Inventory Indices posted modest declines, with the USA500 and USA100 recording 1-week lows and the USA30 recording a 1-½ week low. Rising yields had been damaging for the indices.

Bond yields surged after the August ISM companies report launched on Wednesday elevated greater than forecast, strengthening hypothesis that the Fed will hold rates of interest larger for an extended time. The US ISM companies index in August unexpectedly rose +1.8 to a 6-month excessive of 54.5, stronger than expectations of a decline to 52.5.

The US commerce deficit in July widened to -$65.0 billion from -$63.7 billion in June, a smaller deficit than the -$68.0 billion forecast. Losses on Wall Avenue’s main inventory indices eased at Wednesday’s shut, following the discharge of the Federal Reserve’s Beige E-book. The report revealed that financial development in most areas of the USA was “modest” in July and August. In the meantime, considerations over the way forward for the central financial institution’s financial coverage remained in focus.

Inventory markets in Asia-Pacific had been decrease at present, as damaging sentiment concerning rates of interest appeared to unfold from the USA. The JPN225 fell 0.25%, the Shanghai Composite fell 0.34%, the Shenzhen Composite Index fell 0.85%, and the Dangle Seng fell 0.93%. Kospi misplaced 0.82%. The AUS200 had misplaced 1.11% on the time of writing.

Technical Overview

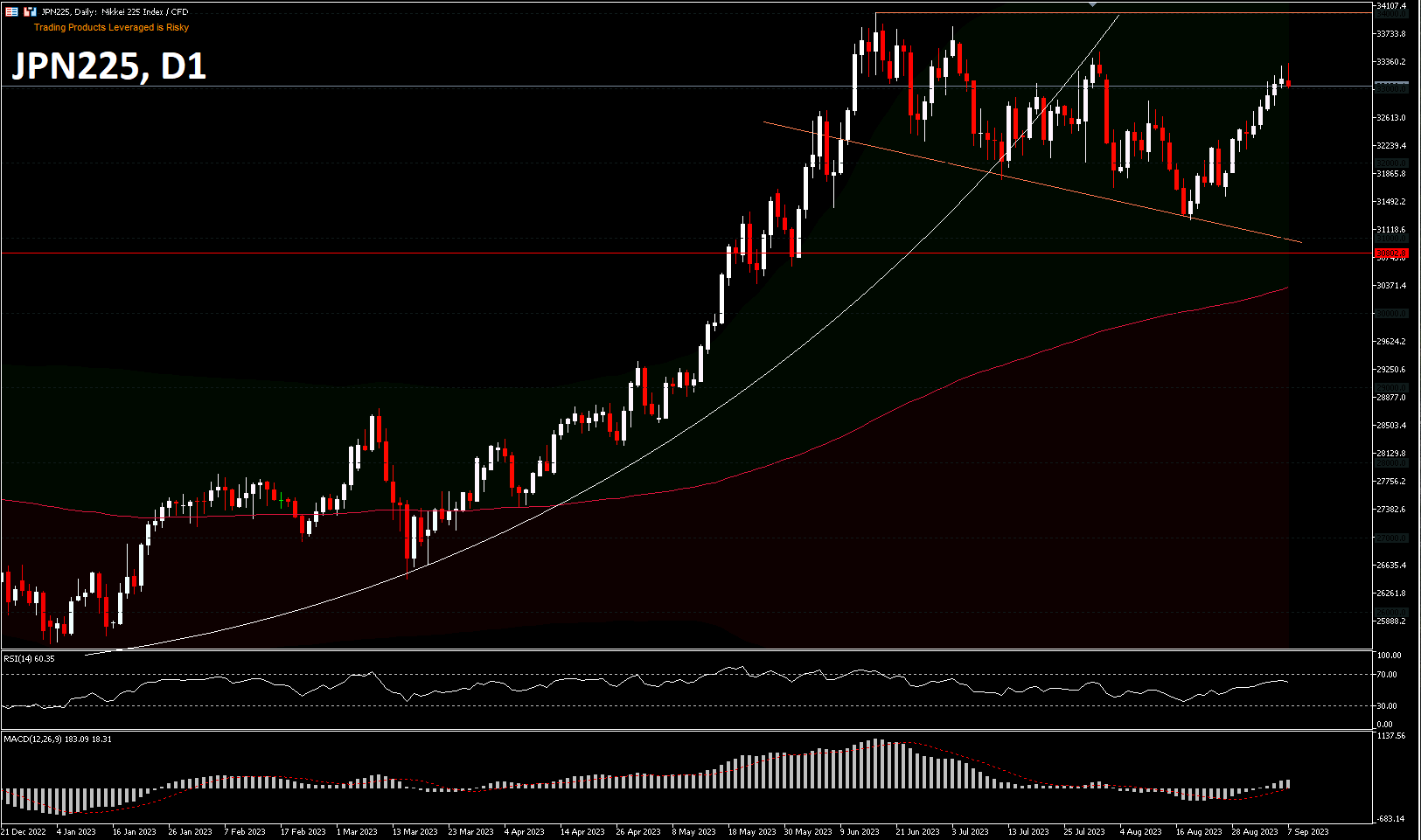

At first look, JPN225 was seen forming a parabolic curve sample, a sample which develops throughout a robust bullish pattern and is a bearish reversal indicator triggered by purchaser exhaustion. The previous connects the lows created by a collection of market pullbacks to construct the formation. In consequence, the sample visually depicts an upward-sloping curve.

The #JPN225 registered a brand new peak in June at 34,012, after a rebound of 24,498 managed to interrupt the important thing resistance of 30,802 final Might. The value of this index appears to have stalled on the 34,012 peak. Since then it appears to be consolidating in a downward trajectory and recorded a 2-month low of 31,244 in August. The rise from 31,244 appears to have began encountering resistance close to the decrease excessive of 33,484 by presenting a day by day taking pictures star candle sample. Nonetheless, technical indications from RSI are but to indicate overbought and MACD continues to be configured within the constructive space. On the draw back, the index may check the 20-day EMA close to September’s opening value of 32,512. Key assist stays at 30,802 resistance which is now assist above the 200-day EMA.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.