- Stronger-than-expected US CPI knowledge revives fee hike bets

- Greenback re-energised, heads for weekly features as yields jumps

- Shares come underneath strain, however selloff restricted forward of Q3 earnings

Dovish Fed bets dented by CPI shock

Markets whipsawed on Thursday after the US shopper worth index rose greater than anticipated in September, dashing hopes that the Fed is completed mountaineering charges. The CPI measure of inflation edged up 0.4% month-on-month, beating forecasts of a 0.3% enhance, whereas the annual determine was unchanged at 3.7% as a substitute of easing to three.6%.

After a string of not-so-hawkish remarks by Fed officers over the previous week put a cease to the relentless rally in Treasury yields, the newest CPI report was a stark reminder to traders that the dangers to inflation stay to the upside. Gasoline costs continued to exert upward strain on headline inflation in September, although by a lesser extent than in August. However the greatest contribution to the month-to-month enhance in CPI got here from greater rental costs – one thing that might probably make policymakers suppose twice earlier than calling time on additional tightening.

Market expectations for yet another fee hike within the coming months rose to round 40% within the aftermath of the inflation knowledge earlier than easing barely. The main focus in current weeks has shifted to the December and January conferences because the Fed is seen desirous to take extra time to guage issues given the blended readings of late on the US economic system. Thus, the subsequent assembly on October 31-November 1 is not within the image so far as a fee rise is worried.

Yields off highs however greenback poised for constructive week

Nonetheless, with fee hike odds having fallen to beneath 30% within the run as much as yesterday’s numbers, the average repricing in futures markets was sufficient to spur important strikes in bond and FX markets. The yield on jumped greater than 15 foundation factors to a excessive of 4.7282% on Thursday, fuelling features of round 1% for the US greenback. Weak demand for 30-year Treasuries in yesterday’s public sale exacerbated the bond selloff.

Yields are buying and selling decrease at present and the greenback is softer too, however the harm has already been achieved to the restoration that was underway for battered currencies such because the euro and pound.

Fed converse is predicted to be quieter at present and the one main launch on the agenda is the College of Michigan’s shopper sentiment survey, so the greenback has a powerful likelihood of ending the week with some respectable features.

China worries add to detrimental temper

One of many worst performers on Thursday was the Australian greenback, which tumbled by about 1.5% as risk-on sentiment took a blow from revived Fed overtightening fears. The in addition to its counterpart stay underneath strain at present following subdued knowledge out of China.

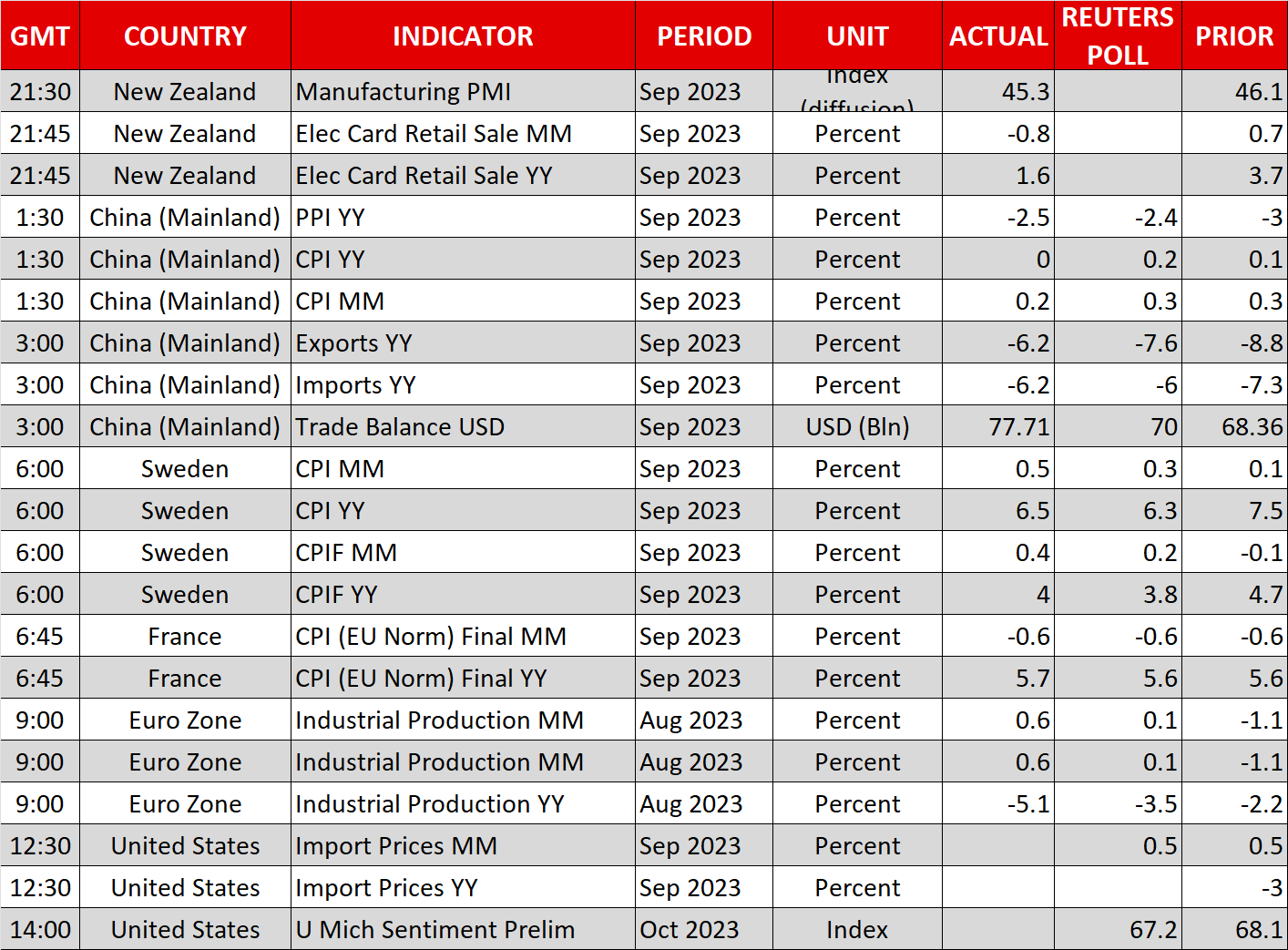

Each producer and shopper costs in China elevated by lower than forecast in September, suggesting that the current stimulus measures have achieved little to spice up home demand. There was barely higher information from commerce figures for a similar interval because the drop in exports wasn’t as massive as had been anticipated.

Oil again on the entrance foot, gold resumes ascent

Oil futures shrugged off the sluggish knowledge to rally greater than 2% after Washington imposed sanctions on two delivery corporations for breaching the $60 worth cap on Russian oil. It’s the first time that the US has sanctioned the homeowners of tankers carrying Russian oil, signalling a contemporary transfer by the West to tighten the enforcement of the G7 worth cap.

At present’s features in oil costs greater than offset the post-CPI drop in addition to the selloff from the surge in weekly crude stockpiles within the US.

Gold, in the meantime, resumed its climb, with yesterday’s decline on the again of the rebound in bond yields proving to be only a blip. The dear metallic approached $1,885/oz, lifting its weekly features to 2.9% – its finest efficiency since March. Ongoing tensions within the Center East are doubtless protecting the safe-haven gold elevated as Israel is intensifying its assault on Gaza following final weekend’s assaults by Hamas.

Shares eye financial institution earnings after yields setback

In equities, a detrimental shut on Wall Avenue yesterday weighed on Asian and European markets on Friday. At this level, the current correction in yields is trying more and more simply that – a correction – and it’s too quickly to have the ability to say with any certainty that yields have peaked. Even when the Fed doesn’t increase charges once more, the danger of inflation taking longer than anticipated to fall all the best way all the way down to 2% can’t be ignored. And when there are three 25-bps fee cuts priced in for 2024, rather a lot can nonetheless go fallacious for fairness markets.

In the interim, nevertheless, all eyes are on the Q3 earnings season, which is ready to kick off at present with the massive banks. JP Morgan Chase (NYSE:), Citigroup (NYSE:) and Wells Fargo are all as a result of report their outcomes in a while Wall Avenue earlier than the closing bell.