Financial development continues to defy expectations of a slowdown and recession on account of continued will increase in deficit spending.

The U.S. Treasury not too long ago reported the December price range deficit, which exhibits the U.S. collected $429 billion by way of varied taxes whereas complete outlays hit $559 billion.

As famous, the issue stays on how the financial system has prevented a recession regardless of the Fed’s aggressive price mountain climbing marketing campaign.

Quite a few indicators, from the main financial index to the yield curve, counsel a excessive likelihood of an financial recession, however one has but to happen.

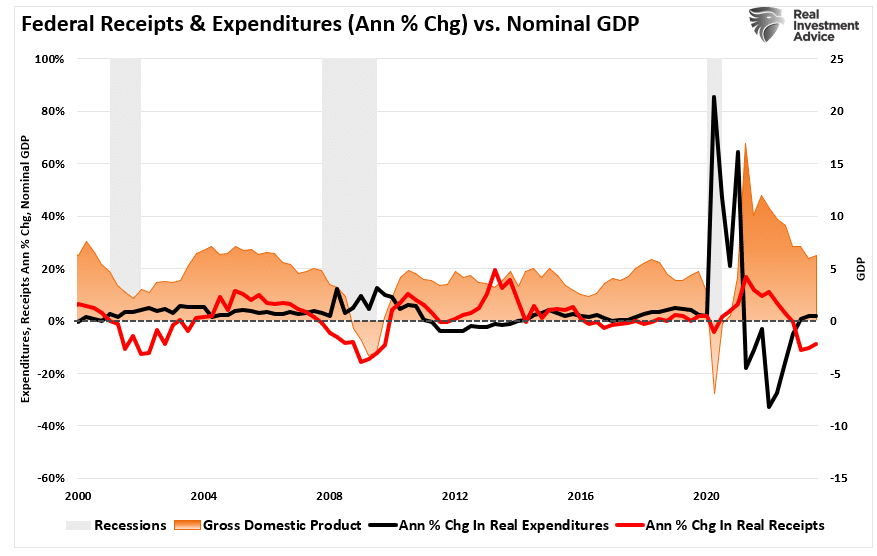

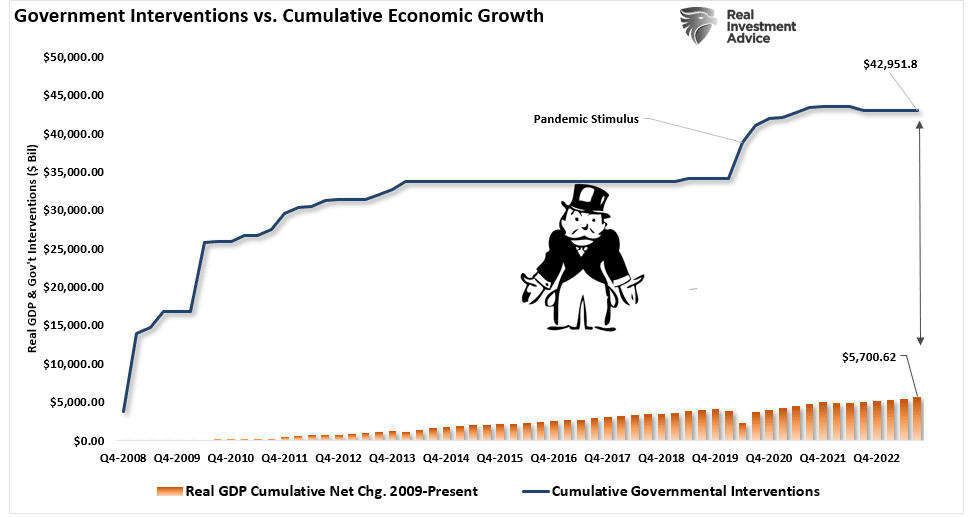

One rationalization for this has been the surge in Federal expenditures because the finish of 2022 stemming from the Inflation Discount and CHIPs Acts.

The second motive is that GDP was so grossly elevated from the $5 Trillion in earlier fiscal insurance policies that the lag impact is taking longer than historic norms to resolve.

Nonetheless, that pink line within the chart above is probably the most attention-grabbing. Discover that whereas Federal expenditures are rising, Federal tax receipts are falling. Such is why the nationwide deficit is growing.

Once we , many thought the shortfall was short-term. To wit:

“California’s tax funds are delayed because of the emergency declaration. Nonetheless, that doesn’t account for the magnitude of the decline in filings.

Secondly, given the shuttering of your entire financial system in 2020, which additionally delayed filings nationwide, the extent of the present lower appears greater than only a single occasion.”

Given the size of time and the very fact the gathering price fell additional, it suggests there may be extra to the decline.

Tax Receipts Ship A Warning

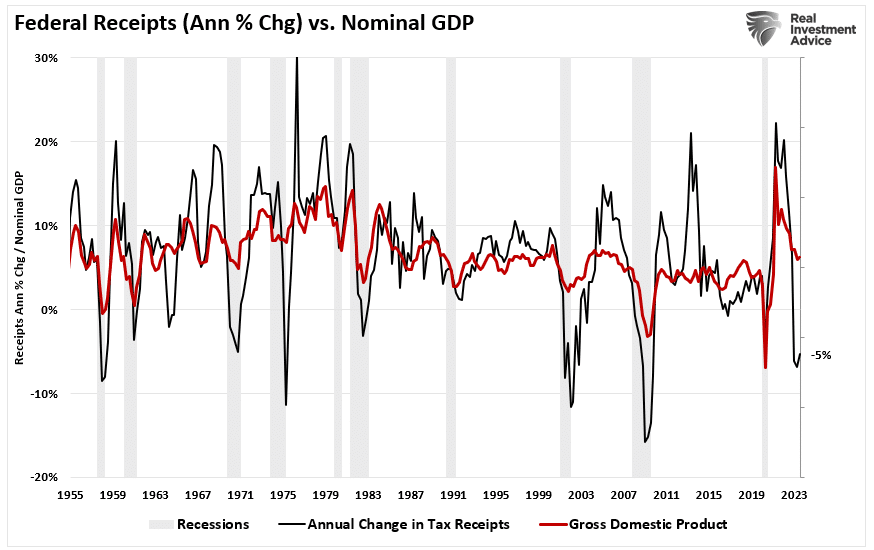

The change in Federal receipts is crucial because the Authorities’s income is from the taxes on each company and particular person incomes.

Unsurprisingly, if revenues and incomes decline, such would replicate financial exercise.

As proven beneath, there’s a very excessive correlation between the annual change in Federal receipts and financial development.

Traditionally, when the yearly change in Federal receipts falls beneath 2% annual development, such has preceded financial recessions. Federal receipts’ yearly price of change is presently a destructive 5 p.c (-5%).

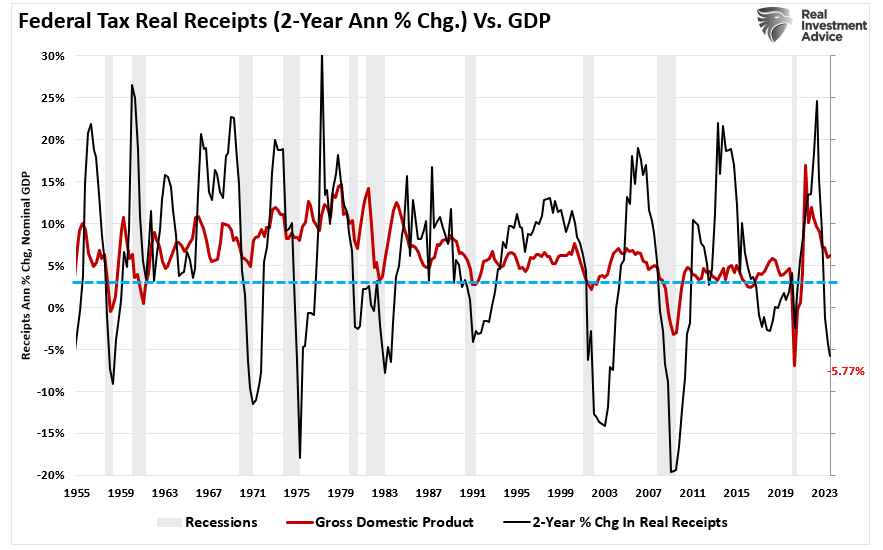

We see the precise correlation by smoothing the information and utilizing inflation-adjusted tax receipts on a 24-month price of change. Once more, a recession follows when tax receipts fall beneath 2% annual development charges.

I like this measure higher because it accounts for the “lag impact” within the financial system. The two-year yearly change in receipts has fallen nicely beneath the two% warning line and is presently at -5.77%.

Whereas tax receipts counsel financial weak point is extra pervasive than headlines counsel, the deficit spending flows maintain financial development from changing into recessionary.

The Frog And Deficit Spending

If we have a look at the present financial system, there is no such thing as a noticeable collapse within the greenback, non-public capital, rampant Inflation, or recession. Nonetheless, like bringing the water to a gradual boil, the frog doesn’t understand it’s in bother till it’s too late.

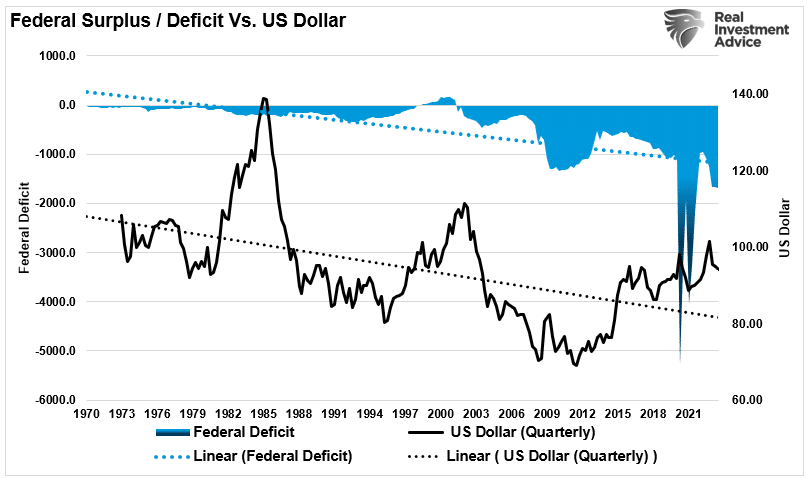

The federal government’s severe endeavors into deficit spending started with Ronald Reagan in 1980. Since then, politicians concluded that lots needs to be higher if a little bit deficit spending is sweet.

For politicians, there are solely optimistic advantages of deficit spending will increase. Extra spending offers a short-term enhance in financial exercise, which will get them re-elected to workplace.

Nonetheless, the water temperature is clearly rising in the long term.

Whereas the hasn’t collapsed underneath the burden of deficit spending, the destructive power pattern relative to different currencies is slowly rising in temperature.

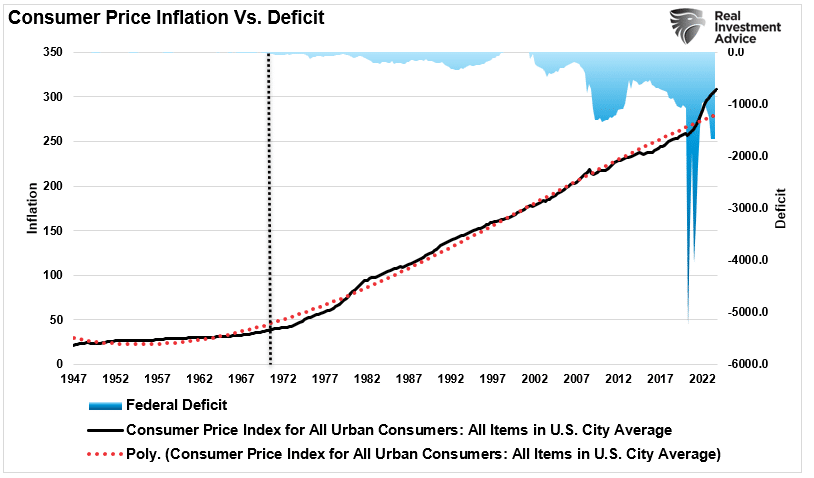

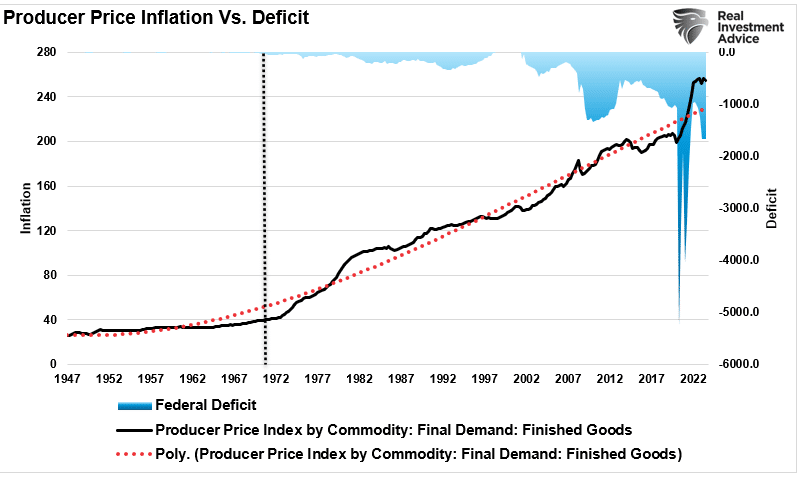

After all, because the greenback weakened and deficits grew, Inflation, for each producers and customers, rose.

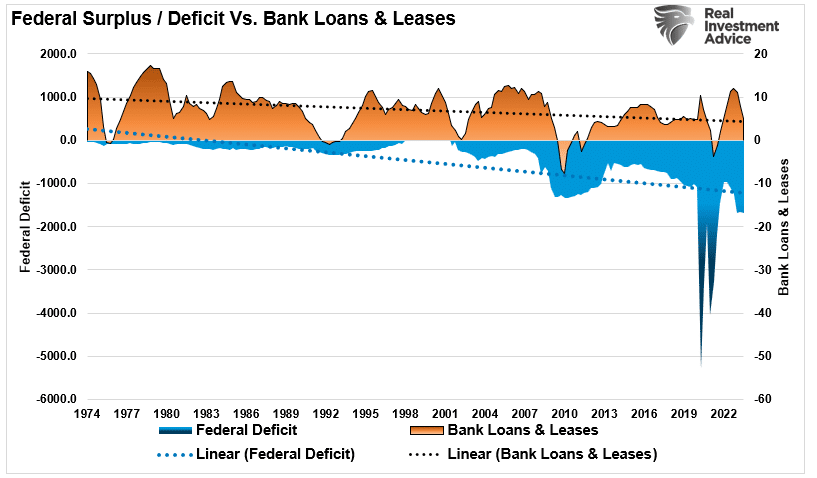

Whereas deficits could not seem to crowd out non-public funding, the rise of behemoth firms like Apple (NASDAQ:), Google (NASDAQ:), and others do crowd out innovation and new firm formations.

Such actions require capital, and an inexpensive correlation exists between the ebbs and flows of deficits and capital acquisition.

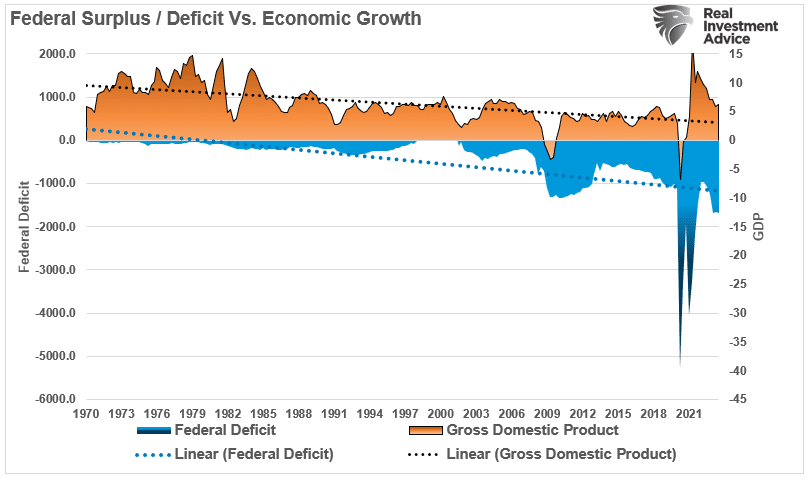

Not surprisingly, because the greenback weakens, the motion of capital slows, and Inflation rises, the financial development price slows.

Such shouldn’t be shocking as debt used for non-productive functions diverts cash from productiveness to curiosity service.

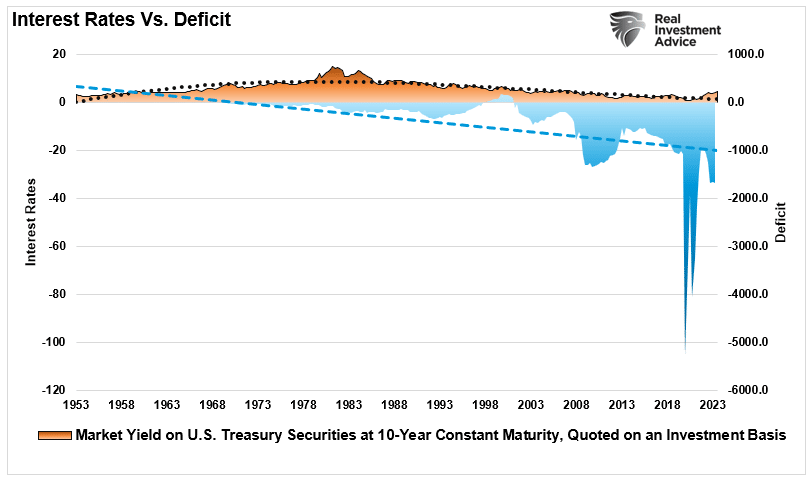

The one factor that deficits haven’t led to is surging rates of interest and big will increase in borrowing prices.

Nonetheless, that suppression of rates of interest has come from two major sources.

- Slower charges of financial development

- Huge interventions by the Federal Authorities to suppress charges.

Given the sharp will increase in Federal debt since 2008 to assist financial development, the financial system cannot maintain increased borrowing prices for lengthy.

The Economic system Is Shut To Recession

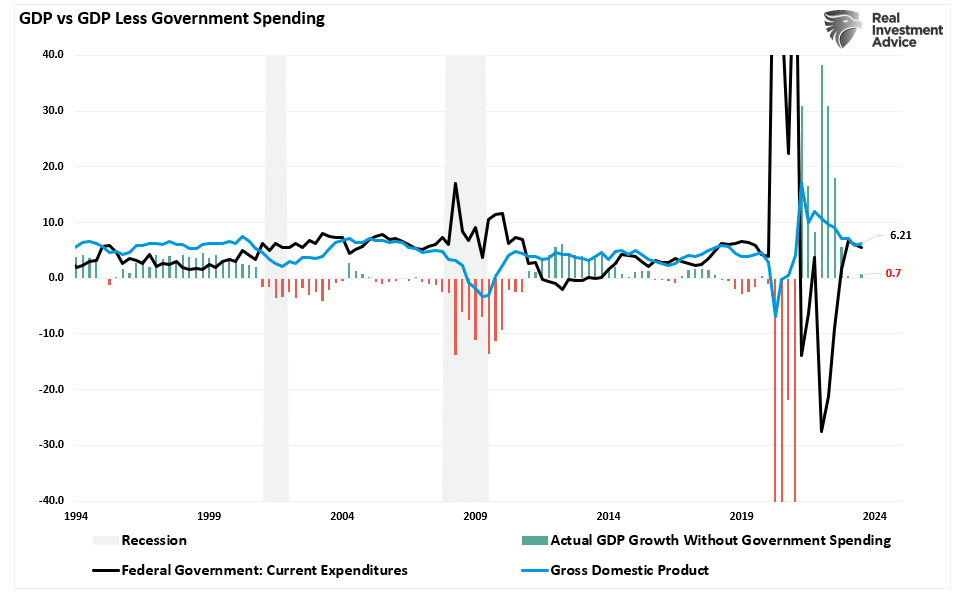

Whereas financial development continues to defy expectations on the floor, if it weren’t for will increase in deficit spending, financial development can be flirting with recessionary stages at simply 0.7% in Q3 quite than 6.21%

In GDP accounting, consumption is probably the most major factor. Since deficit spending doesn’t filter down into the common family, it’s no marvel why Presidential approving rankings are so dismal.

Ought to governments use deficit spending for “productive investments” throughout financial downturns? That reply is clearly within the affirmative class.

Nonetheless, as soon as the financial system returns to development, the deficits needs to be reversed into surpluses to arrange for the subsequent inevitable downturn. Such is your entire underlying premise of Keynesian financial principle.

However, sadly, politicians, of their ongoing endeavor to get reelected, ignore the half about repaying money owed.

Whereas short-term deficits could haven’t any penalties, the rising ranges of corporatism, wage disparities, and wealth inequality present ample proof that one thing has gone flawed.

Are all the issues within the U.S. solely the results of rampant deficit spending? After all not. The U.S. has additionally spent 4 many years making poor political and financial selections.

- Huge will increase in client and company debt.

- A shift from productive to non-productive labor.

- Poor immigration insurance policies.

- The gradual erosion of the rule of legislation; and,

- An undermining of capitalism and a transfer to socialistic insurance policies.

Should you ignore all the anecdotal proof, an argument could be made for operating continuous financial deficits. Nonetheless, suggesting “deficit spending” has no penalties is fully flawed.

We are able to proceed our path for fairly a while, and possibly longer than most think about.

However, simply because we haven’t realized it but, it doesn’t imply we aren’t slowly being “boiled by deficits.”