Up to date on February sixth, 2023 by Samuel Smith

The Dividend Aristocrats are a bunch of 68 firms within the S&P 500 Index, with 25+ consecutive years of dividend will increase. The Dividend Aristocrats every have sturdy enterprise fashions, with aggressive benefits that present them with the flexibility to lift their dividends every year.

There are at present 68 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 68 Dividend Aristocrats (with essential monetary metrics resembling price-to-earnings ratios and dividend yields) by clicking the hyperlink beneath:

So as to grow to be a Dividend Aristocrat, an organization should possess a worthwhile enterprise mannequin and sturdy aggressive benefits, together with the flexibility to lift dividends even throughout recessions. Shopper staples shares resembling Amcor plc (AMCR) have all the mandatory qualities of a Dividend Aristocrat.

Amcor has elevated its dividend for over 25 years in a row. It has maintained its dividend progress streak due to a really sturdy model portfolio.

Enterprise Overview

Amcor plc that trades on the NYSE as we speak was fashioned in June 2019 with the completion of the merger between two packaging firms, U.S.-based Bemis Co. Inc. and Australia-based Amcor Ltd. Amcor plc’s present headquarters is in Bristol, U.Okay. Amcor is a large-cap inventory with a market capitalization above $17.6 billion.

Amcor develops and manufactures a various array of packaging merchandise for a lot of client makes use of everywhere in the world, together with meals and beverage, medical and medicinal, and residential and private care. It consists of two major enterprise segments: Versatile Packaging and Inflexible Packaging.

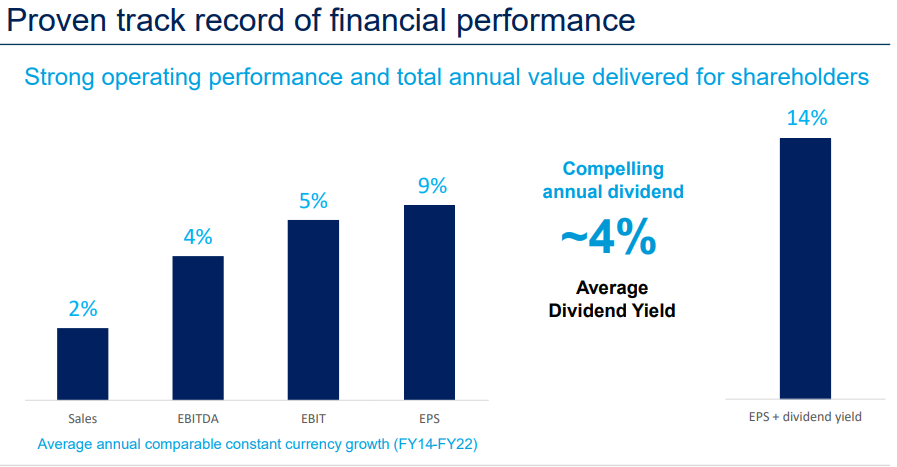

The corporate has generated an extended historical past of regular progress.

Supply: Investor Presentation

Amcor reported its first-quarter outcomes for Fiscal Yr (FY) 2023 on November 1st, 2022. The corporate’s fiscal 12 months ends on the finish of June. Gross sales have been up 9% for the quarter in comparison with the primary quarter of FY2022. Gross sales have grown from $3,712 million in 1Q2022 to $3,420 million this quarter, pushed by worth will increase of about $400 million representing 12% progress. Internet gross sales on a comparable fixed foreign money foundation have been 3% larger than the identical interval final 12 months, reflecting worth/combine advantages. Volumes have been 0.6% decrease than final 12 months. Internet revenue was flat 12 months over-year.

The corporate additionally declared a quarterly money dividend of $0.1225 per share, which is a rise of two.1%. The corporate has now elevated its dividend for 3 straight years.

Administration supplied an outlook for Fiscal Yr (FY) 2023, and so they see EPS progress of three%-8%. The administration crew up to date its adjusted EPS expectations on a reported foundation to $0.77 to $0.81 vs. consensus of $0.81. Additionally they reaffirmed adjusted Free Money Circulation of $1.0 – $1.1 billion. Thus, we are going to use $0.79 per share as our calculation for the corporate valuation and anticipated returns.

Progress Prospects

Amcor is relying on its Bemis acquisition to drive sturdy progress over the following half decade. The principle elements that may drive this progress acceleration are its world footprint opening up new engaging finish markets and prospects for the corporate’s merchandise, and larger economies of scale driving efficiencies and better margins.

One other progress catalyst for Amcor is the rising markets resembling China and Latin America, the place financial progress is excessive and demand for packaging merchandise is rising.

Supply: Investor Presentation

The corporate can be within the midst of an aggressive share buyback program that ought to enhance per share progress numbers. Moreover, its stability sheet is kind of sturdy with a comparatively low leverage ratio, giving it flexibility to finance its dividend, share repurchases, and stay opportunistic on future progress alternatives.

We consider that every one of those elements ought to mix to generate stable 4% annualized earnings per share progress over the following half decade.

Aggressive Benefits & Recession Efficiency

Amcor’s aggressive benefits are fueled by its trade management place. Though Amcor’s headquarters are in Europe, its largest markets are within the Americas. Which means Amcor must be comparatively secure from potential future declines to the pound (or to the Australian greenback, for that matter).

As well as, Amcor’s merchandise are used each day world wide. Folks world wide will proceed to want packaging. Amcor’s emphasis on recyclable and reusable merchandise ought to enchantment to extra acutely aware finish customers, whereas the merger with Bemis brings it large prospects in creating markets.

Plus, with the merger into one gigantic manufacturing entity, Amcor has elevated potential to barter higher prices from its suppliers. This could make Amcor an unstoppable power within the packaging trade.

Amcor can be pretty immune to recessions. As Amcor because it exists as we speak (publish merger) was not a publicly-traded firm through the Nice Recession, its earnings-per-share efficiency through the downturn isn’t accessible.

It’s cheap to imagine Amcor’s earnings-per-share would decline considerably throughout a recession, as the corporate’s world enterprise mannequin is reliant on financial progress. However it ought to proceed paying (and elevating) its dividend every year for the foreseeable future.

Valuation & Anticipated Returns

We count on Amcor to generate earnings-per-share of $0.79 for 2023. Based mostly on this, shares of Amcor are at present buying and selling at a worth to earnings ratio of 15.

Even utilizing a conservative a number of, we predict {that a} recession-resistant Dividend Aristocrat with mid-single-digit progress prospects resembling Amcor ought to commerce for 15 instances earnings. Due to this fact, we view the inventory as pretty valued proper now.

A good five-year anticipated earnings-per-share progress charge of 4.0% and the 4.1% dividend yield will assist enhance shareholder returns. Total, we count on annualized whole annual returns of roughly 8.1% via 2028.

Remaining Ideas

Amcor is uniquely positioned for sturdy progress within the coming years due to its latest acquisition that has opened up a number of new engaging finish markets and gives a chance to unlock helpful synergies. Moreover, the corporate has the stability sheet to fund progress investments, and share repurchases which ought to enhance EPS shifting ahead.

Because of this, we predict that shares supply first rate worth right here. With expectations of ~8.1% annualized whole returns over the following half decade, we view Amcor as a lovely Maintain proper now.

That mentioned, it may very well be a chance for dividend progress traders with a extra conservative outlook, as its 4.1% yield is above common for the S&P 500 and its sturdy progress monitor file and recession-resistant enterprise mannequin make it a lovely long-term holding.

Lastly, with its stable progress outlook, it is going to doubtless proceed rising its dividend for the foreseeable future.

In case you are curious about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The most important home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].