Up to date on September seventh, 2023 by Nate Parsh

The Dividend Kings are an unique group of dividend shares that fulfill our most stringent standards for dividend historical past.

Extra particularly, every Dividend King has elevated its dividend for a outstanding 50 consecutive years. You may see the complete record of all 50 Dividend Kings right here.

Now we have created a full downloadable record of all Dividend Kings, together with vital monetary metrics comparable to price-to-earnings ratios and dividend yields. You may obtain your copy of the Dividend Kings record by clicking on the hyperlink beneath:

Commerce Bancshares (CBSH) is one instance of a slow-and-steady Dividend King. With that stated, the corporate flies below the radar of many dividend development traders as a result of it has a present market capitalization of slightly below $6 billion.

On this article, we’ll look at Commerce Banchshares’ funding attraction by contemplating its enterprise mannequin, development prospects, and anticipated returns.

Enterprise Overview

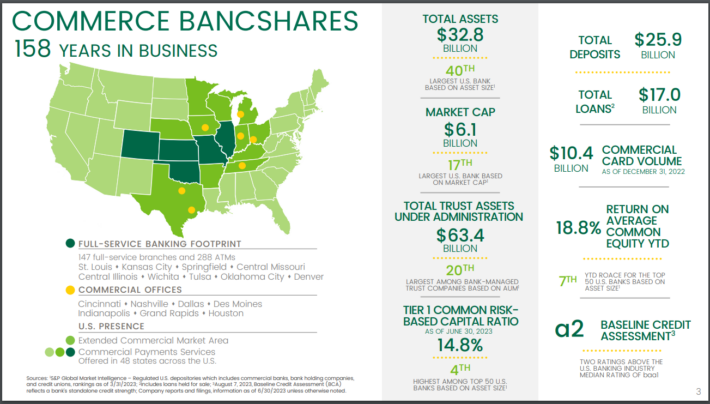

Commerce Bancshares has an easy-to-understand enterprise mannequin. The corporate is a financial institution holding firm whose principal subsidiary is Commerce Financial institution.

Supply: Investor Presentation

Commerce Financial institution gives basic baking providers to each retail and enterprise clients, with gives starting from retail and company banking to asset administration and funding banking. Commerce Financial institution was based in 1865 and operates branches within the following states:

- Colorado

- Missouri

- Kansas

- Illinois

- Oklahoma

Commerce Bancshares reported its second-quarter earnings outcomes on July nineteenth. The corporate generated revenues of $403 million in the course of the quarter, which was up 7.6% from the earlier 12 months’s quarter. On the finish of the quarter, Commerce Bancshares’ mortgage portfolio totaled $16.7 billion, whereas deposits stood at $25.9 billion.

Loans have been up 1.6% sequentially and better by 6.4% on a year-over-year foundation to $15.7 billion. Commerce Bancshares’ provisions for mortgage losses decreased in the course of the quarter.

Commerce Bancshares generated earnings-per-share of $1.02 in the course of the second quarter, which was up 11% in comparison with the earlier 12 months’s quarter. This improve was pushed primarily by income development in the course of the interval. The corporate is anticipated to see a modest decline for earnings-per-share in 2023.

Development Prospects

Commerce Bancshares has a stable if unspectacular development monitor file. Since 2008, the financial institution elevated its earnings-per-share by 7% per 12 months.

Trying forward, Commerce Bancshares’ development prospects haven’t modified by a lot over the past decade. The financial institution’s development continues to be depending on many elements.

First, the web curiosity margin represents the unfold between the rates of interest it pays on its deposits and the rates of interest it earns on its loans. The rise in rates of interest has typically been a optimistic tailwind for the nation’s banks, as their internet curiosity margin has increase.

Mortgage development is one other strategy to develop income. The corporate has steadily grown its mortgage portfolio prior to now 5 years.

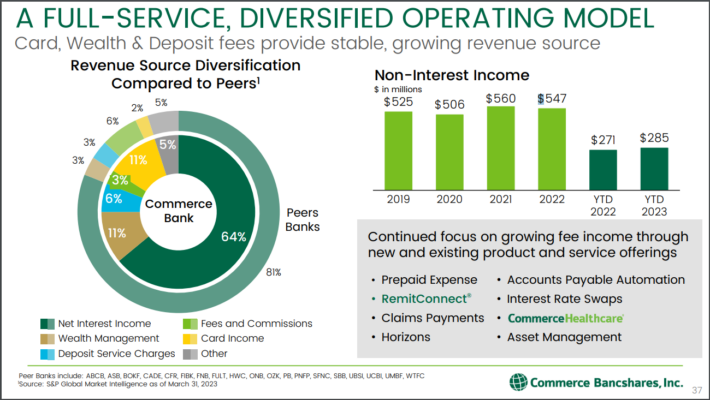

Supply: Investor Presentation

Total, we consider the corporate is more likely to practically replicate its historic development shifting ahead, although we now have lowered our forecast for earnings-per-share development to five% from 6% for the subsequent half-decade.

Aggressive Benefits & Recession Efficiency

Commerce Bancshares is a well-run financial institution, which gives a significant aggressive benefit. The corporate has robust fundamentals. This consists of an above-average return on fairness, which was 14% earlier than the pandemic. In the latest quarter, the ROE was 18.8%. That is fairly enticing versus the ROEs that lots of its friends obtain.

Commerce Bancshares’ capitalization is wholesome as effectively, with the corporate having a tier 1 leverage ratio of 14.8%. Commerce Bancshares’ credit score high quality is powerful, as internet charge-offs are at a below-average degree in comparison with most friends.

Commerce Bancshares carried out exceptionally effectively over the past recession in comparison with its friends within the lending trade. The corporate’s earnings trajectory in the course of the 2007 to 2009 monetary disaster is proven beneath:

- 2006 adjusted earnings-per-share: $1.72

- 2007 adjusted earnings-per-share: $1.65

- 2008 adjusted earnings-per-share: $1.52

- 2009 adjusted earnings-per-share: $1.33

- 2010 adjusted earnings-per-share: $1.71

- 2011 adjusted earnings-per-share: $2.00

Commerce Bancshares’ adjusted earnings-per-share declined by 19.4% peak-to-trough in the course of the worst of the Nice Recession throughout a time interval when many bigger lenders executed recapitalization applications that have been devastating to persevering with shareholders.

Maybe extra importantly, Commerce Bancshares continued its multi-decade streak of consecutive dividend will increase. This compares favorably to so many monetary establishments that have been compelled to chop their dividends throughout this era. Due to this, we consider the corporate will carry out very effectively throughout any future financial downturns.

Valuation & Anticipated Returns

As with all widespread equities, Commerce Bancshares future returns could be estimated by taking a look at every of the three contributors to returns: dividends, earnings development, and valuation modifications.

Dividend funds are probably the most predictable contributor to whole returns. Commerce Bancshares inventory at present has a 2.3% dividend yield. Commerce Bancshares has raised its dividend for 54 consecutive years.

The second-most predictable supply of returns is earnings-per-share development. We anticipate 5% annual earnings development over full financial cycles.

Lastly, future returns are decided partly by modifications within the valuation a number of. Commerce Bancshares is anticipated to earn $3.80 of earnings-per-share in 2023. Which means the inventory is buying and selling at a price-to-earnings ratio of 12.6. The longer-term median earnings a number of is within the mid-teens, however we consider that shares could be pretty valued at a value to earnings a number of of 12.

This would scale back the corporate’s returns by 1.0% yearly if the corporate’s valuation have been to contract from 12.6 instances earnings to 12 over the subsequent 5 years.

Due to this fact, whole returns would include the next:

- 5% earnings development

- 2.3% dividend yield

- -1.0% a number of reversion

Commerce Bancshares are anticipated to supply a complete return of 6.1% yearly via 2027. Due to this excessive valuation, the financial institution earns a maintain advice from Positive Dividend right now.

Remaining Ideas

Commerce Bancshares has a dividend historical past that few firms within the monetary providers trade can match. Sadly, the corporate’s valuation is even richer than its dividend historical past. We suspect that valuation contraction might be a unfavourable contributor to Commerce Bancshares’ future returns.

The inventory has a valuation that’s barely larger than our goal, however the financial institution is anticipated to provide stable earnings development. Commerce Bancshares additionally has an extended historical past of dividend development, however we encourage traders to attend for a greater entry level earlier than buying this Dividend King.

Moreover, the next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].