AlexSecret

Designer Manufacturers Inc. (NYSE:DBI) has seen its inventory worth bounce by 28% over the past 5 days after reporting its Q1 2023 Earnings earlier this week. Whereas thrilling, that is an exaggerated market response to the information of a possible $100 million share repurchase primarily based on debt approval and pleasure round a renewed emphasis on its Nike (NKE) partnership. Designer Manufacturers missed income and EPS expectations for Q1 2023 and lowered its FY 2023 steerage resulting from client discretionary headwinds, pushing a promotional setting throughout the retail trade.

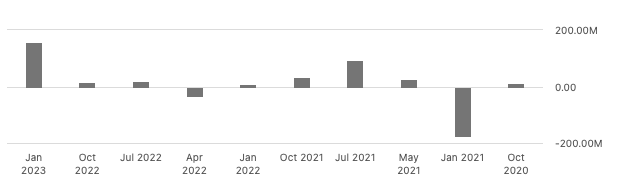

Inventory Pattern Submit Q1 2023 Earnings Report (seekingalpha.com)

Designer Manufacturers has been redeveloping its enterprise by rising its in-house model gross sales via strategic acquisitions and rising its presence in informal and athletic footwear development classes. Though Designer Manufacturers stays a pretty long-term play, buyers ought to be cautious of the excessive quick curiosity in the inventory and the unfavourable impression of client discretionary headwinds predicted to proceed into the subsequent few quarters. Subsequently, I like to recommend a maintain place till the trade exhibits indicators of restoration.

Designer Manufacturers Overview

In my earlier articles, I give an summary of Designer Manufacturers and its rising in-house model technique and transfer into the informal and athletic footwear class. In Q1, own-brand penetration elevated to 27% of web gross sales. Whereas we see retailers throughout the trade take a success resulting from sturdy headwinds, Designer Manufacturers is managing to create a long-term technique displaying resilience in more difficult financial instances. Though gross sales decreased year-on-year, there was a rise in whole gross sales throughout the final two years.

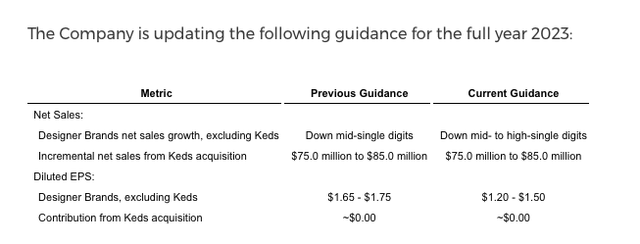

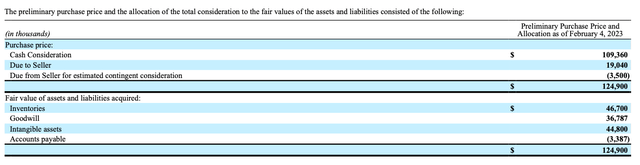

Designer Manufacturers has made vital acquisitions prior to now yr, including three new manufacturers to its portfolio within the informal and athletic classes. These manufacturers embrace Keds, Le Tigre, and Topo Athletic. Keds has already been efficiently built-in into the corporate and has proven a notable enhance in wholesale development in comparison with its earlier efficiency beneath Wolverine. It’s anticipated that Keds will contribute roughly $75 million to $85 million in web gross sales throughout varied channels, together with wholesale, DTC, Worldwide, and Canada.

Acquisition of Keds (sec.gov)

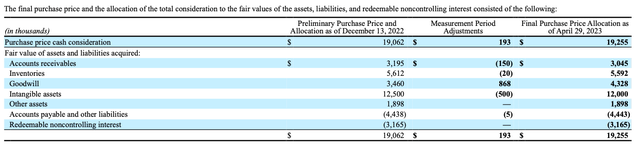

Le Tigre, an economically priced fashion-forward athletic footwear model, is scheduled to launch within the late summer time to profit from the back-to-school season. Lastly, Topo Athletic, a specialty athletic model, might be built-in throughout wholesale and direct-to-consumer channels.

Acquisition of Topo (sec.gov)

As well as, Designer Manufacturers can have sole permission to make use of the Hush Puppies model in the USA and Canada. Nike’s partnership with the corporate has been elevated, overlaying males’s, ladies’s, and kids’s merchandise. Beforehand, Nike accounted for six% of gross sales. Regardless of having established plans for development, gross sales could possibly be affected by challenges within the client market in 2023. Consequently, administration has revised their earnings per share forecast to vary between $1.20 and $1.50, reflecting a better stage of uncertainty.

Designer Manufacturers Q1 2023 Financials

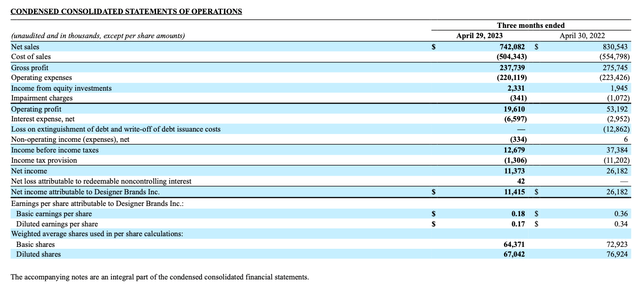

Traditionally, Q1 is usually one in all Designer Manufacturers’ two most vital promoting intervals of the yr. Though gross sales have grown over two years, resulting from its promotional and clearance technique, we noticed web gross sales decline 10.7% YoY to $742.1 million, affected by a constrained discretionary client, extremely promotional retail setting. Gross revenue decreased YoY from $237.7 million to $275.7 million one yr prior, and the margin was 32% in comparison with 33.2% over the identical interval. Web earnings lowered from $36.7 million to $14.3 million YoY.

Earnings Assertion Q1 2023 vs Q1 2022 (sec.gov)

If we have a look at the steadiness sheet, we see $50.6 million in money. Moreover, the corporate has $200.3 million in money in its obtainable revolving credit score facility. Levered free money stream was optimistic at $160.77 million TTM and has been optimistic over the past two monetary years. Moreover, Designer Manufacturers authorizes the inventory repurchase of as much as $100 million, primarily based on buying a $135 million mortgage settlement.

Levered Free Money Circulation by Quarter (seekingalpha.com)

DBI Inventory Valuation

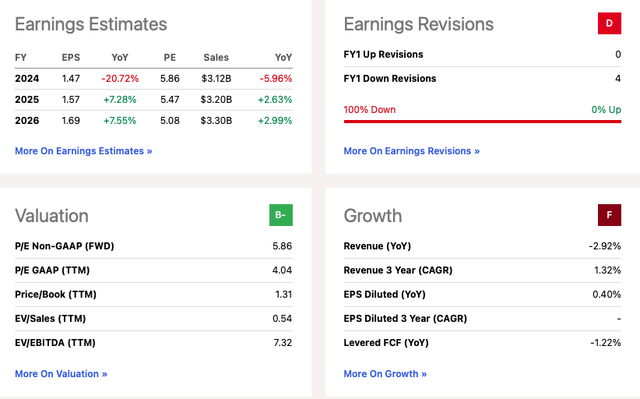

Over the previous yr, Designer Manufacturers inventory has had a disappointing efficiency, reducing in worth by 45.15%. At the moment, it’s buying and selling beneath its one-year worth goal of $9.33 and has been rated as a Maintain by Wall Road analysts.

Common Value Goal (seekingalpha.com)

The inventory has a low worth to earnings ratio of 5.86, which can appear interesting. Nonetheless, we ought to be cautious of the lower in gross sales development from the earlier yr, which is predicted to proceed all through the remainder of the monetary yr because of the present promotional setting. Moreover, the corporate has lowered its steerage for earnings and it could take a while for the acquisitions to grow to be worthwhile.

Earnings and Valuation (seekingalpha.com)

Dangers

Designer Manufacturers delivered a weaker-than-expected Q1 2023 amidst sturdy client discretionary headwinds, which have decreased client demand and pushed a promotional setting inside the retail sector. This could minimize into already slim gross margins in a aggressive setting and negatively impression the corporate’s development efficiency. Shopper discretionary shares are delicate to the financial local weather. Subsequently, we might require the market to get better earlier than gross sales can get better.

Ultimate Ideas

Designer Manufacturers often performs nicely within the first quarter, however this yr it has not met expectations. This has led to a weaker forecast for FY 2023, and administration has lowered their steerage after seeing the outcomes. The corporate additionally must proceed promoting objects on promotion. Whereas Designer Manufacturers has a promising long-term plan for their very own model development, I like to recommend a maintain place till client demand improves.

FY 2023 Outlook (sec.gov)