stockcam

2023 was a 12 months filled with surprises. 2023 established the “Magnificent Seven”, noticed banks similar to Silicon Valley Financial institution collapse, whereas rates of interest continued to climb at a historic tempo.

As an investor, I additionally skilled some surprises in my personal portfolio. Immediately, I would like to debate one my shares which is a founder-led firm which excelled in 2023 because it beat the S&P 500 and grew by over 200%.

That firm is Duolingo (NASDAQ:DUOL). Let’s dig within the firm, latest financials, and why I believe this firm will proceed to a winner within the years to return.

The Firm

Duolingo is a expertise and training firm, and their mission is to develop the perfect training on the earth and make it universally accessible. Many individuals could also be acquainted with Duolingo as it’s a common app which has helped varied people all throughout the globe study a brand new language. Duolingo is presently the world’s hottest training app and as of the corporate’s final annual submitting, Duolingo provided programs in over 40 languages to greater than 60 million month-to-month energetic items.

Duolingo has additionally branched out into math and music along with creating an app for kids (Duolingo ABC) which helps them study to learn. My youngsters use this app and it has been an effective way for them to study new letters whereas letting them have enjoyable.

Duolingo was based again in 2011 by Luis von Ahn and Severin Hacker and the corporate went public in 2021. Each of that are nonetheless with the corporate. The duo have created a enjoyable solution to have interaction customers via gamification as increasingly more customers are downloading Duolingo.

Moat and Alternative

In keeping with the corporate’s newest annual submitting, Duolingo believes there’s a $60 billion greenback market alternative as in response to HolonIQ, roughly two billion individuals throughout the globe are studying a brand new language.

That is simply the language aspect of the enterprise. As famous above, Duolingo has just lately entered into math in addition to music. One cause, I like this enterprise is the potential to enter different areas.

I do suppose Duolingo has a moat, and Von Ahn acknowledged the identical on the corporate’s Q3 earnings webcast, “We have now a robust perception that the toughest factor about studying a language is staying motivated. And that’s one thing that we actually excel at.”

In america, earlier than Duolingo 80% of customers weren’t studying a brand new language which I believe actually speaks to the way in which Duolingo has created a enjoyable, simple, participating app. The streak characteristic was an unbelievable concept and one which hold customers on the app as people need to preserve their streaks.

Duolingo has a primary mover benefit as properly. Some many argue Babble and Rosetta Stone are as aggressive, however I do not consider that’s the case. I believe Duolingo actually emphasised AI and gamification first. In listening to prior earnings calls, human interplay similar to one-on-one tutoring was by no means the plan. Duolingo wished to create an thrilling, participating app that’s repeatedly adapting and enhancing. As famous on the corporate’s newest shareholder letter, Duolingo has a tradition of experimentation and repeatedly testing. The outcomes converse for themselves as this experimentation has led to progress in consumer engagement, studying outcomes and monetary progress (which I am going to focus on in additional depth under).

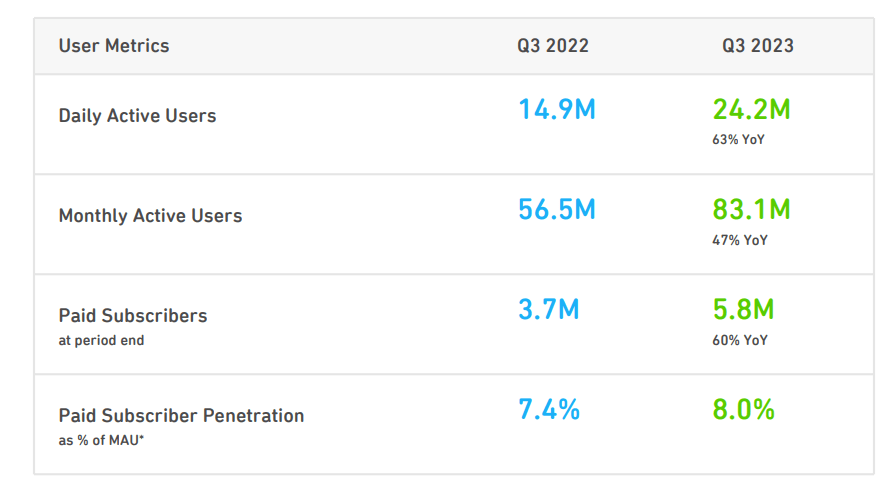

These Q3 2023 consumer metrics clearly illustrate how Duolingo has been in a position to improve their app and development energetic customers and subscribers:

Q3 2023 shareholder letter

Duolingo additionally extra information in comparison with their friends. Roughly 10 billion workout routines are accomplished by Duolingo customers in a single week, so the corporate has extra information on language studying than their opponents. That is actually a aggressive benefit and paired with the corporate’s strong testing and experimentation it is troublesome to see a rival overtaking Duolingo within the close to future.

Administration

Luis von Ahn is the present CEO of Duolingo and as famous above is without doubt one of the firm’s co-founders. Von Ahn has a powerful background as he invented and was the earlier CEO of reCAPTCHA earlier than it was acquired by Google in 2009.

Severin Hacker is Duolingo’s different co-founder and is the present Chief Know-how Officer.

Matthew Skaruppa is the corporate’s Chief Monetary Officer. Skaruppa beforehand labored at Goldman Sachs previous to working at Duolingo.

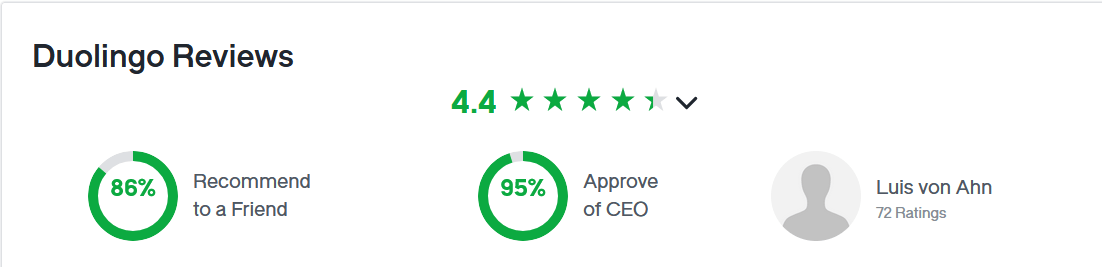

As you’ll be able to see under by the Glassdoor critiques, Duolingo is seen as a superb place to work and the corporate’s workers clearly approve of the job Von Ahn is doing:

Glassdoor

Financials

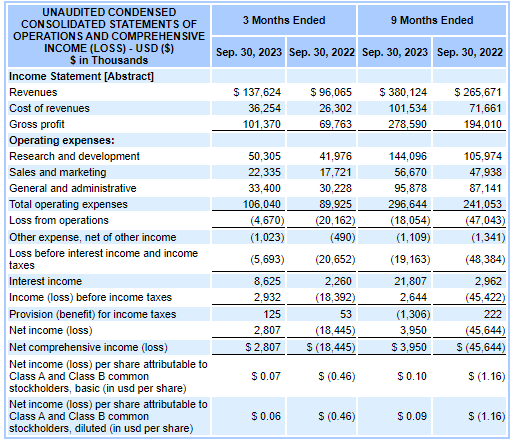

Duolingo’s Q3 2023 outcomes have been stellar as the corporate is now turning a revenue and is producing extra free money circulate.

Complete revenues for Q3 2023 have been roughly $137 million {dollars} which is a rise of 43% in comparison with prior 12 months quarter. Complete bookings have been roughly $153 million which is a rise of 49% in comparison with Q3 2022. Subscription bookings have been roughly $121 million which is a rise of 60% in comparison with prior 12 months third quarter.

The corporate did publish internet revenue of over $2.8 million for the present quarter as you’ll be able to see under:

SEC.gov

The corporate’s curiosity revenue of over $8 million helped them get there for the quarter. Nonetheless, the flip to profitability given the appreciable loss in Q3 2022 is spectacular.

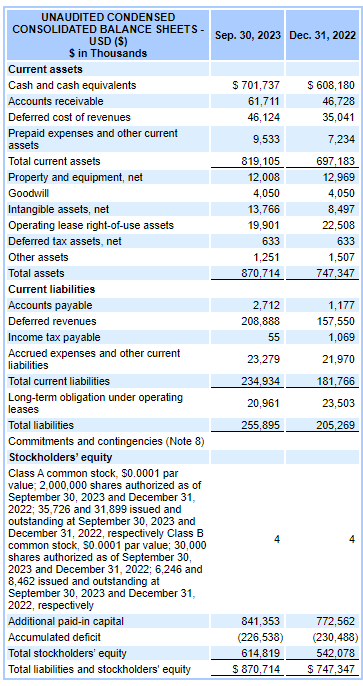

Moreover, Duolingo has a superb stability sheet as you’ll be able to see under:

Sec.gov

The corporate has a sizeable money stability which covers all of firm’s liabilities. Duolingo has no long-term debt and a lot of the firm’s liabilities are comprising of deferred income.

The corporate’s monetary progress is spectacular and it signifies Duolingo’s mannequin is working as their tradition of testing and experimentation coupled with AI is producing a top-notch consumer expertise driving development.

Dangers

Duolingo lists quite a few dangers to the enterprise on their annual report. I’ll focus on three dangers which I consider might harm the group.

Within the quick time period, if macroeconomic circumstances worsen and america enters right into a recession shopper discretionary spending will certainly be impacted. Duolingo has executed a stellar job of monetizing consumer development, however I discover it unlikely as many customers will improve to being a paying consumer if such macroeconomic circumstances come up.

As I discussed above, I consider Duolingo has a moat however given the rise of AI a competitor might be able to catch as much as Duolingo. On the corporate’s most up-to-date earnings name Von Ahn famous he did not view Google as a menace nevertheless Google and Microsoft have the assets to allocate vital funds into AI. I do not personally see both making a large effort to enter this market, however Google has allotted funds to “different bets” so solely time will inform if language studying might grow to be a type of bets.

Lastly, there’s threat entry into Math and/or Music might flop. I believe the corporate can be profitable in increasing into these new areas nevertheless ought to Duolingo fail, customers will not be as prone to take a look at new choices and it might influence the corporate’s skill to develop past language studying.

Valuation

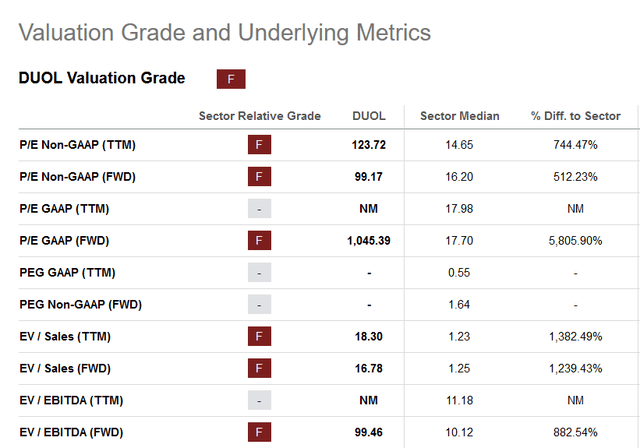

As you’ll be able to see from the under valuation metrics from In search of Alpha, the general worth grade for Duolingo is a “F.”

In search of alpha

It is robust to justify this valuation as you’ll be able to see Duolingo far surpasses the sector medians for all of the metrics famous above.

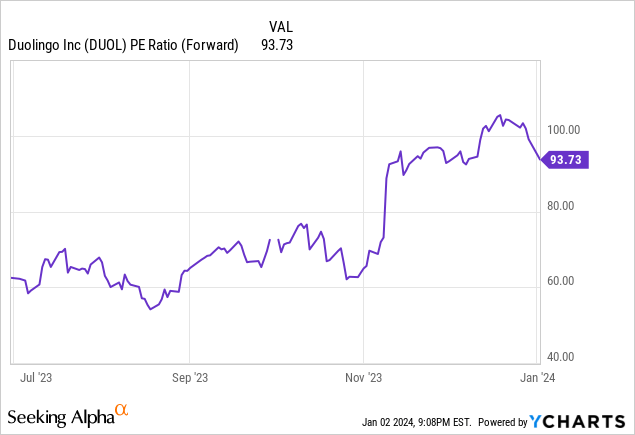

If the corporate’s ahead P/E ratio dropped again to under at the least 60 because it did in September of 2023, I would be a purchaser round that $150 worth level.

As a lot as I like this firm, I am unable to suggest buyers purchase shares given the present valuation.

Conclusion

Duolingo is a powerful founder-led firm with an exquisite mission of growing a world-class instructional app and making it universally accessible. The group’s tradition and give attention to AI has given Duolingo a moat and first mover benefit inside the language studying market.

Duolingo is flourishing as their consumer metrics illustrate and this consumer development is resulting in monetization and profitability.

Nevertheless, the corporate’s valuation is outrageous because the inventory has grown tremendously during the last 12 months.

I will be trying so as to add shares as soon as the inventory worth drops again to ranges skilled again in late summer season as I believe this can be a fantastic enterprise.