Updated on October 7th, 2022 by Nate Parsh

Stocks with very long dividend streaks are highly appealing because they generate stable earnings and pay reliable dividends during recessions.

Very few companies can offer this resilience during economic downturns, so investors must be careful when selecting which dividend stocks to own for the long term.

One group of stocks that has stood the test of time is the Dividend Kings, a set of just 45 stocks in the S&P 500 with at least a half century of consecutive dividend increases.

You can see all 45 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

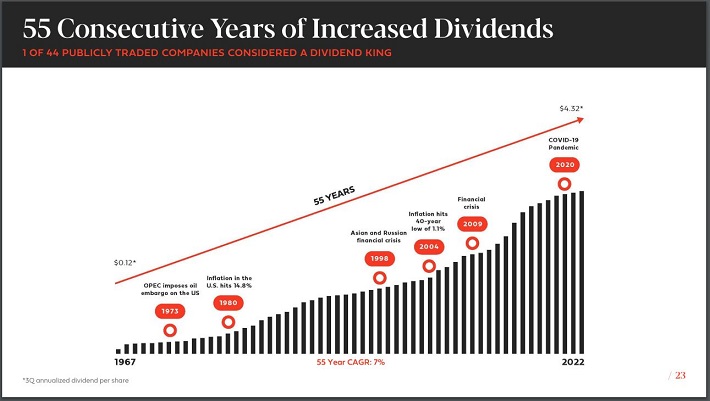

Federal Realty Investment Trust (FRT) is a Dividend King that has 55 consecutive years of dividend increases.

This streak would be impressive for any stock, but for a REIT (a sector which is notoriously susceptible to recessions) this streak is extraordinary.

In fact, Federal Realty is the only REIT on the Dividend Kings list.

Below, we’ll take a look at Federal Realty’s business and its prospects for continuing its dividend streak.

Business Overview

Federal Realty was founded in 1962 and since that time, it has grown into a powerhouse retail-focused REIT that operates in high income, densely populated coastal markets in the U.S.

Related: You can see Sure Dividend’s REIT list here.

The trust sees these markets as having favorable demographics for the long term in terms of population and income growth.

Source: Investor presentation

This strategy of owning premium properties in premium markets has served the trust well, and it has grown steadily over the years.

Federal Realty also has a highly diversified property portfolio. No single tenant represents more than 2.85% of Federal Realty’s annualized base rent, or ABR. And, its top 25 tenants collectively represent 26% of ABR.

Federal Realty has more than 3,100 tenants in over 105 properties, which represents a high level of diversification in terms of both tenants and geographic markets.

Growth Prospects

Federal Realty’s growth hasn’t always been huge in any given year, but over time, funds-from-operations (FFO) continue to move up.

Indeed, 2020 was the first year in more than a decade where the trust didn’t produce higher year-over-year FFO per share.

For a REIT, that is a staggeringly good track record. Of course, the decline in FFO in 2020 was due to circumstances out of the trust’s control, namely the coronavirus pandemic.

However, Federal Realty has also been a huge beneficiary of the economic recovery over the past year.

Federal Realty reported Q2 earnings on Aug. 4th, 2022. FFO per share came in at $1.65, up 17% from $1.41 in the year–ago quarter. Total revenue came in at $264.1M, up 14% year-over-year.

The trust acquired 3 assets totaling more than 1 million square feet on 93 acres of land at gross value of $434 million. During the quarter, Federal Realty signed a record 132 leases for 562,111 square feet of comparable space.

The trust’s portfolio was 92% occupied and 94.1% leased during the quarter, up by 240 and 140 basis points year–over–year.

Moreover, the trust raised its 2022 FFO per diluted share guidance to $6.10-$6.25 from previous guidance of $5.85-$6.05.

Competitive Advantages & Recession Performance

Federal Realty’s competitive advantage is in its development pipeline, as well as its focus and relative dominance of very attractive markets.

The trust has proven over time it can produce industry-leading average base rents and that is because it has proven extremely adept at selecting and developing the best properties in the U.S.

Another competitive advantage is the trust’s strong balance sheet, which stands out among REITs. FRT has a solid credit rating of A- and sufficient liquidity with $177 million of cash and equivalents as of the end of the second quarter.

These competitive advantages have helped it not only grow FFO over time, but continue to raise its dividend during some very harsh recessions.

Below, we have Federal Realty’s FFO-per-share before, during, and after the Great Recession:

- 2007 FFO-per-share: $3.62

- 2008 FFO-per-share: $3.85 (6.4% increase)

- 2009 FFO-per-share: $3.51 (8.8% decrease)

- 2010 FFO-per-share: $3.88 (10.5% increase)

While Federal Realty wasn’t able to grow every year during the recession, it was able to grow over time, albeit slightly. However, this was enough to keep its very impressive dividend streak alive.

Based on FRT’s forward guidance, the trust expects to generate FFO-per-share of $6.08 in 2022. This means the forward dividend payout ratio is ~71%, which indicates a sustainable dividend for a REIT.

The fact that FRT managed to last through the 2020 economic downturn caused by the pandemic, and still raise its dividend, is a sign of the underlying strength of its business model.

Valuation & Expected Returns

At the current share price of $93, and using $6.08 in expected FFO-per-share for 2022, the stock is trading at 15.3 times FFO estimates.

Meanwhile, our fair value P/FFO estimate for Federal Realty is 15, which means we view the stock as slightly overvalued today.

If the P/FFO ratio declines to 15 over the next five years, annual returns would be reduced by approximately 0.4% per year. Therefore, valuation is expected to be a small drag on future returns.

Partially offsetting this will be expected FFO-per-share growth of 4.5% per year, plus the current dividend yield of 4.6%.

Fortunately, FRT stock still has wide appeal as a dividend growth investment.

Source: Investor Presentation

The trust has an unparalleled track record among REITs when it comes to dividend growth.

Overall, we expect total returns of 8.7% per year over the next five years, stemming from a FFO growth rate of 4.5%, a starting dividend yield of 4.6%, and a small headwind from multiple contraction.

Final Thoughts

Federal Realty has had its share of challenges over the years, due to multiple recessions and the coronavirus pandemic.

Despite this, Federal Realty maintains a 55-year history of annual dividend increases, a feat unmatched in the REIT sector.

FFO-per-share growth should be reasonably strong given the trust’s business model. And, the dividend payout appears secure.

We rate shares of Federal Realty as a hold due to projected returns, but would find the stock more attractive on a further pullback.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].