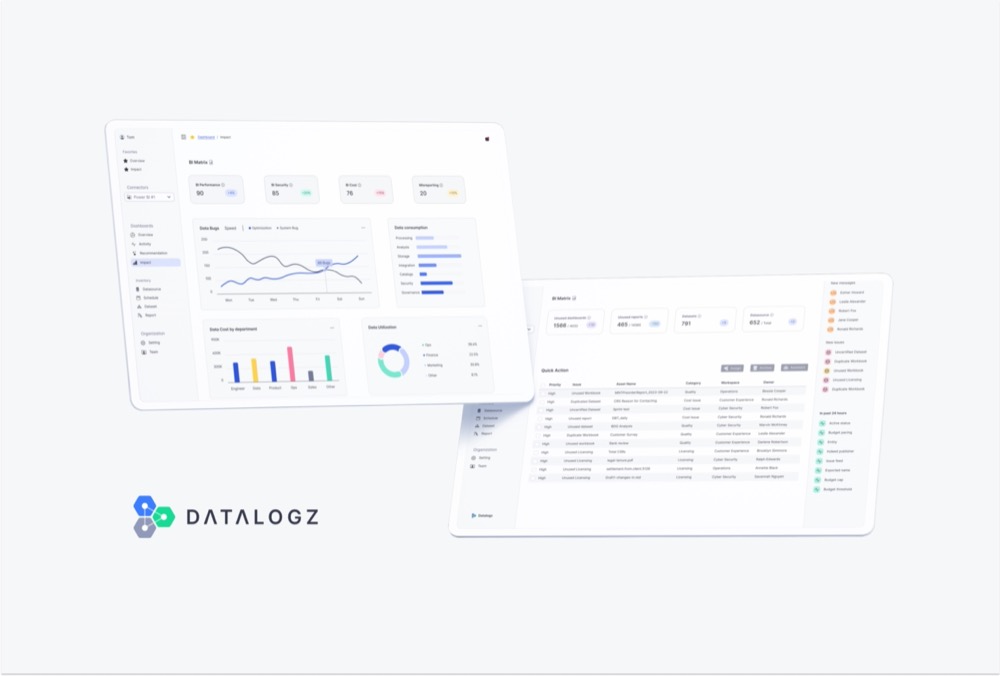

25% of organizations use 10 or extra enterprise intelligence (BI) platforms, 61% of organizations use 4 or extra, and 86% of organizations use two or extra in response to Forrester. Whereas the adoption of a number of platforms for the enterprise can serve different wants and departments, it creates knowledge sprawl. Datalogz is a BI ops platform that enables organizations to optimize and handle their enterprise intelligence environments in a seamless resolution. The safety dangers, computing price, and compliance challenges a corporation faces all enhance as the quantity of information organizations make the most of, analyze, course of, and achieve perception from will increase within the type of BI sprawl. Datalogz, via its BI Ops advice engine, removes the bloat inside a corporation’s BI and knowledge stacks via automation whereas making certain organizations are utilizing essentially the most acceptable knowledge of their decisioning. The platform seamlessly integrates instantly with widespread BI instruments already in use like Looker, Tableau, Energy BI, Qlik, Tibco, and Mode, permitting Datalogz to be adopted at any data-mature group.

AlleyWatch caught up with Datalogz CEO and Founder Logan Havern to study extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, rather more…

Who had been your traders, and the way a lot did you elevate?

Datalogz’s most up-to-date spherical was $5M led by GreatPoint Ventures with participation from Squadra Ventures, Berkeley SkyDeck, Mana Ventures, Outlined, and Graphene Ventures. This brings Datalogz’s whole funding for 2023 to only beneath $8M in seed funding.

Inform us in regards to the services or products that Datalogz affords.

Datalogz is ending Enterprise Intelligence (BI) Sprawl throughout huge organizations, and the world is noticing! Most firms are seeing a excessive adoption of enterprise intelligence platforms, leaving them 1000’s of dashboards, advanced reporting pipelines, and a heavy quantity of analytics. This surge in exercise leads to duplication, unused dashboards, safety dangers, inefficiencies, and governance challenges.

To deal with the dangers and prices of rising enterprise intelligence studies, Datalogz mechanically optimizes and administrates giant BI environments, lowering prices and dangers.

What impressed the beginning of Datalogz?

After I was working at JetBlue a number of years in the past, I spotted that because the airline invested in digital transformation, the variety of studies rapidly grew from a pair hundred to 1000’s, every monitoring completely different key efficiency indicators and tasks. As an information analyst, I used to be always juggling mountains of studies on buyer info, flight delays, misplaced baggage, and different types of knowledge and realized the wrestle in managing giant BI environments.

How is Datalogz completely different?

Datalogz is the primary and solely automated BI Ops software program. Usually, Datalogz competes with legacy options and handbook tasks (typically executed by consultants or corporations) to wash or de-risk these environments.

What market does Datalogz goal, and the way massive is it?

Each data-mature Fortune 2000 firm can profit from Datalogz.

What’s your corporation mannequin?

At Datalogz, we promote enterprise software program contracts to data-mature organizations. The choice-makers are sometimes knowledge administrators/leaders or C suite. Usually, we work with analytics, knowledge, and BI groups as the top customers and implementers of Datalogz.

How are you getting ready for a possible financial slowdown?

Our software program immediately reduces knowledge computing and licensing prices, so Datalogz is ready to construct a really clear worth proposition for purchasers even throughout an financial downturn.

What was the funding course of like?

Throughout our first spherical in 2023, we pitched nearly 100 traders to shut our funding spherical again in January. Luckily, due to the joy of a number of enterprise success tales and excessive product demand, we had traders method us with curiosity on this spherical of funding. We had been capable of work in direction of a fast shut.

What are the most important challenges that you just confronted whereas elevating capital?

Initially, it felt like we had been in a relentless catch-22 with extra capital required to get extra clients and extra clients required to get extra capital. Finally, we had been capable of break via this cycle and discover the suitable early-stage companions that led to the opening of later funding doorways and funding to construct an unbelievable game-changing product in our house.

What components about your corporation led your traders to jot down the examine?

We’re fixing an issue that no different firm is at this time and have constructed an unbelievable staff with actual market-proof factors on why we generally is a $1B firm within the subsequent 5 years. Our staff has deep experience on this house and has confirmed our capacity to promote.

What are the milestones you intend to attain within the subsequent six months?

We goal to shut 20 Fortune 2,000 clients and 5x of our present income.

What recommendation are you able to supply firms in New York that wouldn’t have a recent injection of capital within the financial institution?

I all the time advise placing your self on the market to fulfill new folks and repeatedly discuss to clients about what you might be constructing. With out exterior curiosity, it’ll be robust to construct an organization. I consider as a founder, you’ll both persuade folks to purchase your product or study sufficient to pivot to one thing folks pay for.

The place do you see the corporate going now over the close to time period?

At Datalogz, we stay laser-focused on fixing enterprise intelligence issues for data-mature organizations.

What’s your favourite winter vacation spot in and across the metropolis?

I personally like to play indoor soccer within the metropolis! You’ll seemingly discover me hanging out in Higher 90 in Astoria.