DNY59

We beforehand lined e.l.f. Magnificence, Inc. (NYSE:ELF) in Might 2024, discussing the immense development in its monetary numbers and market share features, because of its well-loved and strategically marketed/ priced magnificence choices.

Even so, regardless of its relative nascency in the wonder sector, the untapped worldwide market, and the potential for large development, it was obvious that the inventory had been overvalued then, with it providing traders with a minimal margin of security, leading to our Maintain (Impartial) score then.

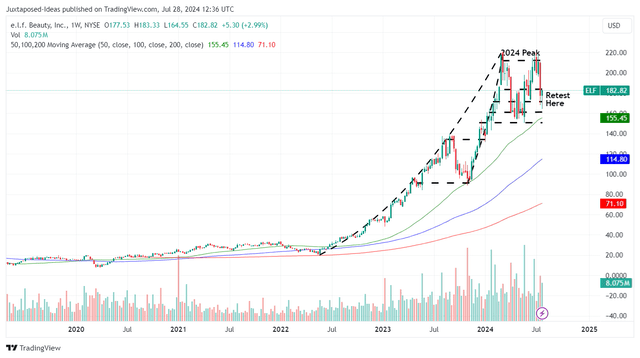

Since then, ELF has charted new heights earlier than pulling again as the broader market rotates from excessive development shares, and we enter the everyday powerful August month, attributed to its 1Y outperformance at +92% in comparison with the SPY at +24%, previous to the latest correction.

Whereas the wonder retailer has delivered double beat FQ4’24 earnings name, its FY2025 steerage has underwhelmed, worsened by the deceleration noticed in its home market, with it remaining to be seen if the administration could proceed to ship excessive double-digit development forward.

On account of the near-term uncertainty and the nonetheless costly inventory costs/ valuations, we’re reiterating our Maintain (Impartial) score right here.

ELF’s Funding Thesis Stays Relatively Speculative Coming into FQ1’25 Earnings Name

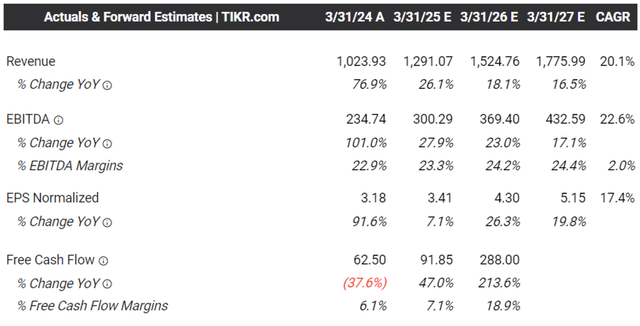

ELF just lately celebrated its twentieth anniversary as an organization, with FY2024 additionally bringing forth spectacular internet gross sales of over $1B (+76.9% YoY) for the primary time, whereas producing sturdy adj EBITDA margin of twenty-two.9% (+2.7 factors YoY) and adj EPS of $3.18 (+91.5% YoY).

With the corporate anticipated to report their FQ1’25 earnings outcomes on August 8, 2024, we will spotlight a number of metrics for readers to look out for, with it underscoring the well being of its enterprise and near-term prospects.

1. ELF’s Underwhelming FY2025 Steerage Implies Both Extreme Prudence Or Macro Headwinds

The Consensus Ahead Estimates

Tikr Terminal

Sadly, ELF has supplied an underwhelming FY2025 income steerage of $1.24B (+21.5% YoY) and adj EPS of $3.225 (+1.4% YoY) on the midpoint, with it lacking the consensus estimates of $1.27B (+24.5% YoY) and $3.56 (+11.9% YoY), respectively.

It seems that the wonder retailer’s excessive development development has lastly proven indicators of deceleration, when in comparison with its 5Y prime/ bottom-line development CAGR of +30.8% and +37%, respectively, additional underscoring why we consider that the above consensus ahead estimates look like overly aggressive.

Whereas it stays to be seen if ELF’s steerage has been on the prudent facet, primarily based on their beat and lift historic tendencies, and/ or if the worthwhile development deceleration is an indication of worse issues to return, one factor is for certain, the macroeconomic outlook stays unsure.

The June 2024 CPI continues to be elevated and stays properly above the Fed’s goal charge of two%, worsened by the latest market rotation from excessive development shares, with ripples being felt all through the inventory market over the previous week.

ELF 5Y Inventory Worth

Buying and selling View

This may increasingly even be why the ELF inventory has retraced because it has because the 2024 peak, with it successfully dropping -16.1% or -$1.58B of its Market Capitalization because the July 2024 peak, and moderating a lot of the features recorded after the spectacular FY2024 earnings name in Might 2024.

Whereas the administration has guided FQ1’25 efficiency “to be above that +20% to +22% internet gross sales steerage vary” on a YoY foundation, they could should ship an enormous beat and lift quarter to place a flooring at present ranges of $180s, as per their historic development.

Barring that, we consider that the market correction could not finish but, with it doubtlessly triggering additional inventory correction to the Might 2024 assist ranges of $150s, implying a -13% draw back from present ranges.

2. Watch ELF’s Worldwide & Pores and skin Care Progress Prospects

ELF has lengthy iterated their subsequent development alternatives within the worldwide market, with it solely comprising 15% of its FY2024 gross sales in comparison with the broader aesthetic market at over 70%.

A lot of the administration’s technique lies in its worth proposition, primarily based on the typical worth level of $6.50 for its merchandise in comparison with $9.50 for legacy mass cosmetics manufacturers and over $20 for status manufacturers. That is on prime of its sustained growth into skincare section, considerably aided by the latest Naturium acquisition price $355M.

For now, the worldwide market development stays sturdy at +25.7% QoQ/ +115% YoY in FQ4’24, attributed to the accelerating features in Canada and the UK, with it additionally driving ELF’s total gross sales.

Even so, readers should observe that the administration’s underwhelming FY2025 steerage implies a slower worldwide roll out, worsened by the slower home development at +17.2% QoQ/ +64.8% YoY within the newest quarter, in comparison with the 12 months earlier than at +27.8%/ +75.5%, respectively.

Whereas these numbers stay sturdy, it stays to be seen if ELF’s partnership with Sephora in Mexico from Q3’24 onwards could properly stability the decelerating development noticed within the home market.

In consequence, readers could need to monitor the administration’s FQ2’25 steerage supplied within the upcoming earnings name.

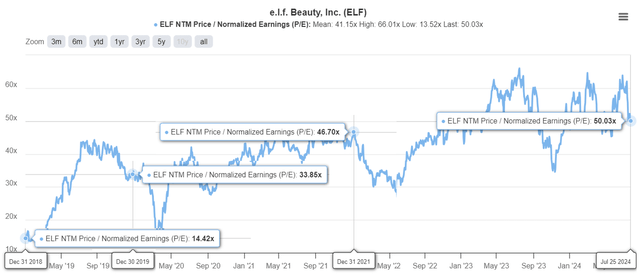

3. ELF stays Inherently Costly Right here

ELF Valuations

Tikr Terminal

Readers should observe that ELF’s elevated P/E valuations include nice expectations, with it solely linked to its means to constantly ship future double-digit development.

Even so, primarily based on the chart above, it’s simple that the inventory has gotten overly costly in comparison with its historic ranges, particularly given the potential development deceleration.

On the similar time, when evaluating to its magnificence/ private care friends, corresponding to:

- Ulta Magnificence (ULTA) at FWD P/E valuations of 14.14x with the projected adj EPS development at a CAGR of +6.1%,

- L’Oréal S.A. (OTCPK:LRLCF) at 29.67x/ +8.3%, and

- Estée Lauder (EL) at 27.47x/ +14.6%,

it’s simple that ELF continues to be costly at 50.03x/ +17.4%, respectively.

Whereas we applaud the sturdy efficiency metrics reported by the administration throughout its monetary numbers, unit gross sales, digital initiative/ channel growth, membership development, and retail partnership (amongst others), there stays a minimal margin of security regardless of the latest correction.

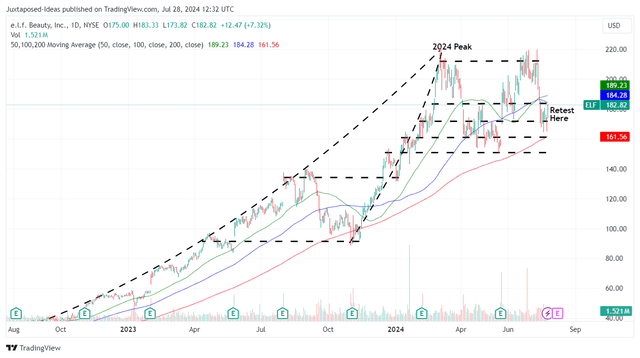

So, Is ELF Inventory A Purchase, Promote, or Maintain?

ELF 2Y Inventory Worth

Buying and selling View

For now, ELF has already retraced dramatically over the previous few weeks, whereas being properly supported at its earlier assist ranges of $170s to $180s.

For context, we had supplied a good worth estimate of $120.80 in our final article, primarily based on the administration’s FY2024 adj EPS steerage of $2.85 and the 5Y P/E imply of 42.41x (nearer to its mature friends’ P/E).

Regardless of the pullback, it’s obvious that ELF stays costly in comparison with our up to date truthful worth estimates of $136.70, primarily based on the administration’s FY2025 adj EPS steerage of $3.225 on the midpoint and the identical 5Y P/E.

With a minimal margin of security to our reiterated long-term worth goal of $182.70, primarily based on the steady consensus FY2026 adj EPS estimates of $4.31, we consider that present ranges don’t seem enticing for these trying to purchase the dip.

With ELF’s FY2025 more likely to convey forth a tougher YoY comparability, we preserve our perception that the market’s exuberance surrounding its future execution could average from henceforth, as noticed within the inventory’s double prime sample noticed to this point.

On account of the potential capital losses, we desire to keep up our Maintain (Impartial) score right here.