Germany 40 (Dax), UK 100 (FTSE) & Wall Street 30 (Dow Jones) Analysis:

Recommended by Tammy Da Costa

Get Your Free USD Forecast

In the aftermath of the FOMC, equity futures have pulled back while US treasury yields, and a stronger Dollar dominate. Ahead of the October NFP (non-farm payroll report) scheduled for release tomorrow, rising interest rates and a tight labor force have altered the forward guidance of the Federal Reserve.

Although the 75-bps Fed rate hike was inline with expectations, it was the accompanying press conference that drove Dow Jones (DJI), FTSE and Dax into a sea of red.

The Federal Reserve: A Forex Trader’s Guide

With Fed Chair Jerome Powell reiterating the Central bank’s commitment to achieving the objectives of its dual mandate (full employment and price stability), expectations of higher rates for longer slashed hopes of a rate pivot in the foreseeable future.

Dow Jones Futures Slide – Wall Street Anticipates Higher Rates for Longer

As markets reacted to what turned into a more hawkish narrative than was initially expected, Dow Jones futures retreated from a high 32273, before reaching a low 31738 earlier today. While Wall Street stocks price in the revised expectations, a push below the daily low could drive DJI futures back towards the 50% retracement of the April – October move providing additional support at 31444.

Fed Hikes Rates by 75bp and Alters Guidance: US Dollar Outlook Post-FOMC

Dow Jones Futures (DJI) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Tammy Da Costa

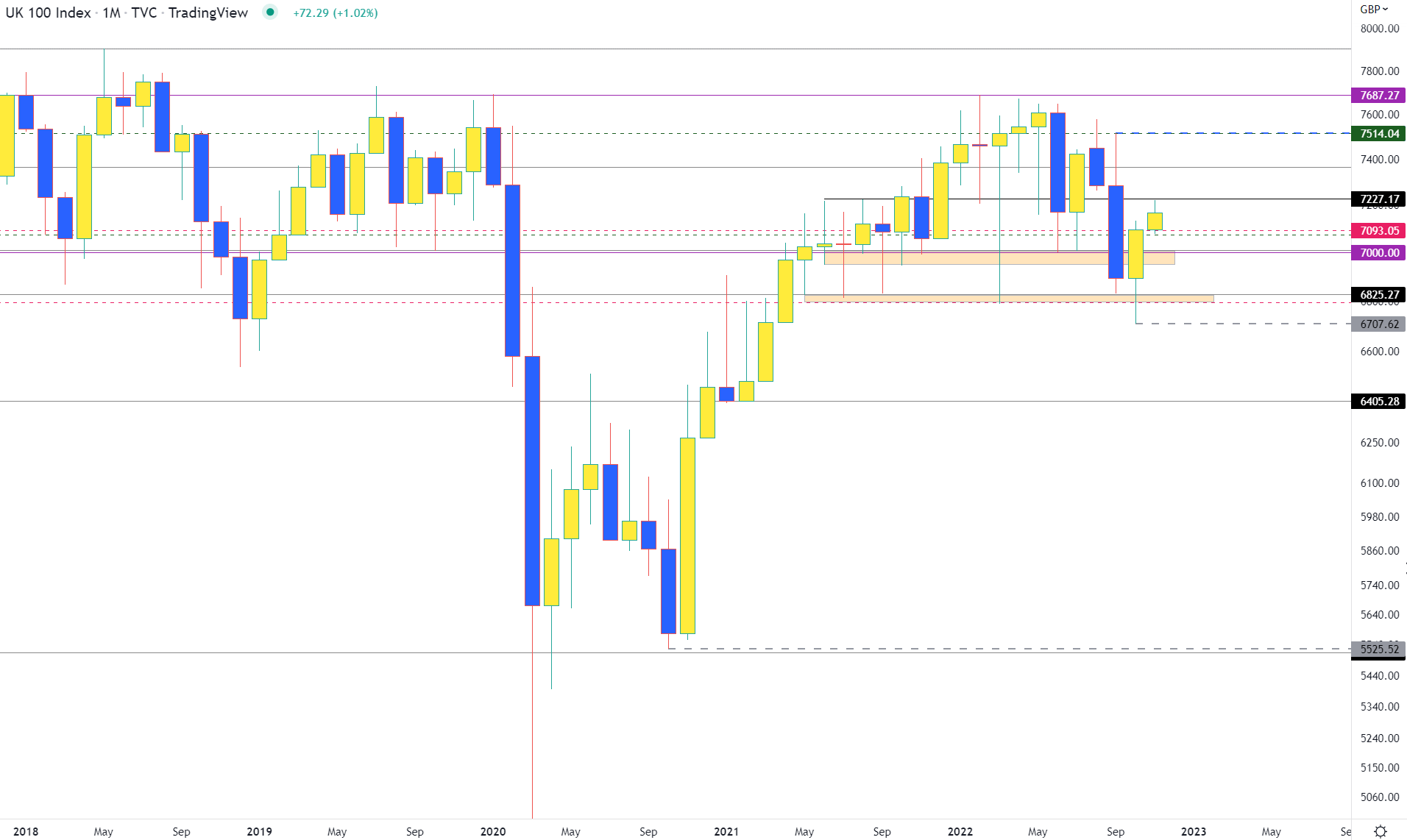

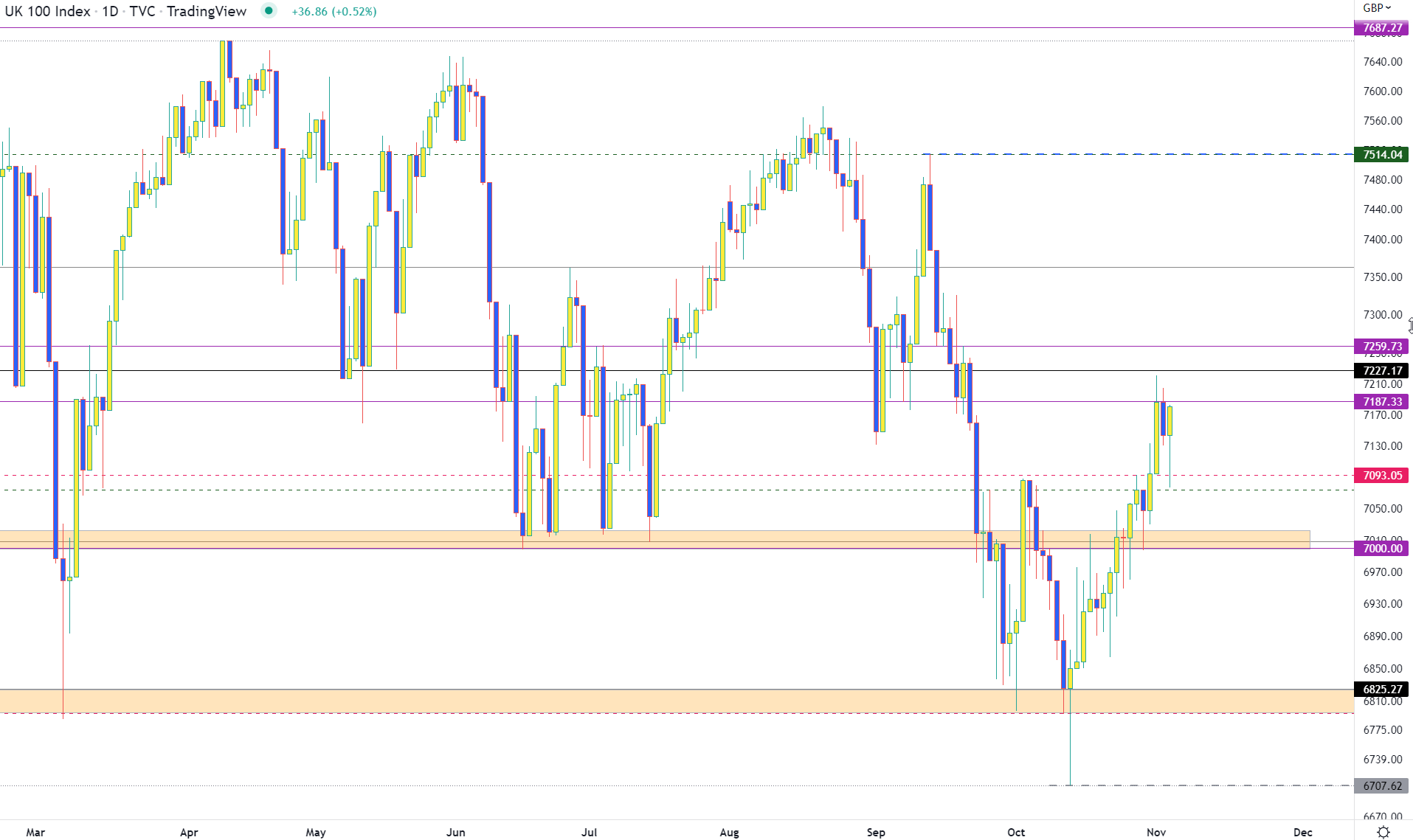

FTSE Price Action Whipsaws Between Psychological Support and Resistance

FTSE prices currently remains within the confines of psychological support and resistance, a break of 7000 and 7200 is required to drive price action out of the current range.

With the 7000 psychological handle proving resistance back in May of last year, its transition into support a month later has allowed it to limit the downwards move on several occasions since.

As highlighted on the monthly chart below, this zone has become technically significant since. After successfully clearing this barrier in December, a strong rally drove FTSE prices higher before peaking at 7689.67 in Feb.

However, with a series of small-bodied candles and long wicks highlighting a fierce battle between bulls and bears, a rebound off the 7646 high in June allowed sellers to step in before stabilizing at that same 7000 level.

UK FTSE 100 Monthly Chart

Chart prepared by Tammy Da Costa using TradingView

Similarly, the 7187 marks has recently provided additional resistance, just below another key layer of psychological resistance at 7200. After briefly retesting 7221 earlier this week and 7205 in yesterday’s session, a close above 7187 is necessary if bulls want to have a chance at driving the recovery higher.

FTSE 100 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Recommended by Tammy Da Costa

Get Your Free Top Trading Opportunities Forecast

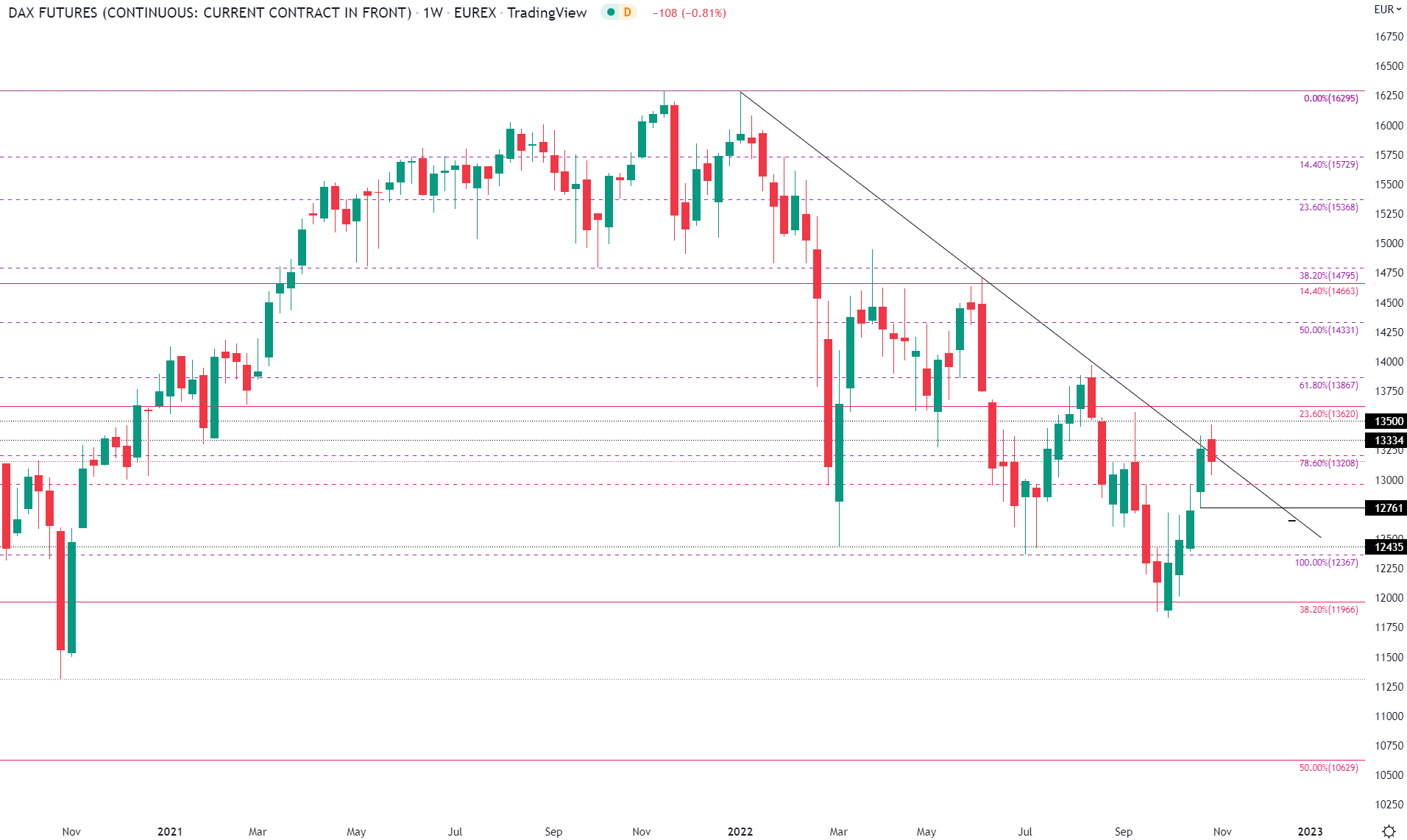

German Dax Dragged to Prior Trendline Resistance

Lastly, Dax futures have followed stock futures lower as the weekly candle pulls back towards prior trendline resistance turned support at around 13200. If prices continue to move lower, a break of 13000 could fuel additional losses with the next layer of support coming in at the prior week low of 12761.

Dax Futures Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter:@Tams707