The real estate industry is one of the top industries when it comes to producing millionaires. Also, at the top of the list is finance and investments. This is where forex trading, as well as trading of other types of assets and markets false under. What does these two types of industries have in common that it is able to produce so much money fast?

The answer is that it allows enterprising individuals to make a quick flip to grow their assets. So, how do real estate investors make money by flipping properties? First, they get a feel of how the real estate market is moving in an area. They would try to find out the price range in which properties are being sold at in an area. Then, they would wait for buying opportunities to come up. They would not buy any and every available property that is presented to them. Instead, they would wait for a property which they could consider as a discount. It may be that the owners are high on debt and are keen to selling their property. It could also be that the property is foreclosed and is being auctioned at a low price. If the price is right, they would dive in to buy the property. Then, they would fix it up a bit and wait for the right buyer to take it off their hands at a price which is at the upper range of the current market price.

Because the same concept of flipping also exists in forex trading, we could also do exactly the same. First, we get a feel if the market is bullish or not. Then, we wait for price to retest or retrace to a level that we could consider as cheap. Using logical trading rules, we then buy whenever price is at a discount. Then, we wait for price to rally back up for a profit. The good thing with forex trading is that we could do the same thing in a bearish market. The only difference is that we short the market whenever price retraces back up.

Dynamic Moving Average Ribbon Forex Trading Strategy is built around this concept of taking trades whenever price retests or retraces a dynamic area of support or resistance using moving averages.

MA Ribbon Filled 89.21

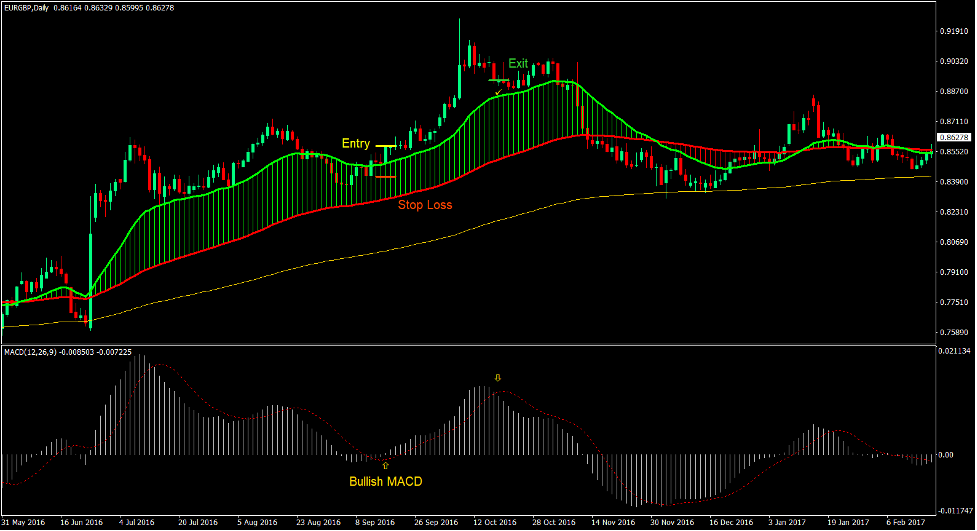

MA Ribbon Filled 89.21 is a trend following indicator based on moving averages. It is a simple indicator which plots two moving average lines, which are the 21-period Exponential Moving Average (EMA) and the 89-period Exponential Moving Average (EMA). The 21 EMA line is colored lime, while the 89 EMA line is red.

This indicator is primarily used to identify trends and trend reversals using the crossover of the two moving average lines. If the 21 EMA line is crosses above the 89 EMA line, the indicator would fill up the area between the two lines with lime bars. This would indicate that the trend is bullish. On the other hand, if the 21 EMA line is below the 89 EMA line, the area between the lines are filled with red bars indicating a bearish trend.

Moving Average Convergence and Divergence

The MACD or the Moving Average Convergence and Divergence is a widely used technical indicator. It is an oscillator which is used to identify trends and possible trend reversals.

The MACD is basically a computation of the difference of two moving average lines, particularly the 12-period Exponential Moving Average and the 26-period Exponential Moving Average. The difference between the two EMA lines is then plotted as the MACD line. In this version, it is plotted as a histogram bar.

Then, a 9-bar Simple Moving Average (SMA) is then derived from the MACD bars. This is then plotted as a signal line.

Positive bars are indicative of a bullish trend, while negative bars are indicative of a bearish trend.

Crossovers between the MACD bars and the signal line indicate potential trend reversals.

Trading Strategy

This trading strategy uses the MA Ribbon Filled 89.21 indicator as an area of dynamic support or resistance. It trades on bounces from the area after a retracement.

First, we must identify the trend. This is based on the moving average lines on the MA Ribbon Filled 89.21 and a 200-period Exponential Moving Average (EMA). The trend is based on how the three lines are stacked, as well as the slope of the lines.

Then, we wait for price to retrace, which should cause the MACD to temporarily reverse.

The entry signal is then based on the crossing over of the MACD bars and the signal line. Trades are also filtered based on whether the bars are positive or negative.

Indicators:

- MA ribbon filled.89.21

- 200 EMA

- MACD

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- 21 EMA should be above the 89 EMA, while the 89 EMA is also above the 200 EMA.

- The 89 and 200 EMA line should slope up.

- Price should retrace towards the area between the 21 EMA and the 89 EMA causing the MACD to temporarily reverse.

- Price action should indicate a resumption of the bullish trend.

- The MACD bars should cross above the signal line while being positive.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the MACD bars cross below the signal line.

Sell Trade Setup

Entry

- 21 EMA should be below the 89 EMA, while the 89 EMA is also below the 200 EMA.

- The 89 and 200 EMA line should slope down.

- Price should retrace towards the area between the 21 EMA and the 89 EMA causing the MACD to temporarily reverse.

- Price action should indicate a resumption of the bearish trend.

- The MACD bars should cross below the signal line while being negative.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the MACD bars cross above the signal line.

Conclusion

This trading strategy produces regular profits with a decent risk-reward ratio which is usually above 1.5:1. This allows traders to consistently profit from the market trading on strong trends after the market retraces.

Traders who are able to read candlesticks and price action proficiently can consistently profit from the market over the long run.

Forex Trading Strategies Installation Instructions

Dynamic Moving Average Ribbon Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Dynamic Moving Average Ribbon Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

Recommended Options Trading Platform

- Free +50% Bonus To Start Trading Instantly

- 9.6 Overall Rating!

- Automatically Credited To Your Account

- No Hidden Terms

- Accept USA Residents

How to install Dynamic Moving Average Ribbon Forex Trading Strategy?

- Download Dynamic Moving Average Ribbon Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Dynamic Moving Average Ribbon Forex Trading Strategy

- You will see Dynamic Moving Average Ribbon Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Save

Save

Get Download Access