Dow Jones, S&P 500, Retail Dealer Positioning, Technical Evaluation – IGCS Equities Replace

- Dow Jones and S&P 500 have been caught in range-bound commerce

- Retail merchants are rising upside publicity, a bearish signal?

- How is the technical panorama shaping up amid this sign?

Really helpful by Daniel Dubrovsky

Get Your Free Equities Forecast

In current weeks, the Dow Jones and S&P 500 have been caught in range-bound worth motion. As volatility continues to chill, retail merchants have continued to adapt their publicity. This may be seen by IG Consumer Sentiment (IGCS), which might at occasions operate as a contrarian indicator. Not too long ago, IGCS has been producing bearish indicators. Allow us to take a better look.

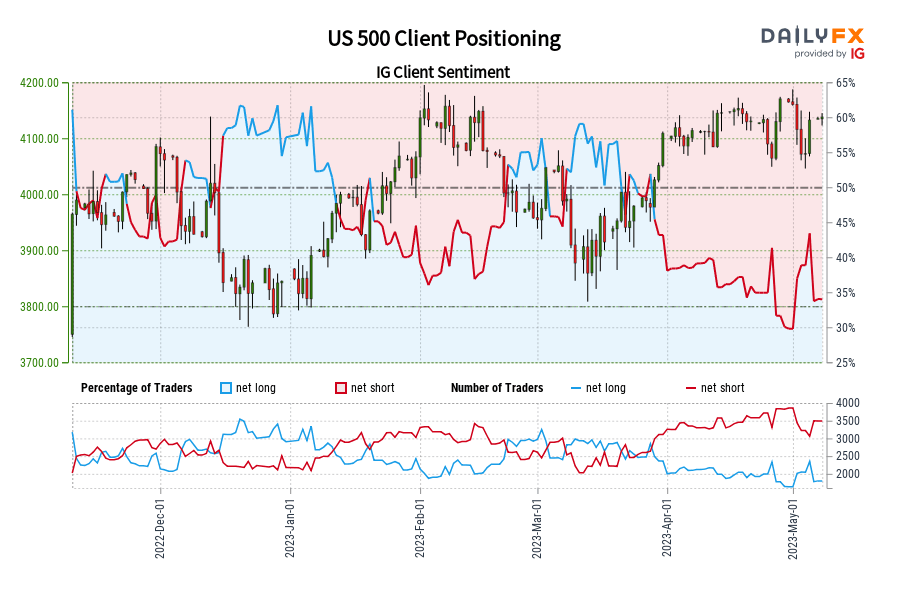

Dow Jones Sentiment Outlook – Bearish

In line with IGCS, about 37% of retail merchants are net-long the Dow Jones. Since most publicity continues to be biased to the draw back, this hints costs might proceed rising. However, upside publicity has elevated by 31.24% and 42.63% in comparison with yesterday and final week, respectively. With that in thoughts, these current modifications warn that the worth pattern might quickly reverse decrease.

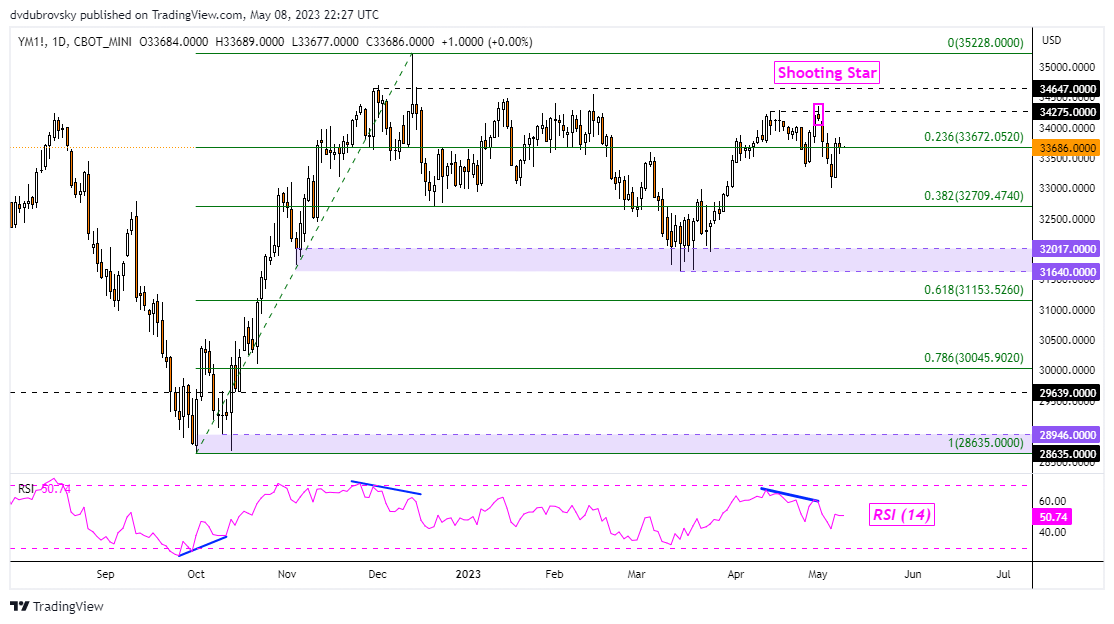

Dow Jones Technical Evaluation

On the every day chart, the Dow Jones has been aiming considerably decrease within the aftermath of a Taking pictures Star candlestick sample in addition to fading upside momentum. The latter was proven by adverse RSI divergence because the candlestick sample emerged. It is a signal of maybe additional weak spot to come back. Rapid assist is the 23.6% Fibonacci retracement degree at 33672. Clearing that exposes the 38.2% level at 32709 earlier than the 31640 – 32017 zone kicks in.

Chart Created in Buying and selling View

S&P 500 Sentiment Outlook – Bearish

In line with IGCS, about 36% of retail merchants are net-long the S&P 500. Since most positioning is biased to the draw back, this hints costs might rise. In the meantime, upside publicity has elevated by 15.11% and 12.72% in comparison with yesterday and final week, respectively. With that in thoughts, current modifications in positioning trace that the worth pattern might quickly reverse decrease.

Really helpful by Daniel Dubrovsky

Enhance your buying and selling with IG Consumer Sentiment Information

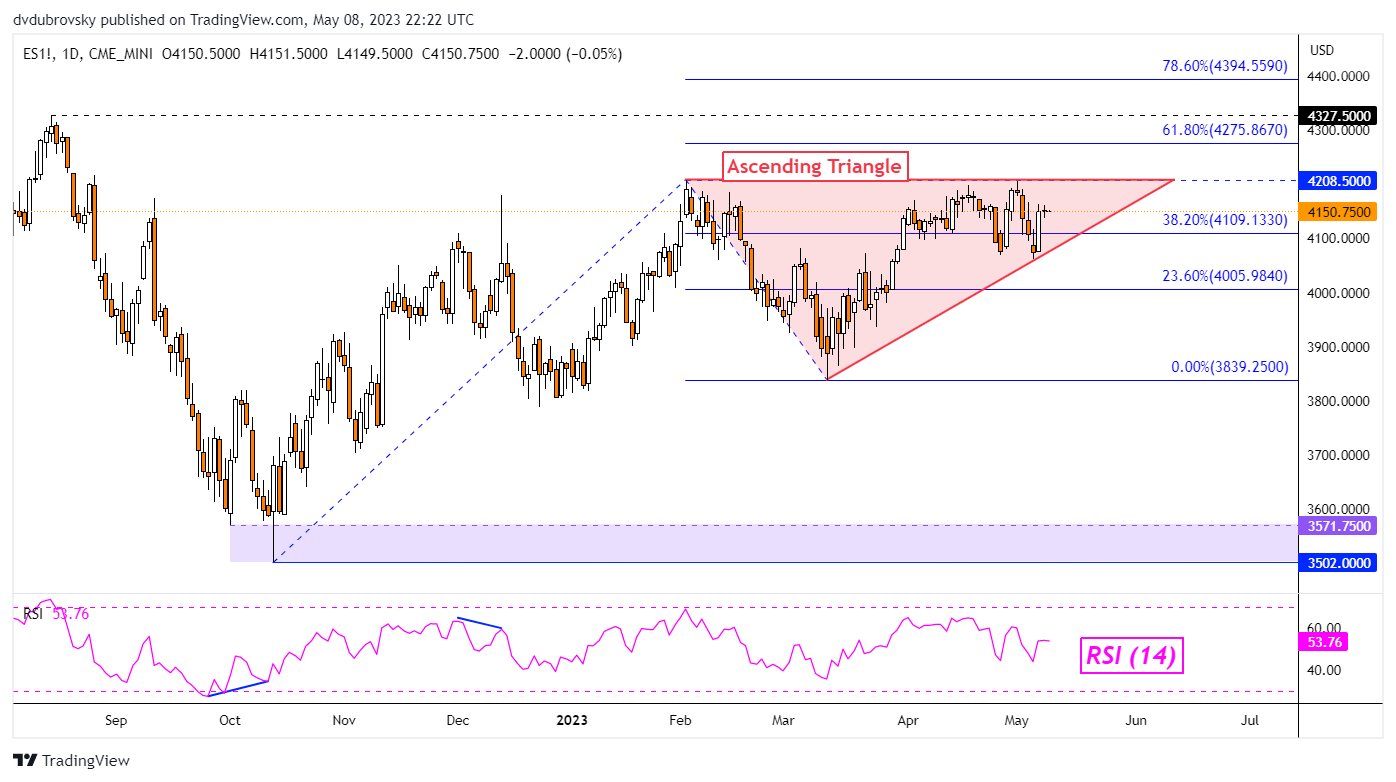

S&P 500 Technical Evaluation

The S&P 500 seems to be forming an Ascending Triangle chart formation. Not too long ago, costs bounced off the ground, which is a rising trendline from March. In the meantime, the ceiling is round 4208, established again in January. The path of the breakout could possibly be key for the approaching pattern. A push decrease exposes the March low at 3839. In the meantime, a flip larger locations the concentrate on the 61.8% degree at 4275.

Chart Created in Buying and selling View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com