Up to date on January twenty seventh, 2025 by Bob Ciura

Annually, we individually evaluation every of the Dividend Aristocrats, a gaggle of 69 shares within the S&P 500 Index that has raised their dividends for no less than 25 consecutive years.

To make it on the record of Dividend Aristocrats, an organization should possess a worthwhile enterprise mannequin with a precious model, world aggressive benefits, and the flexibility to resist recessions.

This is the reason Dividend Aristocrats can proceed elevating dividends in troublesome years.

With this in thoughts, we have now created a listing of all 69 Dividend Aristocrats.

You possibly can obtain your free copy of the Dividend Aristocrats record, together with essential monetary metrics akin to price-to-earnings ratios and dividend yields, by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend just isn’t affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet relies on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official data.

Eversource Power (ES) is among the many new additions to the Dividend Aristocrats record for 2025.

This text will look at Eversource’s enterprise mannequin, development prospects, and whether or not we’re at present ranking the inventory as a purchase, promote, or maintain.

Enterprise Overview

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million prospects after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gasoline in 2020.

Eversource has delivered regular development to shareholders for a few years.

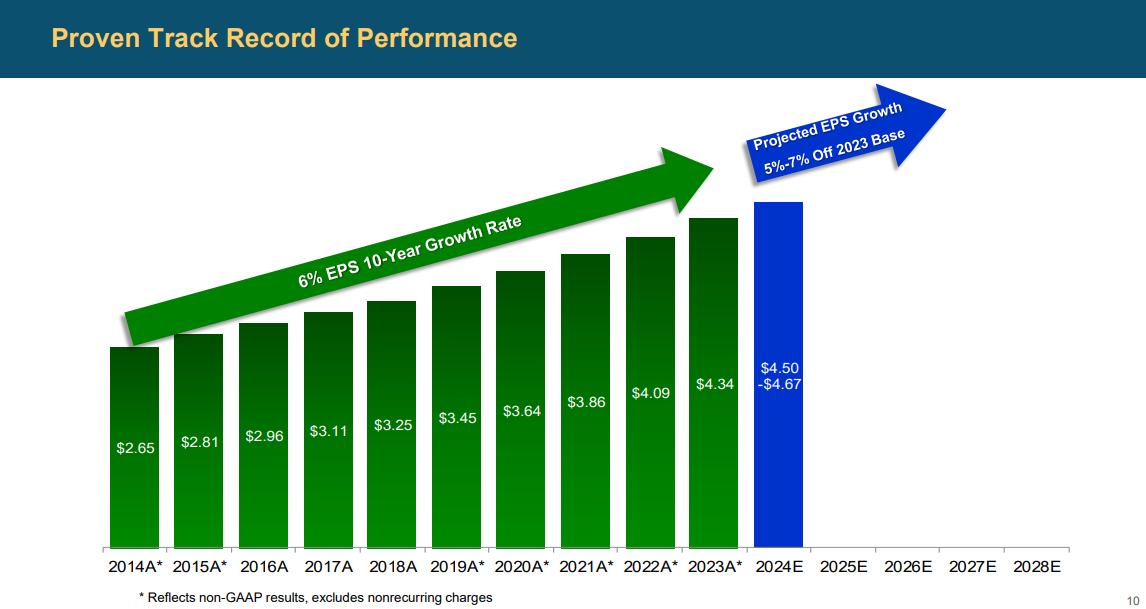

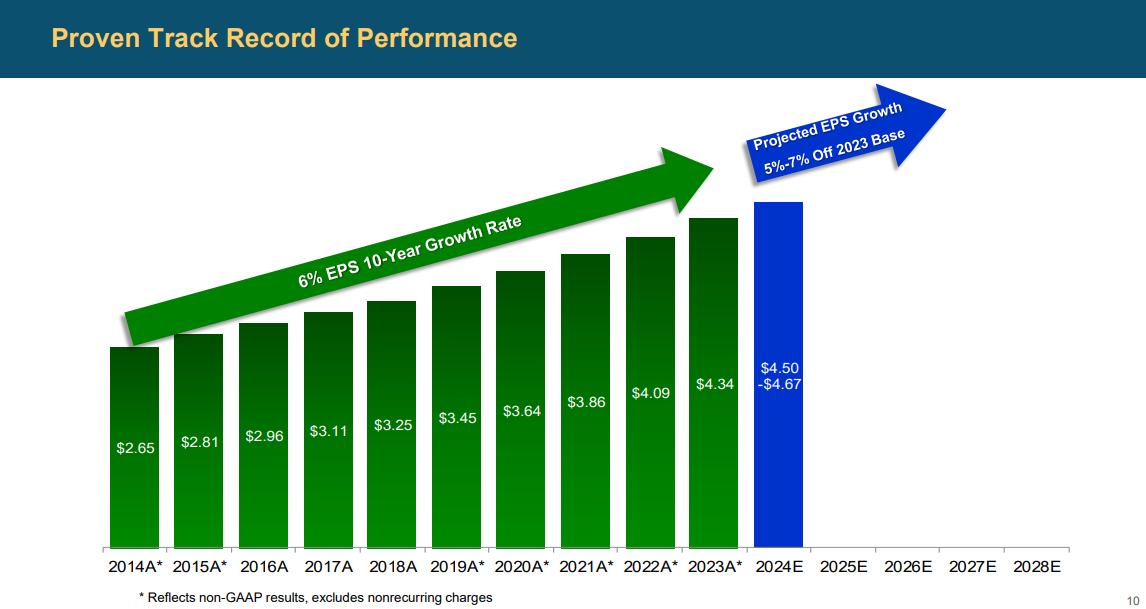

Supply: Investor Presentation

On November 4th, 2024, Eversource Power launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a web lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final yr, which displays the influence of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior yr.

Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior yr, primarily as a consequence of the next stage of funding in Eversource’s electrical transmission system.

Development Prospects

Eversource’s long-term earnings development observe file is strong, rising EPS almost yearly since 2012. Over the past 10 years, the typical EPS development charge is sort of 6%.

We anticipate the corporate to develop its earnings-per-share by 6% per yr on common over the subsequent 5 years. The corporate has an excellent earnings observe file and can profit from charge hikes, transmission investments, and clear power initiatives.

Eversource Power continues to progress in the direction of its up to date funding objective of $23.7 billion in numerous tasks, together with transmission and electrical distribution, in the course of the 2024 to 2028 timeframe.

Supply: Investor Presentation

Earlier within the yr, Eversource and Ørsted’s South Fork Wind farm turned the primary operational commercial-scale offshore wind facility within the U.S., however Eversource has since exited its offshore wind funding, refocusing as a pure-play regulated utility.

The corporate’s earnings-per-share development ambition stays on a tempo of 5% to 7% compound annual charge from 2023 by way of 2028, in step with its dividend development expectations.

We anticipate Eversource to develop its earnings-per-share by 6% per yr over the subsequent 5 years.

The corporate has a protracted historical past of paying dividends and has elevated its payout for 26 consecutive years. In February 2024, the quarterly dividend elevated by 5.9% from $0. 6750 to $0.7150 per share.

Over the past 5 years, the typical annual dividend development charge is 6.0%. Eversource’s goal for yearly dividend development is 5% to 7%.

Aggressive Benefits & Recession Efficiency

As a utility inventory, Eversource advantages from working in a extremely steady and controlled trade, that means earnings are extra constant and predictable.

This additionally permits the corporate to be recession-resistant, and proceed to extend its dividend annually, even throughout recessions.

Eversource’s earnings-per-share in the course of the Nice Recession are beneath:

- 2008 earnings-per-share of $1.67

- 2009 earnings-per-share of $1.91 (14% development)

- 2010 earnings-per-share of $2.19 (15% development)

Throughout the previous 5 years, the corporate’s dividend payout ratio has averaged round 64%. The corporate has a projected 2024 payout ratio of 63%, which signifies a sustainable dividend.

Given the anticipated earnings development, there may be nonetheless room for the dividend to proceed to develop on the similar tempo and lengthen the observe file of consecutive dividend will increase which is a vital issue for dividend development buyers.

Valuation & Anticipated Returns

Based mostly on anticipated 2024 earnings-per-share of $4.55, ES shares are at present buying and selling for a P/E ratio of 12.9. Throughout the previous decade shares of Eversource Power have traded with a mean price-to-earnings ratio of about 20.

That is additionally our honest worth estimate for ES inventory.

Consequently, ES inventory seems to be considerably undervalued right now. If the valuation a number of expands to twenty over the subsequent 5 years, shareholder returns can be elevated by 9.2% per yr over that interval.

Shareholder returns can be positively boosted by earnings-per-share development and dividends. We anticipate ES to generate earnings-per-share development of 6% per yr.

Subsequent, shares are at present yielding 4.9%. Placing all of it collectively, whole returns are anticipated at 20.1% per yr. With such excessive anticipated returns, we charge ES inventory a purchase.

Closing Ideas

Eversource Power is a gentle firm when it comes to its earnings development observe file, its earnings development outlook, dividend development, and its infrastructure investments associated to the net-zero carbon emission goal of 2030.

The corporate’s dividend yield is beneficiant, and the 26 years of consecutive dividend will increase is noteworthy.

We estimate a complete return of 18.2% primarily based on a 6.0% EPS development, a 4.7% yield, and a valuation tailwind. ES shares earn a purchase ranking.

These qualities make Eversource Power a great retirement funding inventory.

Moreover, the next Positive Dividend databases include probably the most dependable dividend growers in our funding universe:

Should you’re searching for shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.