Financial exercise stays on a path to sluggish within the subsequent month’s launch of first-quarter information, in keeping with the median nowcast through a set of estimates compiled by CapitalSpectator.com.

The Bureau of Financial Evaluation is projected to report in late April that output elevated 2.1% (actual seasonally adjusted annual fee) throughout the January-March interval, based mostly on right this moment’s revised median GDP nowcast.

The estimate continues to mirror a considerably softer rise vs. This autumn’s sturdy 3.2% advance, which in flip marks a downshift from Q3’s red-hot 4.9% improve, in keeping with authorities information.

US Actual GDP Change

At this time’s revised Q1 estimate ticked down barely, once more, from the earlier estimate (), highlighting that as extra information for the present quarter is printed, the chances improve that we’ll see a materially softer tempo of progress within the upcoming GDP report.

Regardless of the current downgrades for Q1 output, the nowcasts nonetheless recommend that recession threat is low for Q1. A 2%-plus GDP improve is average, but it surely’s nonetheless nicely above a stage that might ring alarm bells.

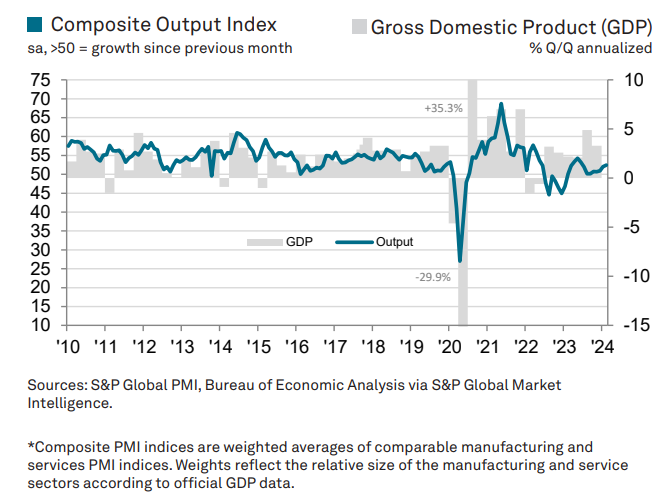

Utilizing survey information for February paints a brighter profile as non-public sector output elevated at quickest tempo in eight months, in keeping with the US Composite PMI Output Index, a GDP proxy.

“The most recent information signaled a thirteenth successive month-to-month growth in enterprise exercise at non-public sector corporations, supported by a renewed upturn in manufacturing manufacturing and additional rise in service sector exercise,”

Stories S&P International, which publishes the PMI numbers.

In the meantime, executives at US corporations are “strikingly extra assured in regards to the financial system, with expectations of stronger gross sales and capital investments,” in keeping with one other supply for enterprise sentiment, stories Axios:

“For the primary time in two years, the Enterprise Roundtable’s quarterly gauge of CEO sentiment is above its historic common, signaling that enterprise leaders’ financial uneasiness might lastly be fading.”

Gregory Daco, chief economist at EY, additionally sees an upbeat pattern unfolding, telling FT:

“The US financial system stays very sturdy and the principle engine of worldwide progress. There are headwinds, however total there are not any indications of an imminent retrenchment within the non-public sector.”

The following key actuality test for Q1 financial exercise arrives tomorrow (Fri., Mar. 8) with the discharge of information for February.

The Labor Division is predicted to report that hiring slowed to a still-healthy month-to-month acquire of 190,000 final month, in keeping with Econoday.com’s consensus level forecast.

That’s considerably under the earlier two months, however the will increase in December and January have been unusually sturdy.