StockByM

Everybody appears to like investing in Japan, as we lately noticed the Oracle of Omaha, Warren Buffett, shun the U.S. and enhance his holdings in Japanese buying and selling homes. Reportedly, traders adopted go well with by shopping for nearly $8 billion in Japanese equities within the days following Mr. Buffett’s Japan go to.

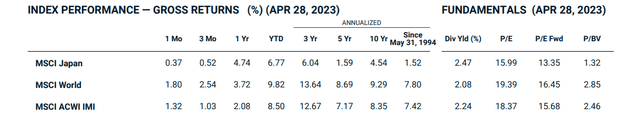

Basically, there are a number of causes to be bullish Japan. Japanese equities are ‘cheaper’ than international markets with a ahead P/E ratio of solely 13.4x in comparison with 16.5x for the World and 18.4x for the U.S. Moreover, the Financial institution of Japan is sustaining unfastened financial insurance policies that spur progress whereas the remainder of the world’s central banks are attempting to throttle progress to struggle inflation.

Nonetheless, you and I are usually not Warren Buffett (as if that wasn’t clear), and we don’t get entry to the identical offers or hedges that Mr. Buffett does. Institutional traders like Berkshire Hathaway (BRK.A)(BRK.B) often have the choice to hedge their foreign money exposures after they spend money on international shares. International traders shopping for native foreign money shares don’t.

One automobile that retail traders can use to achieve publicity to Japanese equities whereas hedging their foreign money publicity is the Xtrackers MSCI Japan Hedged Fairness ETF (NYSEARCA:DBJP).

I’m bullish on DBJP and would look to build up shares on any pullback in the direction of the $52 breakout stage.

Fund Overview

The Xtrackers MSCI Japan Hedged Fairness ETF gives foreign money hedged publicity to Japanese equities by monitoring the MSCI Japan US Greenback Hedged Index (“Index”). The fund absolutely replicates the underlying MSCI Japan Index whereas utilizing spinoff contracts to hedge the fund’s foreign money publicity.

The DBJP ETF has $292 million in property and costs a 0.45% internet expense ratio.

Portfolio Holdings

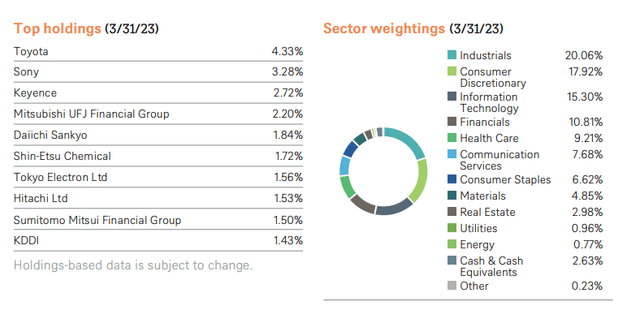

The DBJP ETF holds shares in the identical proportion because the MSCI Japan Index, which comprise among the largest publicly traded Japanese firms like Toyota and Sony (Determine 1).

Determine 1 – DBJP sector allocation and prime 10 holdings (etf.dws.com)

The DBJP ETF has giant sector weights in Industrials (20.1%), Client Discretionary (17.9%), Data Expertise (15.3%), Financials (10.8%), and Well being Care (9.2%).

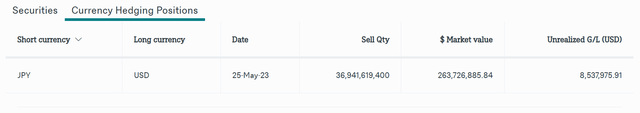

The fund additionally holds a big foreign money spinoff place used the hedge the foreign money danger of the portfolio (Determine 2).

Determine 2 – DBJP foreign money hedge (etf.dws.com)

Distribution & Yield

The DBJP ETF pays a semi-annual distribution with trailing 12 month distribution of $0.39 / share or 0.7% yield.

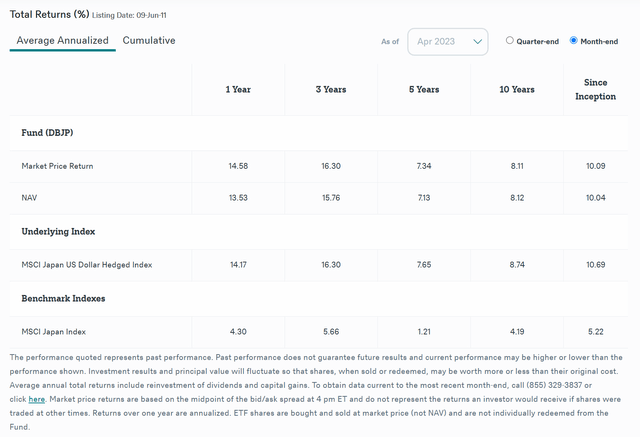

Return

Determine 3 exhibits the historic returns of the DBJP ETF. The DBJP ETF has delivered stable returns, with 1/3/5/10Yr common annual returns of 13.5%/15.8%/7.1%/8.1% to April 30, 2023. DBJP has lagged its benchmark by roughly 50 bps / yr as a result of fund’s 0.45% internet expense ratio and slippage.

Determine 3 – DBJP historic returns (etf.dws.com)

The important thing factor to note from determine 3 is that the underlying MSCI Japan Index has solely returned 4.3%/5.7%/1.2%/4.2% in the identical timeframe, an unimpressive consequence. Nonetheless, the DBJP has been capable of obtain its stable efficiency by way of the addition of its long-term foreign money hedge towards the Japanese Yen.

Yen Has Been In A Lengthy-Time period Downtrend

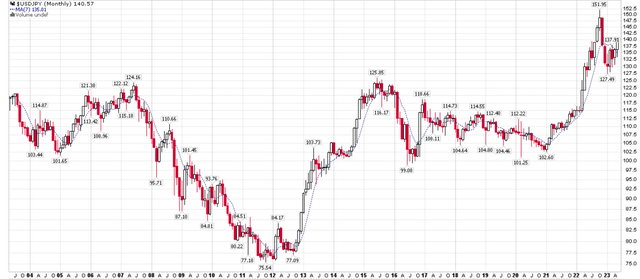

The primary motive for the Yen’s poor efficiency is due to the Financial institution of Japan’s dovish financial insurance policies. Since 2011, the USDJPY alternate charge has weakened from roughly 75 Yen per 1 US greenback to ~140 Yen at the moment, or an 87% depreciation (Determine 4). This has turbocharged DBJP’s returns.

Determine 4 – UPY has depreciated from 75 to 140 (stockcharts.com)

The Japanese yen weakening actually started with the appointment of the late Shinzo Abe as prime minister and his ‘Abenomics’ coverage that mixed aggressive financial easing with fiscal stimulus and structural reforms.

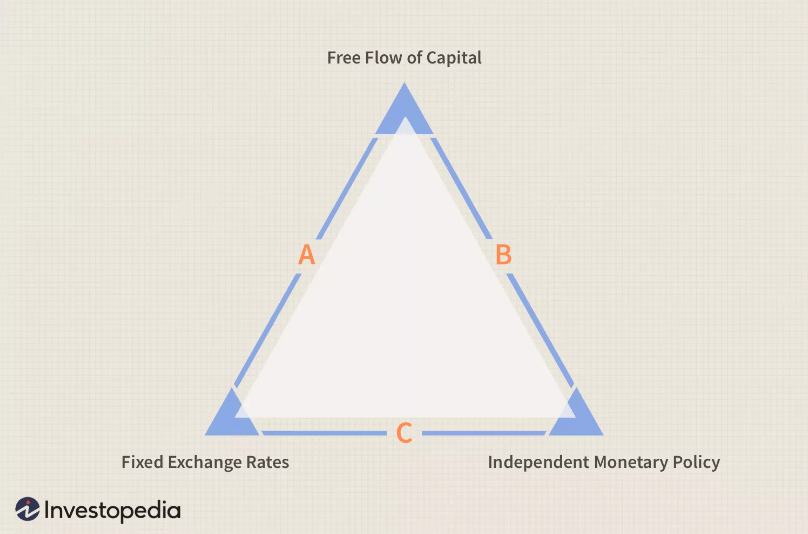

In line with the Mundell-Fleming trilemma, policymakers in any financial system can solely management 2 of three attainable issues at any given time: autonomous rate of interest coverage, fastened alternate charges, or free move of capital (Determine 5).

Determine 5 – Mundell-Fleming Trilemma (investopedia.com)

For the reason that BOJ permits free move of capital and has been engaged in aggressive financial insurance policies (Japan has been in quantitative easing mode and has fastened its rates of interest at zero since 2016), due to this fact, the alternate charge of the Japanese Yen was the variable that has to fluctuate to compensate.

Inflation Turbo-Charged Yen Decline

As inflation surged within the U.S. starting in 2021 and the Fed started tightening financial coverage in response, the USDJPY alternate charge rose quickly (rising USDJPY means weakening Yen), breaking out of a multi-year downtrend.

Actually, the Yen fell precipitously by over 30% from the top of 2021 to September 2022, as the massive rate of interest differential between the BOJ and the Fed created enormous depreciation stress on the Yen. Nonetheless, the weak yen commerce took a pause on the finish of final 12 months, because the BOJ intervened within the foreign money markets to stabilize its foreign money and traders began to cost in an finish to Fed rate of interest will increase.

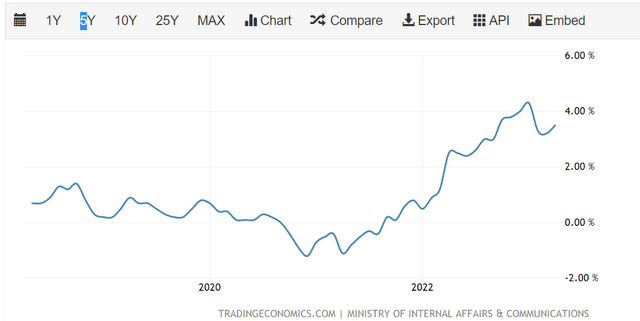

Nonetheless, lately, the USDJPY alternate charge started to reaccelerate to the upside, because the newly appointed BOJ Governor Ueda introduced plans to keep up Japan’s ultra-low rates of interest and burdened that the BOJ wanted “to attend for extra proof to conclude inflation would sustainably obtain the BOJ’s 2% goal.” With Japanese inflation at the moment operating at a 3.5% YoY charge after surging to a multi-decade excessive of 4.3% YoY in January, it’s farcical that the BOJ nonetheless has not concluded that inflation reached its 2% goal (Determine 6).

Determine 6 – Japanese inflation far above goal (tradingeconomics.com)

In any occasion, a dovish BOJ meant that merchants had the inexperienced gentle to re-engage in shorting the Yen, and the foreign money has declined by roughly 5% since Governor Ueda’s speech on April 27.

Japanese Markets Are ‘Low-cost’

One of many main causes Warren Buffett and different macro traders are bullish on Japanese equities is as a result of they’re ‘low-cost’ relative to the ‘costly’ international markets. On a ahead foundation, the MSCI Japan Index has a P/E ratio of 13.4x, in comparison with 16.5x for the MSCI World Index and 18.4x for the S&P 500 (Determine 7).

Determine 7 – Japan is affordable relative to the world (MSCI.com)

Whereas one usually can not predict future inventory market returns, having a low valuation start line makes it simpler to realize above common returns.

Moreover, whereas international central banks within the western world are all in tightening mode attempting to struggle inflation, the BOJ is actively fanning inflation flames because it believes home inflation just isn’t ‘excessive sufficient’. This implies financial coverage in Japan is actively selling progress.

Technicals Counsel Extra Upside

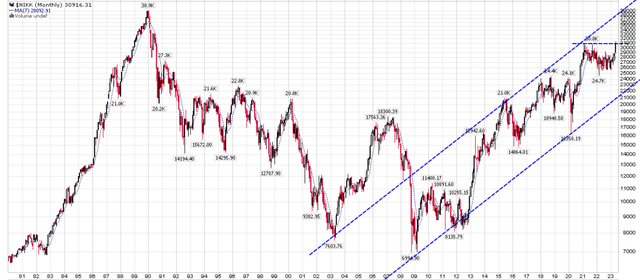

Technical, Japanese equities have executed nothing for greater than 30 years, because the Nikkei Index continues to be under its all-time highs of 38,900 in 1990. Lately, the Nikkei is simply breaking out of a two-year consolidation vary, suggesting extra upside inside a large multi-year uptrend sparked by ‘Abenomics’ in 2012 (Determine 8).

Determine 8 – Nikkei is in a multi-year uptrend (Writer created from stockcharts.com)

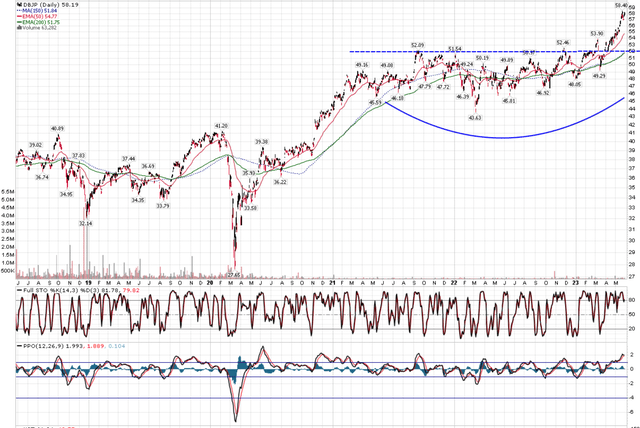

Within the short-term, the DBJP ETF is up greater than 20% YTD and is sort of overbought on the PPO indicator, suggesting a pullback could also be essential to reset momentum. I’d look to build up shares close to the $52 breakout stage if a pullback develops (Determine 9).

Determine 9 – DBJP is overbought; purchase on pullback (Writer created from stockcharts.com)

Conclusion

Whereas everyone seems to be seeking to comply with the Oracle of Omaha into Japanese equities as a result of they’re low-cost, traders are sometimes trying on the incorrect automobile, investing in native foreign money denominated shares and ETFs. The primary subject with native foreign money denominated shares is that the Financial institution of Japan is actively attempting to stoke progress with straightforward financial insurance policies. So, whereas Japanese shares might rally in native foreign money phrases, for American traders, they’re penalized by a weakening Yen.

In distinction, the DBJP ETF gives foreign money hedged publicity to the MSCI Japan ETF. I like to recommend traders look to build up the DBJP ETF on pullbacks close to $52.