Updated on October 5th, 2022 by Josh Arnold

The Dividend Kings consist of companies that have raised their dividends for at least 50 years in a row. Many of the companies have turned into huge multinational corporations over the decades, but not all of them.

You can see the full list of all 45 Dividend Kings here.

We created a full list of all Dividend Kings, along with important financial metrics like price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Kings list by clicking on the link below:

Dover Corporation (DOV) has raised its dividend for a staggering 67 consecutive years, giving it one of the longest dividend growth streaks in the entire stock market.

The company has achieved such an exceptional dividend growth record thanks to its strong business model, its decent resilience to recessions, and its conservative payout ratio, which provides a wide margin of safety during recessions.

Due to its conservative dividend policy, the stock is offering a 1.6% dividend yield, which is roughly in-line with the average yield of the S&P 500 Index.

On the other hand, there is a lot of room for continued dividend raises each year. Dover is a time-tested dividend growth company, and in this article, we’ll examine its prospects in further detail.

Business Overview

Dover is a diversified global industrial manufacturer, which provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions to its customers.

It has annual revenues of about $8.6 billion, with just over half of its revenues generated in the U.S., and operates in five segments: Engineered Systems, Fueling Solutions, Pumps & Process Solutions, Imaging & Identification and Refrigeration & Food Equipment.

Pumps & Process Solutions is the best-performing segment. It proved the most resilient segment amid the pandemic, primarily due to the critical nature of its products, which are essential to Dover’s customers.

The COVID-19 crisis caused some tough times for Dover. As its customers are industrial manufacturers, they were significantly hurt by the global recession caused by the pandemic. However, Dover and its customers rebounded out of the crisis in a big way, and Dover is back to strong growth, including what should be record revenue this year.

Source: Investor Presentation

We can see the company has guided for organic growth of 8% to 10% this year in terms of revenue, which should translate to even more than that from an EPS perspective. The company’s history of boosting revenue is only part of the puzzle, as Dover’s focus on ever-increasing profitability has helped drive EPS growth over the years, including 2022.

The company’s second quarter earnings were released on July 21st, 2022, and showed strong growth year-over-year. Revenue was up more than 6% to $2.16 billion, and adjusted earnings-per-share were $2.14, up from $2.06.

Engineered Products led the way with a 19% organic growth rate in Q2, while Clean Energy & Fueling posted a fractional decline in revenue. The backlog ended the quarter 30% higher year-over-year at $3.3 billion, or roughly four to five months of revenue at the current run rate. Dover raised guidance to the values seen in the slide above, and we see $8.55 in earnings-per-share for this year following Q2 results.

Growth Prospects

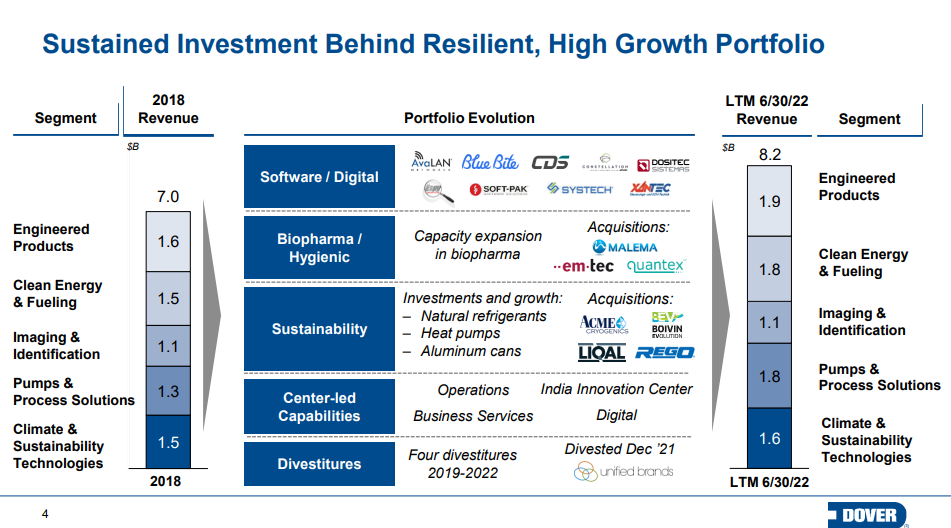

Dover has pursued growth by expanding its customer base and through bolt-on acquisitions. Dover has routinely executed a series of bolt-on acquisitions, along with an occasional divestment, to reshape its portfolio to maximize its long-term growth. Below is a sampling of some of the portfolio activity the company has undertaken in recent years.

Source: Investor Presentation

The management team is constantly focused on delivering the most value to shareholders through portfolio transformation, and it has generally been successful. Today, the company is a highly diversified industrial company with an attractive growth profile.

In addition, Dover is also likely to enhance its earnings per share via opportunistic share repurchases. We see 8% long-term earnings-per-share growth in the years to come, driven primarily by revenue increases, with a helping hand from margin expansion and share repurchases reducing the float.

Competitive Advantages & Recession Performance

Dover is a manufacturer of industrial equipment, and some investors may think that the company has no moat in its business due to little room for differentiation. However, the company offers highly engineered products, which are critical to its customers. It is also uneconomical for its customers to switch to another supplier because the risk of lower performance is material.

Therefore, Dover essentially operates in niche markets, which offer a significant competitive advantage to the company. This competitive advantage helps explain Dover’s consistent long-term growth trajectory.

On the other hand, due to its reliance on industrial customers, Dover is vulnerable to recessions. In the Great Recession, its earnings per share were as follows:

- 2007 earnings-per-share of $3.22

- 2008 earnings-per-share of $3.67 (14% increase)

- 2009 earnings-per-share of $2.00 (45% decline)

- 2010 earnings-per-share of $3.48 (74% increase)

Dover got through the Great Recession with just one year of decline in its earnings per share and the company almost fully recovered from the recession in 2010. That performance was certainly impressive.

Dover is also impacted by downturns in the oil industry during periods of weak oil prices. The collapse of the price of oil from $100 in mid-2014 to $26 in early 2016 is a notable example of such a downturn. Its earnings per share decreased 28% from $4.54 in 2014 to $3.25 in 2016.

However, in 2018, Dover spun off its energy division, Apergy, which now trades as ChampionX Corporation (CHX).

Given its sensitivity to the economic cycles, it is impressive that Dover has grown its dividend for 67 consecutive years.

The exceptional dividend record can be attributed to the aforementioned decent resilience of the company to recessions. Another reason is the conservative dividend policy of management, which targets a payout ratio around 30%. This policy provides a wide margin of safety during rough economic periods. Today, the payout ratio is just 23% of earnings, so we don’t see any scenario where the payout would be at risk.

Moreover, management has become remarkably conservative in its dividend raises over the last five years. During this period, Dover has raised its dividend at a ~3% average annual rate.

Overall, Dover will certainly continue to raise its dividend for many more years thanks to its low payout ratio, its decent resilience to recessions, and its healthy balance sheet. It’s 1.6% dividend yield is congruent with that of the overall market, as is its modest dividend growth rate. From a pure income investor perspective, the stock is therefore likely not that attractive.

Valuation & Expected Returns

Dover stock is trading almost exactly where it did prior to the pandemic, but its earnings profile is much better. That means the stock trades for just 14.6 times this year’s earnings, which is well below our estimate of fair value at 17 times earnings. That implies a ~3% annual tailwind to total returns from valuation expansion, and boosts the appeal of owning the stock.

Including 8% expected annual earnings-per-share growth, the 1.6% dividend yield, and a 3.2% annualized expansion of the price-to-earnings ratio, we expect Dover to offer a robust 12.5% average annual return over the next five years. This puts Dover well into the territory of a buy rating, particularly given its exemplary dividend history.

Final Thoughts

Dover has an impressive dividend growth record, with 67 consecutive years of dividend raises. This is an impressive achievement, particularly given the dependence of the company on industrial customers, who tend to struggle during recessions.

However, due to its conservative dividend policy, the stock is offering a modest yield of 1.6% while its dividend growth has significantly slowed in recent years. As a result, the stock is not highly appealing for investors who are focused primarily on income.

On the bright side, Dover has consistently grown its earnings per share over the years, primarily thanks to a series of bolt-on acquisitions. The stock has generated strong total returns to shareholders due to the company’s revenue and earnings growth.

The company has ample room to keep growing via this strategy for many more years.

We see the stock as attractively priced as well, meaning it earns a buy rating with its 12%+ projected total returns.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].