Japanese candlestick patterns are among the many most generally used instruments in technical evaluation, and people shaped by three or extra candles are usually thought of probably the most dependable. The Three Inside Up and Three Inside Down patterns are prime examples that fall into this class.

These chart patterns work finest on greater time frames, with the potential to yield good points of as much as 10–12% in your deposit. Discover use these triple candlestick patterns successfully in Foreign currency trading.

The article covers the next topics:

Main Takeaways

|

What’s the Three Inside Up/Down candlestick sample? |

The Three Inside Up/Down is a candlestick sample that exhibits up after an uptrend or downtrend, indicating a change in market sentiment and potential worth reversal. |

|

What’s the distinction between Three Inside Up and Three Inside Down? |

The Three Inside Down sample varieties after an uptrend, whereas the Three Inside Up sample emerges after a downtrend. |

|

How does the sample have an effect on the market? |

The Three Inside formation is a reversal sample that emerges on the finish of a pattern, providing merchants an opportunity to enter within the new course. |

|

How does the sample work? |

A dealer locations a pending order to open a brief or lengthy place on the stage of the third candle’s shut. As soon as the order is triggered, the commerce opens mechanically. |

|

The way to establish the sample on a chart? |

The sample consists of three candles. The primary candle has a big physique, whereas the second is smaller and contained fully inside the first candle, just like the Harami sample. The third confirming candle closes past the primary candle’s open, offering the entry sign. |

|

Relevance of the sample |

The sample is comparatively simple to establish on a candlestick chart, particularly if you realize the rules of the Harami sample formation. Furthermore, the sample is often utilized in varied monetary markets. |

|

Benefits of the Three Inside Up/Down sample |

The sample has a easy construction, may be discovered on any time-frame, and infrequently alerts the beginning of profit-taking in current lengthy or brief positions. |

|

Disadvantages of the Three Inside Up/Down sample |

It seems fairly hardly ever on the chart, resembles different patterns, lacks clear profit-taking ranges, and requires opening trades at market worth. |

|

Appropriate time frames |

The sample can be utilized on any time-frame. Nevertheless, as with most patterns, it’s extra dependable on greater time frames. |

|

Cease order ranges |

Cease-loss and take-profit orders are set as soon as the third candlestick closes and a commerce is opened. |

What’s the Three Inside Up/Down Candlestick Sample?

The Three Inside Up/Down sample is a sequence of three candlesticks shaped on the finish of a gradual pattern, signaling an imminent pattern reversal.

That means and Origin of the Three Inside Up/Down Sample

Like many candlestick patterns, the Three Inside Up/Down develops in levels, with every stage reflecting a distinct sample that evolves because the pattern unfolds.

This sample alerts a possible pattern reversal, indicating that momentum is slowing. As soon as the sample is full, the value typically breaks by way of the assist or resistance stage of the earlier pattern, which merchants understand as a sign to open positions.

The primary two candles are key to figuring out the sample. In the event that they kind a Harami, there’s a robust likelihood {that a} Three Inside Up/Down sample will develop. Because the Harami itself is a reversal sample, its transformation right into a Three Inside Up/Down solely strengthens the sign.

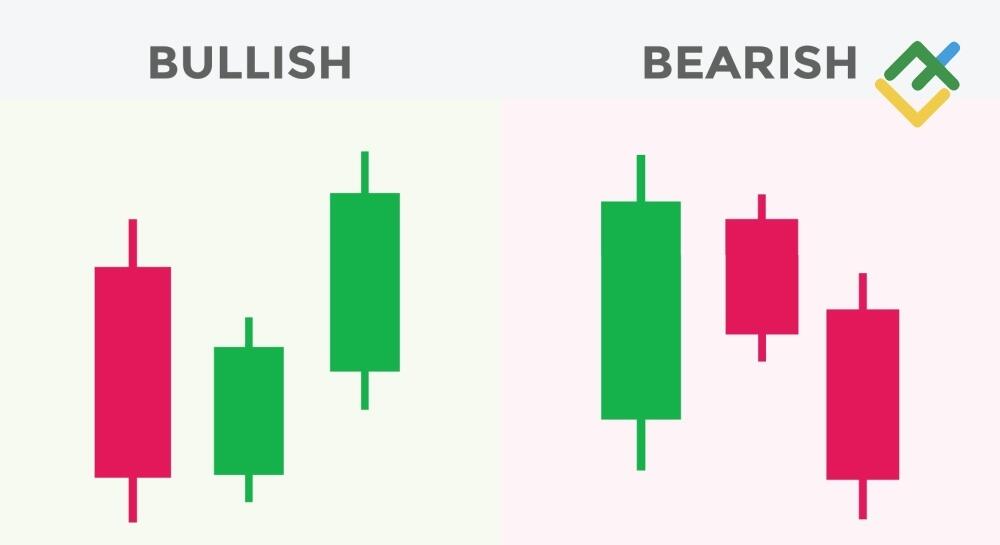

Bullish vs Bearish: Three Inside Up vs Three Inside Down

The Three Inside Up is a bullish reversal sample that varieties throughout a downtrend. Its look alerts that sellers are dropping momentum whereas patrons start to take management.

Three Inside Up

The Three Inside Up sample begins with a protracted bearish candle that continues the downtrend. It’s adopted by a smaller bullish candle that varieties inside the vary of the primary one, making a Harami sample. The third bullish candle gives a affirmation sign, typically accompanied by excessive buying and selling quantity that signifies a gradual rise in bullish curiosity. At this stage, bears acknowledge their weak point, shut positions, or swap sides, whereas bulls achieve management. The formation ends in a bullish candle that closes above the open and physique of the primary one, signaling a bullish reversal.

Three Inside Down

The Three Inside Down sample seems in a bullish pattern. As soon as merchants spot this bearish sample on a chart, they notice that bulls can now not push the value greater and bears are beginning to take over the market.

The Three Inside Down sample begins with a protracted bullish candle that represents a continuation of the current uptrend. It’s adopted by a smaller bearish candle that varieties inside the earlier candle’s vary, additionally establishing a Harami sample. The third bearish candle confirms the reversal, as shopping for quantity is progressively absorbed and bulls can now not assist the value development. At this level, patrons exit their trades or swap sides, permitting sellers to realize management. The result’s a bearish candle that closes beneath the open of the primary bullish candle, signaling a shift from an uptrend to a downtrend.

Why Is It Necessary for Merchants?

This sample is crucial for merchants as a result of it will probably act as a affirmation software for reversal alerts inside broader buying and selling programs. It’s mostly used within the inventory market, the place it typically confirms reversals in methods primarily based on breakouts of assist and resistance ranges.

When the Three Inside Up candlestick sample is used to verify a breakout of assist or resistance, skilled merchants typically analyze a number of time frames. The construction of the sample is exclusive in that it might seem as totally different patterns relying on the chart. For instance, a accomplished Inside Up/Down sample on the H4 chart could appear to be a Morning Star or Night Star on the D1 chart.

How is the Three Inside Up/Down Sample Fashioned?

The sample consists of three candlesticks, every representing a stage in its formation. Let’s break down these levels utilizing the Three Inside Up bullish sample for example.

Step-by-Step Formation Defined

- First candle. A pronounced bearish pattern ends with a big black candle, which can have a protracted decrease shadow, indicating the start of a battle between bulls and bears.

- Second candle. As soon as the primary candle closes, the value jumps, and the second candle opens greater than the shut of the primary one. It has a small physique that’s contained inside the physique of the primary one. These first two candles kind a bullish Harami sample.

- Third candle: On this stage, a big bullish candle varieties, exhibiting clear bullish momentum and breaking above the excessive of the earlier candle. It closes above the opening worth of the primary candle, confirming an upward breakout. Collectively, the three candles full the Three Inside Up sample.

The Position of Candle Colours and Sizes

Every candle performs a big function within the construction of the sample. To establish it accurately, do not forget that the primary candle should at all times be a distinct colour from the subsequent two. If the primary candle is black, the next two needs to be white, forming the Three Inside Up. If the primary candle is white, the subsequent two needs to be black, creating the Three Inside Down.

Furthermore, the scale of candles issues. The power of the sample is commonly assessed primarily based on the second candle. If its physique is a minimum of 3 times smaller than that of the primary candle and a Harami sample has shaped, that is probably the most dependable sign for a reversal.

Time Frames The place It Seems Most Usually

As a rule, candlestick patterns are traded on the identical time-frame the place they had been detected. Nevertheless, the Three Inside Up/Down sample is an exception as a result of once you swap from a decrease to the next time-frame, it might seem as a single candlestick, which reinforces the reversal sign.

Because of this, merchants typically use two time frames collectively when buying and selling this sample. The commonest strategy is to mix the H4 and D1 charts. On H4, one buying and selling day is proven as 4 candlesticks, which merge right into a single one on the D1 chart.

Market Situations The place It Is Most Dependable

For the entry sign to be dependable, the sample ought to seem on the finish of a transparent bullish or bearish pattern, not in the course of motion or inside a sideways market. When it varieties beneath the suitable situations, it alerts a possible reversal and the completion of the prior pattern. If the sample is recognized incorrectly, false alerts could happen.

The way to Commerce Utilizing the Three Inside Up/Down Sample

The sample just isn’t typically employed in standalone buying and selling methods, so there are solely two widespread methods to commerce it. You need to use the technique, the place merchants enter when the third candle closes past the primary candle’s open, or the overbought and oversold reversal technique, the place the sample is utilized together with the RSI.

Entry and Exit Three Inside Up/Down Methods

The commonest approach to commerce this sample is on a breakout of the primary candle. Merchants resolve to enter the market in two steps. The chart above exhibits an instance of opening a brief commerce primarily based on the Three Inside Down sign.

In step one, a dealer waits for the third candle to begin forming and watches whether or not it drops beneath the open of the primary candle. In that case, a dealer then waits for the third candle to completely shut. As soon as it closes beneath the open of the primary candle, a dealer initiates a brief place, aiming to capitalize on a brand new downward pattern.

Threat Administration and Cease Loss Placement

A stop-loss order ought to solely be set after a brief or lengthy commerce is opened. If the sample is bearish, a stop-loss order needs to be positioned at or barely above the open of the primary candle. In a bullish setup, a stop-loss order needs to be set at or beneath the open of the primary candle to handle danger.

Setting a take-profit order with this sample may be difficult because it doesn’t present clear revenue targets. A typical strategy is to put a take-profit order across the stage the place the earlier upward motion started. A extra conservative possibility is to set the take-profit at roughly half of that distance. Another choice is to use a trailing cease, transferring your stop-loss order to the breakeven stage as soon as the value covers the sample’s vary.

Affirmation Indicators to Use

One other widespread technique to commerce the sample is to mix it with extra technical indicators, corresponding to oscillators. The best method is to make use of the sample along side the RSI, though different indicators may be added.

The RSI can be utilized to verify entry and exit factors. A brief commerce may be opened when the third bearish candle closes beneath the open of the primary candle and the RSI worth leaves the overbought zone. An extended commerce may be initiated when the third bullish candle closes above the open of the primary one and the indicator exits the oversold zone.

Finest Markets and Time Frames

As talked about earlier, the Three Inside Up/Down sample may be utilized to any monetary market. Nevertheless, to enhance your buying and selling efficiency, you could think about the next guidelines.

- Commerce solely in extremely liquid markets. In much less liquid markets, such because the inventory market, worth gaps happen virtually every day. These gaps cut back the reliability of the sample and make buying and selling alerts much less correct.

- Don’t commerce unstable devices. The most suitable choice for buying and selling this sample is Forex, because it gives the correct steadiness of liquidity and volatility. Nonetheless, keep away from durations of robust market fluctuations.

- When selecting a time-frame, think about each market noise and correct cash administration. On decrease time frames, the sample typically produces false alerts as a consequence of greater market noise. On greater time frames, trades typically require longer holding durations. Apart from, you could think about commissions and swaps. The H4 time-frame is the simplest, because it gives clearer alerts whereas nonetheless permitting merchants to open and shut positions inside the identical day.

Benefits and Disadvantages of the Sample

Like many candlestick formations, the Three Inside Up/Down sample is used to verify potential market reversals, and it comes with its personal strengths and limitations:

Strengths of the Three Inside Up/Down

- A transparent sign. The sample is straightforward to identify on the chart, easy to interpret, and infrequently doesn’t require extra affirmation.

- Derived from one other sample. The Three Inside sample typically develops from a Harami formation, which reinforces the reversal sign.

- Predetermined ranges. Entry and stop-loss ranges are simple to establish and may be set as quickly because the sample varieties.

- Works on totally different time frames. The sample can seem on any time-frame, making it appropriate for varied forms of buying and selling, from intraday to long-term.

- Seems in numerous markets. The sample happens in any market, from forex and cryptocurrency to the inventory and derivatives markets.

Limitations and When It Fails

- Could give delayed alerts. The primary two candles could already trace at a reversal, and by the point the third one confirms it, the reversal could also be underway, leaving little room to enter.

- The significance of a powerful pattern. This sample is most dependable in a powerful market pattern. When it seems throughout sideways motion, the sign may be weak or false.

- Heavy dependence on volatility. The sample solely works properly in a peaceful market. When the market is very unstable, its alerts are sometimes false.

- An excellent sample is uncommon. Normally, the market varieties variations of the sample or alerts that seem too late, which regularly reduces their effectiveness.

How Correct Is It In comparison with Different Patterns?

Though the right setup is uncommon, even variations of this sample typically present dependable alerts and worthwhile alternatives. It’s advisable to check the sample on the H4 and D1 time frames. On H4, the sample exhibits about 81% successful trades, and 89% of these attain the predetermined take-profit goal. On D1, the alerts are even stronger, with round 90% of trades ending in revenue, and 95% of them hitting the take-profit stage.

In comparison with different candlestick patterns, its accuracy is inferior solely to the Falling Three Strategies and a few indecision candles.

What do the Three Inside Up and Down Patterns Point out in Phrases of Market Sentiment?

Every candlestick sample is preceded by a selected market context. The sample both completes or continues it. For the Three Inside Up/Down, a transparent pattern should be current, and the sample often marks its turning level.

The sample displays a battle between patrons and sellers, which ends with the final word victory of 1 aspect. In a bullish setup, sellers initially dominate. The primary massive black candle exhibits the power of the downtrend. After it closes, some sellers take income, which ends up in the formation of a small white candle. Collectively, the primary two candles typically create a Harami sample, hinting at a attainable reversal. When the third candle seems, sellers lose confidence and begin to retreat. As this candle breaks above the primary one, bears exit rapidly, driving the value greater.

Three Inside Up/Down vs Different Candlestick Patterns

Inexperienced merchants typically confuse this sample with others which might be similar to the Three Inside Up/Down. Though these patterns work in the identical method, it’s essential to grasp their variations. Let’s study the commonest patterns that may resemble the Three Inside Up/Down.

Distinction Between Three Inside and Three Outdoors

The Three Inside Up/Down sample is most just like the Three Outdoors Up/Down. Each include three candlesticks, and the one distinction is how the primary two candles kind.

Within the case of the Three Inside Up candlestick sample, the primary candle is at all times bigger than the second, and the sample they kind typically resembles a Harami sample. With regards to the Three Outdoors Up sample, the primary candle is at all times smaller than the second, and the sample they kind resembles a typical Bullish Engulfing.

Regardless of totally different constructions, patterns kind in virtually the identical method and are traded utilizing comparable rules. Due to this fact, even in the event you confuse them, the ultimate end result will hardly be affected.

How It Compares to Engulfing and Harami

Different comparable formations are the Engulfing and Harami patterns. Actually, each of those patterns characterize the primary stage of the Three Inside Up/Down and Three Outdoors Up/Down patterns.

In a Bullish Engulfing, the primary candle is smaller than the second, and the second candle’s physique fully engulfs the primary candle. That is primarily the primary stage of the Three Outdoors Up sample. The Harami sample, which was already mentioned within the article, works equally. The Bullish Harami represents the primary stage of the Three Inside Up sample.

Due to this fact, the Engulfing and Harami patterns sign the start of the Three Inside Up/Down formation. Once they seem, merchants needs to be ready for the primary sample to emerge.

Is It a Sort of Doji Sample?

In essence, many patterns can seem as variations of each other. Nevertheless, the Three Inside Up/Down and Doji candles are fairly totally different, sharing virtually nothing in widespread.

A Doji is a single candlestick that displays the battle between patrons and sellers, typically ending in a stalemate. With the Three Inside sample, nonetheless, the end result is rarely impartial, as one aspect at all times comes out on prime.

Actual Market Examples of Three Inside Up/Down Patterns

As famous earlier, the Three Inside Up/Down is a powerful candlestick reversal sample. As soon as it varieties, the brand new pattern may be long-lasting and strong. Let’s take a look at an instance the place the sample develops into a complete pattern by itself.

On the every day NZDUSD chart above, the uptrend is fueled by three such patterns. They not solely mark the beginning of the upward market motion but in addition assist maintain the pattern because it develops.

The chart exhibits that there’s a robust downtrend consisting of quite a few black candles previous the primary Three Inside Up sample. Ultimately, the sample reverses the pattern upwards.

When utilizing this sample, merchants have a number of approaches to select from. They’ll open short-term trades on decrease time frames, use a trailing cease to lock in income, or commerce with the pattern utilizing a scaling-in technique. For this sample, scaling in is commonly the simplest. By including new positions every time the sample seems (with out closing the present ones), a dealer can experience the pattern and find yourself holding a number of worthwhile trades. On the D1 time-frame, this strategy can ship substantial returns.

Conclusion

The Three Inside reversal sample is a robust software that helps merchants spot when to enter a brand new commerce forward of a pattern change and when to exit the earlier one. In some circumstances, the Three Inside Up/Down may even function the inspiration of a standalone buying and selling system able to producing constant income.

Nevertheless, it is very important do not forget that no candlestick sample gives a very dependable sign. Their effectiveness will depend on following clear guidelines that match a dealer’s type. Ultimately, the profitability of any technique comes all the way down to combining all components of the plan accurately and making use of correct danger administration.

Three Inside Up and Down Patterns FAQ

The content material of this text displays the writer’s opinion and doesn’t essentially mirror the official place of LiteFinance dealer. The fabric revealed on this web page is supplied for informational functions solely and shouldn’t be thought of as the supply of funding recommendation for the needs of Directive 2014/65/EU.

Based on copyright regulation, this text is taken into account mental property, which features a prohibition on copying and distributing it with out consent.