WTI Crude Oil News and Analysis

- ‘Supply cut’ comments rattle oil markets ahead of inventory data

- RSI indicator suggests the recent pullback may be short-lived – downtrend very much intact

- Oil-focused data: API and EIA inventory data today and tomorrow expecting further drawdowns

‘Supply Cut’ Comments Rattle Markets Ahead of Inventory Data

Saudi energy minister said OPEC+ had the tools to deal with challenges in the oil market, including production cuts, in a Bloomberg interview. Markets quickly responded and WTI and Brent prices shot up by 1% and 0.8%, respectively. US motorist have been breathing a lot easier at the gas pumps as gasoline prices have fallen steadily as we head to the end of the summer (US driving season). While prices have fallen, WTI trades marginally lower than the pre-invasion level of around $93.

WTI Technical Levels

Comments from the Saudi energy minister appear to have helped create a low of 85.75 with an immediate rejection of lower prices – witnessed by the extended lower wick in yesterday’s daily candle.

The short-term advance now trades just below the pre-invasion (Russia/Ukraine) level of around 93 – a level that held as support for most of Q2. Resistance appears at 93 followed by 96.44 and, of course, the 100 psychological level.

Something to note, is the relatively short-lived nature of bullish pullbacks in the past few weeks and the RSI shows a tendency for the indicator to approach the 50 mark before oil prices turned lower and we are nearing that very same level now. Therefore, a break of 93 with momentum will be something to consider for continued upward momentum.

Support appears at 88.40 (61.9% Fib), followed by the yearly low of 85.75

WTI Continuous Futures (CL1!) Daily Chart

Source: TradingView, prepared by Richard Snow

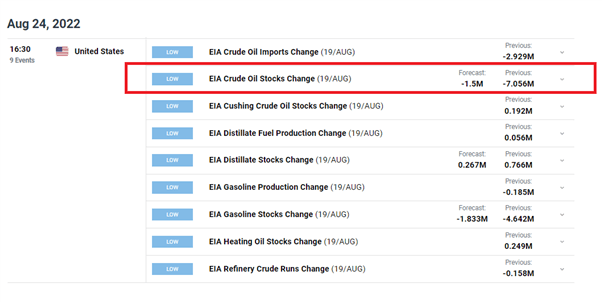

Scheduled Risk Events

WTI-specific data for the week starts today with the American Petroleum Institute’s crude oil stock change and continues into tomorrow with the EIA crude oil stock change with an anticipated drawdown of around 1.5m on the back of last week’s 7.05 m drop in inventories.

It appears the ‘tight supply’ narrative is attempting to make a return after the effects of demand destruction has seen oil prices trend consistently lower since July.

Another factor to consider towards the end of the week is the Jackson Hole Economic Symposium, which isn’t directly related to the oil market but can have wider implications for market sentiment as a whole. The event has been seen by some as a pseudo-Fed meeting and has the potential to move markets due to the FOMC’s recent pivot away from forward guidance towards a more data dependent, meeting-by-meeting approach. Fed Chairman Jerome Powell is due to speak on Friday.

Customize and filter live economic data via our DaliyFX economic calendar

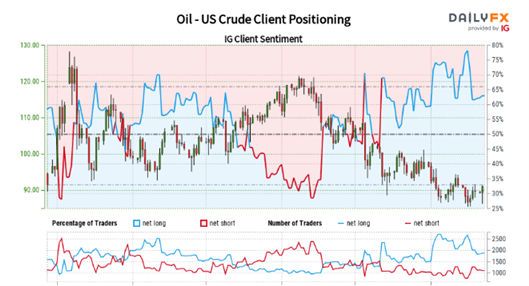

IG Client Sentiment

Oil – US Crude: Retail trader data shows 62.61% of traders are net-long with the ratio of traders long to short at 1.67 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil – US Crude prices may continue to fall.

The number of traders net-long is 0.62% higher than yesterday and 22.98% lower from last week, while the number of traders net-short is 2.20% higher than yesterday and 41.41% higher from last week.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil – US Crude price trend may soon reverse higher despite the fact traders remain net-long.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX