- Q3 GDP and PCE costs revised decrease

- Greenback resumes slide as Fed fee minimize bets enhance

- Aussie and yen the primary gainers in FX area

- Wall Avenue rebounds, gold breaks key resistance

PCE costs for Q3 trimmed forward of PCE inflation for November

The US greenback resumed its downtrend yesterday in opposition to all its main counterparts, with the and the yen taking probably the most benefit and gaining greater than 1% every. The dollar is attempting to recuperate a small portion of yesterday’s losses right this moment.

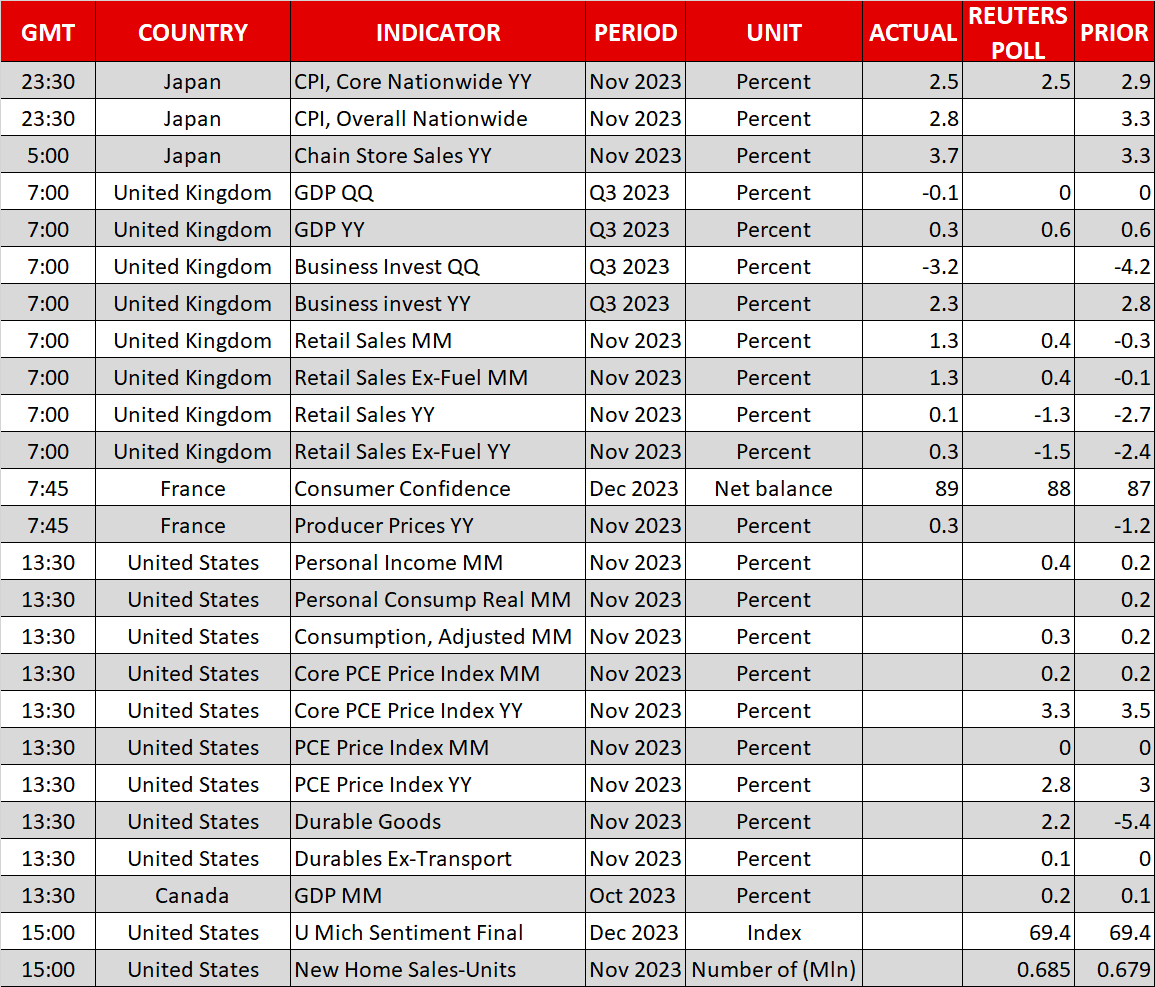

What could have inspired merchants to promote the greenback is the draw back revision within the q/q fee of core PCE costs for Q3, which was launched alongside the ultimate estimate of GDP for the quarter. The PCE fee was revised right down to 2% from a previous estimate of two.3%, signifying an enormous drop from 3.7% in Q2. What’s extra, client spending was trimmed to three.1% from 3.6%, and the general GDP fee was introduced again to 4.9% from 5.2%.

At the moment, the highlight is more likely to fall on the year-on-year fee of the core PCE index, the Fed’s favourite inflation gauge, for November. Expectations are for a small slowdown to three.4% y/y from 3.5%, however with the quarterly fee of Q3 being revised down, a decrease y/y print for final month can’t be dominated out.

Following yesterday’s information, traders have added to their Fed fee minimize bets, now penciling in 155bps price of reductions subsequent 12 months, and pricing in round a 95% probability for the primary quarter-point minimize to be delivered in March. With that in thoughts, a bigger than anticipated slowdown in right this moment’s inflation information might persuade individuals {that a} March minimize is a finished deal and will deepen the greenback’s wounds.

Aussie and yen stay engaging

With the RBA seen slicing its in a single day money fee by solely 50bps subsequent 12 months, and Fed fee minimize expectations not solely hurting the greenback however boosting the broader threat urge for food as effectively, the aussie was yesterday’s foremost gainer, with the yen securing second place on bets that the BoJ will ultimately determine to take rates of interest out of detrimental territory in some unspecified time in the future within the coming months.

At the moment, throughout the Asian session, each of Japan’s nationwide CPI charges slowed, however remained above the BoJ’s 2% goal, permitting traders to assign a 30% likelihood for a small 10bps hike in January. That stated, April appears a more sensible choice for ending the detrimental rate of interest regime. On condition that they pay shut consideration to wage development, officers could want to attend for the end result of subsequent 12 months’s spring negotiations, with unions pushing for an additional robust pay hike. Certainly, the market additionally sees an April hike as extra seemingly, giving an 80% probability for such an motion.

Wall Avenue and gold cheer rising Fed minimize bets

The rising hypothesis about huge fee reductions by the Fed helped Wall Avenue rebound yesterday, with the S&P 500 and the Nasdaq gaining greater than 1%. Though one other slide can’t be dominated out as a result of hedging exercise for the Christmas and New Yr holidays, the broader outlook stays optimistic for now.

Expectations of aggressive fee cuts by the Fed are serving to current values of excessive development corporations which can be normally valued by discounting anticipated money flows for the quarters and years forward, whereas the continued rally regardless of overly stretched valuation multiples means that market individuals are nonetheless calculating excessive current values of future development alternatives. Having stated that although, this additionally will increase the chance of an abrupt sell-off in case information level to a worse-than-anticipated financial outlook or in case the Fed doesn’t proceed with as aggressive cuts because the market at present anticipates.

Gold additionally took benefit of the greenback’s slide yesterday, though Treasury yields held comparatively regular, with the 10-year fee even rising considerably. The advance is continuous right this moment, with the dear steel breaking above final Thursday’s excessive of $2,048. As Fed fee minimize bets hold lowering the chance value of holding bullion, a transparent shut above that zone right this moment might permit post-Christmas advances in the direction of the $2,080 zone, marked by the excessive of Could 4.