- Fed destroys all hopes of an early pivot even before latest jobs report is out

- Dollar climbs to one-week high as stocks turn negative again

- Pound under renewed pressure, yen won’t budge from the 145 level

Hawkish Fed takes shine off September jobs report

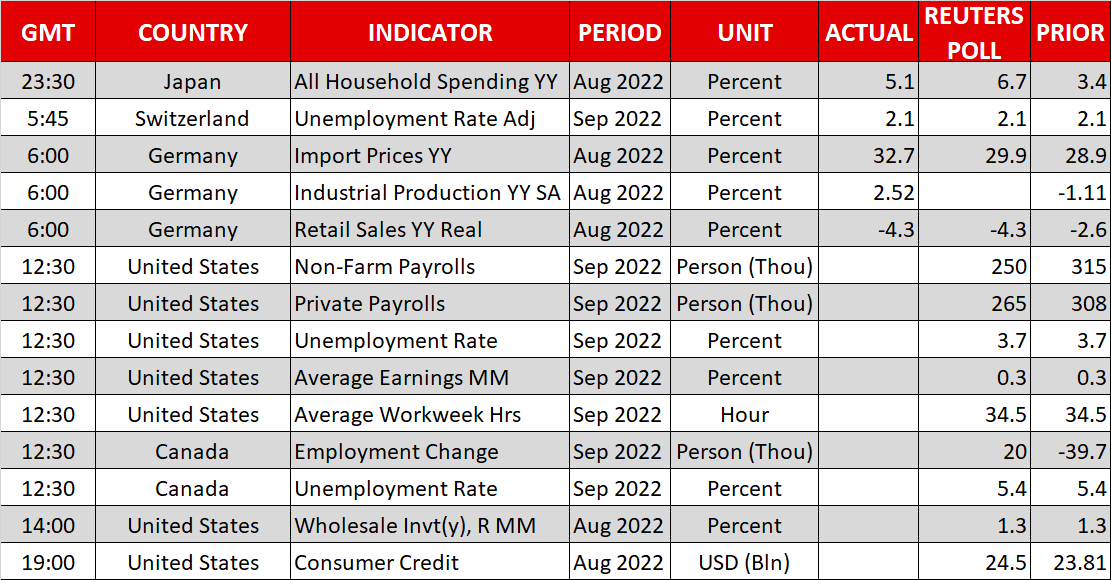

After some very mixed readings on the US economy this week, the latest nonfarm payrolls report will take centre stage today, with investors hoping for some signs of a cooldown in the red-hot labour market. The majority of analysts see the fewest jobs since December 2020 being created in September, but the consensus figure of 250k may still be too hot for the Federal Reserve.

Fed policymakers have been out in droves this week, all reiterating the same message that rate hikes will keep coming until the “job is done”. Joining the chorus of hawkish speakers were the Fed’s newest governors Lisa Cook and Philip Jefferson. But the final blow to any surviving expectations of a near-term policy pivot probably came from Loretta Mester and Charles Evans yesterday. The Cleveland Fed chief gave the strongest indication yet that a rate cut in 2023 will not be happening while Evans, who heads the Chicago Fed, hinted that rates will need to rise another 150 basis points by next spring.

With the Fed clearly prioritising its inflation mandate over its employment objectives, investors have nowhere to hide and fed fund futures finally seem to be conforming with the tone coming out of the central bank. The market-implied terminal rate has crept up to just under 4.60%, while the odds for a 75-bps hike in November have increased to almost 90%.

Treasury yields have also been subsequently recovering from their lows at the start of the week. The yield on is currently hovering around 3.85%, up about 30 bps from Tuesday.

Even if today’s payrolls data disappoints, it’s hard to see the market pricing changing dramatically before the November FOMC.

Stocks on NFP alert after chipmakers’ warnings

The Fed’s latest pushback against market ramblings of a slowing down in the pace of tightening weighed on equity markets. But whilst the October rebound has been thwarted, neither is there any panic selling.

The S&P 500 closed down about 1% on Thursday and the fell even less, by 0.7%. But tech stocks look set to underperform today after chipmakers Samsung Electronics (OTC:) and AMD issued profit warnings due to falling demand.

E-mini futures were only slightly in the red during the European open so a bounce-back cannot be ruled out from a weak jobs report. Similarly, a strong NFP print could fuel fears of overtightening and sink stocks deeper into negative territory.

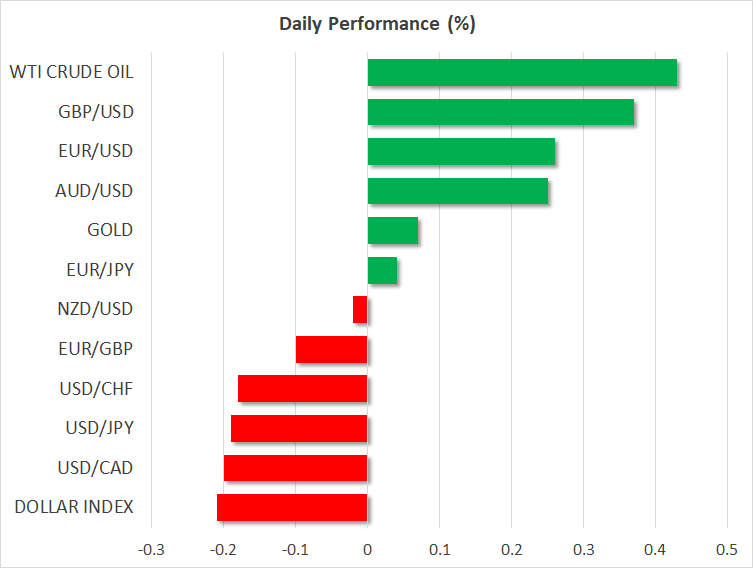

Dollar eases slightly after hitting one-week high

Meanwhile in the currency markets, the US dollar eased from its overnight highs but its index against a basket of currencies was still trading close to a one-week peak. The greenback’s pullback, albeit a modest one, seems a bit out of sync with equity and bond markets, raising suspicions about yen intervention.

The dollar briefly climbed above the 145-yen level late on Thursday and has now started to reverse lower. It comes after official Japanese data showed the country’s foreign reserves fell by $54 billion last month as the Bank of Japan intervened to prop up the yen against the dollar.

Other majors are also now recouping the sharp losses from the past two days. Sterling is attempting to regain the $1.12 handle after getting knocked by a downgrade by credit agencies to the UK’s credit outlook, as well as from a not-so-reassuring debut party conference speech by Prime Minister Liz Truss.

The euro was unable to find much support yesterday from the minutes of the ECB’s September meeting that revealed growing concern by policymakers about high inflation becoming entrenched. The single currency was steadier on Friday around the $0.98 mark.

The Canadian dollar was another currency that could not benefit from more hawkish language. Bank of Canada Governor Tiff Macklem yesterday repeated that further rate hikes are needed. But the nevertheless weakened past C$1.37 to the US dollar.