to a share value of lower than < 20x 2024 free money movement. There’s ample alternative for share worth development after a misplaced decade, and I initiated a small place just lately when shares traded underneath $85 based mostly on my perception that the corporate is primed to return to development. I might be protecting an in depth eye on money movement era and can regulate my share place based mostly on Emerson’s skill to execute on their development plan.