Updated on October 4th, 2022 by Quinn Mohammed

The Dividend Kings are the best-of-the-best when it comes to returning cash to shareholders.

These are stocks that have 50+ year histories of increasing their dividends to shareholders. These stocks are generally ones that long-term income investors seek out due to their earnings stability and impressive dividend track records.

Just 45 companies qualify as Dividend Kings. You can see all 45 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus metrics that matter, such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Colgate-Palmolive (CL) is a consumer staples conglomerate that has increased its dividend for 60 consecutive years, one of the longest streaks in the entire stock market.

Perhaps more impressively, Colgate-Palmolive has continuously paid dividends on its common stock since 1895.

Colgate-Palmolive has been working on increasing its growth in recent years, and the pandemic has only served to accelerate this effort.

Below, we’ll discuss the company’s growth prospects, valuation, and dividend.

Business Overview

Colgate-Palmolive was founded in 1806 and has built an impressive and extensive portfolio of consumer brands. It operates globally, selling in most countries around the world.

About one-sixth of its revenue comes from Hill’s pet food division, which has shown very strong growth in recent years.

The other five-sixths of revenue comes from a mix of cleaning and personal care products, with the company’s most recognizable brands being Colgate (tooth care) and Palmolive (soap).

However, Colgate-Palmolive has built a diverse slate of brands well outside of just its two namesake brands.

Colgate-Palmolive currently trades for a $59 billion valuation, producing about $18 billion in annual revenue.

Source: Investor presentation

Colgate-Palmolive has structured itself into four units: Oral Care, Personal Care, Home Care, and Pet Nutrition.

The company has created and acquired numerous brands over time and, more recently, has worked to innovate with its best brands through line extensions.

Note: A line extension, short for ‘product line extension,’ is when a brand launches a new product in a category where it already has a presence. A line extension could be a new flavor, scent, special ingredient, etc.

Below, we’ll look at the company’s growth prospects.

Growth Prospects

We expect Colgate-Palmolive to post 6% average earnings-per-share growth in the next five years, as it has a few levers, it can pull to power the bottom line higher.

The company has been exposed to forex translation since it sells globally, meaning it is beholden to many different currencies and their relative value against the dollar.

In addition, commodity volatility has sometimes taken its toll on profit margins, although the company has undertaken cost-saving measures to combat this.

Another way Colgate-Palmolive has worked to improve growth is to work true innovation into its portfolio rather than just creating a slightly different version of an existing product.

That has worked well for the company too, but the idea is to take its enormous R&D budget and create new products. Over time, this can lead to incremental revenue growth.

Line extensions, however, still work quite well for Colgate-Palmolive because it can leverage its highly recognizable global brands.

Colgate-Palmolive has done this with numerous products, with its Optic White Renewal being a particularly successful example.

Finally, Colgate-Palmolive has concentrated its R&D dollars on what it calls “premiumization,” which is moving up-market with its products, as it did with Optic White.

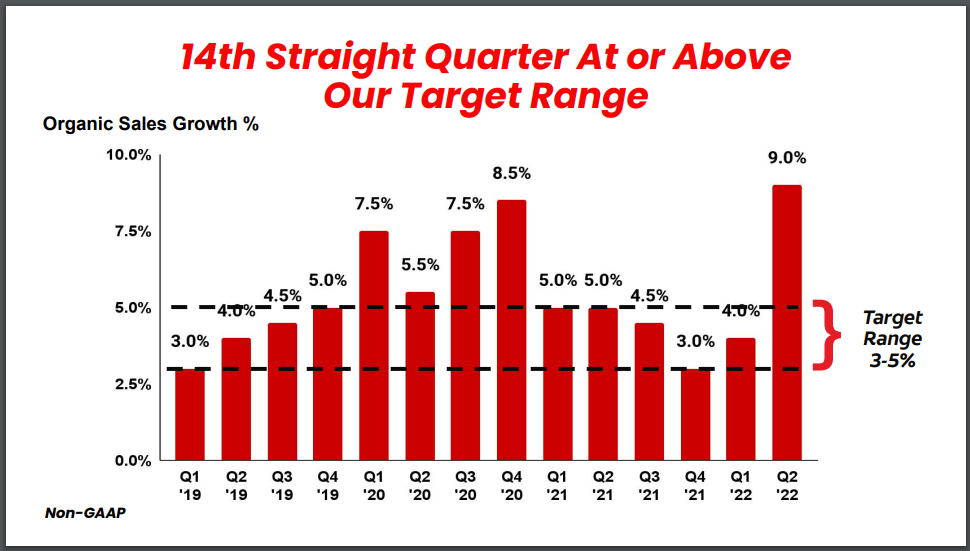

All of this has resulted in what we see below, very strong organic sales growth in recent years.

Source: Investor presentation

Colgate-Palmolive has had fourteen straight quarters at or above the target organic sales growth rate of 3% to 5%. Growth has accelerated in recent years, with the coronavirus pandemic only being a temporary setback.

We see this driving much of the company’s growth in the coming years.

Colgate-Palmolive reported second-quarter earnings on July 29th, 2022. Net sales increased 5.5%, while organic sales grew 9.0% year-over-year. Adjusted earnings-per-share decreased 10% to $0.72 for the quarter.

The gross profit margin declined by 300 basis points to 57.0% as the company saw inflationary pressures causing various costs to rise.

The company maintained a 39.6% global market share in toothpaste and a 31.3% market share in toothbrushes year-to-date, which shows its competitive advantages.

Competitive Advantages & Recession Performance

Colgate-Palmolive’s competitive advantage is its extensive product catalog, as well as its extremely well-known brands.

This has afforded the company size and scale globally that allows it to bring products to market quickly and at favorable pricing.

Colgate-Palmolive’s recession record is extraordinary, having posted strong earnings gains during the Great Recession:

- 2007 earnings-per-share of $1.69

- 2008 earnings-per-share of $1.83 (8.3% increase)

- 2009 earnings-per-share of $2.19 (19.7% increase)

- 2010 earnings-per-share of $2.16 (-1.4% decline)

While earnings dipped very slightly in 2010, it is clear Colgate-Palmolive performs quite well during times of economic duress.

Colgate-Palmolive has managed to build a portfolio that not only holds up to recessions but thrives during such periods.

Valuation & Expected Returns

We expect 6% earnings-per-share growth in the coming years, and the dividend yield is 2.6% right now. This means earnings growth and dividends could provide returns above 7% per year.

However, shares trade today at 23.7 times this year’s expected earnings, which is above our fair value estimate of 23 times earnings. We, therefore, expect a -0.6% annual headwind to total returns in the next five years.

With this somewhat offsetting expected earnings growth and the dividend yield, total returns are expected to be just 7.6% for the next five years.

The dividend is just 63% of earnings for this year, and we expect the payout ratio to remain around 60% for the foreseeable future.

Therefore, we expect the dividend to rise at about the same rate as earnings, meaning Colgate-Palmolive should continue to be a solid dividend growth stock.

Final Thoughts

Colgate-Palmolive has a very impressive history of growing its portfolio over time, and with its recent focus on innovation, it has renewed its growth.

We expect the company to continue growing in the coming years, and we see many years of dividend increases coming as well.

However, the stock appears overvalued, which limits its total return potential. We currently rate Colgate-Palmolive as a hold. The stock would once again be a buy if and when it trades below fair value.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].